In part one of this three-part series, Morgan Creek Capital Management’s China-based investment team explores the evolution of corporate venture capital in China and how technology giants, such as Baidu, Alibaba and Tencent, are attracting more global investments in Asia.

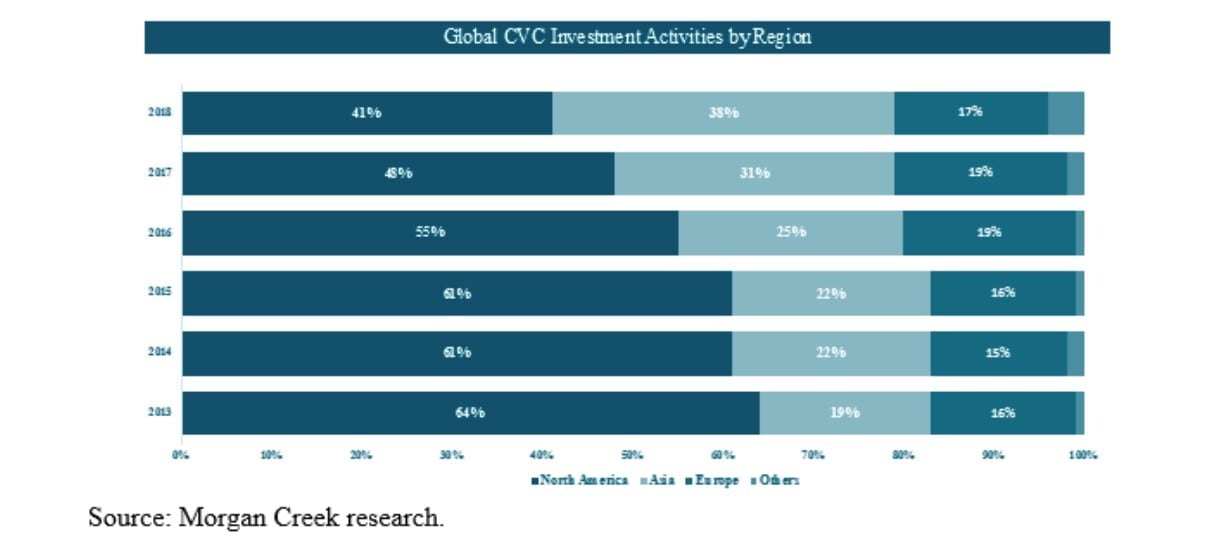

Modern corporate venture capital (CVC) was first established in North America, and in 2014, US corporate investments accounted for 61% of global activity.

In recent years, technology giants, such as the BATs (Baidu [BIDU], Alibaba [BABA], and Tencent [0700.HK]), have hyper-charged Asia’s economic growth and have steadily increased their corporate investments in the region.

By 2018, North America’s share of global investment activity dropped to 41% and Asia’s share doubled to 38%. CVC activity in this region is expected to surpass that of North America in the coming years.

Asian CVC is comprised primarily of conglomerates from China, Japan, and India. The first significant CVC investment in China was in June 1998, when Shida Group invested RMB12m in Beijing-based Mingtai Technology Development Company, establishing Shida Mingtai Company to develop Chinese software.

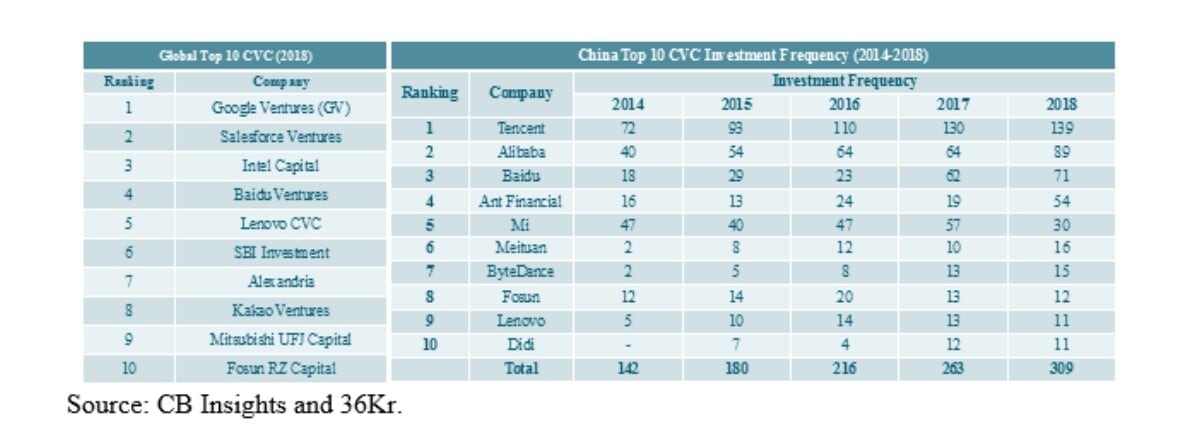

Two decades later, in 2018, China’s corporate venture capital investment output reached RMB20.3bn, or 17% of all venture capital investments domestically. Three Chinese conglomerates — Baidu, Legend [3396.HK], and Fosun [0656.HK] — were recognised as among the “top 10 active CVC institutions in the world in 2018”.

Chinese local VC data platform 36Kr [KRKR] as well as tech giants Tencent, Alibaba, Baidu, Ant Financial, and Mi were ranked as the “top 10 active CVCs in China in 2018 (by investment frequency)”.

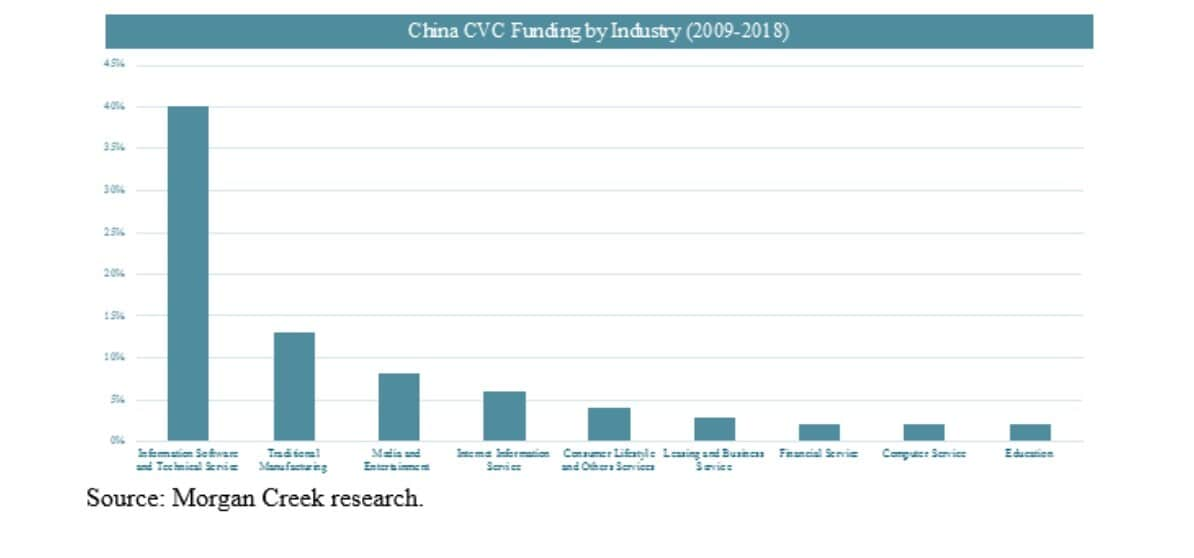

From 2009 to 2018, China's CVC investment in information software and technology services accounted for 40% of all capital, with the manufacturing industry falling to second place with 13%.

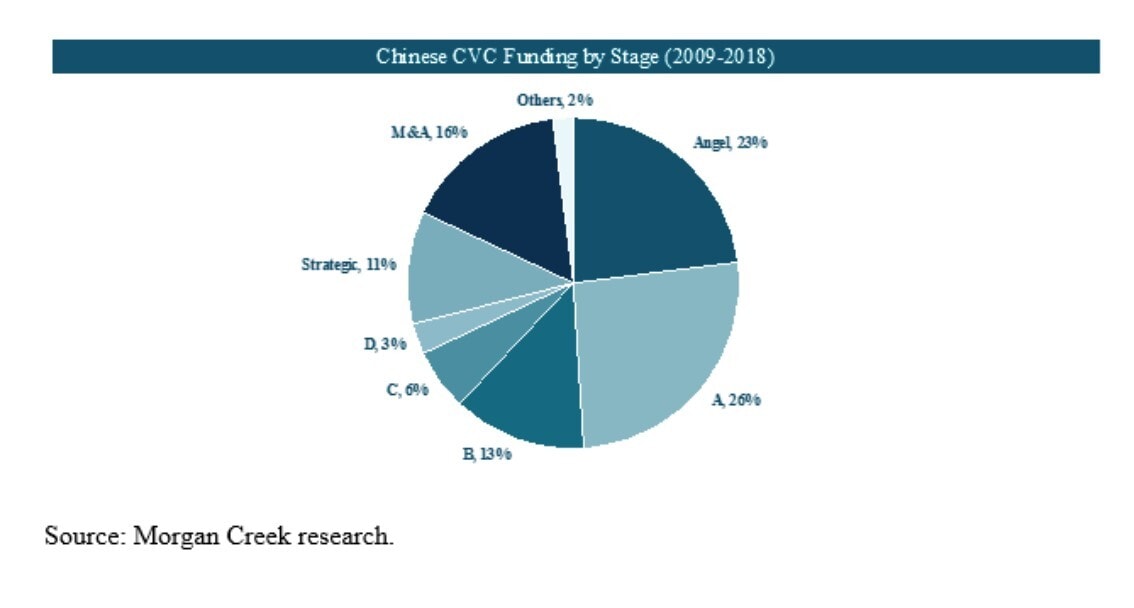

China’s CVC investments focus on start-ups, with almost half of the capital flowing into angel rounds and Series A rounds. Strategic acquisitions and mergers and acquisitions (M&As) also account for a substantial proportion at 27%.

The distribution of CVC investment rounds in China shows a barbell investment approach: either very early in a company’s lifecycle, where the corporate investors are looking at accessing frontier technologies, or very late, where investors are looking for strategic tie-ups.

An example of the latter is Tencent’s $215m investment in JD.com [JD] in 2014, to enhance and improve the ecommerce sector. As part of the agreement, Tencent also gave two of its ecommerce holdings to JD.com and promoted JD.com’s services prominently on its WeChat mobile messaging platform.

This article, originally published on 25 February, has been reproduced with permission from Morgan Creek Capital Management. If you want to learn more from the Morgan Creek investment team, Chinese fund managers and entrepreneurs on investing in private equity markets in technology and healthcare in China, register for the New China Symposium webinar, which is being held between 4-6 May.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy