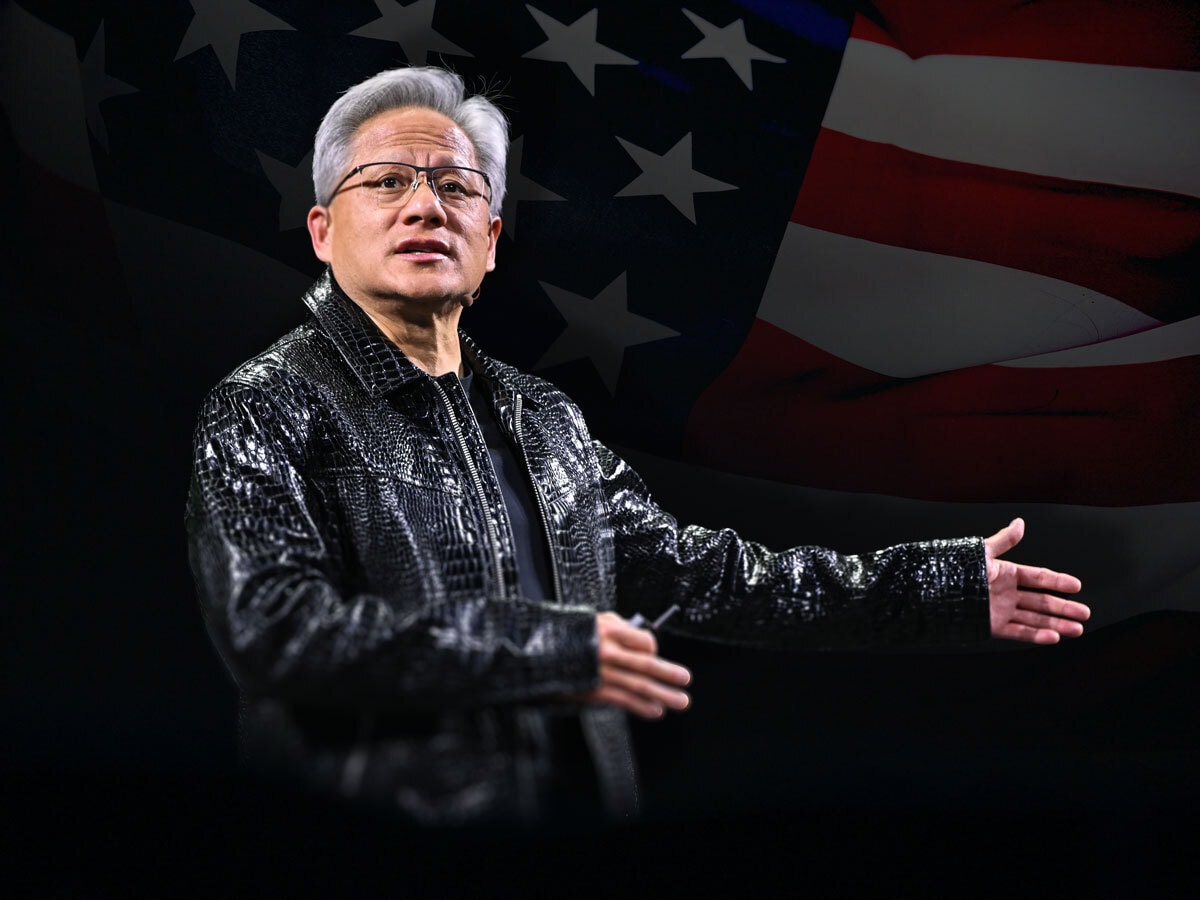

Huang: We’ll Spend Hundreds of Billions in the US

Nvidia [NVDA] plans to spend billions of dollars on US-made chips and electronics over the next four years. CEO Jensen Huang told the Financial Times that the firm will also shift supply chains to the US amid geopolitical uncertainty and tariff threats. “The most important thing is to be prepared,” he said. “At this point, we know that we can manufacture in the US, we have a sufficiently diversified supply chain.”

SoftBank Expands its AI Footprint

SoftBank [SFTBY] has agreed to acquire chip start-up Ampere Computing for $6.5bn, reinforcing CEO Masayoshi Son’s artificial intelligence (AI) ambitions. Ampere designs cloud computing processors using Arm [ARM] technology. Meanwhile, Arm — which is majority-owned by SoftBank — plans to launch its own chip this year, securing Meta [META] as an early customer as it shifts from licensing to direct chip production.

Starlink Challenger’s Growth Stalls

Eutelsat [ETL:PA] shares have surged nearly 300% this month amid speculation around the EU’s push for a Starlink alternative. However, gains are slowing as investors await clarity on the financial support the satellite operator will receive. With Eutelsat burning cash to compete, an analyst cited by Bloomberg warns the rally implies a “very generous” EU deal — one that has yet to materialize.

Is it Time to Buy TEM?

Health infotech firm Tempus AI [TEM] is up 40% year-to-date, Zacks noted earlier this week. Analysts cite strategic acquisitions and partnerships, including its recent Deep 6 AI buyout, announced on March 11, as growth catalysts; the deal strengthens Tempus AI’s clinical trial matching capabilities, potentially boosting future revenue and investor confidence. Read OPTO’s recent deep dive into this Cathie Wood-backed stock.

12 Undervalued Tech Stocks

Morningstar has highlighted tech stocks with strong competitive advantages that are currently undervalued according to a price/fair value metric. The picks include Taiwan Semiconductor Manufacturing Co [TSM] and Adobe [ADBE] (the two biggest by market cap), as well as NXP Semiconductors [NXPI], Block [XYZ], ON Semiconductor [ON], Endava [DAVA] and The Trade Desk [TTD].

Another Setback for Tesla

The electric vehicle maker [TSLA] is recalling 46,096 Cybertrucks in the US over an exterior panel that can detach while driving, increasing crash risks. The recall covers 2024–25 models produced from November 2023 to February 2025. Tesla will replace the faulty piece for free. This follows previous recalls for rearview camera and accelerator pedal issues, Seeking Alpha noted.

SHOP Stock Pops on News

Shopify [SHOP] is moving its listing to the Nasdaq, ending its NYSE and TSX listings after nearly a decade. Shares surged nearly 6% on the news, with the switch set for March 31. The move follows a strong Q4, in which profits doubled and gross merchandise volume surged. OPTO recently unpacked the bear case for SHOP stock, as well as some potential pitfalls ahead.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy