The surge in demand for lithium, driven by the electric vehicle (EV) revolution, is central to the global shift towards clean energy, Alec Lucas, Research Analyst at Global X ETFs, observes on a recent episode of Opto Sessions. Latin America, led by the “lithium triangle” of Chile, Argentina and Bolivia, dominates in the critical resource, even as fears of lithium nationalism grow.

As the world transitions to cleaner sources of energy in a bid to meet climate change targets, lithium has emerged as a key resource, as Alec Lucas, Research Analyst at Global X ETFs, details on Opto Sessions.

One of the most important issues facing the global community is climate change. July this year was the hottest month on record; also in July, the world exceeded the threshold set by the Intergovernmental Panel on Climate Change, with temperatures topping 1.5-degrees Celsius above pre-industrial averages.

These trends underscore the importance of transitioning to cleaner sources of energy.

The focus on reducing greenhouse gases and combatting climate change has led to a surge in interest in lithium, with demand growing more than threefold between 2016 and 2022, according to the International Energy Agency.

“The biggest driver has been demand for EVs,” says Lucas. “They use tens of thousands times more lithium than consumer electronics, which were traditionally where a lot of demand for lithium had come from.”

Latin America Takes the Lead

Latin America — specifically, the “lithium triangle” of Chile, Argentina and Bolivia — plays a major role in global lithium production. Together, the three producers account for more than one-third of lithium in global markets, observes Lucas. As the regional leader in utilising reserves for commercial production, Chile accounts for the bulk of this figure, at around 30%, while Argentina accounts for around 5%.

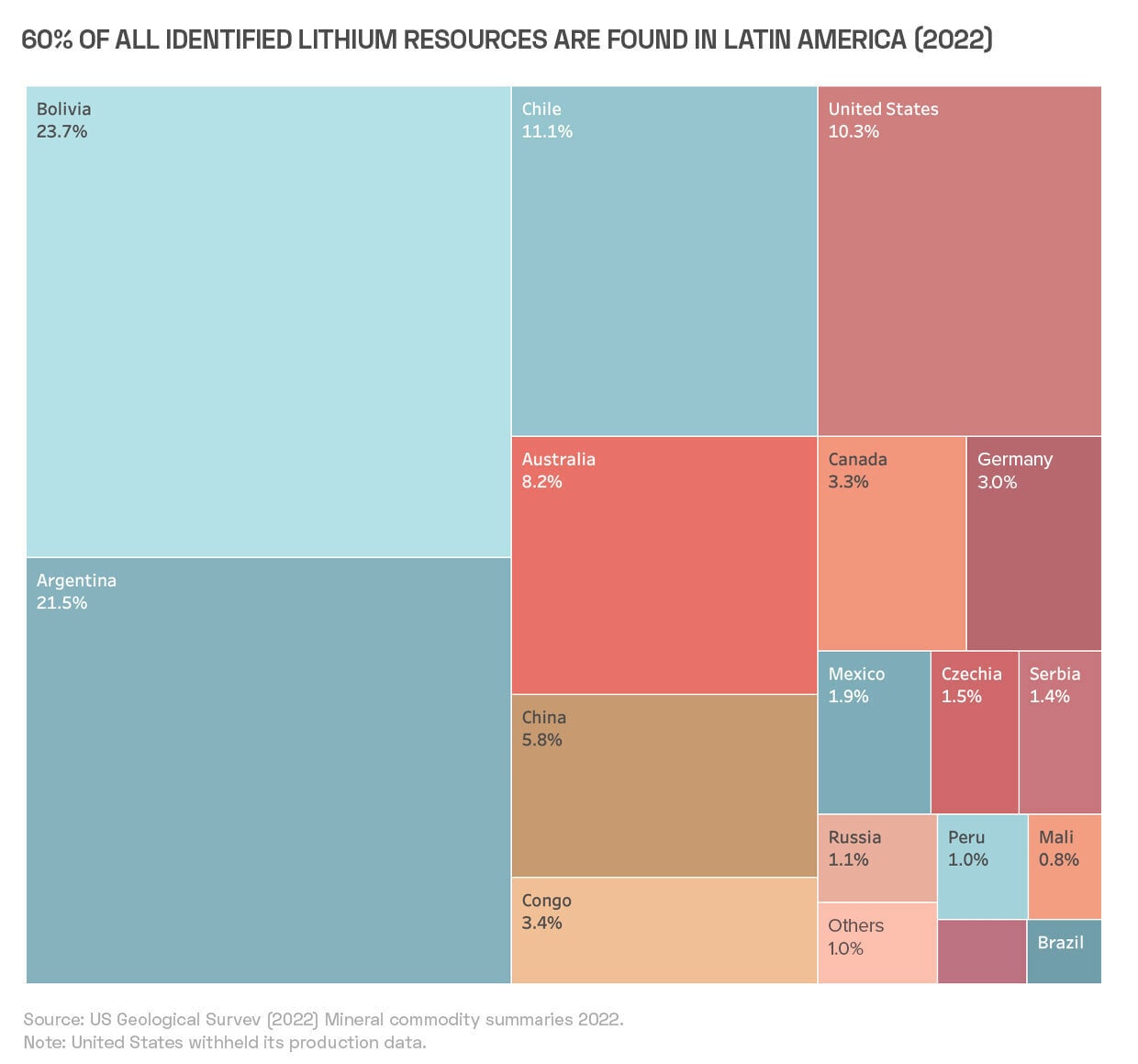

In addition to supply, the region is critical for its reserves of the resource. The UN Development Programme estimates that Latin America is home to nearly 60% of global lithium reserves as of 2022. Bolivia accounted for the largest portion of this, at 23.7% of the total worldwide, or 21 million tonnes, followed by Argentina (21.5%, 19.3 million tonnes) and Chile (11.1%, 9.6 million tonnes).

Despite their comparatively larger reserves, Argentina and Bolivia have fallen behind Chile due to investment challenges, regulatory factors and geographical conditions. According to Lucas, “Brazil is also going to be a fast-growing area.”

Growing Threat of Lithium Nationalism

The importance of lithium has brought the threat of lithium nationalism to the fore.

In April of this year, Chile’s President Gabriel Boric announced plans to nationalise the country’s lithium industry to support the economy and protect the environment. The announcement followed Mexico nationalising its deposits in 2022 and Indonesia banning exports of nickel ore, a mineral key to battery production, in 2020.

“It is a fast-growing industry and economically vital,” Lucas underlines. “Access is important to the world, so there is an incentive to gain control.”

Under the new framework, new and existing projects in Chile must hand over at least 51% ownership to the government. While it is a “seismic shift”, there is nuance: “It is not traditional nationalisation whereby the government comes in immediately and takes over projects and assets.” Rather, the Chilean government has stated that it will honour pre-existing contracts, particularly with two major mining firms: Sociedad Química y Minera de Chile [SQM] and US-based Albemarle [ALB]. SQM’s contract is in effect until 2030, and Albemarle’s through 2043.

Albemarle’s management has expressed that there will likely be “no material impact” on the business model. SQM’s position is more complicated, as their remaining contract is shorter. The challenge is existential: if they fail to reach an agreement with the government, their ability to operate could be compromised.

According to Lucas, “The thinking in the industry is that what does come to pass will likely be favourable to the company because SQM is one of the economic crown jewels of the country.”

Opportunities in the Value Chain

Lithium investment opportunities are multifaceted. Opportunities throughout the production value chain each serve a unique role in the EV revolution.

Upstream players include mining companies and those that convert raw materials into battery-grade resources. Many are integrated, possessing both mining and processing capabilities. Midstream players include manufacturers of batteries and their components, among them cathodes, anodes, separators and lithium-ion cells. Downstream, meanwhile, there are opportunities for EV production and energy storage.

Lucas expects to see significant changes in Latin America’s mining landscape, with the regulatory environment and government policies set to play a pivotal role in this transformation. While Chile has been a longstanding player in lithium production, its growth may slow due to a high degree of government regulation. By contrast, Argentina and Brazil are taking a more aggressive approach to expanding their industries, likely to lead to a shift in market dominance.

Indeed, the region as a whole could benefit from sustained demand: as the world transitions to greener sources of energy, demand for lithium is forecast to increase 40-fold between 2022 and 2040, according to the IEA.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy