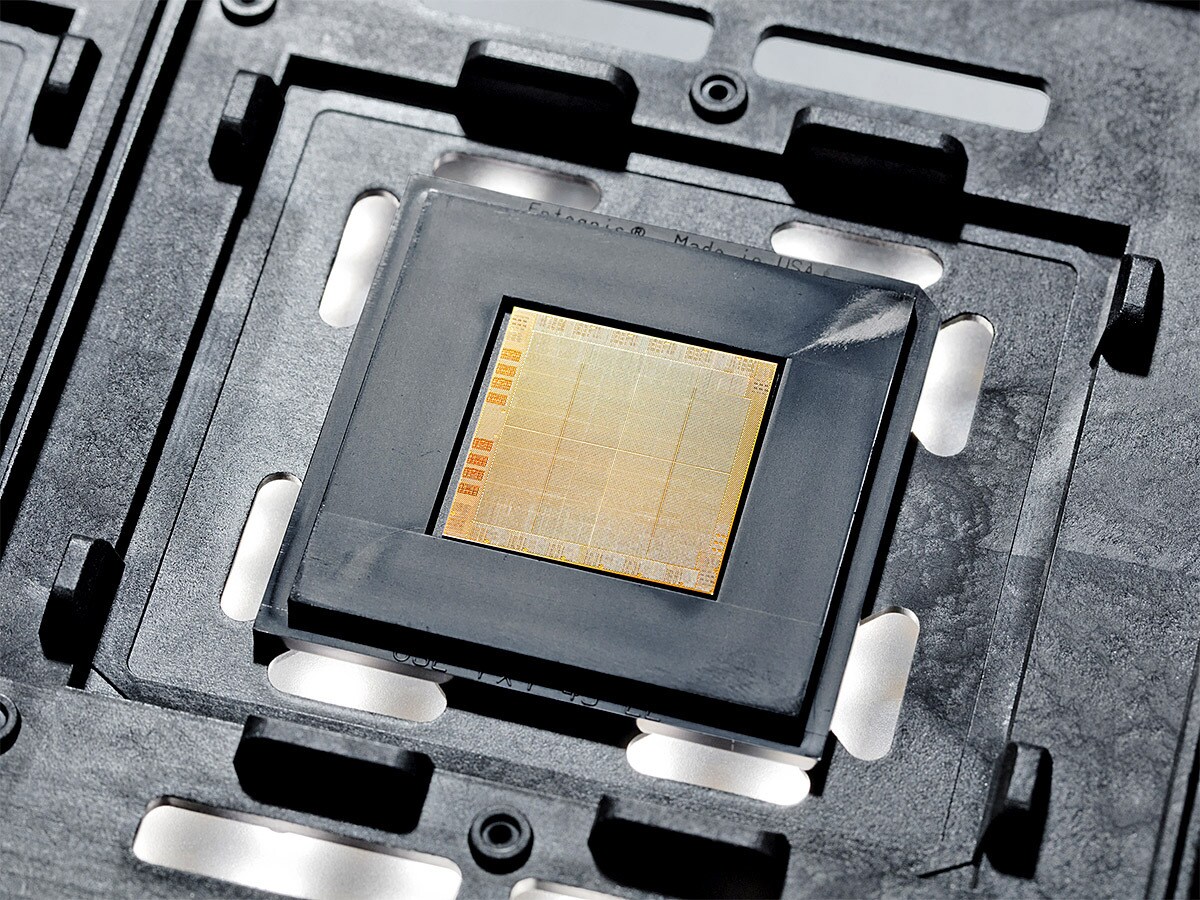

In the world of chips, smaller is better. So, when International Business Machines (IBM) [IBM] revealed its breakthrough 2nm semiconductor earlier this month (May 2021), it caused a stir throughout the industry.

According to the company, the chip will improve performance by 45% compared to the 7nm chips that have been available commercially since 2019. IBM built the first 2nm processor in 2015.

IBM’s share price climbed 2.2% by close on 6 May, the day it announced its breakthrough. This took its year-to-date gains to 19.5%.

IBM’s share price has slipped since, however, falling 1.7% since its 6 May spike to close on 11 May. The stock is up 23.9% in the past 12 months.

Can IBM rise again?

IBM has claimed that the 2nm chip is more efficient, consuming 75% less energy compared to 7nm performance. Current research indicates that it could quadruple the battery life of smartphones.

The development of the 2nm chip is not likely to have a material impact on IBM’s financials for a few years. The technology is still in its Albany, New York, research facility, but is expected to start rolling out of its foundry partners’ factories in late 2024.

It’s anticipated that the roll-out will coincide with the commercialisation of rival Taiwan Semiconductor Manufacturing Company’s [TSM] own 2nm chips.

While IBM won’t be generating any revenue from its breakthrough for some time, the development is an indication of how the company hopes to innovate its way to a brighter future.

The last 10 years or so have been hard on IBM, with quarterly revenue continuously falling — between 2012 and 2017 there were 22 consecutive quarters of declining year-over-year revenue growth, according to MacroTrends data.

In its most recent quarter, Q1 2021, IBM reported a marginal 0.9% year-over-year revenue growth, following four quarters of decline. It was the best-performing quarter since Q2 2018.

Revenue for the three months to the end of March was $17.73bn, beating the $17.35bn that analysts had expected. Earnings per share, meanwhile, were $1.77 versus analysts’ expectations of $1.63, according to data from Refinitiv.

The revenue was underpinned by a 49% year-over-year growth in the mainframe segment, caused by an unexpected demand for the company’s z15 processor which is used in mainframe storage and hybrid cloud technology.

In a note to clients seen by S&P Global, Matthew Cabral, an analyst at Credit Suisse, described the performance as a “much-needed bounce back”.

As slim as overall revenue growth may seem, it could spark a turnaround in fortunes for IBM. The company is working hard to shake off its image as a legal technology player by making the transition to cloud computing and artificial intelligence (AI).

One caveat during the Q1 earnings call was the reiteration by Jim Kavanaugh, CFO of IBM, that the company simply expects positive revenue growth in 2021, as stated in the previous quarter. With no hard figures, this suggests that it’s too early to say whether the Q1 revenue growth will be a one-off event or the beginning of a bullish trend.

For the full fiscal year 2021, 10 analysts estimate IBM’s revenue will be between $73.44bn and $75.45bn, according to Yahoo Finance. The consensus of $74.38bn would represent a single percentage point of growth on the $73.62bn posted last year.

Into the cloud

Looking to the long-term, IBM appears well-placed to continue growing its cloud computing and AI business. This, in part, will be driven by open-source software subsidiary Red Hat, which was acquired by IBM for $34bn back in 2019.

IBM already uses some of its latest next-generation hardware, including its Power10 processors, to optimise Red Hat for enterprise hybrid cloud solutions.

Its latest design, the 2nm chip, is likely to be used to accelerate AI applications and capabilities, while the improved performance and energy efficiency would benefit data centres.

Cloud computing and AI growth should be further boosted by IBM’s decision to spin off its old infrastructure business, which is expected in the fourth quarter of 2021.

Jim Kelleher, an analyst at Argus Research, believes the company’s forthcoming business split will create a significant tailwind. “While investors have been frustrated at the slow state of progress, we believe the spin-off will… stimulate IBM’s hybrid cloud growth,” Kelleher wrote in a note to clients seen by S&P Global.

Kelleher reiterated a buy rating and his $155 price target in late April. In total, IBM currently has 10 Wall Street ratings, according to MarketBeat. Of these, six are a hold and four are a buy. The consensus price target is $148.44, which would represent a 2.9% rise from its closing price on 11 May.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy