2020 will be remembered, in the investment world at least, as a period that accelerated many key technological shifts. These changes will continue to affect the way we work and live long into the future. Here, I take a look at the key software stocks powering the tech revolution, from workflow management to virtual meeting spaces.

One of the key shifts this year has been the pivot to home working, with almost every large corporation proving they are able to continue operating remotely. In turn, this trend has fuelled the adoption and subsequent growth of digital management methods, amongst other things.

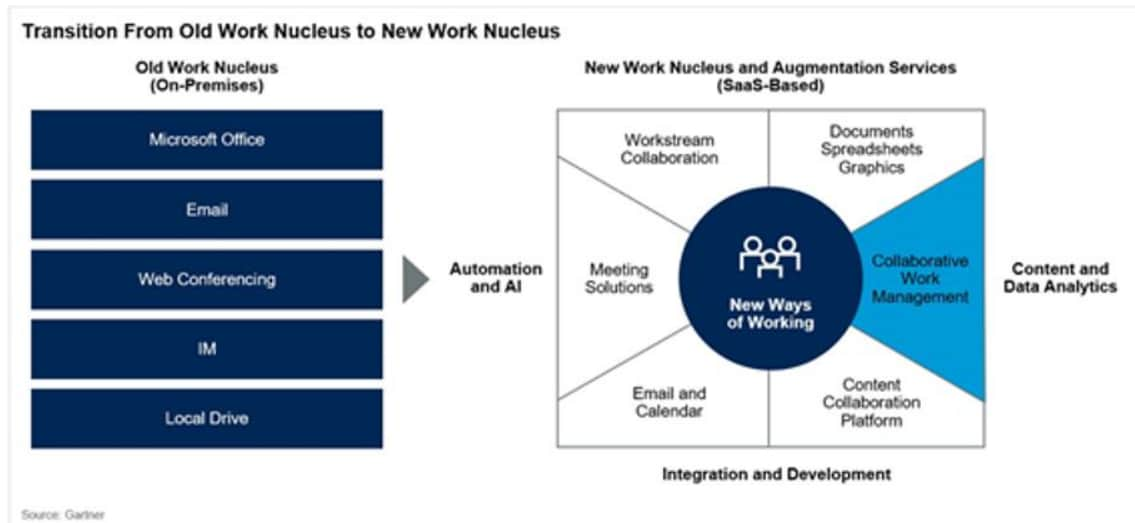

The shift put a spotlight on several IT initiatives including automation, cloud security, and video conferencing. However, in order for any of these corporations to operate remotely, they need a way for employees to collaborate on tasks and projects with open lines of communication — this is where the importance of collaboration software takes centre stage. Productivity is the primary focus of organisations in an era packed with distractions.

Not only are companies’ workers now scattered around the globe, but so their data is scattered across different applications too. Without automation, collaboration and digitisation, the inevitable result is a sharp decrease in productivity.

I believe it’s worth investing in these digital working solutions because the shift is not temporary. Having read hundreds of management team transcripts, work from home is a trend that is here to stay, and many tech firms have already rolled out work-from-anywhere policies.

News broke this week that Salesforce [CRM] has signed an agreement to acquire Slack [WORK] (a component of my Future of Work signature share basket) for $27.2bn — the company was valued at circa $17bn prior to the report. Here you have the best software management team in the world giving a clear signal as to the future importance of collaborative software. Collaborative workflow management tools are seeing incredible innovation that can increase productivity of the workforce and thus drive strong ROI.

Salesforce, commenting on its acquisition of Slack, says: “We see in Slack a once-in-a-generation company platform. It's the central nervous system of so many companies on this call and our company and so many of our great customers, connecting everyone and everything, and now we could go even bigger, better, more exciting. And it brings all the companies, people, the data, the tools together. What this is all about is the value of the social enterprise and creating this incredible idea that you have this amazing hub of productivity, of collaboration and integration and applications that now leverage all this amazing data.”

"this is all about the value of the social enterprise and creating this incredible idea that you have this amazing hub of productivity, of collaboration and integration" - Salesforce spokesperson

We are focusing on the pure play collaboration software names, though the large software companies like Microsoft [MSFT], Alphabet [GOOGL], Adobe [ADBE], Oracle [ORCL], SAP [SAP], Salesforce and Service-Now [NOW] all have exposure to the trend, but their influence in the space is more muted.

Collaborative work management is a set of tools that provides employees a unified and central platform to share business data, documents, and discussions with ease. There is not currently an abundance of names in the group to invest in, but it will be worth watching some private plays such as Wrike, Airtable, Workfront, Kissflow and Clarizen for possible IPOs in the future.

According to a June 2019 IDC report, the markets for collaborative applications and project and portfolio management, in aggregate, are expected to grow from $23bn in 2020 to $32bn in 2023. The Enterprise Content Management (ECM) market size is predicted to reach $95bn in 2025, a 14-15% CAGR with solutions under this umbrella including content lifecycle management, document imaging, web content management, digital asset management, eDiscovery and eSignature.

$95billion

Predicted ECM market in 2025

The potential market is massive for these themes, with Forrester Research estimating there are 1.25 billion global information workers. Core features of collaboration software include file sharing, synchronising devices, and team workspaces. Growth drivers include the growing popularity of the work from home trend, a rising demand for unified communications, the need for automation and streamlining of business processes, and an effort for corporations to reduce SG&A costs. Asana’s research revealed that knowledge workers spend 60% of their time on ‘work about work’: digging through email, searching for the latest business plan, responding to pings, or writing status reports. These are the challenges work management tools aim to tackle: reducing duplicative work and automating routine processes and status tracking to ensure that nothing falls out of date.

DocuSign [DOCU] estimates the TAM of the signature market at $25bn and it is also moving into the Agreement/Contract cloud market — another $20bn-$25bn opportunity. Atlassian [TEAM] estimates 1 billion potential end users can benefit from teamwork and collaboration software and says “we are in very, very early days of the potential that we have with all 3 segments (software developers/engineers, IT teams, and business teams).”

TeamViewer [TMV:GR] acquired Ubimax in July to create the global leader in connectivity solutions and workplace digitalisation technology. It sees that deal expanding its TAM to €40bn in 2023 with a 27% annual growth rate driven by strong expansion in Augmented Reality markets and continued tailwinds from digitalisation, automation and remote control.

In September, Dropbox [DBX] commented “So the way we think about the market we address today is we think of it as a $50bn-plus addressable market, it expands content management, document workflow and eSignature, collaborative applications and project and task management. All teams need a workspace that connects their content, their communications and their project plans together in one organized place that's platform-agnostic and accessible on any device, on any OS platform. And what we see as a major collaboration challenge to date is this sort of idea of content fragmentation, whether it's traditional files like office docs and PDFs or even cloud files, like Google Docs, Paper, et cetera.”

Smartsheet [SMAR] was asked about the collaborative work management space over the next ten years at a Needham conference earlier this year, and responded: “Well, I think you're going to see continued growth. We think the TAM is really huge. I think, as more and more customers discover what's possible using these types of tools versus traditional ways, they're seeing really big increases in effectiveness. We have customers that are seeing 30% and 40% gains in productivity for a team or a workflow when they're able to use our platform versus more traditional ways. And so we think what happens over time is you're likely going to see players like ourselves and others continue to grow, and we think it'll likely shake out to a few key platforms that people will adopt. I think companies will start to move to a chosen platform for the enterprise as opposed to kind of letting everybody decide on their own. And I think as far as the user experience, I think, AI and ML are going to continue to make our apps smarter. I think it's going to make our tools do more of the work for us, and ourselves and many others are investing in that space.”

"I think you're going to see continued growth. We think the TAM is really huge." - Smartsheet spokesperson

In closing, the collaborative workflow management software industry is not only addressing a massive market opportunity with a high rate of growth, but it is also in the early innings of a longer-term transition.

Further, the high ROI of these solutions make it a more resilient area for IT budgeting as corporations look to expand productivity and reduce unnecessary expenses. Despite projected cuts in IT spending, IDC worldwide surveys show 54% of companies expect that they will increase collaboration applications spending this year.

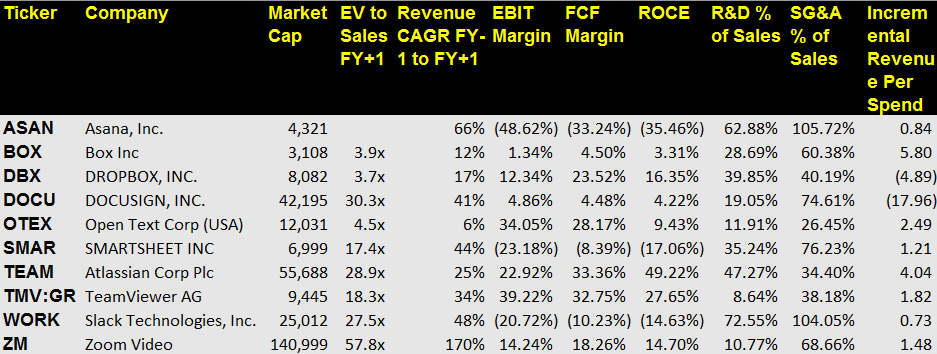

The future seems bright for these companies and innovation continues at a rapid rate. It is also highly likely that new investable companies in the space will come public over the next year, but for now the opportunities look compelling in the US. Dropbox is very undervalued for having mid-double-digit growth and strong profitability, while Atlassian is a best-in-class operator that carries a (deservedly) premium valuation. Asana is a newer hyper growth name, and we need to see inflection in profitability and FCF, but the opportunity is present. Zoom is in a hyper-growth class of its own while also see strong profitability metrics and, as valuation comes in after the latest earnings sell-off, starts to look more attractive.

The new normal is far from decided yet, but one thing seems certain: collaboration software will stick around for as long as remote working does.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy