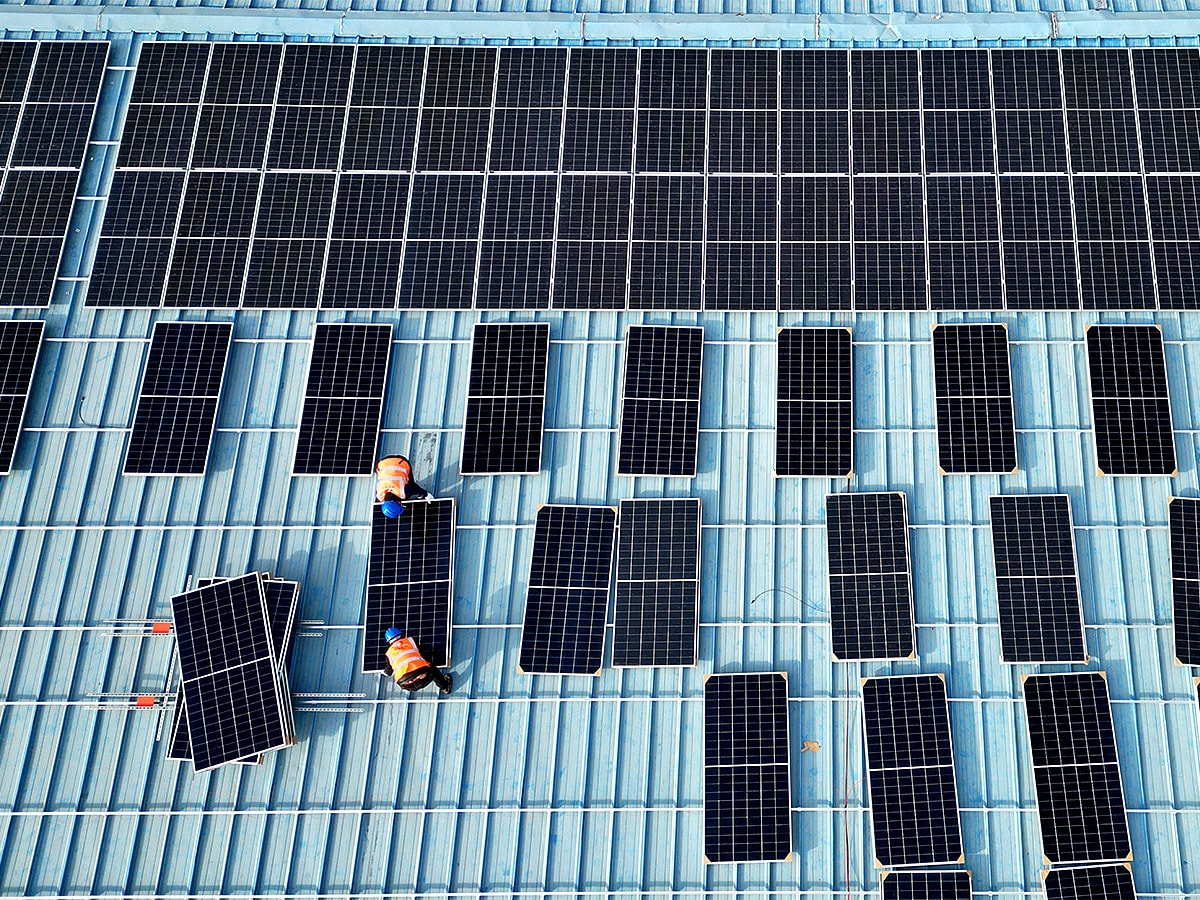

A new report from the International Energy Agency says solar-generated power will overtake coal by 2027, with legislation in the US and France spurring growth in the sector. Enphase Energy and First Solar are up more than 70% in the year, while JinkoSolar’s modest gains nevertheless outperform the S&P 500.

- Solar power generation to overtake coal’s by 2027

- US Inflation Reduction Act already prompting increased solar production

- Invesco Solar ETF provides exposure to JinkoSolar, Enphase and First Solar

The share prices of solar companies like JinkoSolar [JKS], Enphase Energy [ENPH] and First Solar [FSLR] stand to benefit from the latest forecast from the International Energy Agency (IEA). The Renewables 2022 report suggests that solar power could overtake coal power by 2027, with renewables set to become the world’s largest energy source by 2025.

The energy crisis, largely caused by Russia’s invasion of Ukraine, has prompted the “largest ever upward revision of IEA’s renewable power forecast” as countries look to bolster their energy security and reduce their reliance on fossil fuels and renewables from China. According to the report, the five years between 2022 and 2027 could see twice as much new renewable energy capacity added as the previous five.

Solar energy companies have been among the biggest winners of 2021 so far, with Enphase gaining 74.7% in the year to 9 December and First Solar gaining 73.2% over the same period. JinkoSolar lags both, with modest gains of 7.5% year-to-date, yet is still outperforming the S&P 500, which fell 17.5% over the same period.

US Inflation Reduction Act boosts solar stocks

Bearing in mind the IEA’s recent statements, there could still be more growth ahead for these stocks. Further tailwinds are provided by the US Inflation Reduction Act (IRA), which has already boosted the value of stocks in the space. Similar legislation has been passed elsewhere. In February 2022, French President Emmanuel Macron, for example, proposed a tenfold increase in France’s solar capacity by 2050 and this month passed legislation requiring all car parks with capacity for 80 or more cars to be fitted with solar panels.

The IRA itself has already seen a ramp-up in production. First Solar recently confirmed Alabama as the location for its new $1.1bn facility, which CEO Mark Widmar had previously told CNBC was made possible by the provisions contained within the IRA.

Enphase has likewise boosted its US production capacity, with CEO Badri Kothandaraman recently announcing plans for four to six new production lines capable of producing up to 18 million microinverters per year, adding 4.8 GW to 7.2 GW of new capacity.

Solar investment theme set for growth

JinkoSolar’s stock took a hit recently by the findings of a US Commerce Department probe into whether Chinese solar companies exporting to the US were circumventing tariffs by assembling parts in other Southeast Asian countries first. JinkoSolar’s share price fell 5.3% over the weekend when the news was announced.

Meanwhile, Rob Barnett, senior energy analyst at Bloomberg Intelligence, spoke to demand in the solar sector climbing 40% over 2022. He also sees “double-digit sustained growth” for the solar energy sector, including 20–30% growth during 2023. Barnett picked out Enphase and First Solar as 'best-in-class' companies within the space, anticipating that these companies could grow over 30% next year.

Solar companies, moreover, demonstrate profitability alongside these growth prospects. The median solar company in Barnett’s analysis has earnings before interest, taxes, depreciation and amortisation (EBITDA) margin of roughly 16% in 2022. Barnett expects that this figure could increase as high as 20% next year.

Fund in focus: Invesco Solar ETF

The Invesco Solar ETF [TAN] offers investors exposure to this growth potential. TAN holds Enphase and First Solar as its number one and three holdings, respectively, with 11.61% and 9.62% weightings as of 9 December. JinkoSolar also has a 2.42% weighting in TAN.

TAN gained 2.1% in the year to 9 December, with the strong performance of its top two holdings weighed down by Chinese solar stocks such as Xinyi Solar Holdings [0968.HK], which has fallen 33.8% year-to-date as Chinese securities have suffered from the country’s ongoing trade tensions with the US and a restrictive COVID policy.

Analysts polled by the Financial Times have a median 12-month price target with a 31.4% upside for JinkoSolar, with the equivalent figures for Enphase and First Solar currently standing at 1.7% and 9.3%, respectively.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy