Lithium prices increased 150% in 2022 but crashed last year. Analysts reckon that the metal could be set for further price falls in 2024 as the EV market stalls, particularly in China. However, two asset managers believe that lithium prices will recover over the long term.

- Lithium prices fell in 2023, with EV market growth lagging expectations.

- According to Sprott Asset Management, miners remain optimistic: exploration budgets increased 77% year-over-year in 2023.

- Allkem and Livent merge to form world’s third-largest lithium producer.

2023 saw a slowdown in the growth of electric vehicle (EV) sales, which weighed on the price of lithium. The metal, known as “white gold” and a key component of most commercial EV batteries, fell as much as 80% last year, according to Forbes.

However, Global X ETFs views the pullback as a mere “bump in the road”. Alec Lucas, Research Analyst at Global X, writes that, “despite the detour, EV adoption remains brisk”.

He points out that EV battery research firm Rho Motion forecast global EV sales would rise by 30% in 2023. While this is less than the 40% that was forecast at the start of the year, it still marks significant growth.

China’s sluggish recovery from pandemic lockdowns is, in Lucas’ view, one of the main factors behind last year’s underwhelming EV market. However, China’s EV market is still growing, despite the challenges the country is facing, while sales in the US grew 50% year-over-year in the third quarter of 2023.

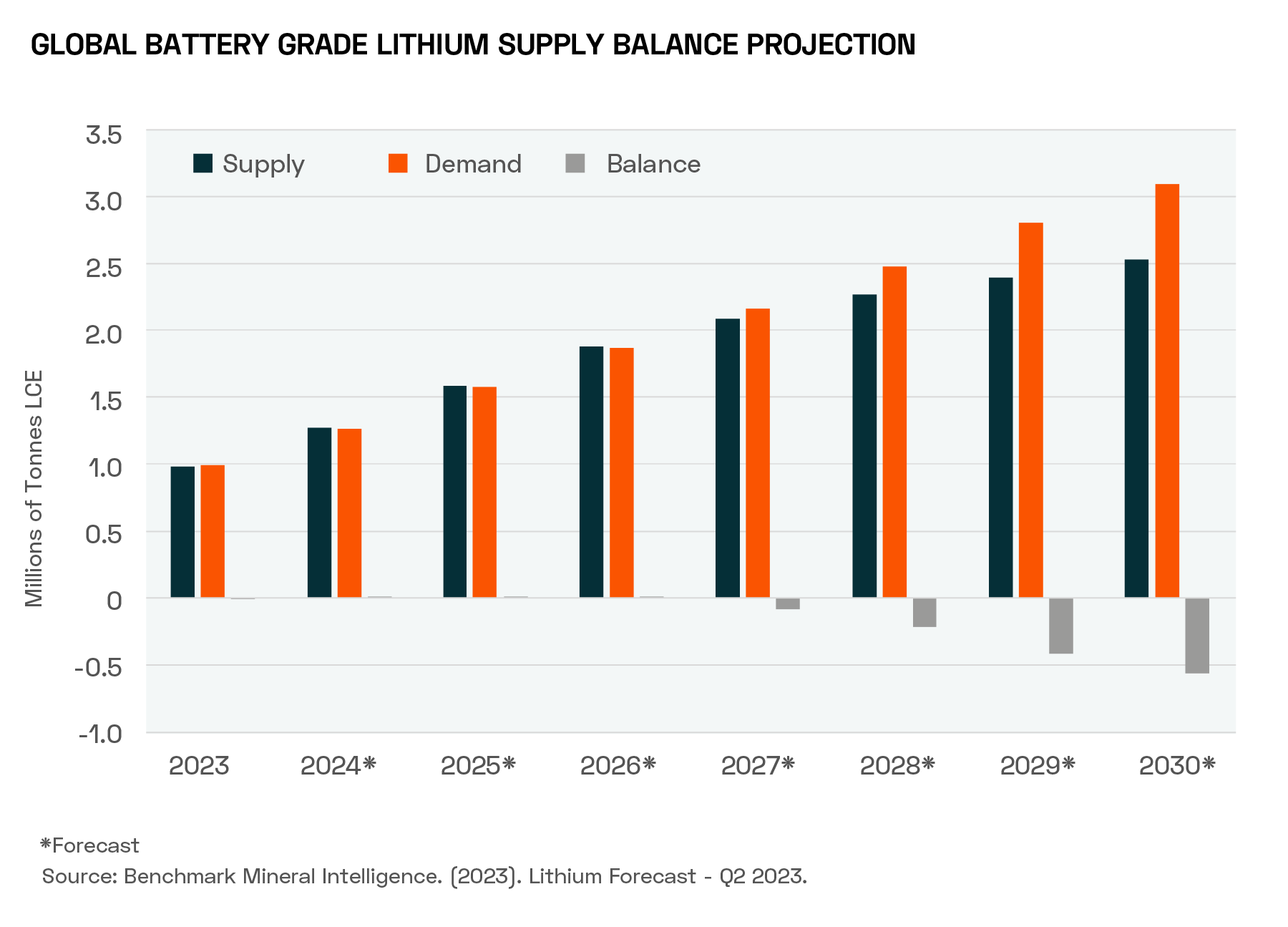

Moreover, over the longer term, the lithium market is extremely tight, with supply limited by various factors, among them the unit economics for lithium miners. Lucas expects supply and demand for lithium “to remain tightly balanced over the next several years until meaningful deficits arise again in 2027”.

If lithium demand does exceed supply as soon as 2027, prices could increase significantly. “Delays to major projects in the space could quickly shift the market to deficit and introduce new upward pressure on prices,” says Lucas.

Miner Optimism

“Inventory destocking amid lower-than-expected EV sales has plagued the immature and volatile lithium market,” write Sprott Asset Management’s Paul Wong, Market Strategist, and Jacob White, ETF Product Manager.

These dynamics led lithium prices to fall 27.6% in November “to levels not seen since the first half of 2021”.

However, miners have remained optimistic, especially because, like Global X, the industry views the current price challenges as a short-term phenomenon that pales in comparison to the long-term tailwinds for the sector. “Lithium exploration budgets for 2023 were at an all-time high of $830bn, a 77% increase from 2022,” write Wong and White — further evidence that, in the long term, the greatest concern around lithium is whether supply can match demand.

Current pricing levels are threatening some projects, but Sprott appears confident that this trend will reverse in due course. “Going forward, we believe a higher lithium price may be needed to incentivise needed supply.”

ExxonMobil [XOM] is also offering a show of faith in the theme by aiming to become a leading lithium supplier by 2030. “ExxonMobil has significant capital to devote toward lithium production, plus a market capitalisation greater than all current lithium miners combined,” explain Wong and White.

Glut or Deficit?

However, it is uncertain how long it will take for lithium’s pricing dynamics to change course. According to Reuters at the start of December, some analysts have forecast Chinese lithium prices will fall over 30% in 2024, having hit a two-year low at around that time.

Reuters based its reporting on four China-based analysts who pointed out that global lithium supply has been rising faster than demand. Supply could grow by 40% in 2024, according to a UBS forecast cited by Reuters, while the end of Chinese subsidies for EVs over the past 12 months has exacerbated the fall in demand.

While it is bad news for miners, the lithium glut could be a boon for the EV sector.

Lithium battery prices have fallen over 80% in the past decade, according to energy analyst Gerard Reid, cited by the Independent last September. EV manufacturers such as Tesla [TSLA] are endeavouring to produce EVs at mass-market pricing; the pullback in lithium prices could be a crucial component in making EVs more affordable.

Of course, over the long run, that dynamic could reinvigorate demand for lithium, as the number of battery EVs produced increases.

Could Sodium Replace Lithium?

On the other hand, alternative battery materials could ease demand for lithium and keep its prices suppressed.

Two sodium-ion powered models launched in China at the end of December: JAC’s [600418:SS] Flower Fairy and JMEV’s Yizhi (Easy Ride) EV3. JMEV is a joint venture between Jiangling Motors [000550:SZ] and Renault [RNO:PA].

China’s BYD [BYDDY], which displaced Tesla as the world’s largest EV producer last quarter, announced last week it is getting in on the action with a ¥10bn investment into a new sodium-ion battery plant. Once completed, the plant should be able to produce 30GWh of batteries per annum.

In the lithium world, two major producers — Allkem [OROCF] and Livent [LTHM] — completed a merger on 5 January to form Arcadium Lithium [ALTM]. Arcadium has significant operations in Argentina, where the recently inaugurated President Javier Milei has vowed to boost the country’s production and remove barriers to exporting the commodity.

How to Invest in Lithium

Arcadium became the world’s third-largest lithium producer following the merger, and represents an option for investors hoping to gain direct exposure to lithium miners. Arcadium’s share price gained 6% in its first session after the merger, but is flat as of 9 January.

Investors seeking exposure to lithium consumers can opt for EV manufacturers such as Tesla or BYD. Tesla gained 100.8% in the 12 months to 9 January, while BYD gained 3.1%.

Alternatively, investors could consider ExxonMobil for exposure, on the basis of its intention to enter the lithium market — though it has no significant position in the sector as yet. ExxonMobil’s stock has fallen 3.8% over the past year.

For diversified exposure, investors can consider either the Global X Lithium & Battery Tech ETF [LIT], which holds BYD, Tesla and Arcadium as of 8 January, or the Sprott Lithium Miners ETF [LITP], which is more focused on producers and therefore only holds Arcadium out of those three stocks. LIT fell 20.8% over the past 12 months, while LITP fell 40.1% in the same period.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy