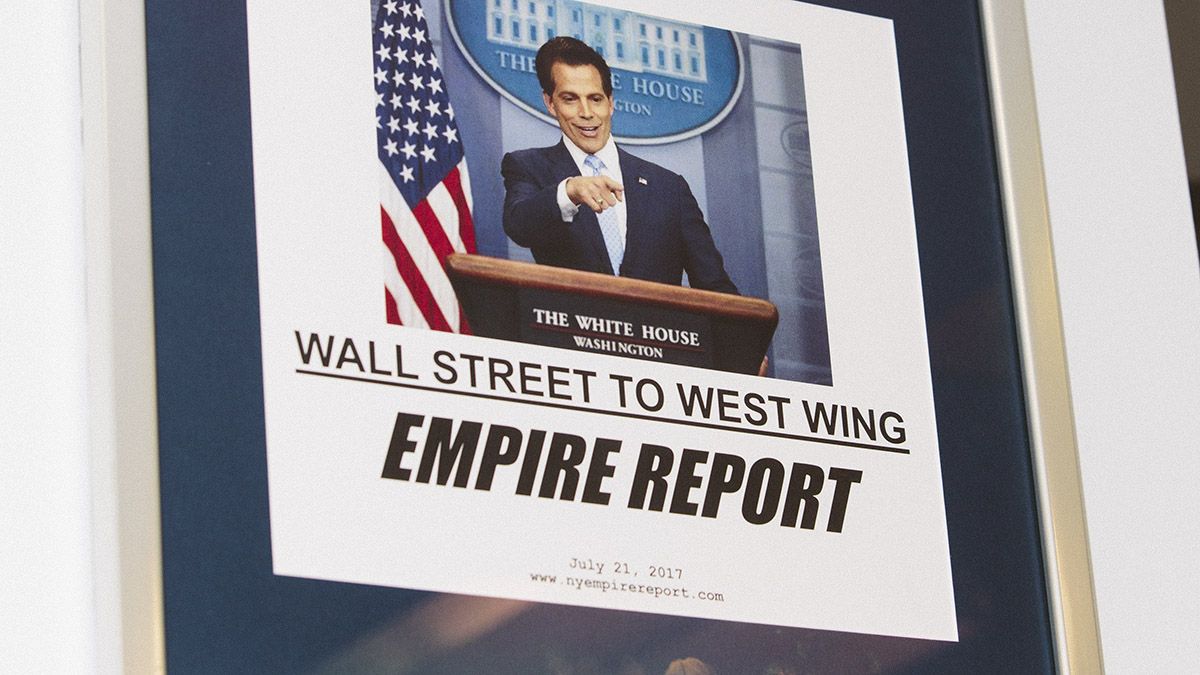

For a brief period in July 2017, Anthony Scaramucci found himself at the centre of American politics. Abrupt, frenetic and referring to himself as “The Mooch”, he quickly became one of the most memorable characters in the ongoing Donald Trump soap opera, despite spending just 11 days in the White House.

Before joining the US president’s administration, he put SkyBridge Capital – a hedge fund with, at the time, nearly $7bn under management that he had spent 12 years building – up for sale in order to “serve”. Having campaigned for Donald Trump, Scaramucci worked on the team managing the transition of power from the Obama administration. He then spent the first six months of Trump’s presidency on the periphery, blocked by insiders from moving into a position of influence.

That all changed, however, when he was suddenly landed the role of communications director – reporting directly to the president – despite an almost complete absence of communications experience other than TV pundit appearances and a stint presenting Wall Street Week on Fox.

Shortly afterwards, another government leak was reported in The New Yorker by Ryan Lizza. Scaramucci had been acquainted with the journalist for a number of years and called him, demanding that he reveal the source of the leak. Scaramucci didn’t hold back, telling Lizza he wanted to “f**king kill all the leakers”. “I’m not Steve Bannon, I’m not trying to suck my own c*ck,” he went on, before calling Reince Priebus a “f**king paranoid schizophrenic”. (As chief of strategy and chief of staff, respectively, both had vehemently opposed Scaramucci’s appointment.) While Scaramucci maintains that the call was off the record, Lizza says otherwise.

Scaramucci did in fact successfully oust Priebus. But in doing so, he put the final nail in the coffin of his nascent White House career: three days later John Kelly was appointed as Priebus’s replacement and ordered Scaramucci be fired.

Still, his time as director of communications made him a celebrity, with about 55% of the US population recognising his name. “These Washington jokesters went, ‘OK, that’s the end of him.’ But they don’t know me. And that’s not the end of me. These guys accidentally gave me a higher profile and a bigger voice in the conversation,” he tells Opto from SkyBridge’s offices in Manhattan.

“These Washington jokesters gave me a higher profile and a bigger voice in the conversation”

He seems to be enjoying the limelight: he frequently appears in the media, has released a new book about Donald Trump’s presidency, and launched a podcast with his wife, Deidre Ball, a vocal Democrat supporter. He is also back at SkyBridge Capital, which he pledged to “make fun again” after returning to the helm. (The time Scaramucci spent in Washington was, perhaps fortuitously, not long enough for the sale of SkyBridge to Chinese buyers to go through.)

But while much has been written about Scaramucci’s stint in the White House and his colourful personality, there’s very little focus on his business credentials as a successful hedge-fund owner, entrepreneur and manager of both people and money.

Mooch, the money manager

In stark contrast to starting his first day as the White House communications director with “a chainsaw and a hockey mask on” – a move that he now admits was probably the wrong one – Scaramucci has been cautious and calculated in his money-management career.

The Mooch’s management playbook

Effective delegation

“You have to have the capacity to delegate. The employees of one of my competitors call him ‘The Bottleneck’, because every single decision inside the firm has to pass through him. It means he’s anchored to his desk and everyone else in the company is slowed down.”

Empower autonomous decisions

“You have to allow your employees to make autonomous decisions. They have to take ownership. As part of this you’ve got to put your people in a position where they can fail or rise on their own ambition or own work ethic.”

Developing staff

“I played a lot of sports as a kid. A key thing I learned from captaining teams is that, if you're focused on your own statistics and your own glory or vanity, you’re not going to be the captain very long. You need to sit down and look at all the other players on the team and say, ‘I’m going to help each and every one of these players on this team.’ Management follows the same principle.”

Honesty and accountability

“You have to hold people accountable. If you’re on my team and you make a mistake, I'm going to own that mistake with you. So long as you’ve made the mistake honestly. If you said you’d buy oranges, and that’s what you did, fine. But if you tell me that you’re buying oranges and you’ve actually bought apples, and the apples go bad, you and I have a problem.”

Don’t get in the way

“Never let your plans or ideas get in the way of a better idea. I just finished re-reading Walmart founder Sam Walton’s Made in America; it’s one of his main ideas and one that I run my business by.”

“As a money manager, the most important thing is compound interest and just staying in the game; recognising that the tortoise is going to win the race,” he says.

For the most part, this has served Scaramucci handsomely. While the hedge-fund industry suffered a brutal 2018, with 4% losses on average, SkyBridge’s public fund made a 3.2% gain. But his cautiousness also led to passing on a huge opportunity he now puts down as one of his biggest mistakes in finance: not buying into Uber.

“I had an opportunity to buy into Uber at a $25m valuation,” he says. “But when they came in with the business plan my reaction was that they were nuts. I thought: ‘I’m not going to put my wife or my daughter in a car with a stranger that nobody knows.’ My daughter now has the highest Uber bill in the world! I totally missed that opportunity.

“The money that I could have put in there would have been worth my entire personal fortune 10 times over. So I would say my mistakes are more in caution and missing unicorn opportunities.”

Nonetheless, the episode encapsulates Scaramucci’s view of money management: “I would rather make less money and delay gratification to ensure my clients are on a very steady ship.”

Spotting opportunities

Not that Scaramucci doesn’t seize opportunities when they are presented to him, both in traditional hedge-fund man-agement and launching new products.

Before launching SkyBridge in 2005, he had already set up and sold his first fund, Oscar Capital Management, to Neuberger Berman, which was in turn purchased by Lehman Brothers in 2003.

In 2010, SkyBridge acquired Citigroup’s hedge-fund business. And, on the back of the financial crisis, Scaramucci made the decision to diversify, launching the SALT (SkyBridge Alternatives) conference in Las Vegas, an annual event which “facilitates discussions and debates on macro-economic trends, geo-political events and alternative investment opportunities”. Presidents George W. Bush and Bill Clinton are former speakers there.

A fund of funds

SkyBridge’s main fund is a fund of funds, whereby investments are made into a collection of specialist funds and money managers, rather than directly into assets. Scaramucci isn’t a fan of the term, however.

“I don’t view us as a fund of funds,” he says. “The way I look at our business model, we are an outsourced multi-strat. Rather than having an internal mechanism with internal managers, I go with the best and the brightest in different sectors.

“That way I can decide where we’d like to be, and then allocate funds to the best managers in that industry. Then, if we don’t like those sectors anymore, we can take the money away without any of the internal politics.”

“We launched in December and have already raised a ton of money for it. I think we can raise $2-3bn in total. I’m super excited,” he says, adding that the ability to take advantage of opportunities such as this is one way hedge funds maintain their edge.

Blue-collar kid

As a “blue-collar kid who grew up with nothing”, Scaramucci says the Opportunity Zone investment represents a way in which “Wall Street can help Main Street”. It’s also why the minimum buy-in for SkyBridge’s main fund-of-funds offering is just $25,000 (most funds start at at least $250,000).

“For some reason, there’s this idea that richer people are more sophisticated than poorer people,” he says. “I tell my elitist friends, ‘You think you're that smart? The kids in my neighbourhood are as smart as you, their dads just weren’t doctors or Wall Street bankers who provided them with the opportunities you had.’”

Charges are, according to Scaramucci, some of the lowest: “We have lower fees than some of the multi-strategy hedge funds we compete with. Through our scale we negotiate down underlying manager fees on behalf of our clients.”

“I tell my elitist friends, ‘You think you're that smart? The kids in my neighbourhood are as smart as you, their dads just weren’t doctors or Wall Street bankers who provided them with the opportunities you had.'”

His background also forms the principles on which Scaramucci runs SkyBridge, and who works for him. “In my business, the only thing that really matters for someone like me are your ethics.

If I watched my father take his lunch out of the refrigerator and go to work at four o'clock in the morning and do everything right: paid his taxes, tried to raise his family, played everything straight; you're not coming into my shop at SkyBridge Capital and doing things wrong. We're not going to do anything in this organisation to hurt my father's last name, under any circumstances.”

The Mooch on BREXIT

“When I think of London – and I lived there when I was a college student at the London School of Economics for a semester –I think of the city as a great destination for all of Europe and into the Middle East and possibly even North Africa, too. So when we were looking for a place to put the office in Europe, I dropped it in London.

“And we were actually opening that office a week or two before the Brexit vote. Somebody said to me, ‘Well, what if Brexit happens? Isn’t that going to change your decision? Wouldn’t you rather put it on the continent?’ I said, ‘No. The City of London has flourished for 500 years, with or without the economic union, with or without being in the EU.’”

“I don't know where you guys are going with Brexit; I don’t have any idea what you are doing. But for me, we’ve done very well in London. It’s been two and a half years and my guys in the City have attracted entrepreneurial capital from both Europe and the Middle East to our funds.”

Scaramucci grew up on Long Island, the son of a construction worker – and has an accent to prove it. “I hustled my way into Tufts [University] and Harvard Law School,” he says.

He credits his working-class origins and values instilled in him by his parents as the main reason why no media organisation or political opponent has been able to dig up any dirt on him from his Wall Street career – aside from his frequent use of colourful language – as much as some might have tried.

“My dad handed me my last name unsullied,” he says. “So if you want to call me stupid for working in the White House or stupid for having a bad phone conversation, or using a curse word, it’s no big deal, but you’re never going to call me dishonest.”

He continues: “That was like the big irony when Rancid P*nis [Scaramucci’s name for Reince Priebus] and his buddies were trying to do opposition research on me. They figured that, because I’ve been on Wall Street for 30 years, I must have done something wrong. Well, good luck! I don’t even have a personal trading account.”

Management and recruitment

As with all of Scaramucci’s endeavours outside politics, he often puts complete trust in others to run the business, which now has over $9bn under management. Luckily, he’s already developed a playbook for leading a team and getting the best out of staff (see Management Masterclass box).

At SkyBridge, the policies have worked well, with his core money management team having been with the fund for 14 years. “I take a lot of pride in being able to recruit people, retain people and empower people. At the end of the day, I want the kinds of people who view this as a mission rather than just some job,” he says.

“The winning people in business are about collaboration and creating win-win situations, whereas in Washington it’s zero-sum. And let me stab your eye ball out while I’m at it.”

“I didn't expect people to act the way they did. These guys are on my own team. I didn't expect them to turn on me... Politics is not a team sport. In Washington it's a race to the top”

‘I didn’t understand the viciousness’

So why did Scaramucci enter the White House in the first place then? “Stupidity,” is his simple answer. He likens his decision to the 1939 comedy film Mr Smith Goes To Washington, in which a new senator attempts to single-handedly change a corrupt political system.

“When a buddy of yours wins the presidency and asks you to go work for him, you think it’s part of the American dream. I thought, ‘I’m going to go there, try to do a good job, and try and help people who had similar upbringing to me.’

“But I didn’t understand Washington. I didn’t understand the viciousness – that was my naïveté, I have to own that. Getting my a*s kicked as hard as I did was very humbling.”

With the gift of hindsight, Scaramucci believes that staying involved in the White House after “forces in the administration blocked my getting a job at the start” was a mistake. But it was one that taught him some valuable lessons. “It made me understand you can’t let your ego infect your decision-making because, once it does, you end up doing regrettable things,” he says. “I should have dropped it. But I got my ego involved, and I kept pushing to get a job.

“At the end of the day, you have to be resilient. And you have to forgive yourself. You can't sit there and think, ‘Oh shit, 18 months ago I got fired from the White House for a mistake I made, let me kick myself today.’ I’m not doing that. I’ve dusted myself off, no whining, no complaining, I’m moving on."

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy