Trade on shares, tax free*

Get exposure to global growth stocks, like Amazon, Apple, Google, Tesla and Lloyds Bank at home or on the go via financial spread betting.

Start tradingNo minimum deposit • Or try a FREE demo

Why spread bet on shares?

Spread betting offers a number of benefits over traditional share dealing, especially if you want to trade on high-growth stocks over the short term.

Tax-free profits*

There’s no capital gains tax to pay on profits from share spread bets

No stamp duty*

You won’t pay stamp duty as you don’t take ownership of the share

Trade with leverage

Deposit a percentage of the full value of your position to open a trade

No commisions

Unlike traditional share trading, you don’t pay commission when you buy and sell

Your funds are secure

Under FCA obligations, we hold your money in separate bank accounts to our own

Short-term opportunities

Trade quickly and cost effectively on trending, high-growth stocks around the world

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Spread betting vs share dealing

Spread betting can be a more cost-effective way to trade on the movement of share prices than traditional share dealing. Also, the availability of leverage means you can control the same size position with a smaller initial outlay. Remember, trading on leverage can amplify losses as well as profits.

Trade example: Buy £10,000 worth of Barclays shares at 158p and hold for 1 month

- Winning trade

- Losing trade

| Spread bet | Share deal | |

|---|---|---|

| Trade value | £10,000 | £10,000 |

| Stake | £63.29/point | 6,329 shares |

| Initial outlay | £2,000 | £10,000 |

| Opening share price | 158p | 158p |

| Trade duration | 30 days | 30 days |

| Closing share price | 171p | 171p |

| Profit | £822.78 | £822.78 |

| Stamp duty | £0 | £50 |

| Commission | £0 | £23.90 |

| Typical spread costs | £20 | £0 |

| Overnight holding cost | £26.50 | £0 |

| Tax on profit | £0 | £164.56 |

| Total cost | £46.50 | £238.46 |

| Total profit | £776.28 | £584.32 |

| Spread bet | Share deal | |

|---|---|---|

| Trade value | £10,000 | £10,000 |

| Stake | £63.29/point | 6,329 shares |

| Initial outlay | £2,000 | £10,000 |

| Opening share price | 158p | 158p |

| Trade duration | 30 days | 30 days |

| Closing share price | 153p | 153p |

| Loss | -£316.45 | -£316.45 |

| Stamp duty | £0 | £50 |

| Commission | £0 | £23.90 |

| Typical spread costs | £20 | £0 |

| Overnight holding cost | £26.50 | £0 |

| Tax on profit | £0 | £0 |

| Total cost | £46.50 | £73.90 |

| Total loss | -£362.95 | -£390.35 |

This example is for illustrative purposes only.

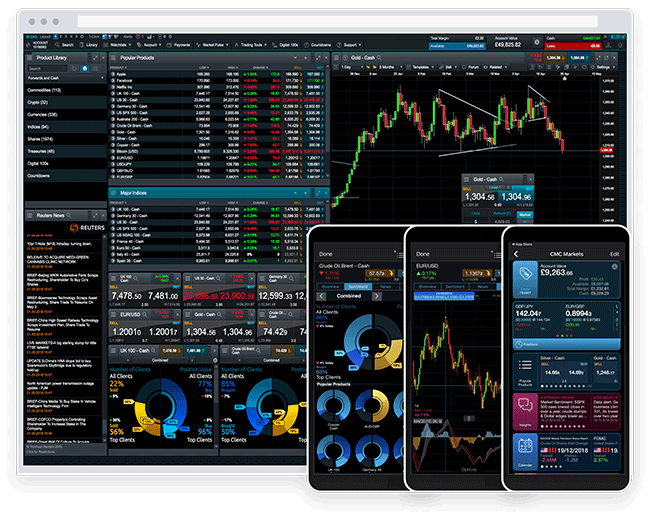

An industry-leading trading platform

Our multi award-winning platform provides everything you need to spread bet on shares.

Free live pricing

It’s free to view live share prices, unlike on many traditional share dealing platforms.

Free charting package

Our fully-customisable, advanced charting package with over 100 technical indicators and drawing tools is completely free, for every client.

Thousands of markets

Choose from over 8,500 shares from around the world. Branch out with indices, FX, commodities and cryptos.

Trade anytime, anywhere

Our award-winning apps allow you to use your mobile and tablet devices as well as your desktop to trade when and where it suits you.

One account, one currency

Trade on US, UK and other countries’ shares from just one account. Trades are always in GBP.

Common questions

How much does it cost to open an account?

How does spread betting on shares actually work?

Do spread bets on shares attract dividends?

Why spread betting?

What is leveraged trading?

What can I trade?

Do you offer a demo account?

What are the costs of spread betting?

Where do your prices come from?

How to start spread betting on shares

- 1

Apply

Complete and submit our straightforward online application form. Apply now →

- 2

Fund

Deposit funds easily with a debit card, PayPal or bank transfer.

- 3

Trade

Once you’ve funded your new account, you’re ready to start trading.