In this article, RBC Wealth Management compiles its analyst’s and strategist’s portfolio positioning for 2022 by asset class and region, as well as offers forecasts for currencies and commodities.

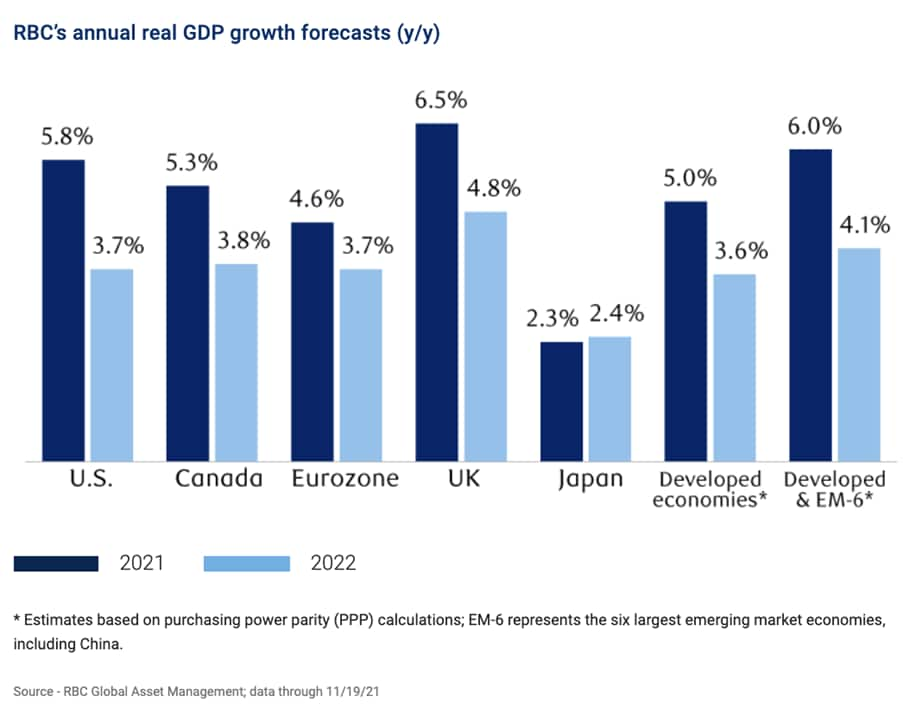

The strong initial recovery phase that transpired following the depths of the pandemic has already given way to a more normal yet above-average growth phase. We think this will become more entrenched in 2022. Industries most constrained by COVID-19 headwinds should continue to normalize as long as omicron or some other variant does not result in disruptive lockdowns.

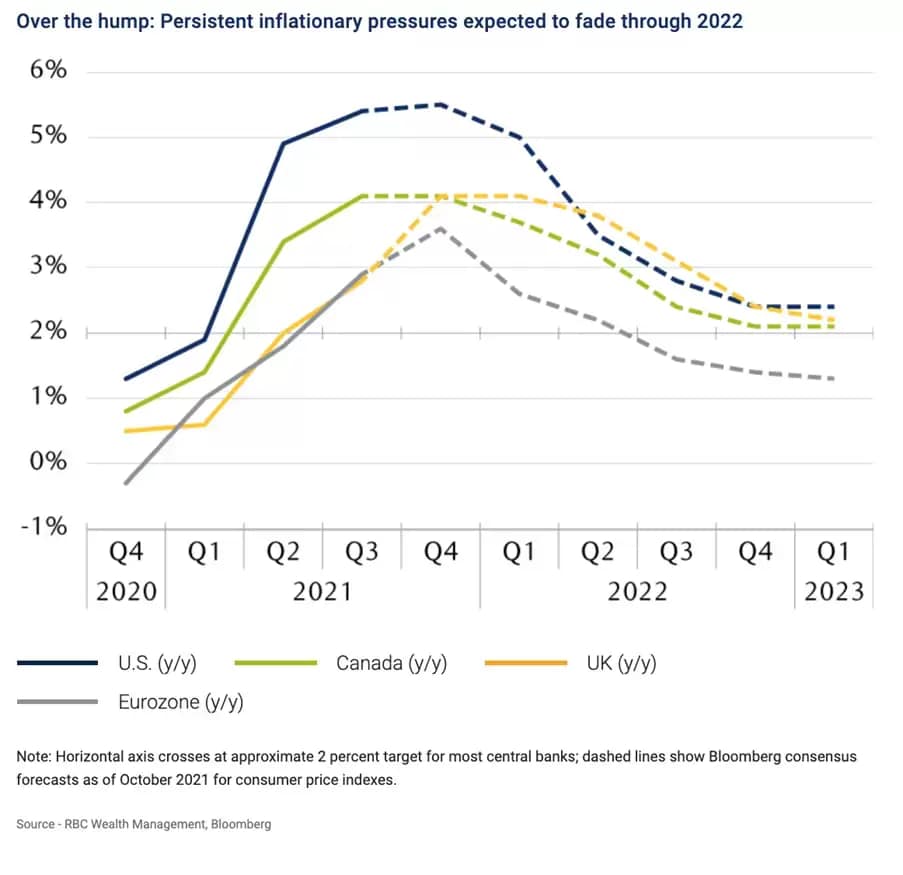

An elevated level of infrastructure spending by governments, led by the US, should keep fiscal policy relatively accommodative. While China’s ongoing regulatory reform agenda poses risks, we think the Chinese authorities will fine-tune fiscal and monetary policies as needed to support growth. Inflationary pressures, which have spread to all regions, will be one of the key challenges facing major central banks. Following are our thoughts about portfolio positioning for 2022 by asset class and region, and our forecasts for currencies and commodities.

Fixed income

Central banks will aim to right-size policy support in 2022 amid an ongoing economic recovery, and the process of dialling back accommodation will be about finding the right balance. Current market expectations for multiple rate hikes from many major central banks are too aggressive, in our view. We see policymakers continuing to view elevated inflation as temporary, with central banks staying reasonably patient in pursuit of complete economic and labour market recoveries.

United States

Thomas Garretson, CFA – Minneapolis

- The window for Federal Reserve policy rate hikes will open in the middle of 2022 following the completion of its bond-buying program around June, based on the current rate of reduction in its asset purchases. We expect the Fed to have a more stringent test for rate hikes, however, the most important of which could be an unemployment rate below 4%, a mark which should be achieved by the fourth quarter of 2022, according to the Fed’s latest set of economic projections. This supports our call for the first 0.25% rate increase at that time.

- Treasury yields, and the shape of Treasury yield curves, could be the dominant theme of 2022 as the Fed nears the point of raising short-term policy rates. But while short-term policy rates may climb, we expect stable long-term Treasury yields, with the 10-year Treasury likely to hold below 2% for the balance of 2022. This should result in a gradually flattening yield curve. Should it flatten too much, or even near the point of inverting, it could raise fears about the durability of the economic recovery.

- Credit markets will likely remain well supported through 2022 on account of strong corporate balance sheets and historically low default rate forecasts. We remain comfortable augmenting portfolio income with lower-rated credits and preferred shares as long as the economic recovery remains intact.

Canada

Ryan Harder, CFA – Toronto

- While 2021 involved a great deal of debate about the timing of central bank rate hikes, 2022 is likely to be the year that policy rates actually start to rise. The Bank of Canada (BoC) has been on the more aggressive end in dialing back COVID-19 monetary stimulus, and we expect this will be the case in the coming year as well.

- Despite the likelihood of rate increases in 2022, the additional yield available when extending duration in bond portfolios compensates investors now for rate hike expectations that the market has already priced in. We see intermediate-term bonds as relatively attractive, as they offer a meaningful pickup in yield over cash, but without taking undue interest rate risk should inflation prove to be more persistent than expected.

- Corporate credit was very well supported in 2021 by near-zero interest rates and the BoC’s asset purchases. While support from the BoC is now being gradually reduced, we expect the economic backdrop to remain accommodative for corporate bonds in the coming year. However, this environment is already represented in the low compensation available for assuming credit risk, particularly in high-yield bonds, and to reflect this we are recommending a high-quality bias in corporate bond allocations.

Europe and the UK

Rufaro Chiriseri, CFA – London

- Amid higher inflation and slowing growth concerns, the Bank of England (BoE) sent a strong signal on future monetary policy at the November 2021 meeting. The BoE stated that if the post-furlough labour market data is “broadly in line with the central projections in the November Monetary Policy Report” then an increase in interest rates would be warranted. We now expect a December 2021 rate lift-off followed by further hikes in Q1 and Q3 2022 to reach a 0.75 percent bank rate.

- The European Central Bank’s (ECB) December 2021 meeting is anticipated to have significant announcements on the tapering of the Pandemic Emergency Purchase Programme (PEPP) and the future of the existing Asset Purchase Programme (APP). We expect the APP to continue, which would support yields, albeit to a lesser extent than the PEPP, and we see a risk of purchases being expanded to offset the end of the PEPP in March 2022. Recent downbeat ECB comments lead us to believe that conditions for a rate hike are unlikely to be met in 2022.

- Reduced asset purchases and tight spreads mean credit returns are highly sensitive to Gilt and Bund yield movements; we remain selective across issuers. Gilts are likely to underperform Bunds into next year due to diverging central bank policies.

Asia Pacific

Calvin Ng – Hong Kong

Chun-Him Tam – Singapore

- We believe the volatility in the Chinese bond market that began in 2021, due to efforts to step up economic reforms, has a high likelihood of persisting into 2022 as policies remain uncertain across sectors. In particular, the deleveraging campaign within the property sector has led to a massive volatility spike mainly on refinancing concerns. Unlike previous cycles where the government fine-tuned its policies after a gradual correction started, to date, the government has remained steadfast in its reforms.

- That said, Asia high-yield bonds have repriced to multiyear lows with the JP Morgan Non-Investment Grade Index showing that companies are paying an average yield spread of 10 percent over the benchmark rate. This is the highest level in the past decade and is starting to look attractive for longer-term investors with the risk appetite to invest in a diversified portfolio of Asia high-yield bonds. One caveat is that the index composition is roughly 50% Chinese property developers, which are expected to see further consolidation within the industry.

- Looking beyond the volatility, we believe the government’s reforms should create a better long-term growth foundation for China, enabling the country to overcome the middle-income trap and to establish a more developed credit market.

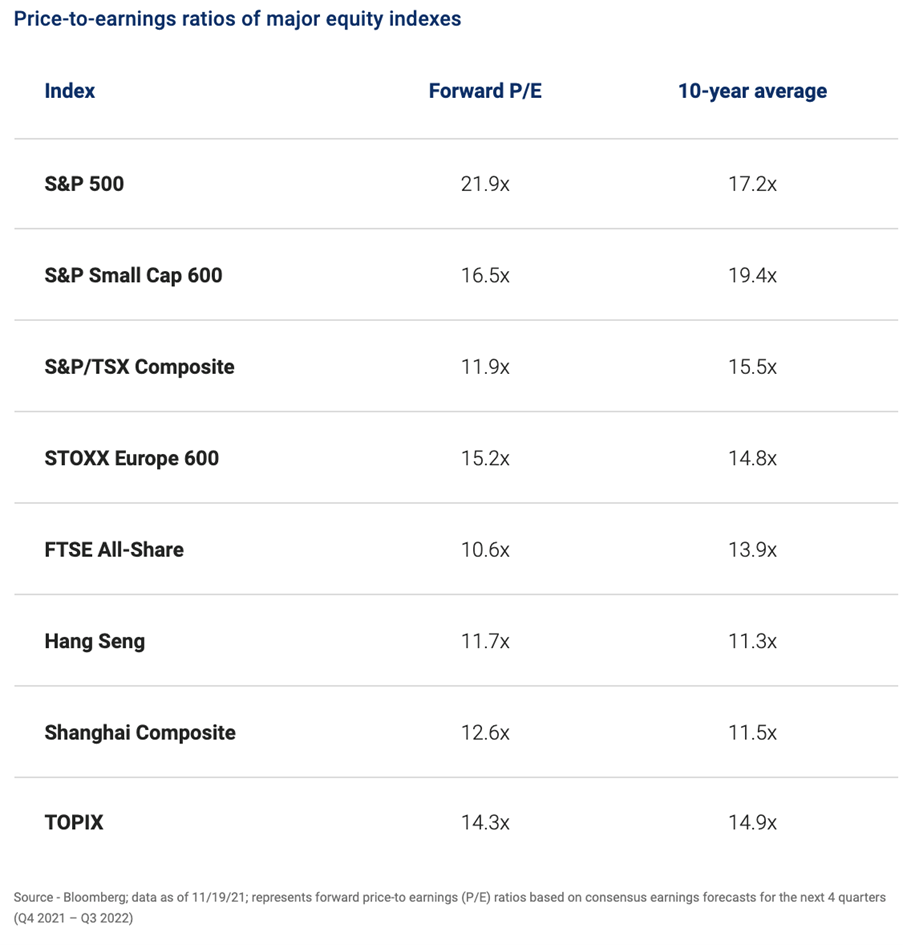

Equity

Our outlook for 2022 features worthwhile global equity returns and moderate earnings growth, supported by above-average GDP growth and strong consumer and business capital spending. Major central banks seem set to begin raising interest rates, yet equity markets typically perform well surrounding the first rate hike. Furthermore, even as rates inch higher, we expect them to remain rather low by historical standards. These factors should make equities the asset class of choice once again in 2022. We recommend holding a moderate Overweight position in equities.

United States

Kelly Bogdanova – San Francisco

- Above-trend GDP growth should set the stage for moderately higher U.S. earnings growth and stock prices in 2022. The inflation, supply chain, and labor headwinds should gradually dissipate as we move further away from the peak of the COVID-19-related disruption, but are unlikely to fully abate. We think most industries and leading companies will continue to manage around these headwinds by containing costs and using technology to support productivity. The S&P 500 consensus earnings forecast of $221 per share for 2022 seems achievable and has potential for upside, in our view, so long as new COVID-19 variants do not seriously disrupt economic momentum.

- The market will be laser-focused on gauging both the timing of the Fed’s first rate hike, likely in 2022, and the magnitude and pace of the rate hike cycle thereafter. Historically, the S&P 500 has performed well in the 12 months that precede and follow the first rate hike, on average, and has outperformed bonds during each tightening cycle since 1989. Typically, a bull market becomes threatened only when rate hikes pile up, constricting access to credit, and when recession risks rise notably. We don’t foresee this occurring in 2022. We would moderately Overweight US equities to start the year.

Canada

Sunny Singh, CFA – Toronto

- We expect the solid market performance of 2021 to continue into 2022, albeit at a more moderate pace. Above-trend global economic growth should persist, which we expect to support the Canadian market given its cyclical orientation.

- The Canadian banks have had a strong year, and valuations remain reasonable. The biggest risk to the bank group, in our view, is the Canadian housing market. However, pointing to a catalyst that may shift the positive momentum remains a challenge. Canada’s population growth over the next several decades is expected to be amongst the strongest globally, while the persistence of supply-side constraints also supports continued strength in housing. Overall, we remain positive on the bank group on the expectation of improving loan growth and increased cash returns to shareholders given regulatory capital restrictions have been lifted.

- West Texas Intermediate crude oil prices have reached multiyear highs and appear well supported heading into 2022 led by expectations for post-pandemic demand growth to outpace supply. The supportive backdrop for oil leaves us constructive on oil producers as valuations remain attractive amidst impressive free cash flow generation potential.

Europe and the UK

- We would hold an Overweight, or above-benchmark, position in European equities. Ongoing fiscal support and a relatively dovish European Central Bank should continue to support the economy, while supply chain disruptions should start to diminish over the course of 2022. Moreover, the region typically outperforms as bond yields rise, and valuations remain attractive on most measures. With the initial bounce-back phase of the business cycle morphing into a more normal expansion phase, we suggest positioning equity portfolios with secular growth stocks and select quality cyclicals, ensuring companies have strong pricing power to defend their profit margins in an elevated inflation environment.

- There are growing concerns with regards to the UK economy. A relatively hawkish Bank of England and a chancellor of the exchequer eager to return to fiscal rectitude by raising taxes make for a complicated outlook given the existing Brexit and COVID-19 challenges. Consumer confidence has been falling precipitously. Despite this, we retain a Market Weight recommendation on UK equities, which continue to stand out given their low valuations with the FTSE All-Share Index trading close to a record discount to global developed markets. Given the difficult domestic background, we have a bias towards internationally oriented UK-based companies. We prefer the Financials and Health Care sectors in particular.

Asia Pacific

Jasmine Duan – Hong Kong

Nicholas Gwee, CFA – Singapore

- China underperformed among emerging market equities in 2021. We believe the regulatory overhang could still lead to market volatility in 2022. However, a large part of the unwinding of Chinese equities is likely over and we think there could be some trading opportunities in 2022. Valuations are undemanding, we expect macro policy to become moderately growth-supportive, and there may be some policy fine-tuning in key industries, i.e., housing policies. Overall, we prefer China A-shares within the broad China equity space due to their lower exposure to growth stocks and tech in particular, which is in the crosshairs of regulators. We believe tension between the U.S. and China is still a risk that investors should closely monitor.

- In Japan, we expect private consumption to rebound and the recovery to extend into the first half of 2022. With new COVID-19 cases declining, the government plans to resume travel and dining-out subsidies. Meanwhile, wage growth has been encouraging. While production and exports remain weak, manufacturers expect that the gradual easing of bottlenecks will lead to a strong rebound. With the Liberal Democratic Party maintaining its “absolute stable majority” in the lower house of parliament, we expect attention to turn toward potential additional economic stimulus. We are positive on Japanese equities for the near term given these supporting factors and reasonable valuations. We are cautious on the medium- to longer-term outlook as political risks remain.

Currencies

Nicolas Wong, CFA – Singapore

USD – Fed rate hike expected. The Federal Reserve recently announced plans to begin tapering its asset purchases, a process which if kept at a consistent pace would see quantitative easing end in the summer of 2022. We expect moderate U.S. dollar strength in 2022, with the first interest rate hike currently priced in at the Fed’s July or September policy meeting. Labor market and inflation data will likely dictate the pace at which the Fed adjusts monetary policy going forward.

EUR – ECB to stay dovish. The European Central Bank is expected to replace its current Pandemic Emergency Purchase Programme (PEPP), which is ending in March, with a different form of asset purchases, keeping it amongst the most dovish of central banks. Increasing uncertainty ahead of the French presidential election in April is a potential headwind for the euro.

CAD – Market too hawkish on rate hikes. At its October meeting, a hawkish Bank of Canada (BoC) brought forward the timing of its first potential rate hike from the second half of 2022 to April 2022. While the market has priced in about five rate hikes for 2022, RBC Capital Markets’ economists believe this pace is too aggressive. A dialing back of rate hike expectations could lead to mild loonie weakness in 2022.

GBP – Weaker despite widely expected BoE hikes. A surge in UK inflation could force the Bank of England (BoE) to start raising rates, but similar to the BoC, we think markets have overpriced the extent to which the BoE will tighten in 2022.

JPY – USD/JPY to rally with Fed hikes. With the Fed likely to start to normalize rates in 2022 and the Bank of Japan in no hurry to adjust monetary policy, we believe interest rate differentials between the U.S. and Japan will be the main driver for a higher USD/JPY.

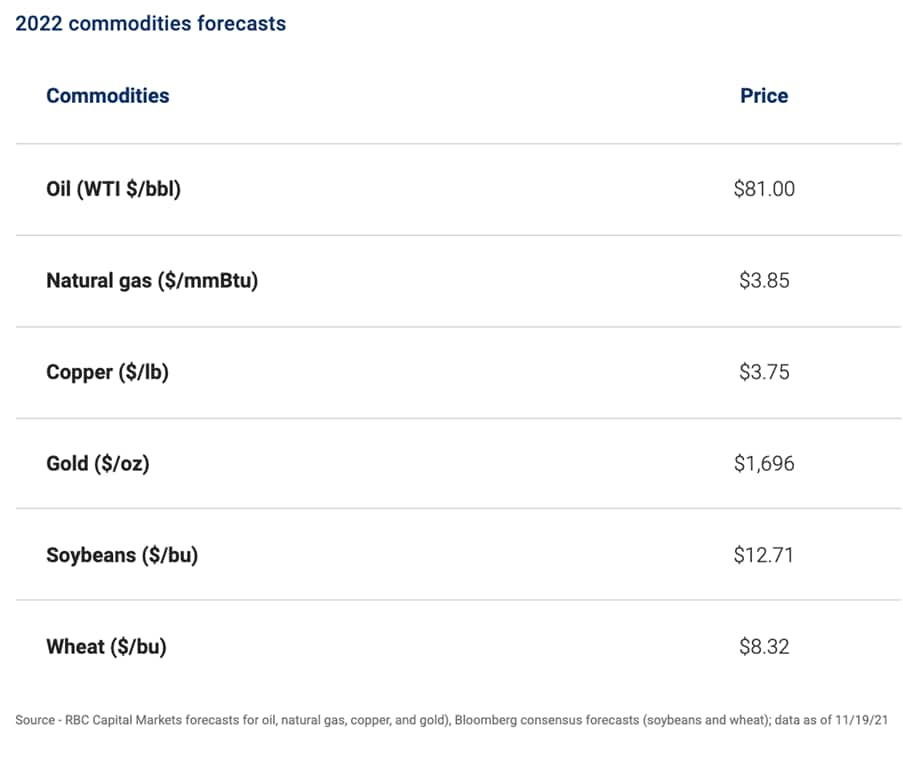

Commodities

Richard Tan, CFA – Toronto

Crude oil – Bullish signs. RBC Wealth Markets’ oil strategist anticipates WTI prices will remain elevated in 2022 and have further to run driven by the combination of tight supply and strengthening demand. Despite the 57 percent rally year to date, RBC Wealth Markets believes oil is in the early stages of a multiyear bull cycle. Furthermore, OPEC+ reiterated its commitment to gradually increase production, which lowers geopolitical risk, in our view.

Natural gas – Multiyear highs. Natural gas prices are trading at multiyear highs driven in part by U.S. production outages, low European stockpiles, and strong liquefied natural gas demand. Furthermore, exploration and production companies have generally committed to capital discipline, which is translating into lower supply growth. Prices are currently trending above RBC Wealth Markets’ 2022 high scenario forecast of $4.89/mmBtu.

Copper – Green support. While copper has pared its gains amid slowing Chinese demand, we think the ramp-up in green initiatives should allow copper prices to stay elevated in 2022. RBC Wealth Markets expects supply deficits to persist until 2023.

Gold – Downside risks. Gold has been a relative underperformer in 2021 amid the global economic rebound, although prices have stabilized around $1,800 with the help of U.S. dollar weakness and higher inflation. RBC Wealth Markets believes further economic momentum and tighter monetary policies expose gold to downside risks in 2022.

Soybeans – Record production. North American production is on pace for a record year as soaring fertilizer prices have incentivized farmers to grow more soybeans relative to corn or wheat. Soybean prices are down approximately 4 percent year to date and will likely require a rebound in Chinese demand before prices can pick up in 2022.

Wheat – Firming support. The U.S. Department of Agriculture is projecting continued strength in international exports, offset slightly by lower domestic consumption. It also anticipates reduced North American production and a drawdown in global inventories. This should provide support for wheat prices.

This article was written by RBC Wealth Management and originally published on the firm’s research and insights page, here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy