A group of experts and business leaders, including OpenAI co-founder Elon Musk, have signed an open letter calling for a pause in new roll-outs of generative AI technology. The move comes as big tech firms slim down their ethical AI divisions, Microsoft launches its Security Copilot, and Google’s CEO compares Bard to a Honda Civic, but promises an upgrade.

- Big tech firms trim ethical AI teams as Musk signs call for roll-out restraint.

- Microsoft is launching Security Copilot, while Google is to upgrade Bard.

- The Global X Artificial Intelligence & Technology ETF is up 22% year-to-date.

Meta [META], Microsoft [MSFT], Amazon [AMZN], Twitter, and Alphabet’s [GOOGL] Google are among the technology companies to have cut headcount from teams focusing on the ethics of artificial intelligence (AI).

While these cuts number in the dozens and are minimal compared to the tens of thousands of people laid off over the past year, experts are troubled that the moves coincide with AI’s sudden adoption by the mass market.

They also coincide with the signing of an open letter by a range of experts and businesspeople, including OpenAI co-founder Elon Musk, calling for a six-month pause on the development of new AI systems, citing potentially “profound risks to society and humanity”.

The letter argues that Asilomar AI Principles—which call for AI to be “planned for and managed with commensurate care and resources”—are not being adhered to.

Microsoft’s share price has gained 15.6% in the past month, and 20.5% year-to-date. Meta’s stock gained 21.2% over the past month and 76.1% year-to-date, while Amazon has gained 9.6% and 23%, and Alphabet 15.2% and 17.6%, over the respective periods.

CEO compares Bard to “a souped-up Civic”

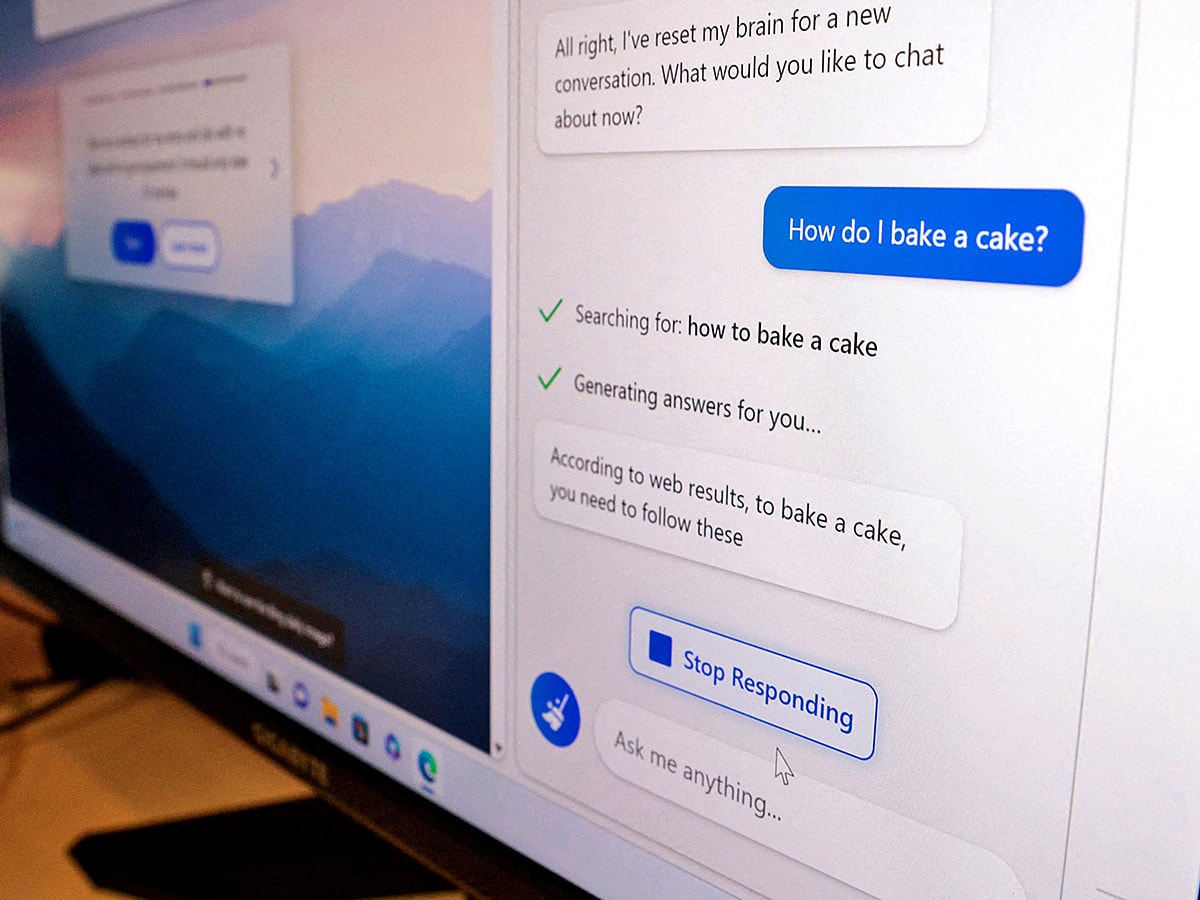

Notwithstanding the open letter, Microsoft is rolling out a ChatGPT-powered assistant for cybersecurity professionals: Security Copilot. Microsoft’s multibillion-dollar stake in OpenAI positions it well to leverage the start-up’s developments in the field of generative AI. The Security Copilot draws on both OpenAI’s GPT-4 and a security model that Microsoft has developed with daily activity data it gathers.

Google, meanwhile, has promised an upgrade to its own ChatGPT competitor, Bard. CEO Sundar Pichai told the New York Times’Hard Fork podcast that the company has “more capable models” available, noting the lightweight version of its language model for dialogue applications that the software currently runs on.

“In some ways,” said Pichai, “I feel like we took a souped-up Civic and put it in a race with more powerful cars.”

Google is expected to upgrade Bard to one of its more capable models as early as the first week of April.

AMD and Arista soar on tailwinds

The widespread adoption of AI is expected to drive the sector forward during the second half (H2) of 2023, aided by tailwinds such as a loosening of Fed monetary policy.

According to Livy Investment Research, this will be a boon for high performance computing chipmaker Advanced Micro Devices [AMD].

However, with financial conditions expected to remain tight in the short term, there is likely to be a pull-back during the second quarter, which may represent the final buying opportunity before the H2 surge. AMD stock gained 52.89% in the year to 30 March, with 21.68% gains in the past month alone.

Another high performer in the sector has been Arista Networks [ANET], which FactSet analysts expect will increase sales by 48.6% and grow EPS by 11% over the coming year. Arista has gained 21% in the past month and 38% year-to-date.

Funds in focus: Global X Artificial Intelligence & Technology ETF

The Global X Artificial Intelligence & Technology ETF [AIQ] offers investors broad exposure to the sector.

As of 31 March, its top holding is Meta, with 4.07% of net assets. Microsoft is the fifth-largest holding at 3.27%, while Amazon and Alphabet have respective weightings of 2.92% and 2.86%. The fund does not hold Arista or AMD stock.

AIQ is up 9% in the past month to 30 March, and up 22.3% year-to-date.

Investors seeking exposure to AMD through a disruptive technology ETF can opt for the Simplify Volt RoboCar Disruption and Tech ETF [VCAR]. Microsoft is VCAR’s top holding with a 10.29% weighting, while AMD is the fourth-largest at 9.15% of net assets. Alphabet is the eighth-largest at 4.00%, while Amazon is ninth at 3.49%. Meta accounts for 1.75% of net assets.

VCAR is up 5.1% in the past month, and up 33.9% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy