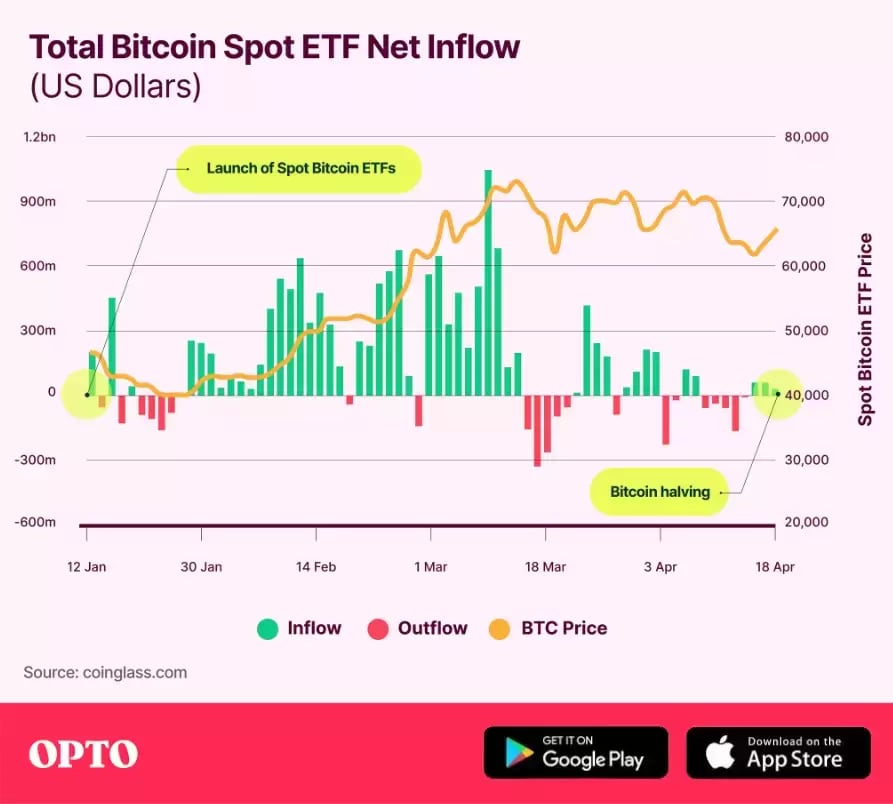

With spot bitcoin ETFs defying expectations with billions of dollars of inflows during their first weeks of existence, bitcoin had unprecedented momentum ahead of the fourth bitcoin halving event. However, ETF inflows slowed in the run-up to the halving. Four industry experts explain what makes this bitcoin halving unique.

- Bitcoin spot price up 4% since the halving event.

- Spot bitcoin ETFs saw net outflows in the five days prior to the halving.

- MARA stock down 17% year-to-date but up 18% post-halving.

What Is the Bitcoin Halving?

Bitcoin miners solve complex cryptographic challenges that add new blocks to the network. When a new block is created, new bitcoins are also created, and these are paid as a ‘block reward’ to the miner.

In 2009, the block reward was 50 bitcoins. However, this figure is halved every time 210,000 new blocks are added. This happens approximately every four years and is referred to as a ‘halving’.

The first three bitcoin halvings took place on 28 November 2012, 9 July 2016 and 11 May 2020. The most recent took place on 19 April. The 2024 halving reduced the block reward to 3.125 bitcoins.

As well as cutting the rate at which new bitcoins enter circulation, halving the block reward also strains the miners themselves and can make it difficult for smaller outfits to remain in business, in turn putting pressure on the supply of new bitcoins.

This creates a disinflationary influence on bitcoin’s price over the long term. Historically, bitcoin prices have tended to peak 12–18 months after a halving event.

Larger miners tend to have the scale and resources to withstand this short-term pressure. For Marathon Digital [MARA], it has been business as usual since April’s halving.

“Post-halving, we have witnessed a major uptick in transaction fees,” Adam Swick, Chief Growth Officer at Marathon, told OPTO. “These increased transaction fees have almost offset the halving at this stage.”

While conceding that it is unclear how long the elevated fees will last, Swick said that the halving “has not impacted MARA’s day-to-day operations as we remain focused on operating the most efficient fleet of miners in the most optimal way.”

What is Different About This Year’s Halving?

Bitcoin had already been in the news in the months preceding this halving. In January, the US Securities and Exchange Commission approved the launch of spot bitcoin ETFs, which track the spot bitcoin price (as opposed to bitcoin futures).

“This halving was a bit unique as the ETF approval pre-empted the halving,” said Swick.

The launches of these ETFs were some of the most successful in history. In their first 21 trading days, the funds attracted approximately $2.8bn in net inflows, according to data from Bloomberg.

“The enthusiasm of the first few weeks went even beyond the most optimistic expectations,” Noelle Acheson, author of the Crypto is Macro Now newsletter, told OPTO.

The billions of dollars that poured into spot bitcoin ETFs (which acquire and hold bitcoins) fuelled demand for bitcoin. The price of bitcoin gained 37% between 11 January (when the ETFs were launched) and 18 April (the day before the halving). This would seem to suggest that similar inflows to the ETFs in the future might be associated with a similar spike in the cryptocurrency’s price.

It should be noted, however, that initial positivity waned in the build-up to the halving. Five days of consecutive net outflows from the funds preceded it, with a peak of $165m on 17 April, according to data from Coinglass.

“I believe that most of the inflows up until this point were from self-directed retail investors,” Michael Zhao, Research Associate at Grayscale Investments, told OPTO.

“US spot bitcoin ETFs have been the fastest-growing ETFs in history, so it is expected that inflows will taper relative to the first few weeks.”

“It's natural that the initial excitement would wear off,” said Acheson. “Another reason flows slowed is the market mood. The recalibration of interest rate expectations fed some weakness into the BTC market, and active investors largely took a breather.”

Flows returned to positive on 19 April and remained positive for the next two days. The consensus appears to be that spot bitcoin ETFs will continue to be a tailwind for the bitcoin price in future.

“Interest is far from over,” according to Acheson, “as many registered investment advisor platforms are still onboarding.”

“We expect additional waves of inflows, especially with increased education from financial advisors and increased access across financial platforms, especially as wire houses conduct diligence on bitcoin,” said Zhao.

“I have the highest degree of confidence in the long-term trajectory,” Matt Hougan, Chief Investment Officer at Bitwise Asset Management, told OPTO. “There are trillions of dollars of professionally managed capital that has, for the first time ever, access to bitcoin. I think this is going to create a long-term bid for the asset.”

Bitcoin’s Pre- and Post-Halving Price Movements

The timing of the spot bitcoin ETF approval has undoubtedly made this halving unique in bitcoin’s history. As Zhao put it, “Typically, bitcoin’s price increases a few months after the halving. Due to the idiosyncratic nature of the flows this cycle, bitcoin’s price started to rise before the halving.

“As a result of this, people have started referring to this cycle as a ‘left-translated’ cycle, meaning the cycle started earlier than everyone anticipated.”

Acheson added that the halving “focuses attention on bitcoin’s hard supply cap, at a time when currency dilution is becoming a global problem”.

The slowing of ETF flows accompanied a dip in the bitcoin price in the runup to the halving.

Zhao attributed this to wider market sentiment. “Bitcoin’s price movements appear largely correlated to movements of the broader stock market and other risk assets,” he told OPTO.

“Given geopolitical tensions in the Middle East that escalated on the evening of 18 April, both traditional equities measured by the S&P 500 Index and bitcoin fell sharply.” He noted, however, that bitcoin recovered relatively swiftly from this dip.

Hougan echoed this positivity. “Bitcoin is trading in a healthy manner right now,” he said. “Broadly speaking, it's been chopping sideways in a narrow trend between $60,000 and $70,000, digesting its strong run-up at the start of this year.”

Bitcoin gained 4% between 19 April and 23 April, with a close price of $66,407.27.

“I've been particularly pleased with the relatively strong performance post-halving,” said Hougan.

“There is always a concern of sell-the-news action when you have a highly anticipated event, but that’s not what we’ve seen. Instead, we’ve seen some quiet ‘buy the news’ action. I love it.”

Acheson, however, is conscious that weakness in the stock market could negatively affect bitcoin prices in the short term. “I’m concerned about a stock market correction, and BTC is likely to get hit should that happen as investors sell whatever they can.”

Long-Term Expectations

“Medium-term, the trajectory is likely to be up, whatever happens to the economy,” said Acheson. “If growth slows and interest rates come down, any liquidity boost will be good for risk assets such as bitcoin. If growth continues and rates remain high, the currency dilution from the expansion of the deficit will enhance bitcoin’s role as a hedge asset.”

She also expects new use cases for bitcoin, greater adoption by developing nations, and the approval of spot ETFs in new jurisdictions (such as Hong Kong) to continue this momentum.

However, she acknowledged that “long-term, the cycle will eventually turn as investors lock in profits and macroeconomic conditions shift.”

“The long-term set-up for bitcoin right now is extraordinarily good,” said Hougan. “For the first time, we have a supply shock and a demand shock at the same time. It may be the first time that’s happened in the history of commodities. I think the impact could be quite significant.

“I’ve said before that we will see ‘six digit bitcoin’ — meaning, bitcoin trading north of $100,000 — sometime this year, and I still think that’s true,” Hougan added.

Could Diversification Bolster MARA’s Share Price?

Besides transaction fees, larger bitcoin miners have other means of diversifying their revenue streams in order to minimise the turbulence of the halving.

Marathon, for example, has invested in initiatives “specific to bitcoin mining, such as firmware development, as well as advances that have broader applications such as cooling technologies that can be used for any data centre,” said Swick.

“MARA has also been actively piloting energy harvesting initiatives, such as mining using landfill methane, in an effort to reduce our electricity costs. Similarly, we have been experimenting with heat re-use applications to offset the cost of this electricity by doing things like heating greenhouses or shrimp farms.”

Research from Coinshares suggests that bitcoin miners may turn to artificial intelligence (AI) in order to diversify their revenue streams. Bit Digital [BTBT], Hive Digital Technologies [HIVE] and Hut 8 [HUT] are all reportedly generating a small amount of revenue from AI already, according to the report.

Marathon’s share price fell 17.2% in the year to 24 April but gained 17.8% following the halving. The Grayscale Bitcoin Trust ETF [GBTC] has gained 71% year-to-date and 3.3% post-halving. The Bitwise Bitcoin ETF [BITB] has gained 32.7% since its launch on 11 January and 1.3% post-halving.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy