What Is the Mag 7?

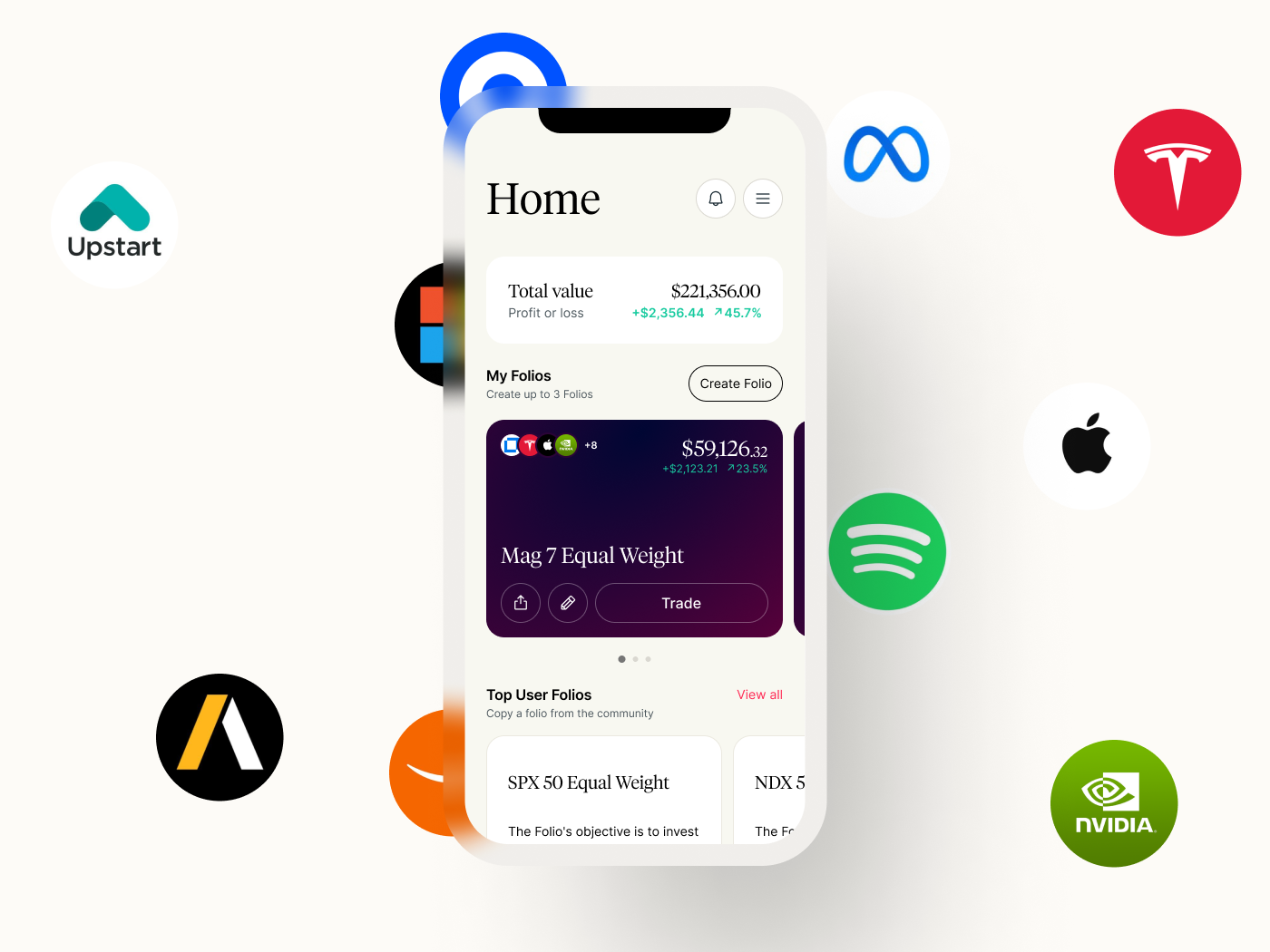

The Mag 7 Folio offers a way for investors to access the seven leading stocks that have transformed the tech industry: Alphabet [GOOGL], Amazon [AMZN], Apple [AAPL], Meta Platforms [META], Microsoft [MSFT], Nvidia [NVDA] and Tesla [TSLA].

The seven have surged in valuation over the past couple of years, particularly on the back of investor excitement around artificial intelligence (AI). However, they have been caught up in the recent selloff sparked, in part, by US President Donald Trump’s tariff wars.

Here, OPTO examines whether this selloff has made investing in the Mag 7 Folio a more attractive opportunity.

All the data is based on back-tested results and market metrics available within the OPTO app. This content shouldn’t be taken as investment advice and is for informational purposes only.

A Magnificent Opportunity?

Investing in the Mag 7 Folio gives you exposure to seven stocks that have been described as ‘magnificent’ because of their rapid share price growth.

All of the Mag 7 set all-time highs between December last year and February. However, they’ve all pulled back sharply, roiled by jitters about the US slipping into a recession, and not helped by President Trump’s tariff trade war.

These pullbacks could provide an attractive entry point for investors who may have considered their recent valuations too lofty.

The seven companies could be considered ideal long-term investments. They boast impressive earnings and revenue growth and strong balance sheets, while they have plenty of cash in reserve to continue innovating and developing new products. They should also be well-placed to weather any economic downturn.

Back-Tested Performance Analysis

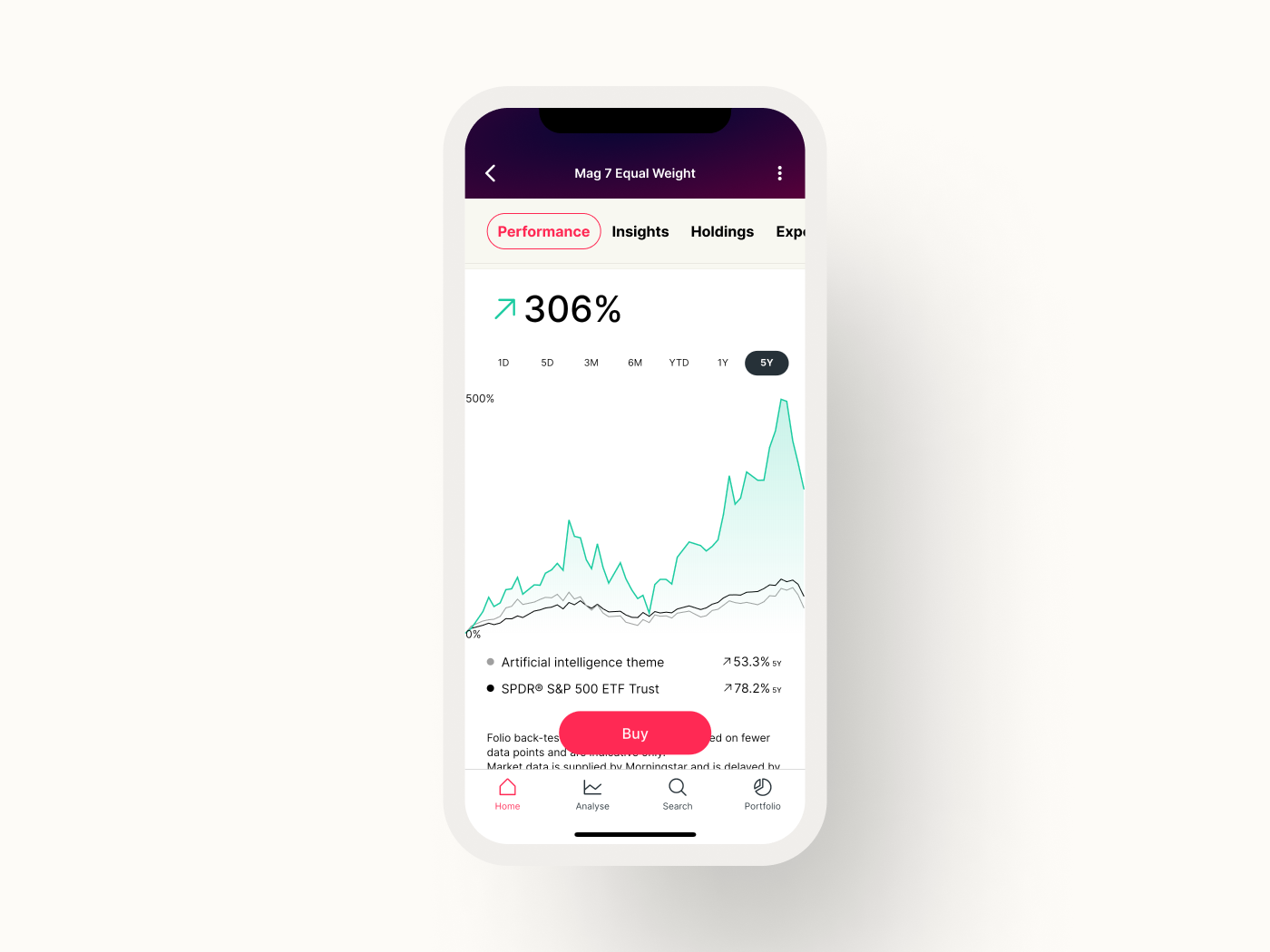

The Mag 7 Folio is down 12.7% since January 1 through March 20 versus a 3.5% drop for the S&P 500.

The stocks in the Mag 7 Folio returned a combined 14.9% in the past 12 months, compared to the index’s 8.3% rise. Over the past five years, they returned an astronomical 543% versus the index’s 145.6% rise.

Mega-cap companies can capitalize on tech trends quickly to corner the market and gain a competitive advantage. This analysis shows how exposure to them can lead to higher returns in the long run.

Mag 7 Breakdown

Here is an overview of recent developments from the seven companies in the Mag 7 Folio.

Apple

Market cap: $3.21trn

P/E ratio: 34.00

P/S ratio: 8.22

The Cupertino-based company is reportedly set to overhaul its iOS, iPadOS and macOS operating systems to give sluggish sales a boost. The changes, which are expected to include redesigned apps, buttons, icons and menus, would be the first major revamp since iOS 7 was launched in 2013.

Nvidia

Market cap: $2.97trn

P/E ratio: 41.38

P/S ratio: 22.89

The so-called ‘king of chips’ is forecasting revenue for Q1 fiscal 2026 of $43bn, which would be a 65.4% jump year-over-year. Demand for its AI GPUs from tech firms, including Amazon and Microsoft, seems to be holding up amid concerns about DeepSeek’s low-cost AI model, launched in January.

Microsoft

Market cap: $2.89trn

P/E ratio: 30.31

P/S ratio: 11.03

Microsoft is looking to reduce its dependence on OpenAI, despite being the ChatGPT maker’s biggest backer, and develop its own large language models (LLM). The Redmond, Washington-based software giant was the world’s second-biggest cloud infrastructure services provider in Q4 2024, with a 21% share of the market, according to Synergy Research Group.

Amazon

Market cap: $2.10trn

P/E ratio: 35.80

P/S ratio: 3.25

In order to keep up with its competitors, the tech giant announced earlier in March that it’s establishing a new unit to build software for users and customers who want to work with agentic AI. The company was the leading cloud infrastructure services provider in Q4 2024, with a 30% share of the global market.

Alphabet

Market cap: $2.02trn

P/E ratio: 20.57

P/S ratio: 5.82

The ad and search engine leader is planning to spend $75bn on AI this year, according to its Q4 results. The company revealed some major AI products during the final three months of 2024, including Gemini 2.0, its latest LLM. Google owner had the third-biggest share (12%) of the cloud infrastructure services market in Q4.

Meta

Market cap: $1.54trn

P/E ratio: 25.47

P/S ratio: 9.36

The social media giant wants to reduce its reliance on suppliers, like Nvidia, and start making its own silicon chips. The Facebook owner is reportedly testing its first in-house chip for AI training purposes. It’s projected it will spend up to $119bn this year, $65bn of which will be on AI infrastructure.

Tesla

Market cap: $804.1bn

P/E ratio: 122.54

P/S: 8.18

The EV maker has previously propped up the rest of the Mag 7 but has seen its valuation plummet in recent weeks. Sales in China and Europe have been slowing, while Elon Musk’s divisive political role in Trump’s government has also been weighing on the stock.

The Trends Driving the Mag 7

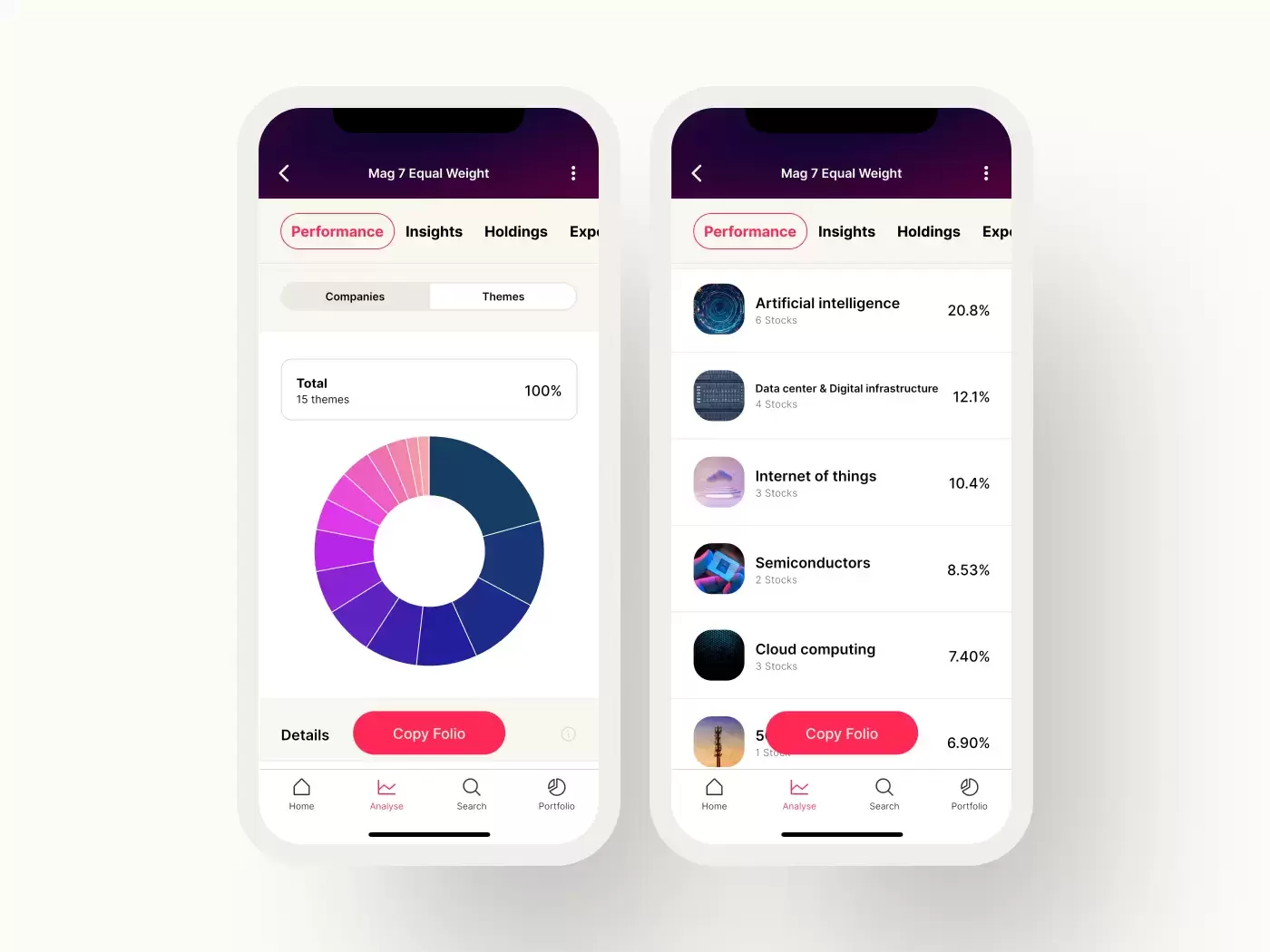

AI currently has the largest thematic exposure in the Mag 7 Folio, at 20.5%. This dominance is not surprising, given the huge investments the tech behemoths are making: Microsoft, Amazon, Meta and Alphabet are set to collectively spend up to $320bn on AI-related expansions in 2025.

This surge in AI investments is directly fuelling the growth of data center and digital infrastructure, which accounts for 12.3% of the Folio’s exposure, in second place.

In third place is the Internet of Things (IoT), representing the Folio’s third-largest thematic exposure, at 10.5%. By 2025, IoT is expected to drive substantial efficiency gains, with 83% of businesses that implement IoT technology reporting an improvement. This trend aligns with the Mag 7’s efforts to develop and integrate IoT solutions across various sectors.

Semiconductors, crucial for AI and other advanced technologies, comprises 9.05% of the Folio’s exposure. Nvidia, a key player in this space, is positioned as a supplier rather than a buyer of AI technology, potentially benefiting from the increased demand driven by its peers’ investments.

More Reading on The Mag 7

Before you consider investing in the Mag 7 Folio, here are some recent OPTO articles on AI and cloud computing, which will to give you a better idea of how these sectors are driving the tech industry forward, as well as investment opportunities beyond the Mag 7.

- 5 SaaS Stocks to Watch in 2025

- Seeking Alpha’s Top Tech ‘Buys’

- Where AI Meets Cloud: the Road Ahead for Box

- 3 Chip Stocks to Watch Amid Industry Turmoil

- Beyond Nvidia: 3 Chip Stocks to Watch in 2025

Conclusion

To explore and potentially invest in the Mag 7 stocks, you can copy the Mag 7 Folio as a staring point, or customize as you see fit on the OPTO platform. For more on how to do this, click here.

While the Mag 7’s recent performance may be underwhelming, the seven companies’ financial strength and market dominance in AI and cloud computing means they could all be winners in the long-term.

The content of this article is for general informational purposes only. All examples are for illustrative purposes only.

Past hypothetical backtest results do not guarantee future returns, and actual results may vary from the analysis.

All investments involve risk, and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Please note that diversification does not ensure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

OPTO Markets LLC is not a broker-dealer, investment adviser or member of FINRA. Please see www.optothemes.com. Securities offered by Alpaca Securities LLC (“Alpaca Securities”).

Alpaca Securities, LLC (“Alpaca Securities”) is not responsible for and is not providing the technology and services you receive from us to access and manage your brokerage account with Alpaca Securities. You firmly agree to hold Alpaca and its affiliates, owners, directors, employees, clearing firm and agents harmless for any loss or damage arising from the use of or unavailability of the technology and services that we are providing.

Alpaca Securities is a member of FINRA and the Securities Investor Protection Corporation. Pursuant to FINRA Rule 4311, Alpaca Securities and Opto and have entered into an agreement where Alpaca provides clearing services for the Opto platform. For further information, please refer to the Alpaca Disclosure Library.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy