When it comes to autonomous vehicles (AVs), Pedro Palandrani, Director of Research at Global X ETFs, says one niche stands out: “I’m more excited about the autonomous trucking vertical than the passenger or the robotaxi verticals, initially,” he recently told OPTO Sessions.

Autonomous trucks are a key sub-theme that could radically shake up the entire transportation industry, Palandrani says.

“We move goods all around the world at massive scale. It is clear that introducing autonomous systems could drastically change the dynamics of the industry. Think about the potential impact to productivity when you can have autonomous trucks moving goods 24/7.”

| 5 Autonomous Vehicles ETFs available on the OPTO App | 5 days performance |

|---|---|

| SPDR S&P Kensho Smart Mobility ETF | +3.73% |

| ARK Autonomous Technology & Robotics ETF | +3.28% |

| Global X Autonomous & Electric Vehicles ETF | +2.43% |

| First Trust S-Network Future Vehicles & Technology ETF | +2.09% |

| ALPS Disruptive Technologies ETF | +0.62% |

Data correct as of Friday, 22 March.

The American Trucking Association valued the global trucking industry at $4trn in 2023, accounting for 4% of total GDP in the US. It is an integral part of the economy, and an area that demands high-level attention, Palandrani stresses.

“There’s a lot of economic incentive for governments and corporations to invest in autonomous technology for trucks.”

An End to Driver Shortages?

Autonomous truck fleets could provide a remedy to an ongoing challenge for transport firms, says Palandrani: the need for a supply of reliable, experienced and willing drivers. “The trucking industry around the world is usually characterised by having very high driver turnover. You also have a lot of challenges in finding drivers,” he says.

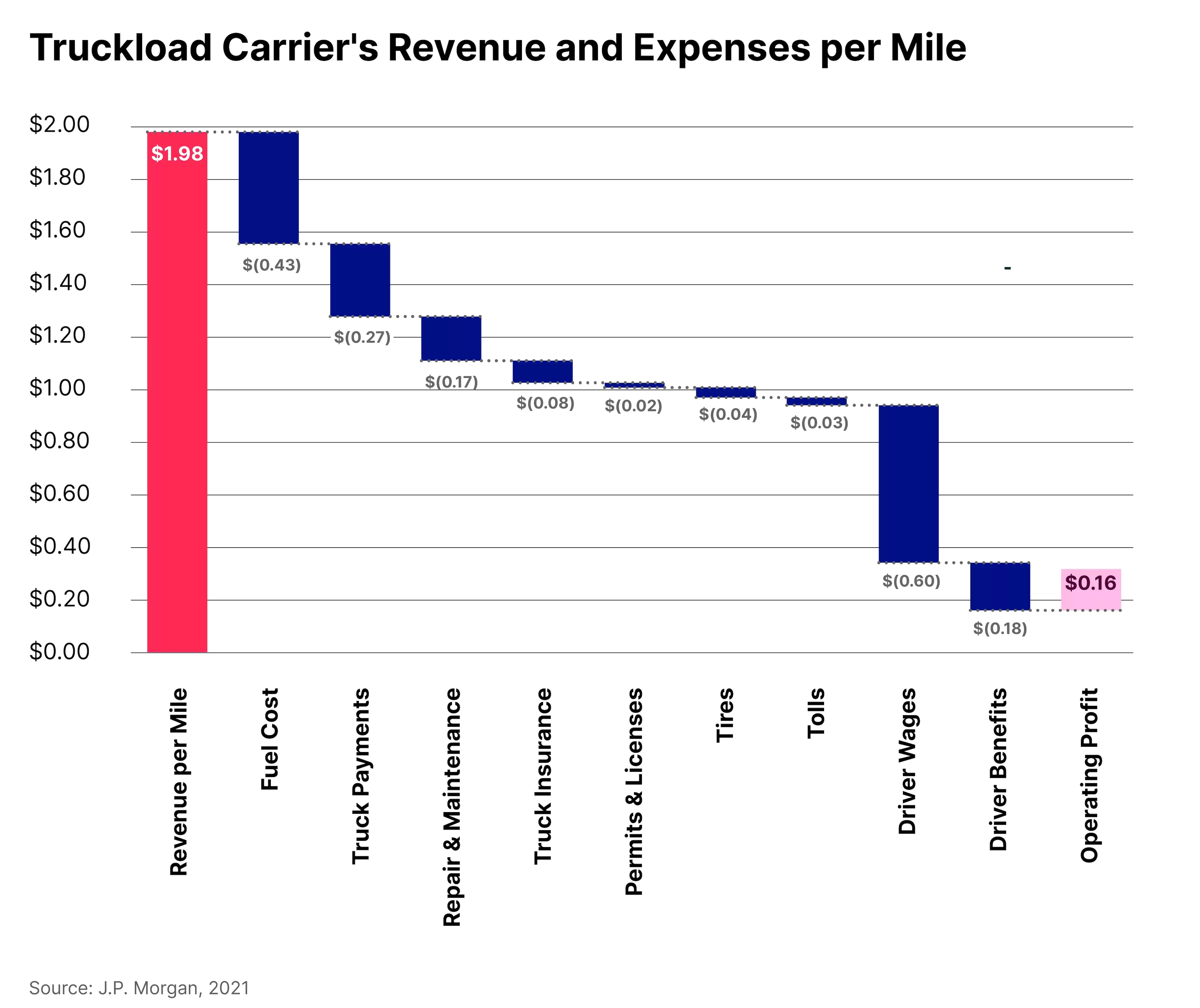

But AVs, unlike human drivers, don’t need sleep, snacks or rest stops. “Even when you find drivers, there are mandatory breaks. And that’s OK, clearly, because we’re human. But as we understand the unit economics of those businesses, we realise that today, 40–45% of truck expenses are actually driver-related.”

From that perspective, driverless trucks could eventually lead to substantial savings for operators at scale. According to a 2021 report by JP Morgan, trucks haul 70% of all freight in the US. The impact on “short, predictable hub-to-hub routes” alone could cut logistics expenses by 46% by 2030, estimates J.P. Morgan.

“Autonomous trucks have the potential to improve utilisation rates,” Palandrani says. “Instead of having a truck operating for eight hours a day, you can at least double that number with autonomous features. That’s going to translate into greater revenues and margins for the carrier operators of these trucks.”

A network of indefatigable driverless trucks transporting everything from groceries to fuel might sound like science fiction, but Palandrani says this futuristic vision is growing closer to reality thanks to certain players leading the field.

Those to watch include private company Kodiak Robotics and publicly traded company Aurora Innovation [AUR] in the US. “They are definitely making a lot of progress when it comes to autonomous driving technology. Those two companies are expecting to roll out fully driverless trucks in 2024.”

“Autonomous trucks have the potential to improve utilisation rates.”

He highlights Kodiak’s ground-breaking “plug-and-play” technology, which utilises so-called SensorPods. “These are essentially replacing the truck’s mirrors with a package of technologies, including lidar, radar and cameras, combined with computing systems.

In January, Kodiak unveiled the world's first autonomous semi-truck “designed for scaled deployment”, with a raft of high-tech safety features.

“Those two companies are expecting to roll out fully driverless trucks in 2024.”

Passive Approach

Palandrani says autonomous trucks constitute one of the “main areas of commercialisation” within the theme of transportation.

The trend extends beyond companies building physical vehicles. Investors could also consider those “developing the hardware and software that actually makes AVs a reality,” notes Palandrani.

Global X offers broad exposure to AVs and self-driving technology with its Autonomous & Electric Vehicles ETF [DRIV], which gives global exposure across multiple sectors and industries.

DRIV’s holdings range from large companies like Nvidia [NVDA], which has developed a hardware and software platform for driverless vehicles, to luxury carmaker Lucid [LCID], whose models feature advanced driver assistance.

However, there are a number of potential risks: “We’re in the very early stages of development and adoption of AVs,” Palandrani acknowledges.

Potential stumbling blocks include the thorny issue of regulation.

Palandrani points to General Motors’ [GM] Cruise, which suspended its autonomous car fleets last October after one of its driverless vehicles dragged a pedestrian 20 feet on the streets of San Francisco. “That could happen any day with any company,” he admits.

However, he says a “passive, diversified way of capturing that opportunity is probably the best way forward for investors today, as the market tries to recognise who are going to be the leaders and losers in the space.”

He recommends investors interested in the trucks cast their net wide.

“Innovation doesn’t happen only here in the US, China or Europe. Regardless of what innovation platform or technology you're looking at, I think the best approach is always going to be global.

“When it comes to innovation and thematic investing, it’s very important to take an unconstrained approach.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy