As the second quarter comes to a close, the numbers are in and we’ve thoroughly analysed them. Through OPTO’s proprietary data and thematic research, we break down the fund’s holdings and examine the key performance drivers, thematic trends and investment outlook underlying the ARK Innovation ETF’s Q2 results. Read further for the full exclusive report.

- Although the ARK Innovation ETF (ARKK) has the highest exposure to the biotechnology theme, none of its top ten holdings are in this sector.

- Half of the ARKK’s top 10 holdings performed impressively, with share prices up between 30% to 40%.

- Amid increasing inflation, deflation is imminent and will benefit innovation, Cathie Wood said in July on her In The Know podcast.

Disruptive Innovation

ARK Invest defines "disruptive innovation" as the launch of a technologically enabled good or service that has the potential to alter how the world functions. Innovations centred on AI, robotics, autonomous technology, energy storage, DNA sequencing, blockchain technology and next-generation internet services, according to ARK, will deliver outsized growth as they redefine industries and change how the world operates. ARK’s principal fund, the ARK Innovation ETF [ARKK], aims to offer long-term equity growth and broad exposure to disruptive innovation, which it identifies in these cornerstone technologies. Established in 2014, the fund is actively managed by CEO and CIO Catherine (Cathie) Wood, and typically maintains a diversified portfolio of 30 to 55 holdings at a given time, spanning different sectors, geographical regions, and market capitalisations.

Methodology

OPTO’s thematic universe consists of 46 themes ranging from AI to Blockchain. We have identified the ETFs that provide pure-play exposure to each theme and aggregated the performance of each group of funds to create a performance benchmark. Throughout this report, we use this unique thematic taxonomy to analyse the ARKK portfolio, and leverage our proprietary benchmark data to compare the performance of relevant themes. Track the performance of these themes over various timeframes in the OPTO app.

At a glance: ARKK’s Q2 performance

The ARKK fund was up 9.42% over the quarter, growing at a slower pace than the 32.44% share price increase in Q1.

The chart below showcases the performance of the ARKK ETF in comparison to the S&P 500 equity index. The SPDR S&P 500 ETF [SPY], which tracks the performance of the S&P 500 index, can serve as a benchmark to evaluate stock market activity.

As of 13 July 2023, ARKK has yielded a return of 51.98% year-to-date, significantly outperforming SPY's return of 17.51%. However, according to Portfolios Lab, over the past decade, ARKK has underperformed SPY, with an annualised return of 11.49%, in contrast to SPY's 12.35%. ARKK had a notably higher volatility, at 9.61%, compared to SPY’s 2.89%, however.

Diving in: ARKK’s Q2 highlights

| Ranking | Holding | Share price | Weighting | Theme |

|---|---|---|---|---|

| 1 | Tesla | + 34.4% | 11.63% | Electric vehicles (EV) |

| 2 | Coinbase | + 12.5% | 7.17% | Blockchain |

| 3 | Roku | - 0.5% | 7.15% | Digital transformation |

| 4 | Zoom | - 6.8% | 7.07% | SaaS |

| 5 | Block | - 1.9% | 5.94% | Blockchain |

| 6 | UiPath | - 4.7% | 5.88% | Artificial intelligence (AI) |

| 7 | Exact Sciences | + 40.7% | 4.77% | Genomics |

| 8 | Unity Software | + 35% | 4.57% | Gaming |

| 9 | Shopify | + 37.2% | 4.42% | Ecommerce |

| 10 | DraftKings | + 40% | 4.03% | eSports |

The table above highlights the Q2 share price performance of ARKK’s top ten holdings, including their weightings in the fund and their corresponding themes as classified by OPTO. Five of the top holdings performed notably well over the quarter, with share price increases in the 30% to 40% range.

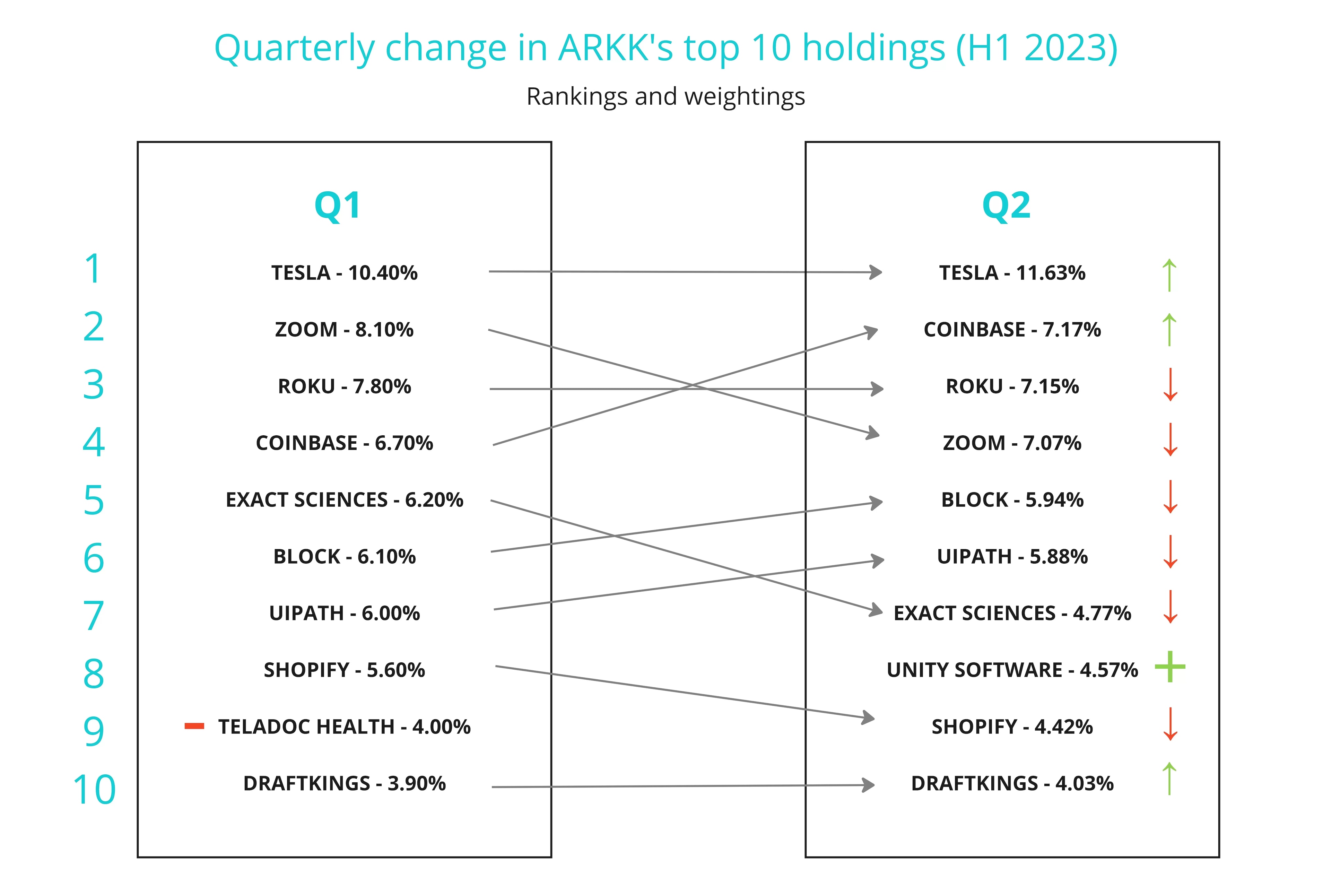

In contrast, the four stocks that experienced declines saw minor changes in their share prices, with Zoom [ZM] witnessing the largest decrease. Zoom's ranking within the fund dropped from second in Q1 to fourth in Q2, as demonstrated in the chart below, which outlines the quarterly changes in the fund's top ten holdings.

During this period, ARKK increased its weightings of Tesla [TSLA], Coinbase [COIN], and DraftKings [DKNG], while reducing the weightings of the rest of its top ten holdings.

Coinbase, Block [SQ], and UiPath [PATH] climbed the top ten rankings, while Zoom, Exact Sciences [EXAS], and Shopify [SHOP] slid. Tesla, Roku [ROKU], and DraftKings maintained their positions.

Teladoc Health [TDOC] dropped from ARKK’s top ten altogether in Q2, with Unity Software [U] replacing it.

Cathie Wood’s strategy

Wood is known for her portfolio management strategy of increasing ARKK’s top holdings, like Tesla, when share prices are low according to her valuation. Once Cathie has identified her top picks from ARK's investment universe - characterised by its exposure to 'disruptive innovation' as previously mentioned -, she aims to 'buy the dip', adding to those high-conviction bets whenever she deems the valuation to be at an attractive level.

In early June, she bought $21.6 million worth of Coinbase shares spread across ARKK and two other ARK funds, after the US Securities Exchange Commission sued the only publicly traded crypto exchange and sent its share price tumbling.

Stock drivers

Unity Software’s share price was up 15% on 27 June on its plans to release two new AI-based products, Sentis and Muse, this year, and is launching an AI marketplace in the Unity Asset Store that will provide third-party AI-focused solutions, ARK’s stock commentary noted on 30 June.

Tesla's stock surge could be largely attributed to its North American Charging Standard (NACS) charging port becoming an unofficial industry standard, with several carmakers, including Ford [F], General Motors [GM], Rivian [RIVN], Volvo [VOLV], and Polestar Automotive [PSNY], joining Tesla's Supercharger Network. Tesla also concluded Q2 with a strong performance, exceeding Wall Street’s estimates with vehicle deliveries up 83% year over year.

Exact Sciences' shares have been on an upward trajectory since the company reported a robust Q1 performance that exceeded expectations, with a 24% revenue increase and an upward revision of its 2023 guidance. This resulted in numerous price target upgrades from analysts, feeding a positive investor sentiment.

Similarly, Shopify benefited from a positive momentum following a 25% revenue increase in its Q1 earnings report.

DraftKing continues to grow on the back of a rising market for technology and growth stocks. Alongside other growth stocks, the online sports betting platform benefitted from the Federal Reserve’s decision on 14 June against raising interest rates, which lifted investor sentiment.

Holdings & themes

OPTO has reclassified ARK’s holdings based on themes from our unique taxonomy.

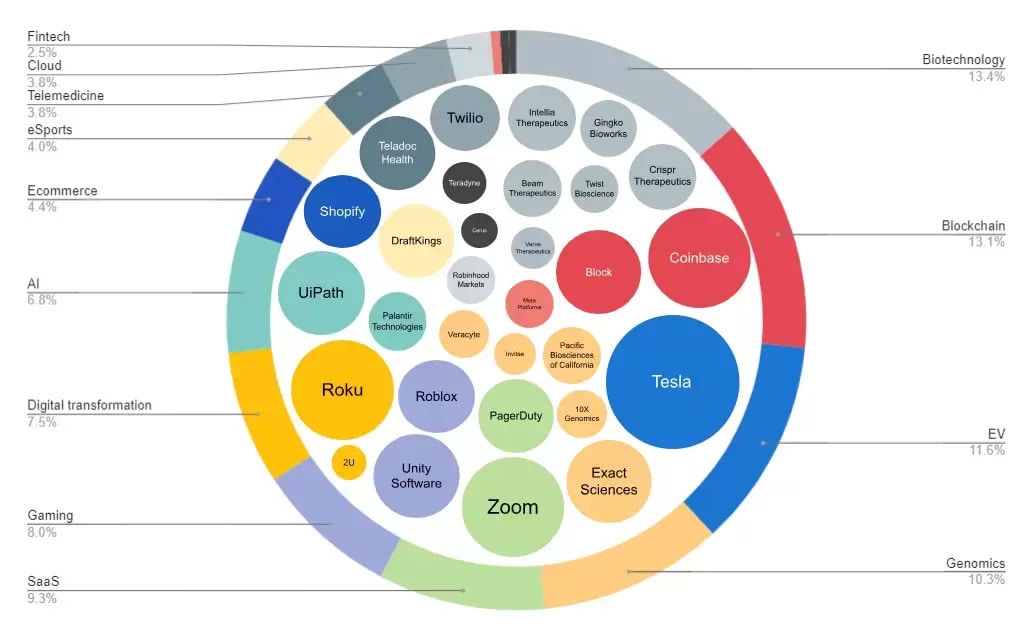

The infographic below displays ARKK's 30 holdings as of the end of Q2 and their corresponding themes, according to OPTO’s classification. The size of each holding is roughly proportional to its weight within the fund.

Fund thematic breakdown

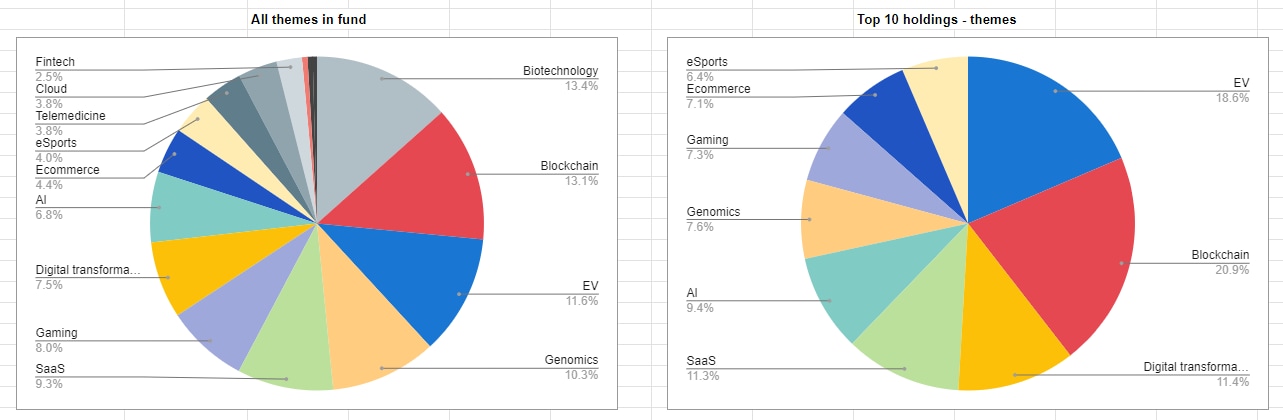

The subsequent charts break down the thematic composition of the entire fund and that of the top ten holdings, based on OPTO’s classification.

The chart attests that ARKK maintains a diversified set of top ten holdings, spanning nine distinct themes.

An interesting observation is that while biotechnology is the fund's largest theme, it is not represented in any of the top ten holdings. This is because up to six stocks outside of ARKK’s top ten operate in the biotechnology space. This finding emerged during our thematic research as OPTO differentiates between genomics and biotechnology, whereas ARK - at least for the purposes of portfolio analysis - does not. Genomics forms 7.6% of the ETF’s top ten thematic exposure.

OPTO benchmarks: How ARKK’s themes performed in Q2

The table below presents the Q2 performance of the themes that ARKK has exposure to, based on OPTO’s proprietary thematic research, available exclusively in the OPTO app. This data aggregates the performance of other ETFs operating within the same sectors to form a benchmark measure of a theme’s performance.

| Themes ranked | Weighting within fund | Q2 theme performance |

|---|---|---|

| Biotechnology | 13.40% | - 0.85% |

| Blockchain | 13.11% | + 23.60% |

| EV | 11.63% | + 13.90% |

| Genomics | 10.28% | + 4.44% |

| SaaS | 9.30% | + 9.02% |

| Gaming | 7.97% | - 1.91% |

| Digital transformation | 7.45% | + 7.61% |

| AI | 6.82% | + 9.40% |

| Ecommerce | 4.42% | + 1.78% |

| eSports | 4.03% | + 0.68% |

| Telemedicine | 3.82% | - 3.92% |

| Cloud computing | 3.80% | + 11.60% |

| Fintech | 2.47% | + 9.01% |

| Social media | 0.53% | - 4.51% |

| Semiconductors | 0.50% | + 11.60% |

| Medical devices | 0.41% | + 0.13% |

The majority of the themes ARKK is exposed to have performed well over the quarter.

The blockchain theme surged 23.6%, outperforming all others, followed by EVs, which increased by 13.9%. Cloud computing and fintech both grew by 11.6%.

However, biotechnology, the fund's largest thematic exposure, declined by 0.85%, and social media experienced the largest fall, at 4.51%.

Analysis

ARKK’s stock valuation models

| Year | Stock | Current value | Expected value | Bear case | Bull case | Projected growth (current-actual) |

|---|---|---|---|---|---|---|

| 2027 | Tesla | $262 | $2,000 | $1,400 | $2,500 | 86.90% |

| 2026 | Zoom | $68 | $1,500 | $700 | $2,000 | 95.47% |

| 2026 | Roku | $64 | $605 | $100 | $1,493 | 90.17% |

| 50% probability | 25% probability | 25% probability |

ARK has developed price valuation models for each of its top three holdings, using the Monte Carlo analysis framework. The table above collates their share price valuation estimates for these stocks in 2026 and 2027, positioning them beside the current share prices for perspective (share prices as of 30 June 2023). According to this model, the expected value holds a 50% probability, while bear and bull cases each carry a 25% probability.

One of the world’s most innovative car manufacturers, Tesla, has been investing heavily in AI and machine learning technology. Behind ARK’s strong outlook for Tesla were the asset manager’s projections for the EV-maker’s robotaxi, or driverless ride hailing, segment, forecasting revenue of $200bn in 2027 in a bear case and $613bn in a bullish scenario. This unit currently generates no revenue.

Tesla's AI capabilities are integrated into its self-driving features: Autopilot and Full Self-Driving (FSD) technology. Though these are still under development, they are being designed for fully autonomous driving, without the need for human intervention. Additionally, on 21 June, Tesla released a forecast for its compute capacity, which ARK claims could position it among the world's largest AI training companies.

ARK has likely built all of these positive technological developments into their bullish valuation, which represents a nearly 87% increase in share price over almost four years. Wood expects the EV maker to surge to a $6 trillion market capitalisation by 2027, but other investors like Warren Buffett are more bearish on the stock, as discussed in OPTO’s recent piece on Tesla’s valuation.

Macro factors at play

Amid an environment of increasing inflation, no one is talking about deflation, but ARK is confident it is bound to happen. “Innovation is deflationary,” Cathie Wood said on the July episode of her In The Know podcast. AI training costs are decreasing by 70% annually, which will permeate other costs and spur unit growth.

The transition towards electric is occurring at a much faster pace than the auto industry initially anticipated, and ARK asserts that AI will further “turbocharge the speed at which these shifts take place”.

Wood believes AI will induce a lot of commoditisation, helping companies improve productivity and reduce their unit costs. However, the companies that will stand to benefit the most are those that possess exclusive proprietary data.

In a turbulent macro environment and with the margin pressures that corporations are facing, the use of AI and innovation is poised to grow.

Nvidia: A missed opportunity?

The ARKK fund manager predicts software companies will be the next to benefit from the AI boom sparked by Nvidia [NVDA]. “We are looking to the software providers who are actually right now where Nvidia was when we first bought it,” Wood told Bloomberg TV in May, adding that Tesla stands as the “biggest artificial intelligence play”.

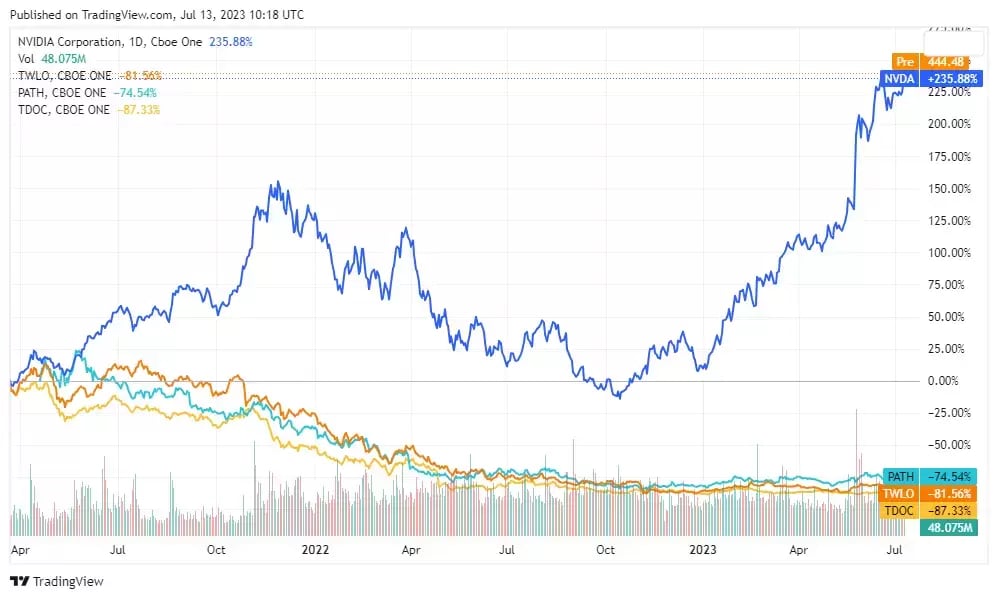

Instead of hardware, Wood is setting her sights on software stocks that she anticipates will grow to Nvidia’s size, with some of her biggest bets including UiPath, Twilio [TWLO], and Teladoc Health. “For every dollar of hardware that Nvidia sells, software providers, SaaS providers will generate $8 in revenue,” she stated.

However, each of the three chosen stocks have significantly tumbled from their peaks, as shown in the chart below. UiPath escalated to over $79 per share post-IPO in 2021 but has since plummeted by approximately 77%. Similarly, Twilio nosedived by 84% from its 2021 high, whereas Teladoc Health has receded by over 91% from its peak in the same year, as of 13 July 2023.

Although she acknowledges that Nvidia holds potential for long-term growth, Wood claimed that ARK is already “onto the next thing”. Her flagship fund sold its Nvidia holding in January, and subsequently missed the chipmaker’s incredible valuation surge over AI developments that tipped its market valuation above $1 trillion. Nonetheless, Wood stands by her decision to scale back on Nvidia, attributing it to the cyclic nature of the semiconductor industry and opinion that Nvidia’s stock is “priced ahead of the curve,” as she conveyed in a recent tweet.

Looking ahead

Where next for ARKK?

ARKK had its golden period between 2020 and early 2022, massively outperforming the S&P 500 during the pandemic years. However, currently significantly underperforming the benchmark index (as visualised in the chart), it has yet to recover to previous highs. Most of its holdings - disruptive innovators - were unable to climb back to their COVID peaks, including pandemic darlings like Zoom, which crashed 88%. Growing competition and a lack of moat are potentially two of the main factors that have contributed to this declining growth, analysts say.

Despite this, the fund is still bullish on its big bets, maintaining Zoom as one of its top three holdings, having published a punchy three-year valuation model for the stock (further discussed below). Recent momentum in AI has ushered in a new wave of possibilities, creating opportunities for these fallen stocks to potentially regain their competitive advantage and potentially restore some of the fund’s returns.

ARK’s Big Ideas - converging themes

In their Big Ideas 2023 report, ARK identifies some fascinating theme overlaps set to disrupt the world as we know it. These could be an indicator of the themes in which the ARKK fund may focus future investment.

AI, ROBOTICS & EV

AI Chatbots Enabling Robotaxis

The acceleration in AI innovation bolsters confidence in the commercial viability of robotaxis and other autonomous mobility systems. Neural networks, which are now surpassing human capabilities in various domains, are expected to do the same in autonomous transportation. Enhanced neural network performance is anticipated to facilitate the development of scalable robotaxi systems that surpass human-driven vehicles in safety.

LITHIUM, METAVERSE & AR

Battery Developments Essential for Augmented Reality

Advancements in battery technology, specifically in capacity and energy density, are crucial for the progression of intelligent devices such as smart glasses. For instance, to conserve battery life, the initial four generations of Apple’s [AAPL] smartwatches turned off their displays unless users lifted their wrists. Similar to smartwatches, smart glasses face power constraints which can be mitigated through advancements in battery technology, thereby enhancing their utility.

SPACE

Satellite Connectivity Boosted by Reusable Rockets

Companies like Iridium [IRDM] and Starlink have revolutionised global connectivity through satellite networks, benefiting from the cost reductions enabled by reusable rockets. Over 19 years, satellite bandwidth costs have dropped significantly, by 7,500 times, which facilitated a record number of communication satellite launches in 2022. Intelligent devices depend on connectivity, and affordable connectivity is crucial for widespread accessibility.

SOLAR & BLOCKCHAIN

Cryptocurrency Mining Augments Solar-Battery Installations

Bitcoin mining machines, being modular, movable, and adaptable, make an excellent pairing with intermittent energy sources such as solar and wind power. By integrating bitcoin mining into solar storage systems, the scalability and reliability of grids can be improved without increasing the levelized cost of electricity. Bitcoin miners can utilise excess energy. ARK’s research indicates that by enlarging a solar network’s battery size by 4.6 times and incorporating a bitcoin miner, the system can meet over 99% of end-user demand while maintaining profitability.

3D PRINTING, ROBOTICS, SEMICONDUCTORS, AV, HEALTHCARE, SPACE

3D Printing's Potential in Diverse Markets

ARK estimates the market opportunity for 3D printing to be $500 billion when applied to existing products. 3D printing is also poised to catalyse the creation of new products and markets. For example, Boston Dynamics’ Atlas humanoid robot achieved a remarkable strength-to-weight ratio, allowing it to perform leaps and somersaults, a feat made possible through 3D printing. This technology holds potential across various sectors, including containers and packaging, semiconductors and equipment, footwear, plastic products, foundries, consumer electrical components and equipment, automobiles, healthcare, machinery, and aerospace and defence.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy