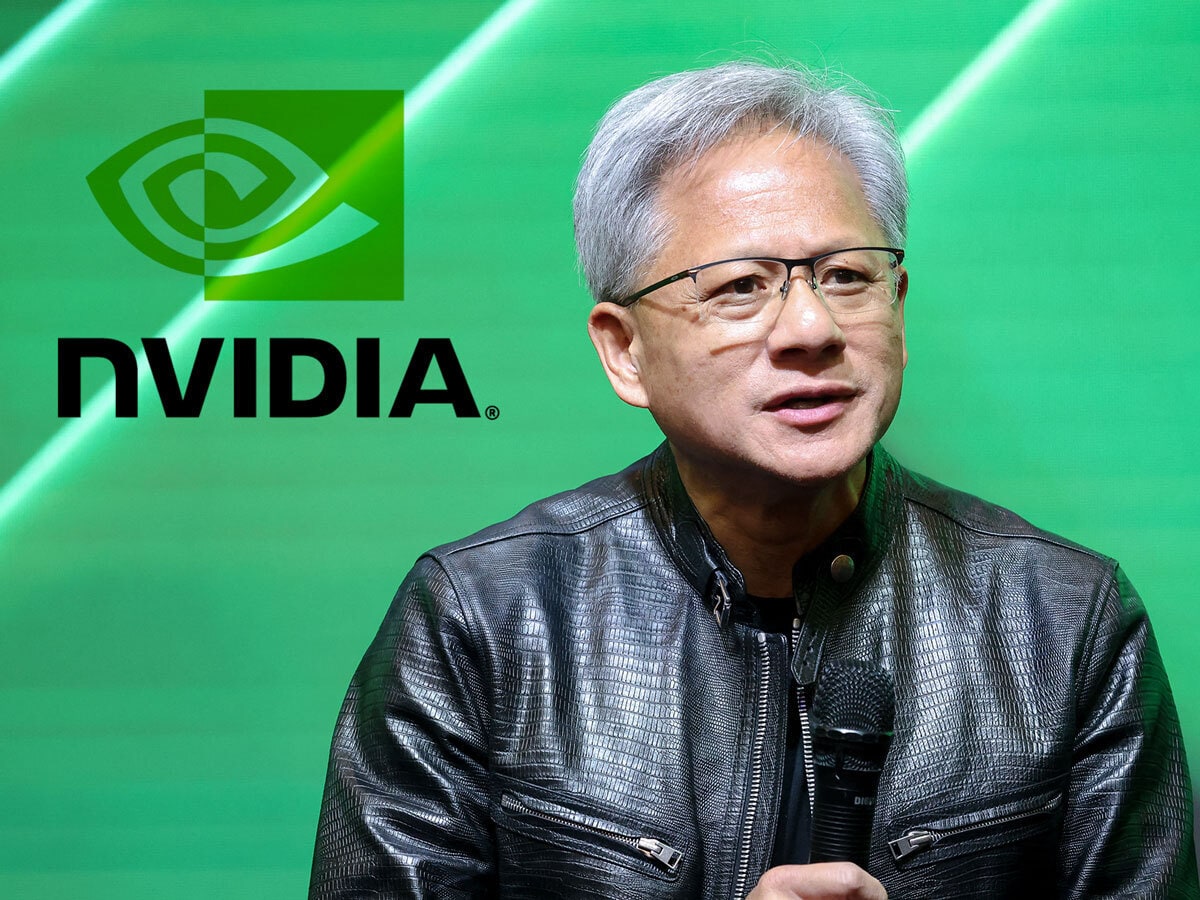

Nvidia Earnings: What You Need to Know

The chipmaker [NVDA] beat Wall Street’s revenue estimates for Q4, albeit by a smaller margin than in previous quarters. CEO Jensen Huang highlighted strong demand, with Blackwell chip supply issues resolved. Margins are tighter due to rushed product rollouts but are expected to rebound in H2 2025. Artificial intelligence (AI) “is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries”, said Huang in a statement quoted by Seeking Alpha.

Meta to Step Up TikTok Challenge?

Meta’s [META] Instagram is exploring the launch of a standalone Reels app as uncertainty looms over TikTok’s future in the US, The Information reported; Instagram head Adam Mosseri has apparently discussed the potential move with staff. TikTok faces a possible ban or forced sale under US law. Meta previously attempted a TikTok competitor with Lasso in 2018 but later shut it down.

Hey Alexa: Do Better

Amazon [AMZN] has unveiled an improved, “conversational” version of its chatbot. Called Alexa+, it will be able to engage users in “natural, flowing conversations”, the Financial Times reported. Free for Prime members, it integrates with daily schedules and smart home devices. Amazon hopes Alexa+ will boost Prime adoption while competing with Alphabet’s [GOOGL] Google, Meta and Microsoft [MSFT] on the AI front.

DeepSeek Finds Backers in China

China is rapidly adopting DeepSeek’s AI, with hospitals, local governments and state-owned enterprises integrating its R1 model. Since its January debut, the Hangzhou-based start-up has gained backing from major cloud providers and automakers, solidifying its role as Beijing’s AI champion, the Financial Times has detailed. Read OPTO’s breakdown of three China tech stocks that could benefit from DeepSeek’s rise.

Short Report Trashes Tech Darling

“The claims of financial and accounting improprieties are factually incorrect and have no basis whatsoever,” AppLovin [APP] CEO Adam Foroughi said in a blog post, per the Financial Times. Nevertheless, AppLovin stock plunged as much as 23% after short sellers Culper Research and Fuzzy Panda Research accused the company of overstating its AI capabilities, losing $20bn from its market value. AppLovin had surged nearly 800% in 2024.

Moderna Could Lose Bird Flu Contract

Moderna [MRNA] fell 6% after hours after US health officials said they will reconsider a $590m bird flu vaccine contract awarded under the Biden administration. The review aligns with the Trump administration’s broader scrutiny of mRNA vaccine spending. If funding is withdrawn, Moderna’s planned late-stage study for its H5 and H7 bird flu vaccines could be at risk, Seeking Alpha outlined.

Why Has Cathie Wood Been Buying Tempus AI?

Tempus AI [TEM] is a precision medicine company that is leveraging AI and machine learning to transform healthcare. The company has drawn attention by showing up on a number of prominent 13F filings in Q3, including those of Cathie Wood’s ARK and JPMorgan. While TEM stock has fallen from all-time highs following a slight Q4 revenue miss, OPTO examines the investment case for this biotech.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy