Introduction

Advanced Micro Devices [AMD] and Nvidia [NVDA] are two of the world’s chipmaking giants.

In the ranking of semiconductor companies by market capitalization, they were sixth and first, respectively, as of November 13.

The two compete in the artificial intelligence (AI) chips and graphics card markets. This year has seen numerous product and technology launches as each tries to gain an advantage over the other.

This stock spotlight will highlight some of AMD’s and Nvidia’s recent launches and discuss their recent financial performance. Could one or the other emerge victorious from the AI chip race? Or does the market have room enough for both?

AMD Launches Rival to Nvidia’s Blackwell

On October 10, AMD announced that its MI325X chips will begin shipping to customers in Q4 2024. The chip boasts “industry-leading” performance compared with Nvidia’s current generation of chips, the Hopper H200.

AMD’s competitor to the Blackwell data center GPU, the MI355X, and its AI accelerator, the MI350, are not expected to drop until the second half of calendar 2025.

In this, Nvidia is a step ahead of its rival. On its Q2 2025 earnings call in August, the company said that it expects to ship several billion dollars-worth of Blackwell GPUs in its fiscal Q4, which ends January 31.

“Hopper demand is strong, and shipments are expected to increase in the second half of fiscal 2025,” noted Nvidia CFO Colette Kress in commentary released alongside the most recent earnings report.

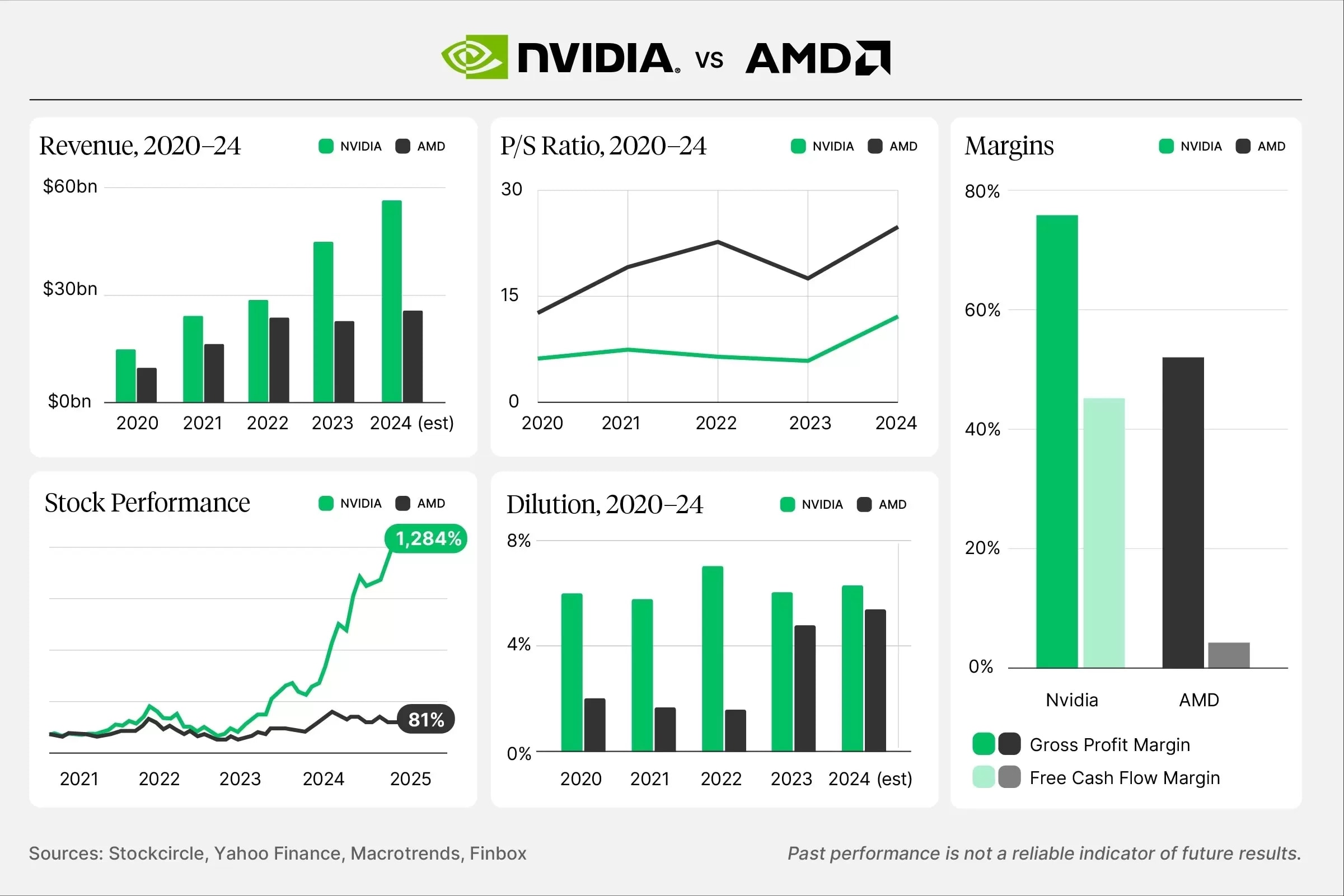

Contrasting Fortunes for AMD Stock and NVDA Stock

Despite AMD’s moves in the AI chip space, its share price has been under pressure, falling 38.67% from its 52-week high set on March 8 through November 19.

AMD stock is down 5.44% since the start of 2024, although is up 15.57% in the past 12 months.

In contrast, the Nvidia share price continues its tear. It has gained 196.93% since the start of 2024 and has risen 198.32% in the past 12 months.

NVDA stock recorded a new all-time high following the US election results and, in the process, overtook Apple [AAPL] as the most valuable company in the world.

AMD and Nvidia Report Record Data Centre Revenue

AMD reported a 18% year-over-year increase in revenue to $6.8bn for Q3 2024, “led by higher sales of EPYC and Instinct data center products and robust demand for Ryzen PC processors,” according to CEO Lisa Su. Data center sales revenue rose 122% to a record $3.5bn, while gaming revenue slumped 69% to $462m.

Nvidia reported record quarterly revenue of $30bn for Q2 2025, which ended July 28, up 122% year-over-year. This was driven by a 154% jump in data center revenue to a record $26.3bn, while sales in its gaming segment were up 16% to $2.9bn.

Both chipmakers reported their most-recent quarterly profit more than doubling from the same period a year ago. AMD’s net income was up 157.86% to $771m and Nvidia’s was up 168.25% to $16.6bn.

AMD is guiding towards revenue of $7.5bn for Q4 2024, an increase of 22% from Q4 2023. Nvidia sees sales topping $32.5bn, up 78.57% from $18.2bn revenue reported for Q3 2024.

Here’s how the two stocks’ fundamentals stack up against each other, as well as against those of another important player in the space, Intel [INTC].

| AMD | NVDA | INTC |

Market Cap | $226.20bn | $3.61trn | $104.37bn |

P/S Ratio | 9.38 | 38.01 | 1.91 |

Estimated Sales Growth (Current Fiscal Year) | 13.20% | 107.32% | -2.76% |

Estimated Sales Growth (Next Fiscal Year) | 27.00% | 46.51% | 6.22% |

Source: Yahoo Finance

While AMD is expected to report a modest growth in revenue over the next couple of years, it could be argued that AMD stock is more fairly valued than Nvidia’s, given its lower P/S ratio.

AMD Stock and NVDA Stock: The Investment Case

The Bull Case for AMD

Research published by SemiAnalysis on November 3 shows that AMD’s quarterly data center segment revenue eclipsed Intel’s for the first time in the last quarter.

While it is still dwarfed by Nvidia’s, AMD’s data center segment could be a key driver of growth in the long term. Speaking on the Q3 earnings call, Su indicated that she expects the total addressable market for AI accelerators to grow at a CAGR of more than 60% to $500bn in 2028, which is equivalent to the semiconductor industry’s total sales in 2023.

“This is an incredibly exciting time for AMD as the breadth of our technology and product portfolios … provide us with a unique opportunity as we execute our next arc and make AMD the end-to-end AI leader,” Su added.

The Bear Case for Nvidia

While no company has benefited more from the AI hype, perhaps the biggest concern for NVDA stock is that no bull run lasts forever. At some point, there could be a significant pullback.

Data shows that insiders have sold NVDA stock 25 times over the past three months, while there have been no open market purchases. On top of this, 13F filings show that a dozen institutional investors, including Ken Griffin, Ray Dalio and Cathie Wood, dumped $4.2bn of shares in the three months to June.

A lack of buying enthusiasm from insiders and institutional investors does not mean they are not confident in the company’s growth story. However, it could suggest that they consider the stock to have run up too much too soon, and have decided to take some profit.

Conclusion

NVDA stock and AMD stock have been on very different trajectories this year. Nevertheless, there should be room for both companies in the AI chip market. Nvidia’s earnings report on November 20 should give investors some indication of the current state of affairs in the broader chip ecosystem.

-

OPTO’s proprietary theme relevance system maps the world’s biggest investing megatrends. For in-depth analyses of stocks with high growth potential, subscribe to OPTO Foresight.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy