In this article, Julian Klymochko, founder and CEO of Accelerate Financial Technologies, delves into the complex process of special purpose acquisition company (SPAC) arbitrage.

Each decade is typically characterised by a financial innovation that comes to define a certain point in economic history.

The “go-go” eighties brought the high-yield bond, which powered the high-flying career of junk-bond king Michael Milken and helped bring leveraged buyouts to the forefront.

The great bull market of the nineties highlighted the exponential growth of the mutual fund, captivating retail investors and cementing star managers such as Peter Lynch and Michael Price into investment lore.

In the 2000s, certain complex credit products such as credit default swaps and collateralised debt obligations were borne of a credit binge, which legendary hedge fund manager John Paulson utilised to make billions of dollars betting against the housing market, setting the stage for the “greatest trade ever.”

A more pedestrian financial instrument best represented the twenty-tens, the exchange traded fund (ETF). Low-cost and easy to use, ETFs helped bring index investing to the masses, popularised by firms such as Vanguard and iShares.

What is in store for the twenty-twenties? It’s still too early to tell, really, so the jury is still out. However, the SPAC has already made a strong case to be the defining financial instrument of the decade.

What is a SPAC?

SPAC is an acronym for special purpose acquisition company. Also known as a “blank-cheque company,” a SPAC is a cash-rich shell company that raises money from investors in an initial public offering (IPO) and seeks to acquire a private acquisition target over a fixed time period. Simply stated, it serves as a vehicle to bring a private company to the public markets.

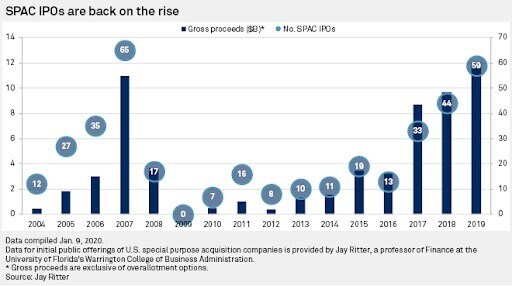

SPACs have emerged in recent years as a viable alternative to the traditional IPO as a way for a private company to complete a going-public transaction. Its emergence as an asset class has been made apparent by its fast growth over the past few years.

Source: S&P Global

After the economic hangover from the 2008-2009 global financial crisis, SPAC issuance was left for dead. However, over the past three years, SPAC financing has come back with a vengeance. In 2019, SPAC financings reached a record annual haul of $12bn. Last year, the 59 special purpose acquisition company IPOs represented 25% of total IPOs. In the first quarter of this year, the trend continued with 13 SPAC IPOs, which represented nearly 30% of all IPOs.

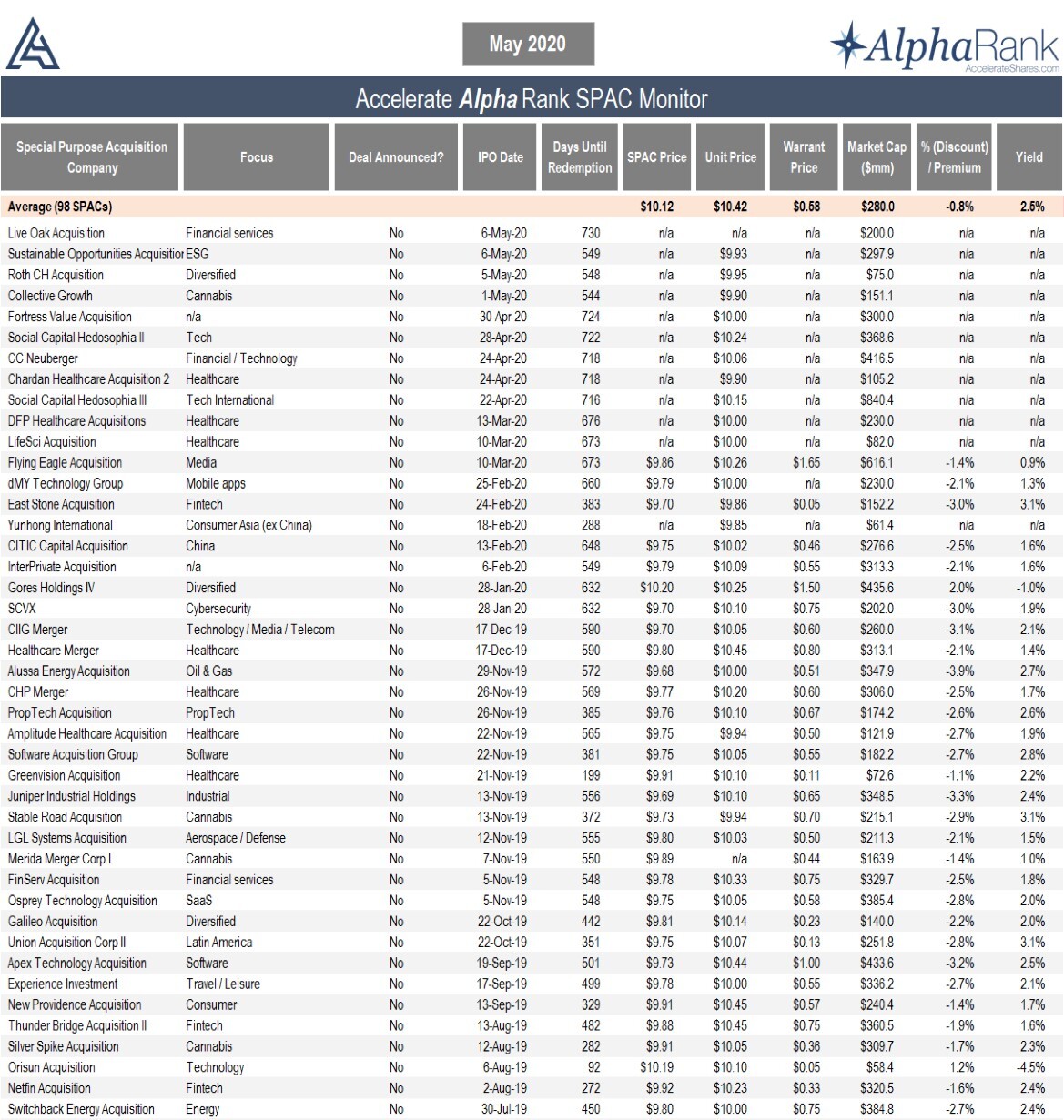

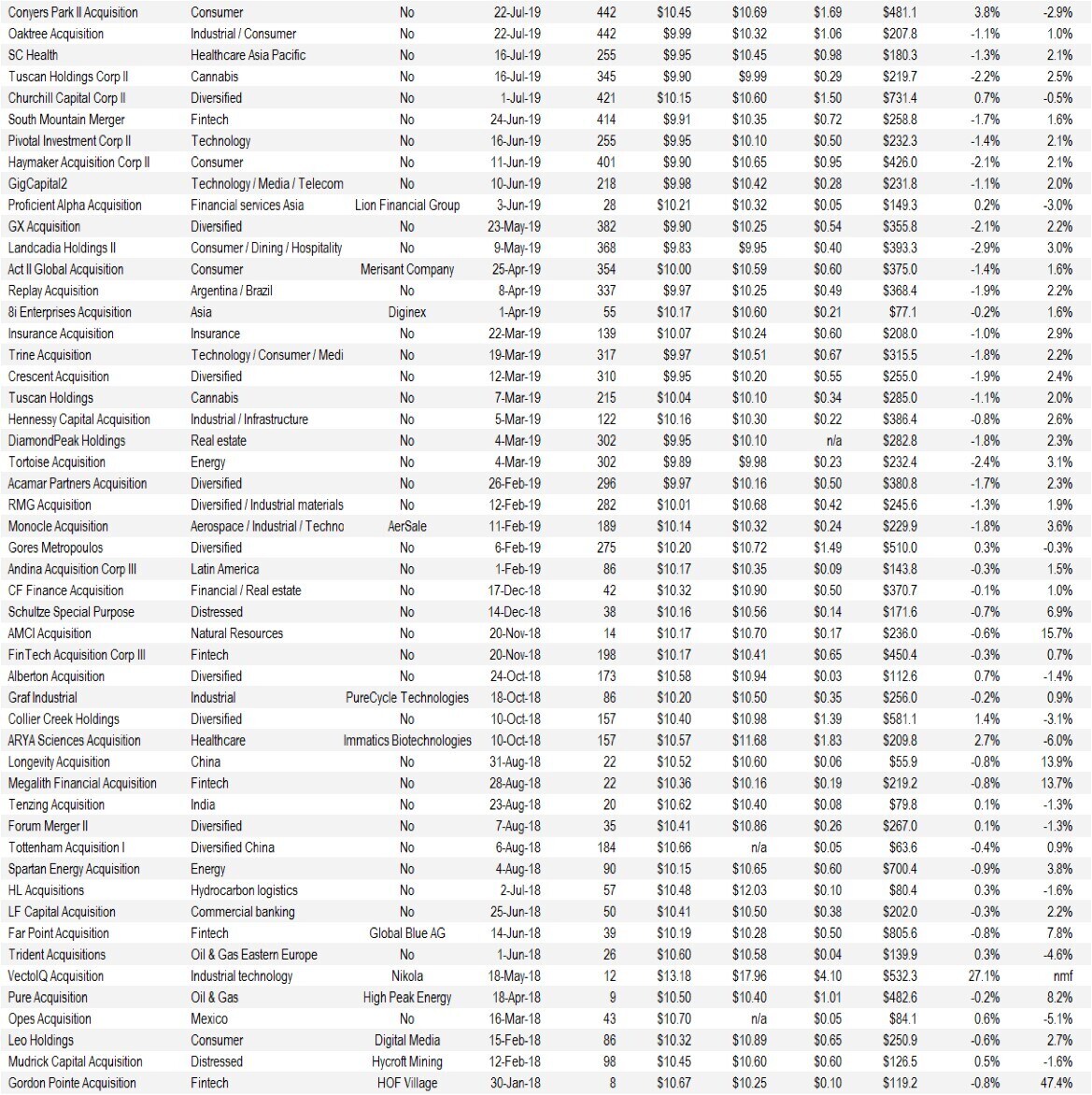

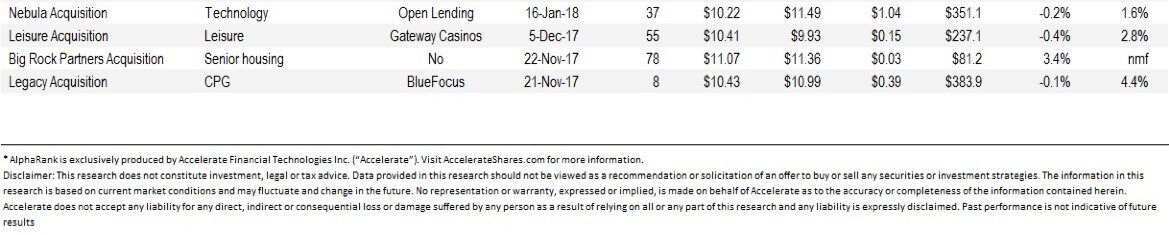

There are currently 98 SPACs outstanding, representing an aggregate market value of $27.5bn. Accelerate’s proprietary AlphaRank SPAC Monitor showcases all outstanding SPACs.

SPACs are a legitimate, multi-billion-dollar asset class that is here to stay, while offering a unique arbitrage opportunity for enterprising investors.

How do SPACs work

The typical SPAC is a Delaware corporation that completes an IPO for between $40m and $800m, although there isn’t a set minimum or maximum. Over the past two years, the average SPAC IPO has raised $234m.

In the IPO, a SPAC offers units to investors for $10.00 per unit. Each unit consists of a common share and a fraction of a warrant. Units contain anywhere from 0.25 warrants per unit to as much as a full warrant per unit. The warrant terms are such that they offer the investor the option to buy more shares at $11.50 per share in the future (as long as five years), giving a SPAC unit investor further upside on the performance of the company.

Capital raised in the IPO is placed in a trust account, which is tightly governed. This capital may only be invested in the safest securities — typically US treasuries of tenors less than 185 days. These funds cannot be used to finance the operations of the blank-cheque company as it searches for an acquisition target.

The capital raised in the IPO remains in the trust account accruing interest and is only used to acquire a company or to distribute to redeeming shareholders. To provide the necessary working capital, the SPAC sponsor subscribes to private placement warrants, which will allow the sponsor to buy shares at $11.50 after it completes a business combination.

This investment in private placement warrants represents capital at risk for the sponsor. If they do not get a deal done within the allotted time frame, the millions of dollars spent on the private placement warrants are lost. The private placement warrant financing provides working capital to the SPAC, so the IPO proceeds in trust remain untouched until the deal vote, business combination or company liquidation.

Where is the upside for the sponsor or promoter of the SPAC?

In exchange for setting up the blank-cheque company, funding the working capital through a subscription of private placement warrants and searching for a business combination, the sponsor is given founder shares for nominal consideration. These founder shares convert to 20% of the pro-forma equity once a business combination is complete.

If a SPAC fails to complete a business combination within the specified time frame, these founder shares become worthless, as do the private placement warrants. There is immense financial pressure for a sponsor to get a deal done.

Generating investment returns from SPACs

Once the IPO is completed, the SPAC is listed on an exchange and its units start trading in the market while the company is on the hunt for a business combination. As stated in its prospectus, a SPAC has limited time to complete an acquisition — typically 12 to 24 months.

SPAC units, essentially common shares paired with warrants, trade as one security usually for the first 52 days. After 52 days, investors have the option to separate trading of the units into common shares and warrants.

The key aspect of SPAC arbitrage is the existence of untouched capital from the IPO invested in risk-free US government securities, giving investors a baseline return of short-term treasury yields, combined with a set deadline offering the ability to redeem shares for the underlying net asset value (NAV, or the value of the treasuries plus accrued interest) either around the date of the vote for the SPAC’s business combination or its liquidation date.

A SPAC’s NAV starts at $10.00 upon its IPO. As time passes, the NAV grows as interest accrues. An investor can track each SPAC’s net asset value by analysing 10-Qs, 10-Ks and proxies.

The return on a SPAC investment consists of two value drivers: yield and optionality.

Yield is measured as the accrued interest on the SPAC’s NAV, which consists of short-term treasury securities. Last year 180-day T-bills yielded about 2.5%. Now the same T-bills yield roughly 0.15%. Therefore, the baseline yield on SPACs is extremely low right now. However, additional yield can be generated by buying the SPAC in the market at discount to its NAV. Currently, the average SPAC trades at a -0.9% discount to its NAV and offers a 2.4% yield.

Why do SPACs generally trade at a discount to their net asset values?

SPACs are less liquid than the underlying treasury securities, therefore, investors typically require a higher return to own a less liquid asset. This phenomenon is known as the illiquidity premium, which is defined as the premium return an investor can earn for holding an asset that is difficult to trade out of.

Optionality refers to the return a SPAC investor can attain in addition to yield. This upside can occur when the sponsor announces an attractive business combination for the SPAC. The announcement of an attractive acquisition can bring in new investors and speculators into the stock, affecting the share price.

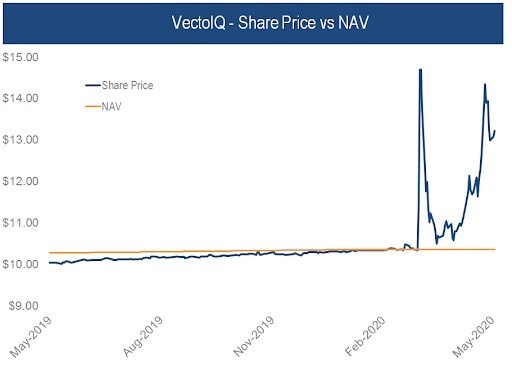

For example, [in June 2020] blank-cheque company VectoIQ Acquisition announced a business combination with electric vehicle maker Nikola Motor Company [NKLA]. Investors viewed this announcement positively and bid up the stock far in excess of the SPAC’s net asset value, crystallising the upside optionality for SPAC arbitrageurs (see below).

Source: Bloomberg

This article, written by Julian Klymochko, was first published by Accelerate. The original article can be found here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy