We believe life sciences are an important allocation in any portfolio. Yet despite its historical outperformance of the broader market1, executing an investment strategy in this complex sector is not easy.

On the one hand, the sector is synonymous with its contribution to advances in the health of our society and the associated potential for financial rewards. The prospect of these advances may continue to attract investors, but an unsophisticated approach to biopharma might not result in a repeat of the last 30 years of outperformance1. Stock picking in this sector can be difficult for the

non-specialist investor. Ever-evolving treatments and technologies, an intense competitive landscape and the many different disease areas create both opportunity and challenge. These opportunities and challenges are clearly evidenced by a broad dispersion of returns that are driven as much by science as by financial indicators. The cost of funding lengthy clinical trials and their inherent binary outcomes serve to underscore the need for experience and risk management.

This case study begins by evaluating the merit of an allocation to life sciences. History, population growth, valuations and M&A are countered by regulatory uncertainty, clinical trial risk, return concentration and funding risk. Innovation is both an opportunity and a challenge. We then review historical impact of clinical trials on company returns and how this shapes an active approach.

In our opinion, the mix of risk and reward provides an opportunity for an approach that focuses only on the most promising areas of life sciences. This case study analyses the creation of ETF strategies that utilize an experienced team, a rigorous process and a network of professionals with domain expertise.

- Opportunity - What is the merit in investing in Life Sciences?

- Challenges - What are some of the risks and challenges?

- Targeted approach - Should investors be more selective in biotech today?

- Active investment process - Can active management address the challenges?

Source: Nature, Nat Biotechnol 35,1149-1157 (2017) (see chart on slide 2). temaetfs.com

Framing the Opportunities of a Life Sciences Allocation

1. History

In our view, the life sciences opportunity can be framed through five key elements.

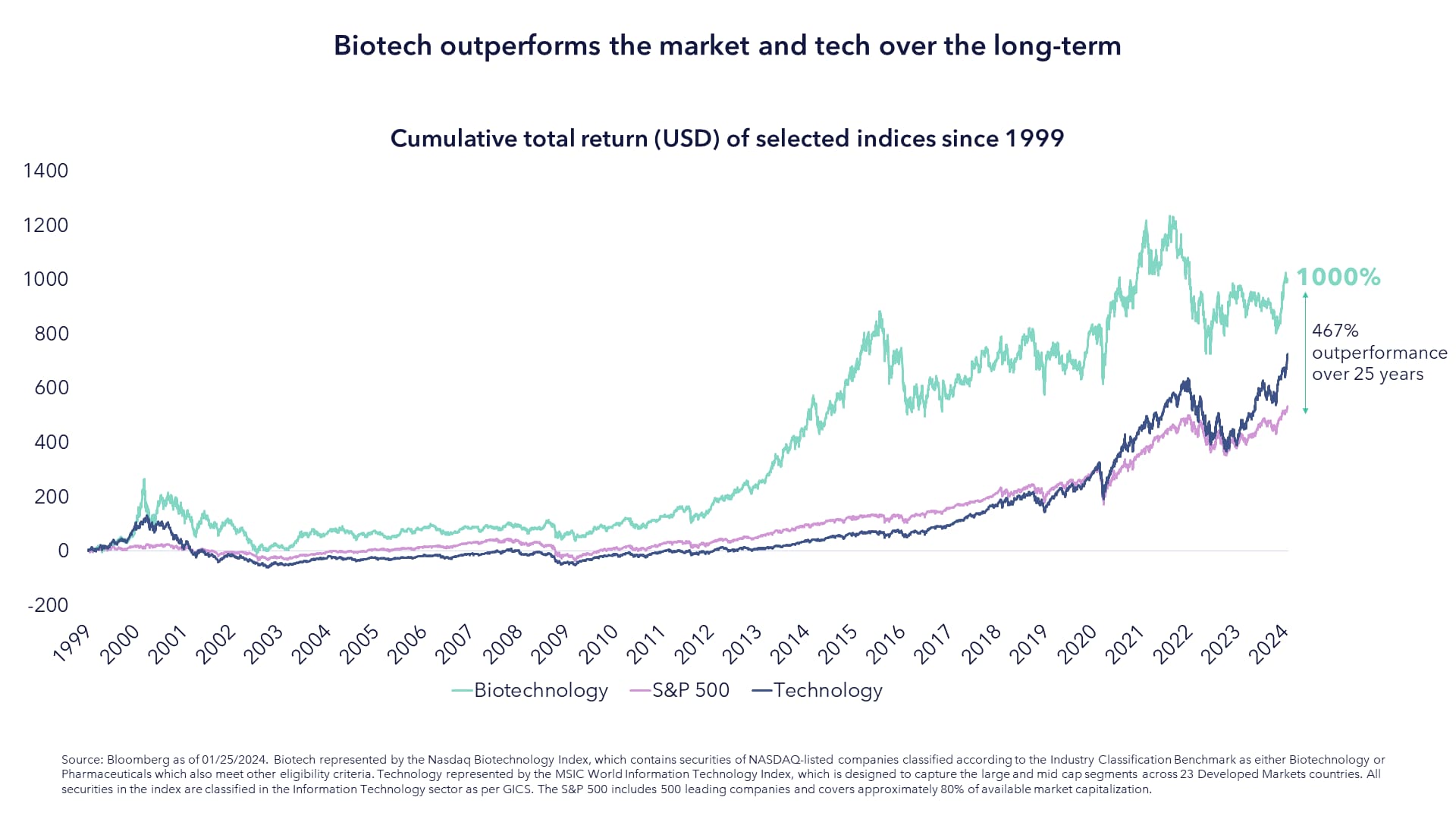

Biotech Returns Has Outperformed the Market Over the Long-term

The key takeaway from the above chart is that biotech has consistently beaten the broader market, small caps and even tech stocks over a long period of time, yet this isn’t a narrative that is often discussed today.

2. Opportunity

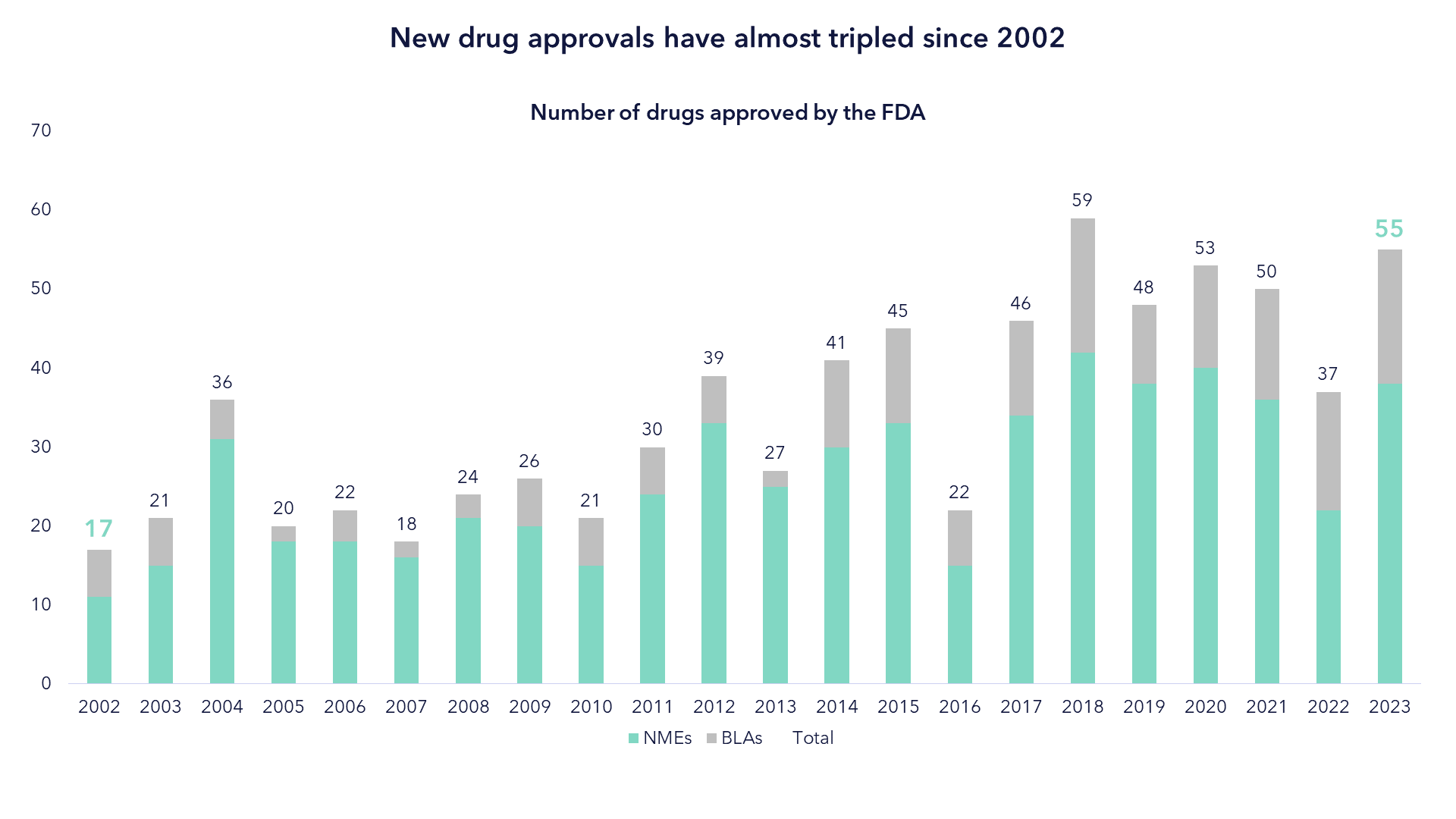

The Pace of Biopharma Innovation Continues to Grow

Innovation is nothing new. Great innovations in life sciences have helped shape the world today and will likely help shape the world of the future. The difference today is the speed and scale of these innovations, exemplified by the number of FDA approvals. In 2002 there were 17 new drugs approved. In 2023 there were nearly 60.

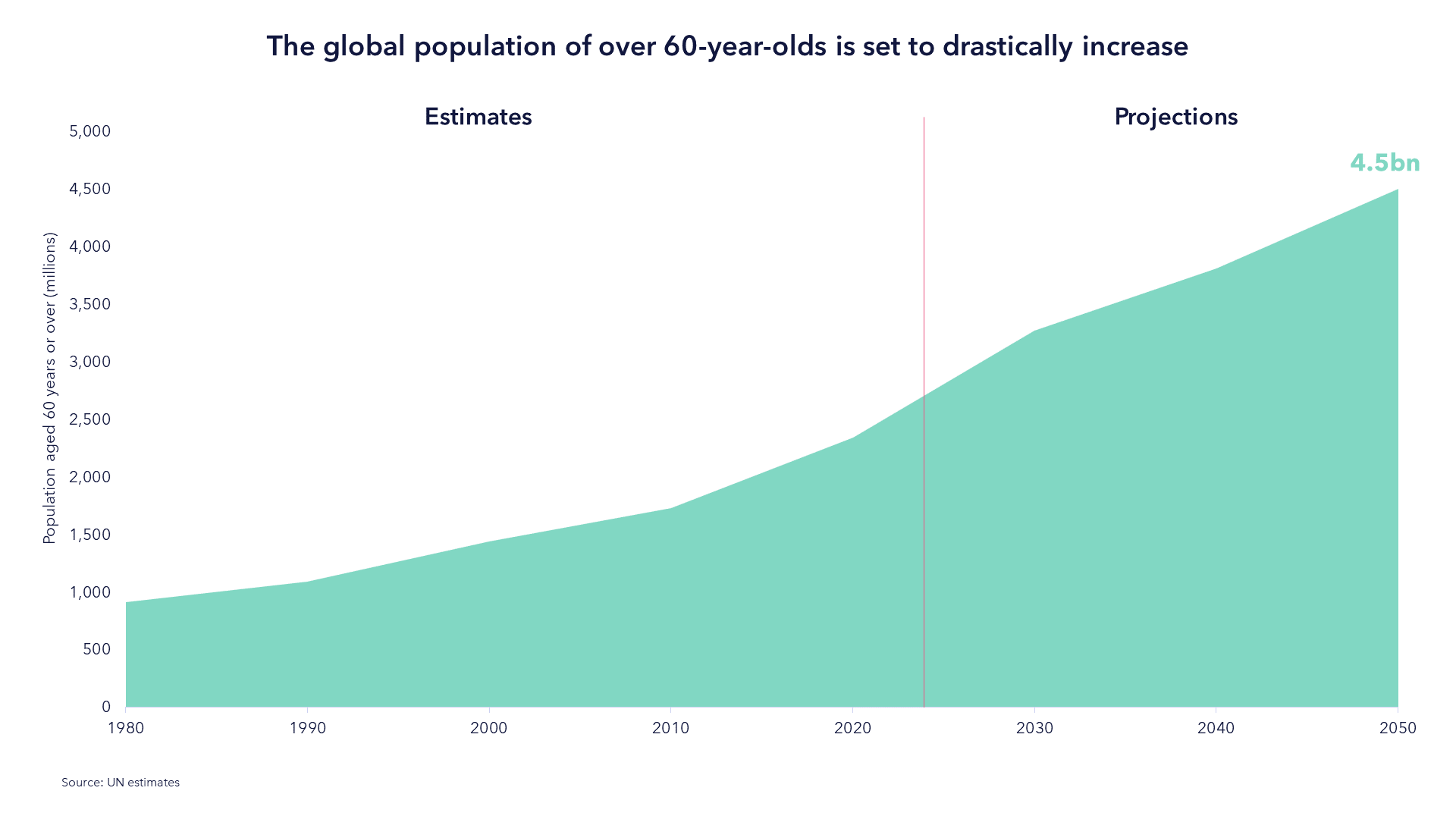

3. Population

As the Population Ages Medical Spend Will Increase

The UN forecasts that by 2050, the number of people over 60 years old globally will double. The US is experiencing the greatest surge of new retirees in the nation's history.

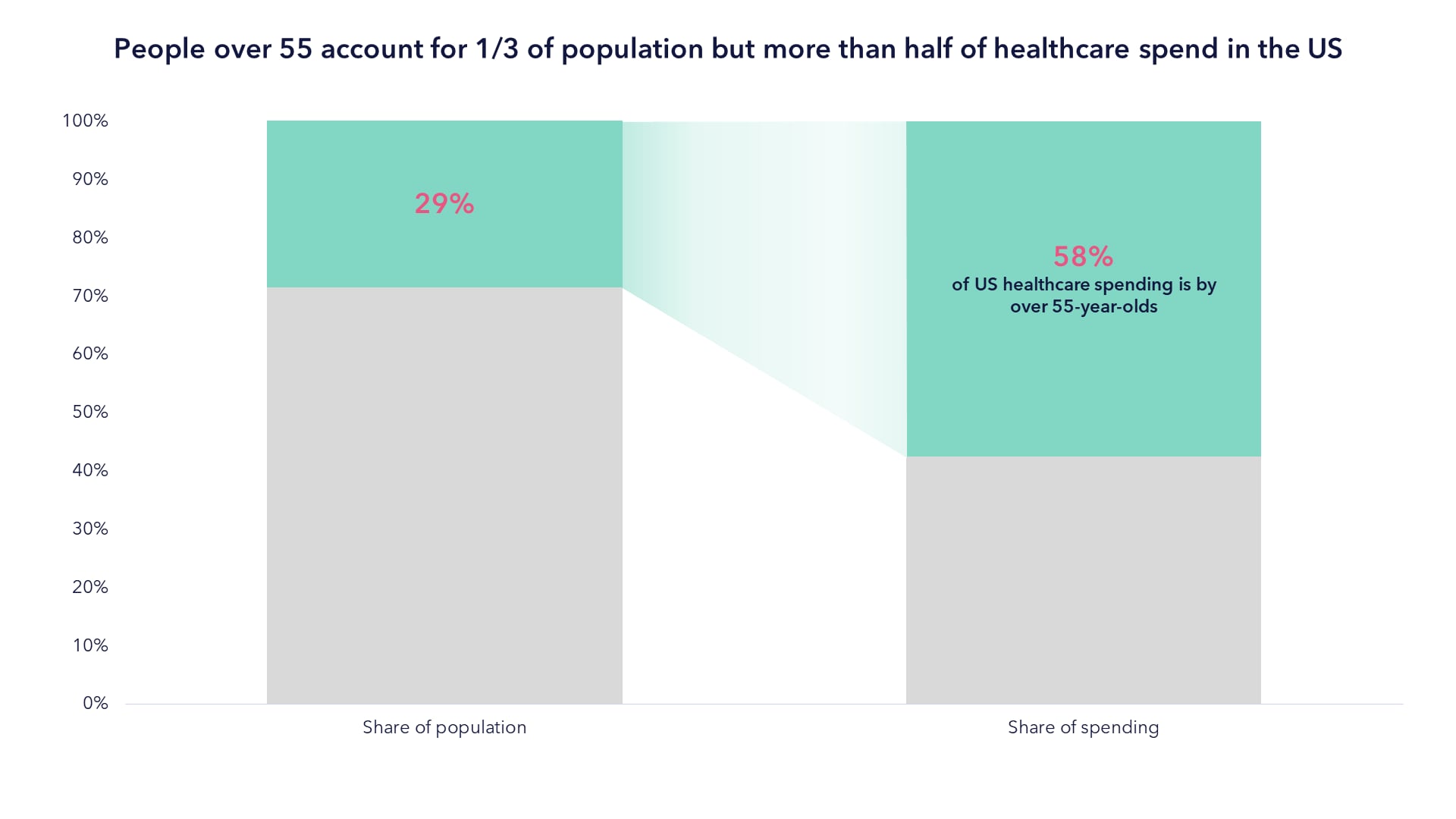

As this older population grows, the healthcare spend is likely to grow at an even greater rate because people over 55 account for half the healthcare spend in the US today, as seen in the chart below.

Source: Kaiser Family Foundation, 2023.

These demographic changes are, in our view, likely to lead to a surge in demand that will outpace general economic growth.

4. Valuations

Valuations at Historic Lows

Biotechnology valuations are at historic lows. The sector has been out of favour with investors for some time, especially with respect to small and mid-cap names. In fact, nearly a quarter of listed SMID biotechnology companies are trading below the level of cash currently held on their balance sheets.

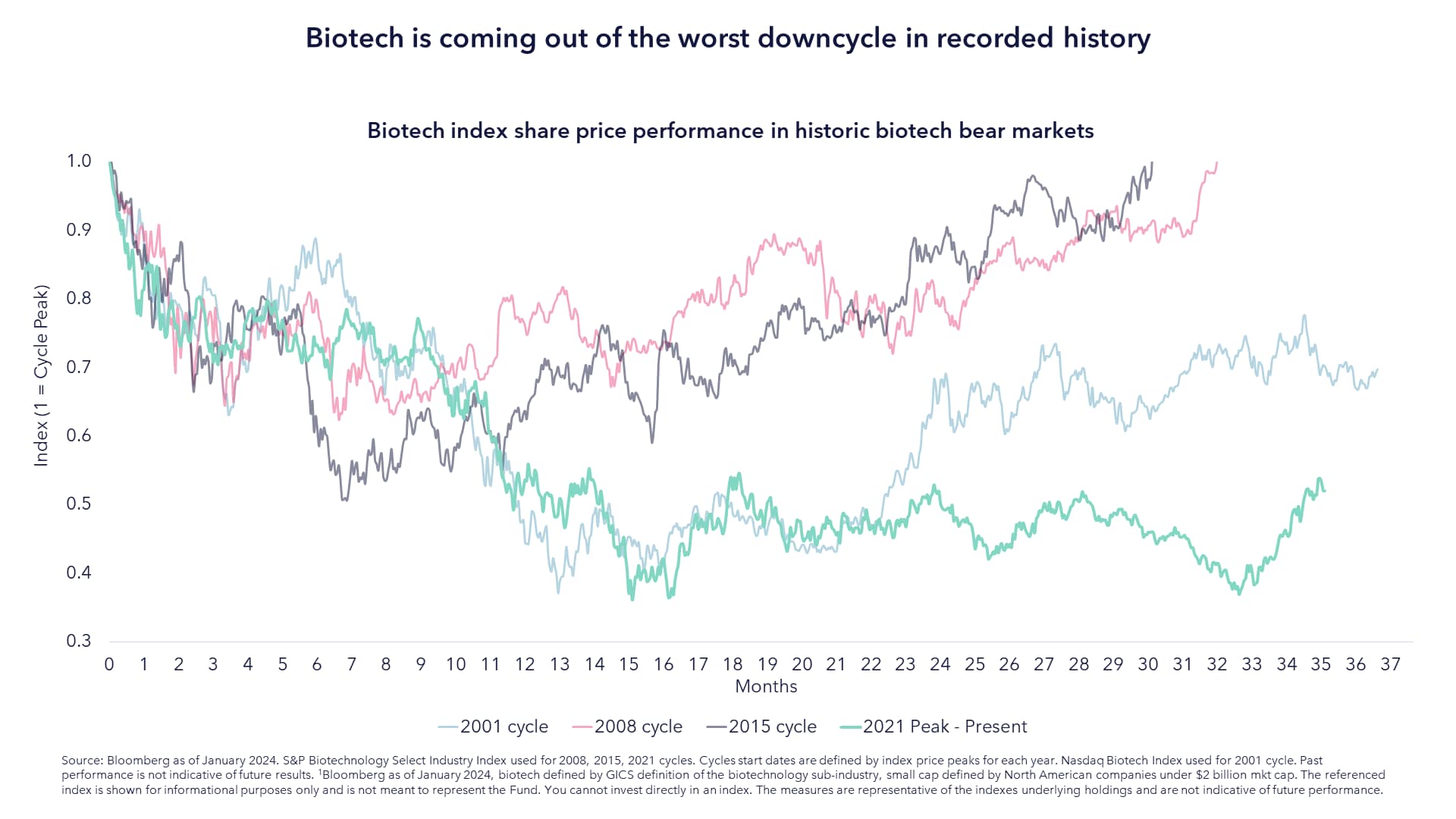

As shown in the chart above, the biotechnology sector is going through its worst downcycle in decades. Returning to the point around tech vs biotechnology stocks, the performance differential has never been wider.

SMID: Small and Mid Caps, listed companies with small and medium-sized capitalisations.

5. M&A

M&A is a Hallmark of Life Sciences

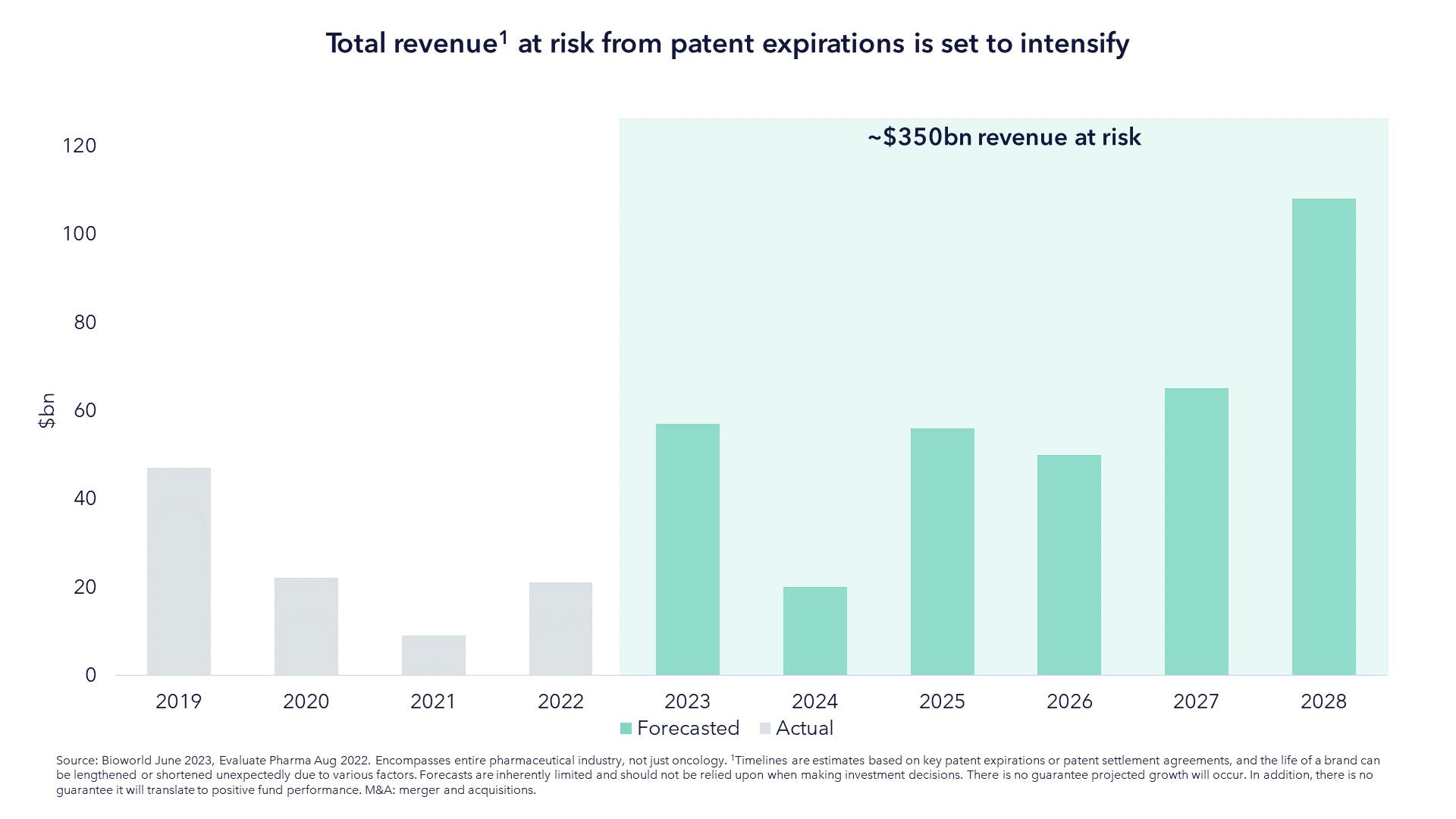

M&A has always been an inorganic tailwind of the life sciences sector - much more so than in other sectors - and that has never been more the case than it is today. In the chart below, we show the total revenue at risk from patent expiration for the next five years. Replacing this lost revenue is hard. It takes a decade or more to bring a drug candidate to market and the probability of failure is high.

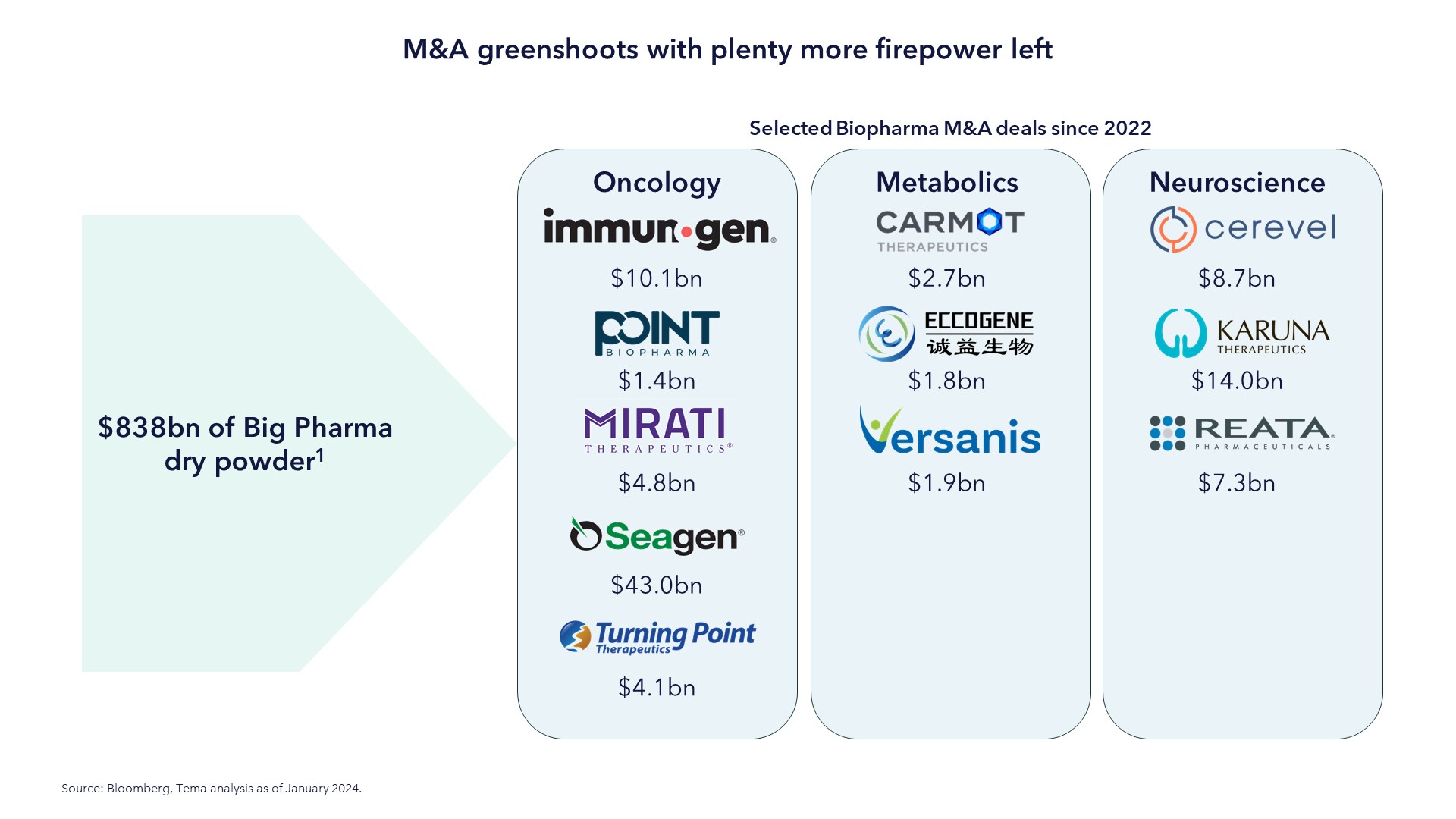

M&A is critical for big pharma to drive future innovation, meaning they pay large premiums for acquisition targets. The premium for recent oncology acquisitions, for example, currently stands at a staggering 98%, offering investors an additional potential source of return. The chart below shows some of the significant acquisitions made since 2022.

With $838bn of dry powder on the sidelines and the sector continuing to be appealing from a valuations perspective, we saw green shoots in late 2023 of a recovery in M&A.

Source: Bloomberg. Select Oncology acquisitions >$1bn average premium since 2019.

The Challenges with Life Sciences Allocations

1. Innovation distinctions

Despite the promising prospects, life sciences contains some of the most unique challenges in public equity markets.

Relentless Innovation That Differs by Disease Area

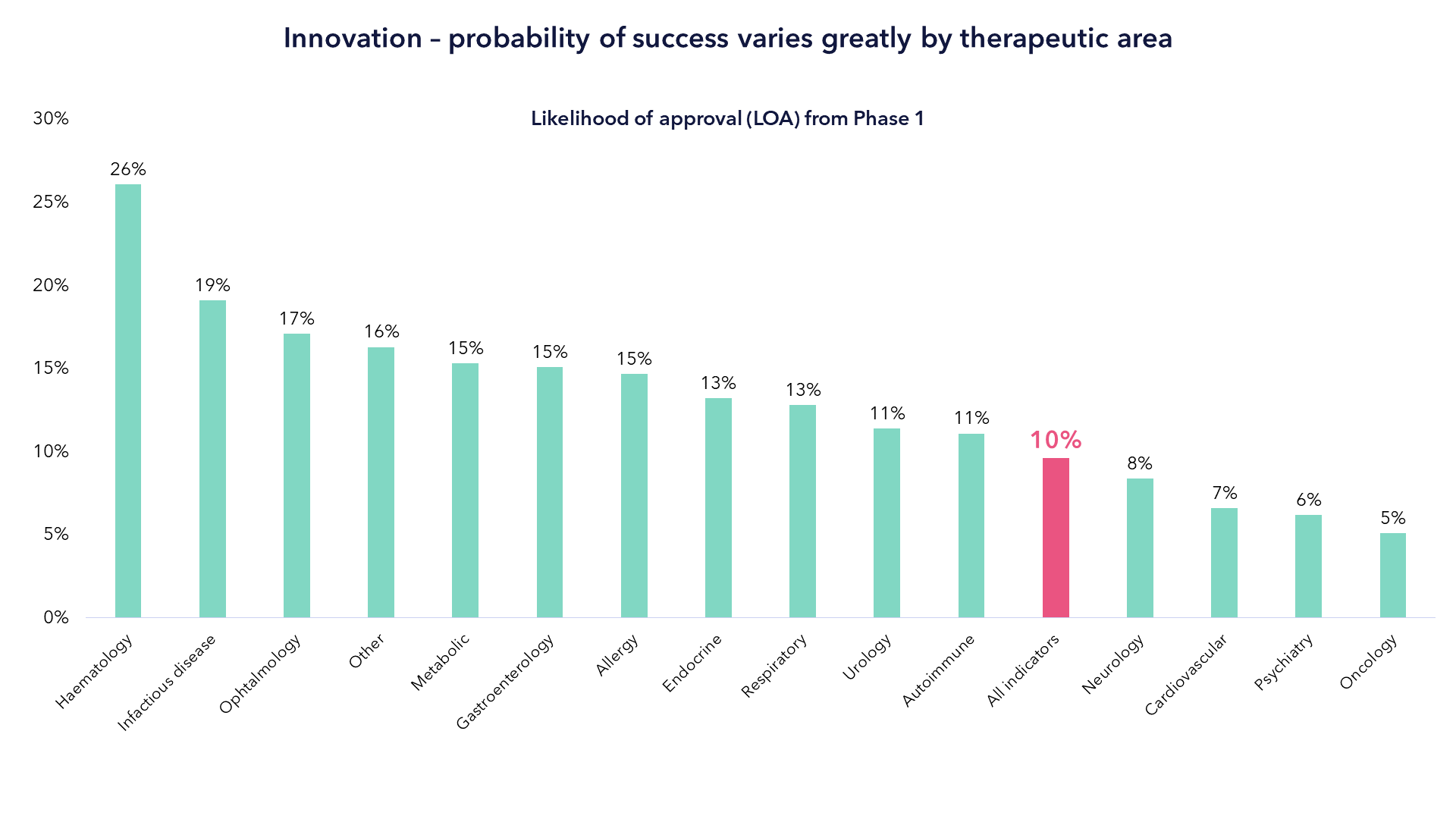

We have outlined the tailwinds from innovation but picking the best innovators - and avoiding the landmines - is difficult. The hard truth of life sciences innovation is laid bare in one simple stat: less than 5% of drug discovery projects ever make it to market. Less than 10% make it from a Phase I clinical trial to market.

These challenges are compounded when you consider that the pace and scale of innovation differs significantly between disease area, with each area needing its own consideration. The chart below shows the difference rates of success of drug candidates from different disease areas.

Source: Nature Reviews, Drug Discovery. Data from Clinical Development Success Rates 2006-2015 by BIO, BioMedTracker and Amplion.

Source: Biotechnology Innovation Organization (BIO) via N-side, ''What's the average time to bring a drug to market in 2022?'', May 2022.

2-3-4. Binary Event, Regulatory, and Funding Risk

Binary Event Risk

Binary event risk in clinical trials refers to the manner in which the outcome of a single clinical trial can determine whether, in some cases, an entire company succeeds or fails. Clinical trials are complex, involving intricate biological processes, diverse patient populations and the potential for unforeseen adverse events. Trial design, patient characteristics and the viability of the science all need to be considered at great length to understand the investment merit of any company approaching a binary event.

Regulatory Uncertainty & Drug Pricing

Another hallmark of life sciences is regulatory uncertainty. The intricate nature of innovation often leads to regulatory agencies, such as the FDA, taking a cautious stance or varying interpretations of the rules, so it can be difficult to predict whether - and when - a new drug application will be approved. The FDA is tasked with balancing the promotion of innovation with ensuring the safety and efficacy of drugs. This phenomenon is fairly unique to the life sciences industry. For example, when investing in the technology sector, one doesn't have to predict whether Meta will receive regulatory approval for its launch of Threads. Chat GPT was able to become an almost instantaneous success without regulatory approval.

This regulatory landscape is often complicated by the changing nature of US politics. Leaving personal affiliations to one side, there are clear differences in how the last two administrations have handled both the FDA and healthcare in general. The discussion around the healthcare system continues to challenge the life sciences sector, giving rise to the complex problem of drug pricing. Drug pricing and its impact on a company is a complex topic that requires careful consideration on a case-by-case basis.

Funding Risk

The capital-intensive nature of lengthy clinical trials means that funding is an inherent risk, particularly to smaller companies. High R&D costs can be exacerbated by unexpected delays or uncertainty over drug pricing. The volatility of the biotech market compounds these risks by often providing only a short window in which a company can execute a successful (and less dilutive) fundraise in the public market. We believe that understanding and analyzing balance sheets and carefully constructing a balanced portfolio are key to success.

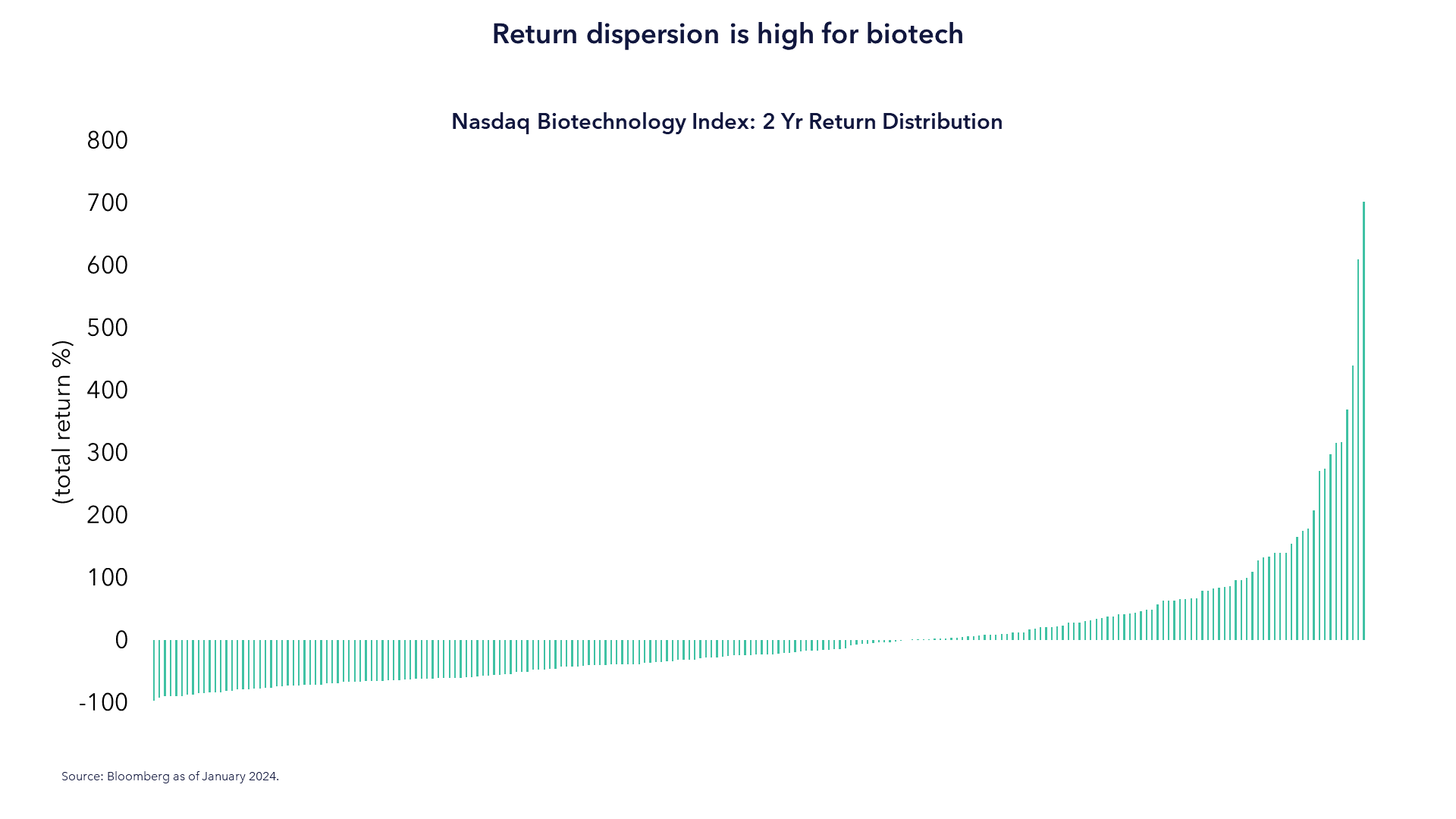

5. Return Dispersion

Return Dispersion Undermines Indexation

The result of the aforementioned challenges inevitably gives rise to a few winners and a lot of losers. Even the financial nature of these companies are highly variable, ranging from loss-making firms with only a handful of products in development to companies paying double-digit dividend yields.

This results in the type of return dispersion that we feel makes indexation very difficult, especially when there are more losers than winners. In the chart below, we show the range of returns of Nasdaq Biotechnology Index constituents just for the last two calendar years.

The Need for a Targeted Approach in Life Sciences

In our view, the solution to these unique challenges and opportunities necessitates a focus on the most compelling segments within biopharma, namely those with the requisite tailwinds and growth prospects.

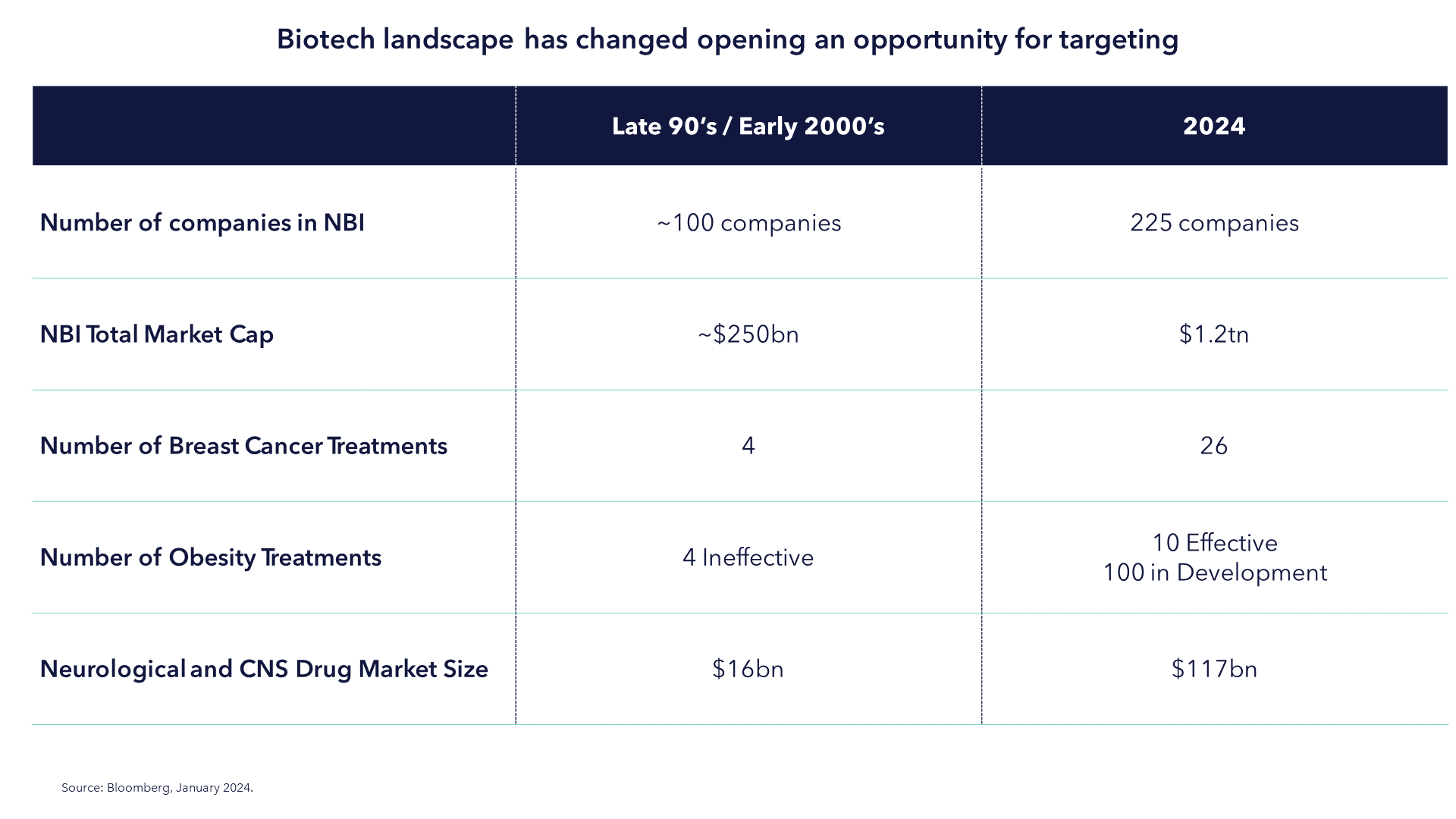

Historically, investing in life sciences through public equity has resulted in a choice between broad healthcare funds or slightly narrower but still all-encompassing biotech funds. However, knowing what we know about science today, one might reasonably segregate the market along different lines.

In 1990, when biotech investing really first became "a thing", this immature corner of the public equity market barely had enough companies to form an investable index; the Nasdaq Biotechnology Index (NBI) launched in 1993 with 100 companies. The prospect of dividing up the healthcare market into disease areas would never have been feasible.

The picture is now entirely different. The NBI has 225 companies. The total market cap has grown over one trillion dollars. There are 3,275 listed companies in the wider life sciences universe today according to GICS. At the treatment level the story is the same. In 1988, there were eight drugs available for breast cancer. Today there are 39. The American Medical Association only officially classified obesity as a chronic disease in 2013. Today, there are 65 drugs for obesity and diabetes and more than 100 in development. In 1998 the market for neurological and CNS drugs was $29bn. Today it is $116bn.

The unexpected result of this growth is that "investing in healthcare" today often means an extremely broad and hard-to-define fund. The drivers of success of any such fund may not always be clear. While generally population growth (particularly in moats magnified by regulatory barriers and IP) lifts all boats, the industry also has its share of winners and losers, and significant return dispersion, particularly in biopharma, but occasionally disruption of legacy business models over a long period of time. Some of the criticisms levied on a general healthcare fund, particularly around winners and losers, can also be levied on passive investing.

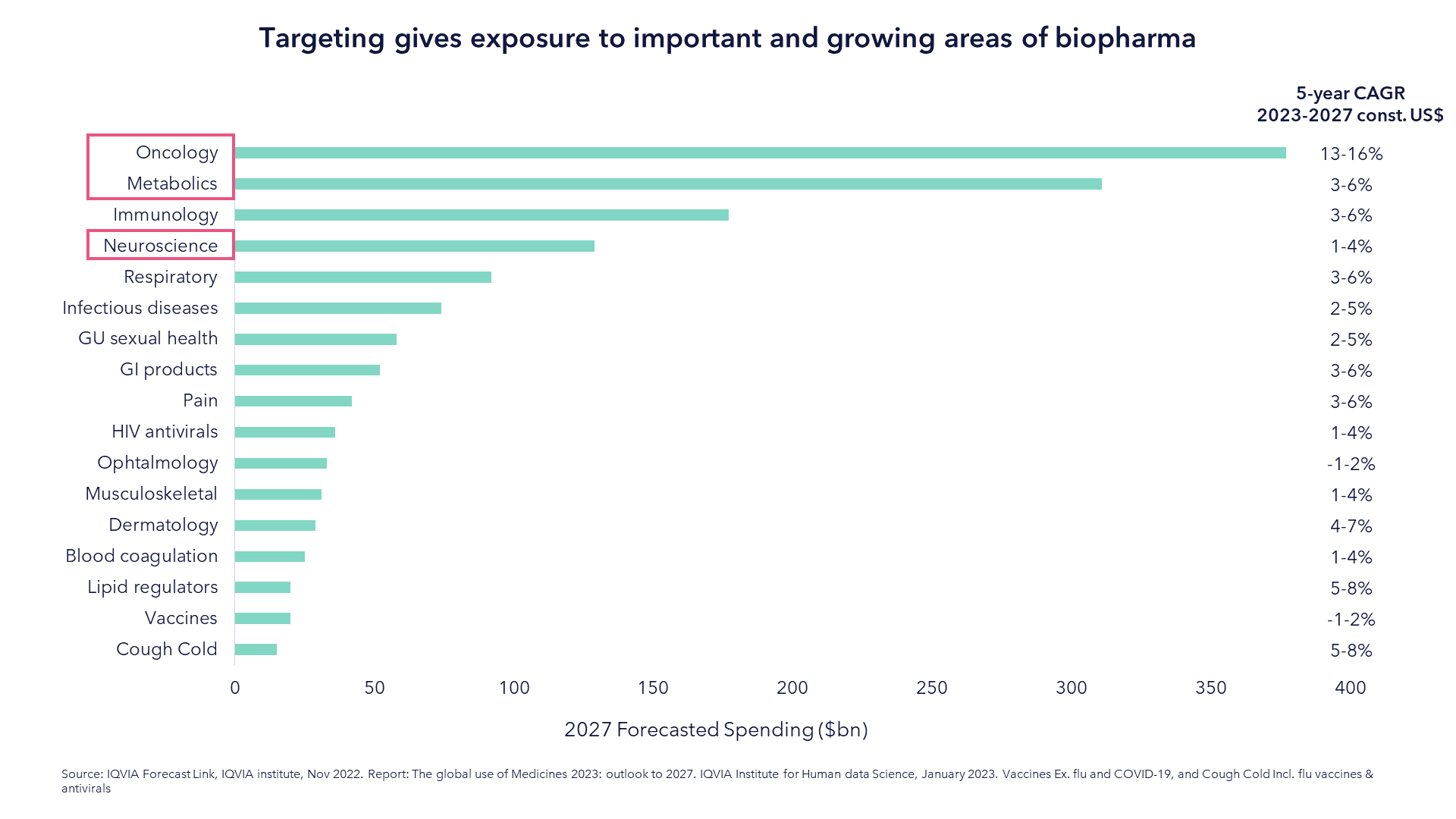

Not only does that advocate for active management, we believe it calls for portfolios designed around the most pressing and pioneering treatments available. Dissecting by disease verticals allows a focus on those areas that are predicted to have the largest spend in the next decade, as shown by the chart below, but also allows a focus beyond biopharma. For example, some of the most innovative companies in the oncology space are within med tech, diagnostics or tools. A narrow biotechnology fund, with its focus only on therapeutics, would miss these potential growth opportunities.

Our three funds, Tema Oncology ETF, Tema Obesity & Cardiometabolic ETF, and Tema Neuroscience and Mental Health ETF, aim to address these areas.

Focusing on these very sizeable but growing markets also aims to give investors what we believe they want from life sciences: a genuine prospect of growth. By segmenting in this way, we aim to overexpose investors to the opportunities and by taking an active approach we aim to underexpose investors to the challenges.

The Case for Active Management in Life Sciences

While we feel the ideal approach should start with a top-down segmentation of the life sciences landscape, in our opinion a bottom-up approach to security selection better answers the challenges referred to earlier in this case study.

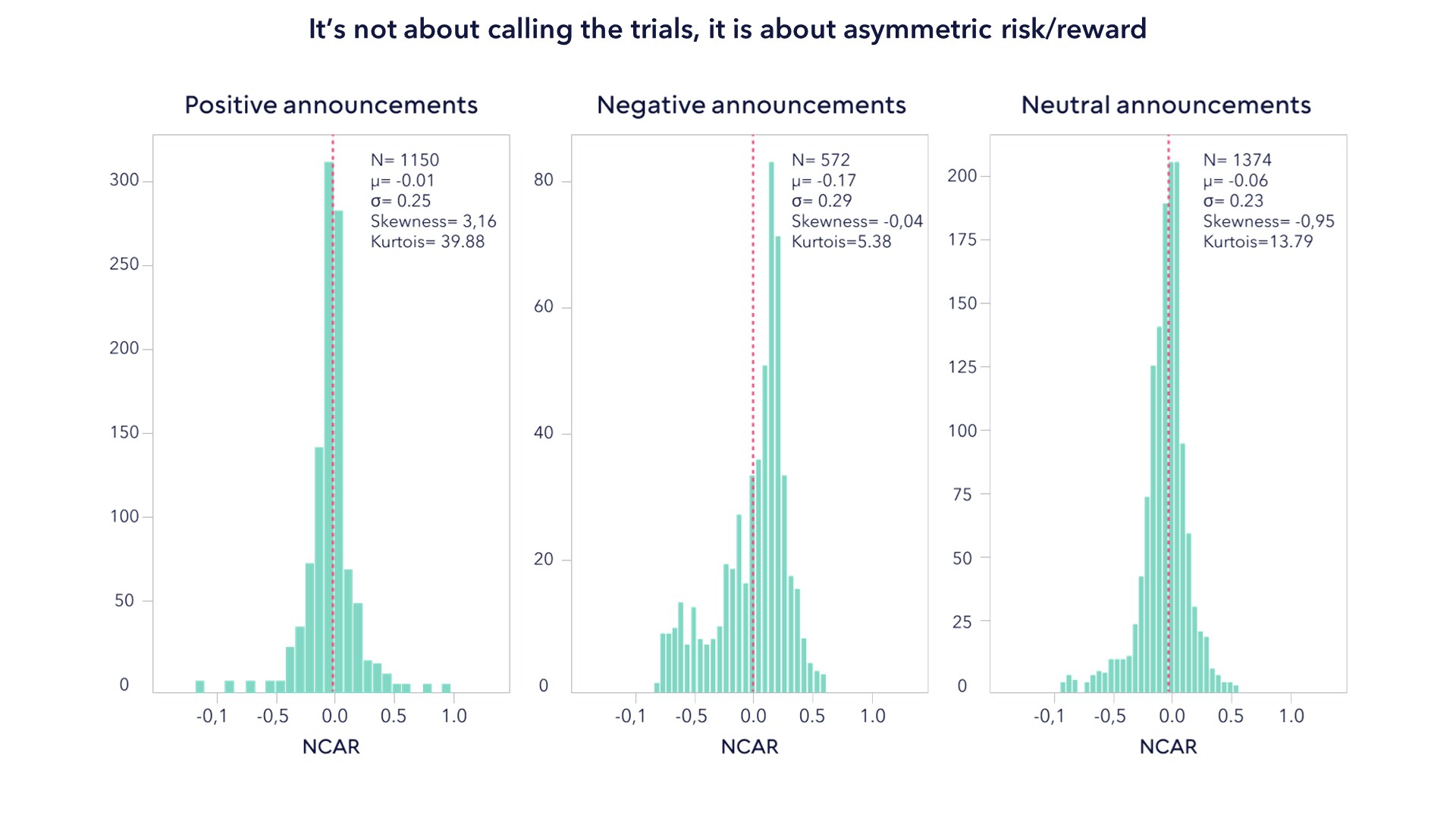

Our case for active begins with the need to understand clinical trials. A recent study published in Nature, which examined the results of over 5,000 clinical trial announcements, found that negative clinical trial results have a greater share price impact than positive ones. The chart below shows the respective price change distributions of positive, negative and neutral clinical trial results announcements. The mean values, depicted by the line in red, show that the responses to positive and negative announcements are inherently different. The greater skew of the negative outcomes shows that negative events lead to a greater and more definitive impact on share price than the positive ones. Moreover, the lack of asymmetry in the negative announcements appear to show that in some cases there are extreme price corrections when a company announces a failed trial. The authors of the Nature paper attribute this to overconfidence assumed in the price of future success, hence, the share price would not change by an equal and opposite amount if the results of a trial are indeed positive. In other words, "buy the rumor, sell the news".

The paper includes the somewhat obvious fact that a company with a larger pipeline of drug candidates is likely to see less of an impact on its share price.

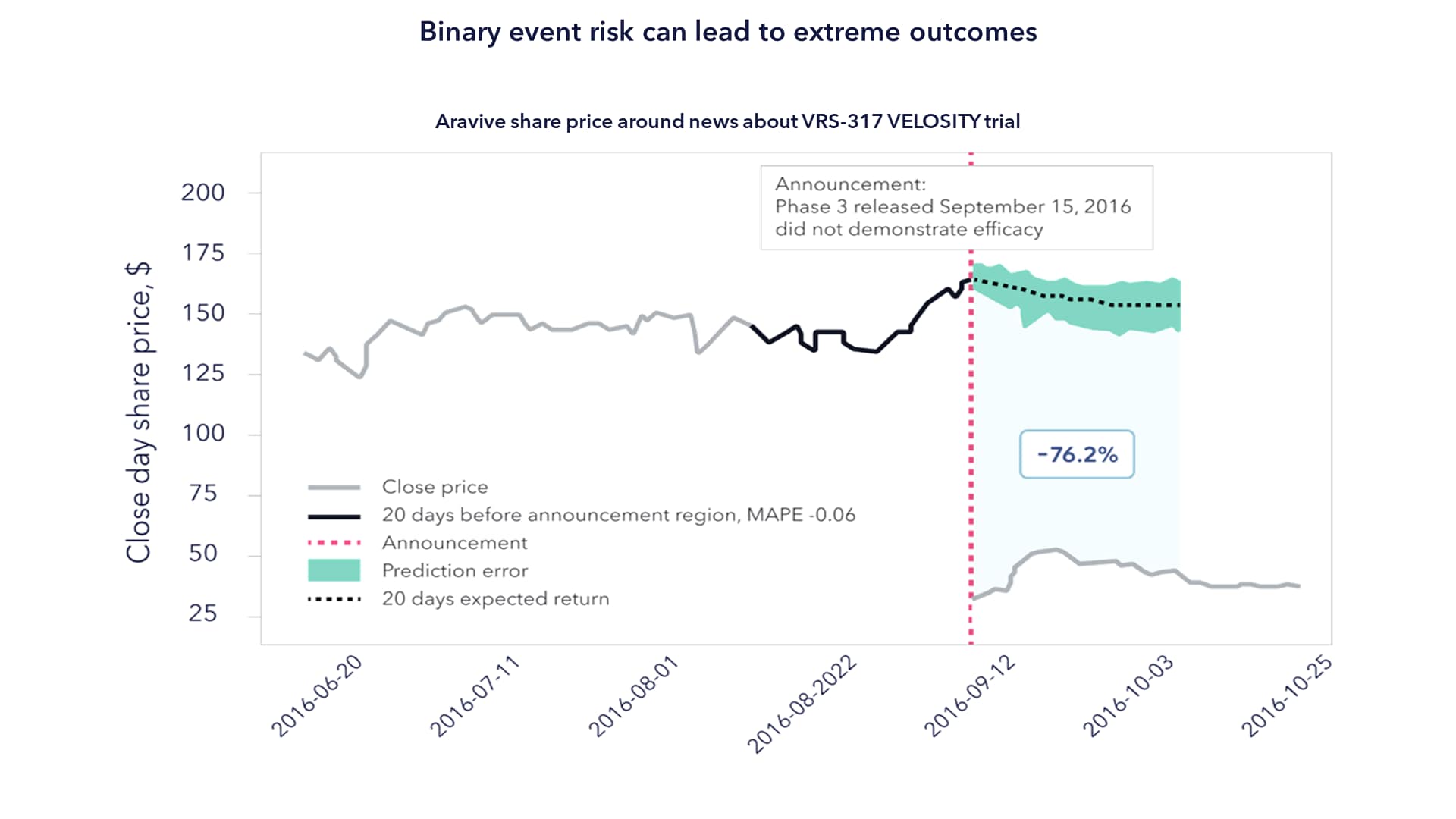

To demonstrate this, the authors include the example of Aravive's Phase Ill VRS-317 VELOSITY trial, shown in the chart below.

Source: Bloomberg. Aravive is not a holding of a Terna fund. for a full list of holdings, please visit each individual fund page at temaetfs.com.

Assuming an indexation approach, an investor would have indeed benefited from a c. 50% share price increase in the weeks leading up to the trial, when the market began to assume a positive outcome. That same investor would have also endured the 76% correction on the negative announcement. Our case is not that we could have predicted the outcome with respect to Aravive, but rather that a rigorous approach to risk-weighting positions ahead of clinical trial announcements is vital. Put another way, successful active management in life sciences is about understanding the confluence of scientific, clinical, regulatory and commercial risks in the context of how the market thinks about these. It is not about calling the outcome of a clinical trial but about knowing what is already priced in beforehand.

Our case for active is further underpinned by two commercial aspects: treatment pricing power and funding risk. Funding risk pertains largely to development-stage companies. The average cost of developing a new drug Is estimated to be between $1.8 billion and $4.2 billion1. Raising that amount of capital can be extremely difficult in certain market conditions, for example in 2023, especially when one considers the median market cap of companies in the Nasdaq Biotechnology Index is only $1.1 billion2. In our view, fundamental balance sheet and cash flow analysis combined with a deep understanding of clinical trials is necessary to mitigate the "funding gap" risk.

Treatment or drug pricing power refers to the strong economic moat established by certain treatments. Drugs that are innovative and unique, targeting high areas of unmet medical need with little competition, are more likely to command higher prices. Drugs with longer patents can command these prices for longer.

Source: Geneva Graduate Institute, Global Health Center, Costs of Pharmaceutical R&D. 'Bloomberg.

On the other hand, drugs with near-term patent expiry that are targeting highly competitive disease areas are unlikely to have much of an economic moat. Drug sales fall significantly when a patent expires because the company has to reduce the price to compete with generic versions. The solution to this problem is to continually assess a company's current and future treatments against the broader market in an effort to select only those companies with the requisite pricing power.

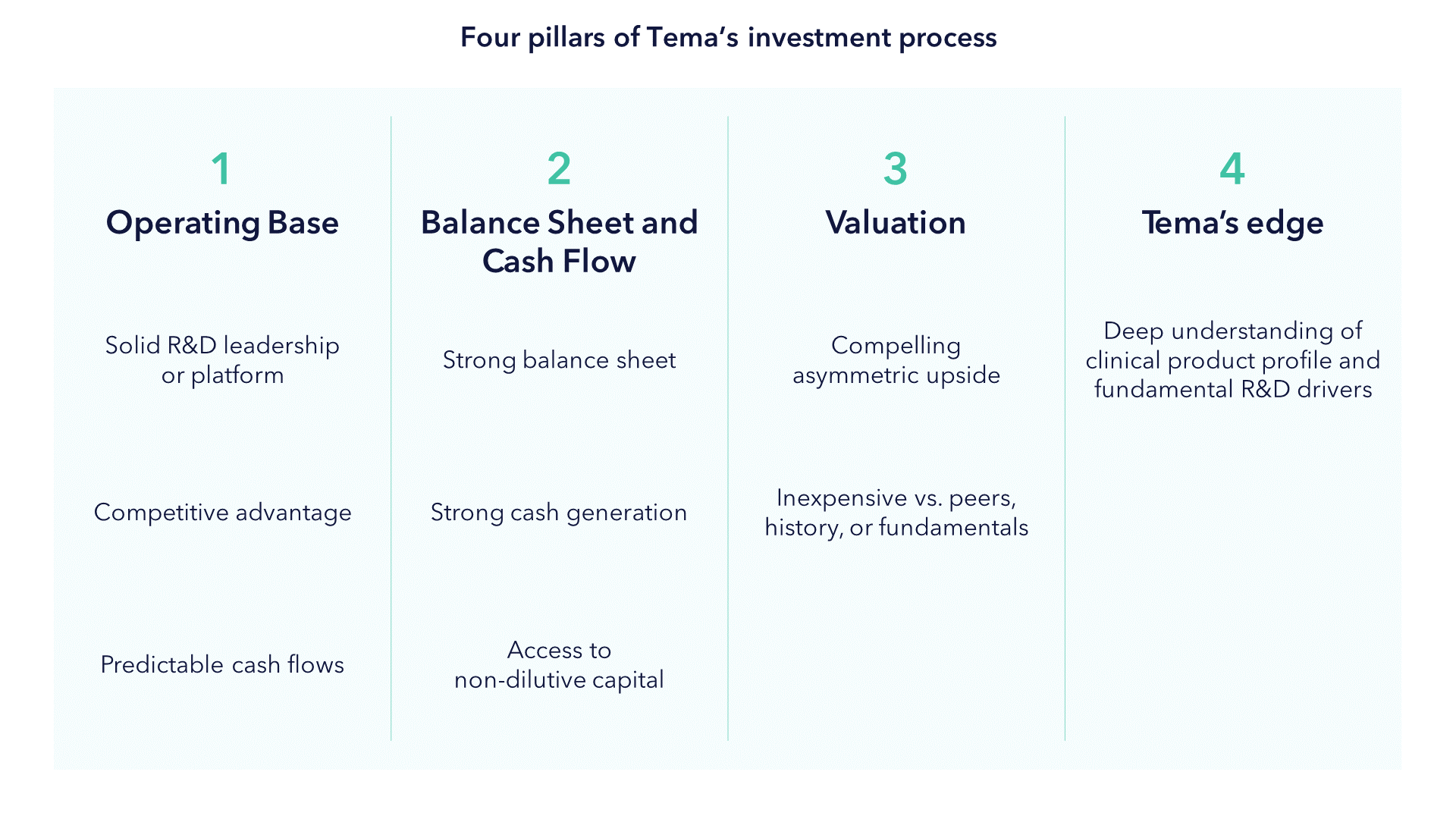

As such, Tema's investment process for this sector can be described as investing in stocks that meet four pillars:

Portfolio companies must have a solid operating base, which means compelling innovation that has the potential to produce differentiated clinical data in an unmet medical need. We don't buy "me too" product companies and we also tend to back scientific and management teams that have pedigree. In the case of pre-revenue companies, we seek to establish a clear line of site for the funding of all projected R&D expenditures. For product companies, our model must show strong cash flows to back investment. In the case of pre-revenue companies, we assess asymmetric risk-reward opportunities around timely catalysts where we can form a differentiated view. To gain an edge, these catalysts must be within our area of competence or that of our network of key opinion leaders.

We then build a careful analysis of upside potential involving commercial outcomes should the trial read out positive. We also build a downside case to distinguish between temporary and permanent loss of capital. Underpinning this is a review of medical data and literature, scientific conferences, financial analysis and speaking to our key opinion leader network. We don't participate in binary risk for the sake of doing so. The ratio of upside to downside creates a risk-reward, and we only invest where we believe this is asymmetric. This asymmetry also dictates how we size our positions.

Building a balanced portfolio is also an important risk management tool. We aim to strike a balance between technologies, stage of company and type of company (for example, therapeutics vs. healthcare services firms). We believe this approach only works if it is complimented by the right mix of experience. A solid understanding of the science, as well as its clinical application, needs to be backed up by a demonstrable history of fundamental equity analysis over the many highs and lows of the last 30 years. In our view, those skills are a necessity for active management to succeed in life sciences, but they must also be complimented with a wide network of key opinion leaders, scientific conferences, and third-party data.

Conclusion

To conclude, we believe that focusing on investing in the therapeutic areas that are the most prevalent, pressing and pioneering increases the chances of success in this complex sector. In our opinion, the unique mix of opportunities and challenges in the sector warrants risk-reward based process combined with the experience to manage of a wide range of risks.

Despite these inherent risks, we think the outlook for 2024 is positive. While the fundamentals of the life sciences industry remain strong, valuations are still cyclically depressed. The gap between tech and biotech is continuing to widen. Those depressed valuations are beginning to give rise to an increase in sector M&A, noticeably in oncology. There were 15 >$1bn M&A transactions between November 2023 and January 21st, 2024 in the biopharma space. Several other inorganic and organic catalysts may be on the horizon.

The year also kicked off with a very positive JP Morgan Healthcare Conference where the general mood seemed to indicate an acceleration in breakthrough innovation. The consensus is that the future is bright and we believe we are providing innovative ways to access that future that is adapted to how the biopharma space has evolved .

Disclosure

Carefully consider the Fund's investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund's prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com.Read the prospectus carefully before investing.

Important Risks

Diversification does not ensure profits or prevent losses.

Investing involves risk including possible loss of principal. There is no guarantee the adviser's investment strategy will be successful.

Sector Focus Risk: The Fund may invest a significant portion of its assets in one or more sectors, including Engineering and construction, Financial Sector, FinTech, Industrials and Infrastructure, and thus will be more susceptible to the risks affecting those sectors than funds that have more diversified holdings across several sectors.

SpecificFundRisks:

CANC: Oncology companies are highly dependent on the development, procurement and marketing of drugs and the protection and exploitation of intellectual property rights. A company's valuation can also be greatly affected if one of its products is proven or alleged to be unsafe, ineffective or unprofitable. The stock prices of oncology companies have been and will likely continue to be very volatile. The costs associated with developing new drugs can be significant, and the results are unpredictable. Newly developed drugs may be susceptible to product obsolescence due to intense competition from new products and less costly generic products. Moreover, the process for obtaining regulatory approval by the U.S. Food and Drug Administration or other governmental regulatory authorities is long and costly and there can be no assurance that the necessary approvals will be obtained or maintained.

HRTS: Obesity and Cardiology companies are highly dependent on the development, procurement and marketing of drugs and the protection and exploitation of intellectual property rights. A company's valuation can also be greatly affected if one of its products is proven or alleged to be unsafe, ineffective or unprofitable. The stock prices of oncology companies have been and will likely continue to be very volatile. The costs associated with developing new drugs can be significant, and the results are unpredictable. Newly developed drugs may be susceptible to product obsolescence due to intense competition from new products and less costly generic products.

Moreover, the process for obtaining regulatory approval by the U.S. Food and Drug Administration or other governmental regulatory authorities is long and costly and there can be no assurance that the necessary approvals will be obtained or maintained. Companies in the medical equipment industry group may be affected by the expiration of patents, litigation based on product liability, industry competition, product obsolescence and regulatory approvals, among other factors.

MNTL: Neuroscience companies are often subject to the potential or actual performance of a limited number of products or technologies and may be greatly affected if any of their products or technologies proves to be, among other things, unsafe, ineffective or unprofitable. Neuroscience companies may not be able to capitalize on such products or technologies. Neuroscience companies may face political, legal or regulatory challenges or constraints from competitors, industry groups or local and national governments. They are also subject to product liability claims, patent expirations and intense competition, which may affect the value of their equity securities. Neuroscience companies may be thinly capitalized, and their equity securities may be more volatile than companies with greater capitalizations. Neuroscience companies are also susceptible to the market and business risks of related industries, such as the biotechnology, pharmaceutical and health care equipment industries.

Investing in foreign and emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments. In addition the fund is exposed to currency risk.

Terna Global Limited serves as the investment adviser to Tema Oncology ETF, Tema Neuroscience and Mental Health ETF, and Tema Obesity & Cardiometabolic ETF (the "Funds"), and NEOS Investments, LLC serves as a sub adviser to the Funds. The Funds are distributed by Foreside Fund Services LLC, which is not affiliated with Terna Global Limited nor NEOS Investments, LLC. Check the background of Foreside on FINRA's BrokerCheck.

For inquiries: info@temaetfs.com

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy