This month on The Big Picture, Jens Nordvig, Co-Founder and CEO of MarketReader, discusses interest rate peaks on the back of lower inflation concerns, and a shift from the market’s focus on inflation and supply-side concerns, to questions related to growth.

After predicting that interest rates would peak due to lower inflation last month in The Big Picture, OPTO’s monthly look at the macroeconomic climate, Jens Nordvig, Co-Founder and CEO of MarketReader, returns to discuss his expectations for the coming months.

“We’ve really been in a multi-year period where rates were going up and up, with few interruptions. Then in the last period there was something new, and that was that people have concerns about the long end of the bond market,” explains Nordvig.

If the long end experiences significant movement, “in a way that kind of short circuits how the Fed thinks”, and it affects the regulator’s approach to fiscal tightening.

“That’s exactly what we’ve seen play out — the long end moved so much that the Fed started to actually get reluctant to do more on its end, and start to talk more about financial conditions having moved.”

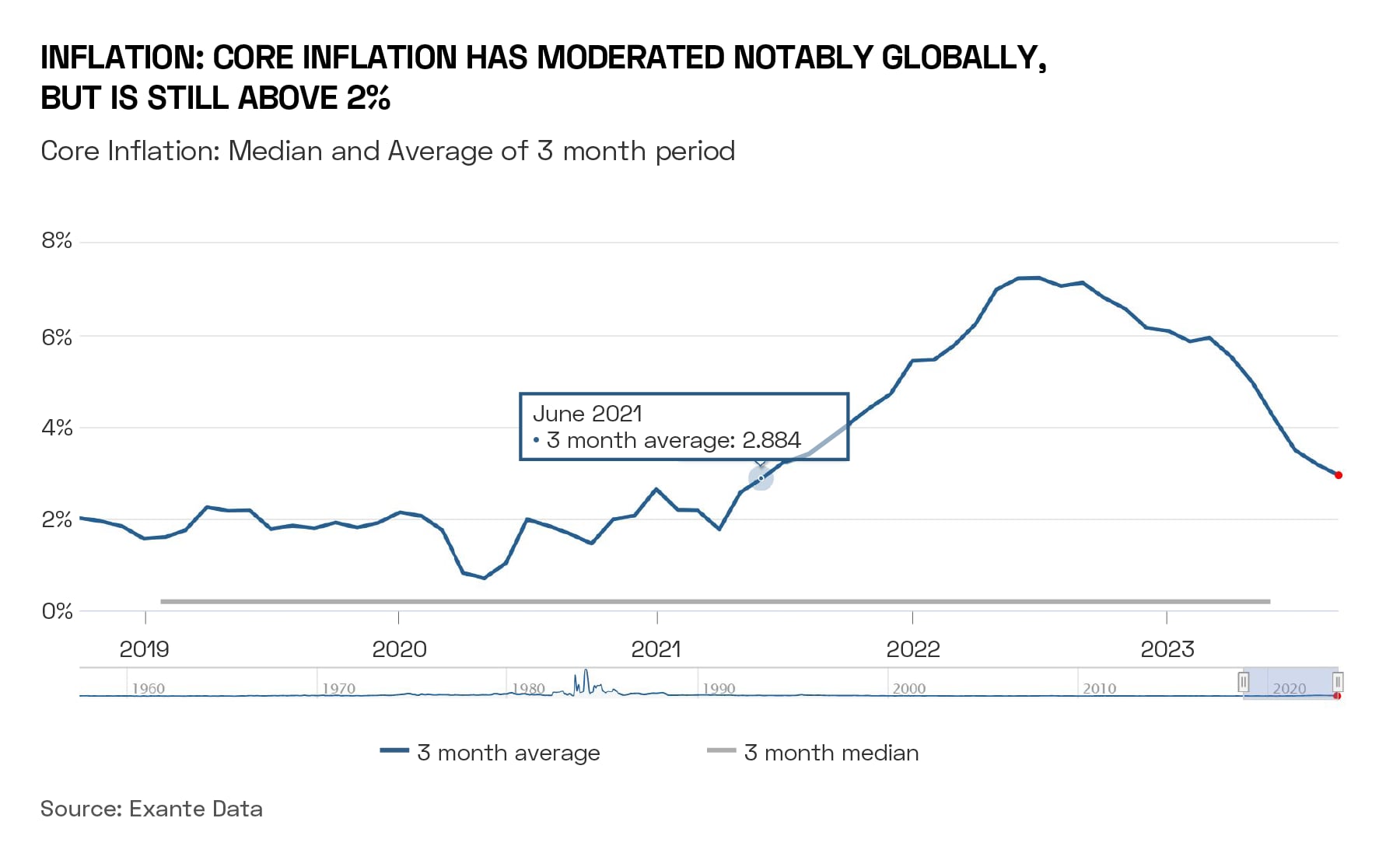

Additionally, a notable improvement in inflation, particularly in services, contributed to this shift in narrative. “The reason why the Fed has been reluctant to sound more hopeful on inflation was that for services prices, things have been very sticky, even when headline inflation has been going down. And the last print sort of changed that.”

By analysing median values, Nordvig notes a potential shift towards the Fed’s 2% target. “I’m not saying we’re at the 2% target yet, but we have come from around 4% for effectively two years, and the latest print showed approximately 2% annualised. If we have another couple of months of that, then the Fed will be able to move to a totally different narrative.”

The Market Rallies

The market, detecting this shift, has responded with a substantial rally, surprising many who were focused on persistent supply concerns. “All these things together have led to a big rally. It surprised a lot of people in the bond market because people were so focused on the supply issue, thinking we’re going to have supply issues forever, and that’s calmed down. But it’s also surprised in the equity space, where people thought, ‘OK, we are getting close to this lower growth point where equity is finally going to flip over.’”

Despite these fears, “It’s been inflation that has dominated”. The result of this was a substantial 10–20% surge in the S&P, reflecting a rapid and unexpected market shift, according to Nordvig. The impact has not been confined to specific markets, but is evident across global risk assets, with a noticeable effect on the US dollar as well.

2024: Bull or Bear?

Looking ahead, Nordvig expects it will be difficult to fade ongoing market trends.

Various positioning indicators, such as the recent dent in the US dollar’s multi-year bull run, suggest the potential for continued momentum in the selling of dollars. A similar situation may apply to equity markets, where fund managers aiming to meet year-end benchmarks could engage in technical buying.

For the remainder of the year, it appears difficult to go against the prevailing trends. However, revisiting the transition discussed in the last episode, the initial phase has seen risk assets being supported by diminishing inflation concerns and less extreme worries about bond supply — a generally bullish scenario.

The question arises as to whether there will be a subsequent shift where concerns about growth take the forefront.

“As we head into the first quarter of 2024, we could have that transition,” he says. “We’re starting to see some data points in the US that look shakier,” such as home sales figures. To describe recent developments, “we can use dramatic terms like falling out of bed; it’s really breaking out on the chart”.

This hints at a potential “reset” in growth, to a point where it affects the labour market, challenging the notion that the economy has been resilient to rising rates.

Looking at the raw data and non-seasonally adjusted figures, “I think we’re heading in a direction where housing-related stuff is very weak,” as stimulus effects wane, tax credit effects diminish, and overall income growth moderates gradually from both wage and job growth perspectives.

“As we get further into 2024, there’s a risk that this shift from low inflation is going to move into a scenario where growth is meaningfully weaker and earnings could be impacted. I don’t think it’s going to be necessarily 1 January — it could take a couple of months before we get to that point.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy