Given the hype surrounding generative artificial intelligence (AI) in 2024, you would be forgiven for thinking that all semiconductor stocks had a fruitful year. In reality, it was a mixed bag.

Unsurprisingly, Nvidia [NVDA], the king of AI chips, surged more than 200% over the year, setting an all-time high on November 21, though it has pulled back 5.51% since then. NVDA stock’s Q3 revenue came in at a record $30.8bn, up 17% from Q2 and up 112% year-over-year.

In stark contrast, ASML [ASML] is up just 0.44% during the period. ASML stock tumbled over 15% on October 15 — its largest fall since 1998 — after an unintentional early release of Q3 earnings revealed that net bookings were down 53% from the previous quarter. The leading provider of chipmaking equipment also warned of a slow recovery in end markets away from AI, and that some customers were delaying fabrication plans.

ASML’s warning spooked other chip equipment makers. Applied Materials [AMAT] and Lam Research [LRCX] have both tumbled in recent weeks, posting gains of 10.77% and 4.12%, respectively, over the past 12 months.

So, what could 2025 hold for the chip industry? According to IDC’s latest ‘Worldwide Semiconductor Technology Supply Chain Intelligence’ report, the global industry is poised to grow by 15% this year on the back of ongoing demand for AI chips.

“The semiconductor supply chain — spanning design, manufacturing, testing and advanced packaging — will create a new wave of growth opportunities under the cooperation between the upstream and downstream industries,” noted Galen Zeng, Senior Research Manager at IDC Asia/Pacific.

Looking beyond Nvidia, here are three semiconductor stocks to keep an eye on over the next 12 months.

Broadcom

Past 12 month gain: 117.13%

Following its reassuring Q4 results, Broadcom [AVGO] became the latest (and eighth) entrant to the trillion-dollar market cap club in December.

Total sales for fiscal 2024, which ended November 3, came in at $51.6bn, up 44% year-over-year. While revenue from its main segment, semiconductor solutions, only grew 7% to $30.1bn, within that, AI-related revenue jumped 220% to $12.2bn.

Broadcom is having its own “Nvidia moment”, said Bernstein analysts following the Q4 results. They expect a “sharp new product ramp” in the second half of this year, according to a note to clients seen by MarketWatch.

As of January 2, the stock had 10 ‘buy’ ratings and 27 ‘outperform’ ratings in total. JPMorgan has named it as one of its top picks for 2025 and believes its AI revenue could grow 40% this year. Meanwhile, Morgan Stanley analysts have argued that “the stock has clearly been held back” and they “expect momentum to build from here”.

The Bear Case for AVGO Stock

Despite the burgeoning AI opportunity, Broadcom’s position in the custom chips market faces “stiff competition [from] Nvidia’s stronghold in merchant silicon and enterprise customers”, Bank of America analysts have warned.

Marvell Technology

Past 12 month gain: 103.9%

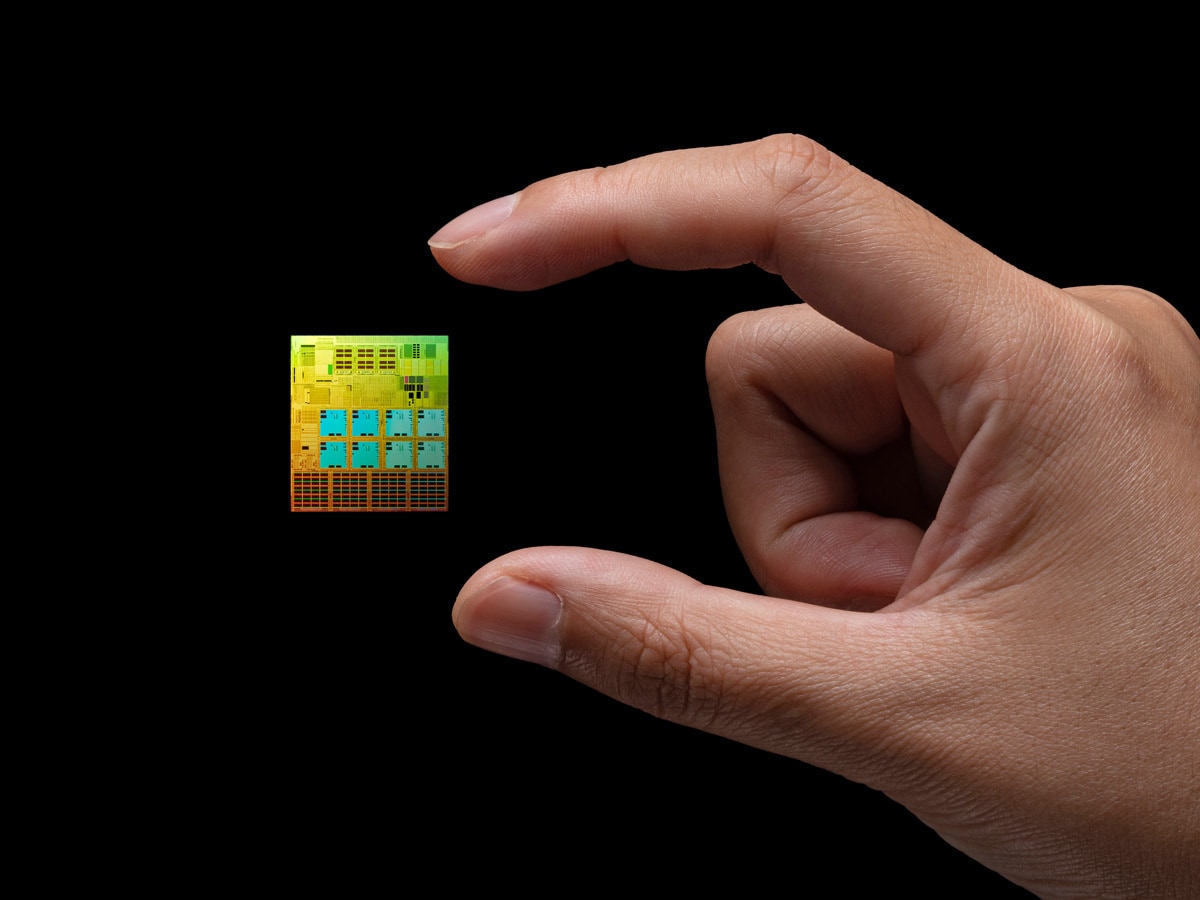

Like Broadcom, Marvell [MRVL] is a key player in the custom chip market, whose customers include Alphabet [GOOGL], Amazon [AMZN] and Microsoft [MSFT].

Revenue for its fiscal Q3 2025, which ended November 2, was up just 7% year-over-year. However, data center revenue surged 98% year-over-year and 25% from the previous quarter, highlighting the ongoing demand for custom chips for AI applications.

“We look forward to a strong finish to this fiscal year and expect substantial momentum to continue in fiscal 2026.” commented Marvell CEO Matt Murphy in the earnings release.

Marvell has become “a data center silicon leader”, Bank of America analysts wrote in a note following the results. Emerging opportunities in the automotive industry, enterprise and 5G infrastructure could help the chipmaker to deliver 25% to 30% earnings growth over the long term.

The Bear Case for MRVL Stock

Marvell had set itself a goal of $2.5bn in data center revenue in fiscal 2026. Following the Q3 results, Wolfe Research estimates that it will achieve $3.4bn. Custom silicon is becoming a more competitive market, however, and if Marvell were to experience a slowdown in demand for custom chips, then this could disappoint analysts and investors.

Taiwan Semiconductor Manufacturing Company

Past 12 month gain: 108.38%

TSMC’s [TSM] CEO CC Wei expressed confidence on the Q3 2024 earnings call in November that the broader semiconductor market was not faring badly. With regard to chip demand, Wei said, “everything is stabilized and starting to improve”.

Capital expenditure is “very likely” to be higher in 2025 than in 2024, although the foundry giant did not disclose an exact figure. Expenditure for Q3 was $6.4bn and it is expected to be in the region of $30bn for the full year. This is about the same as 2023, though down from a record $35.22bn spent in 2022.

According to a report from the Economic Daily News in November, TSMC is accelerating spending to expand capacity in Arizona, Germany and Japan, in order to try to shield the business from any geopolitical risks. TSMC could potentially confirm the exact details of its 2025 capital expenditure plans on its Q4 2024 earnings call on January 16.

The Bear Case for TSM Stock

There have been concerns that US President-elect Donald Trump’s second term in the White House could impact TSMC. Speaking with podcaster Joe Rogan at the end of last year, Trump accused TSMC of stealing the US chip industry and has threatened to impose sanctions on Taiwan-made chips.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy