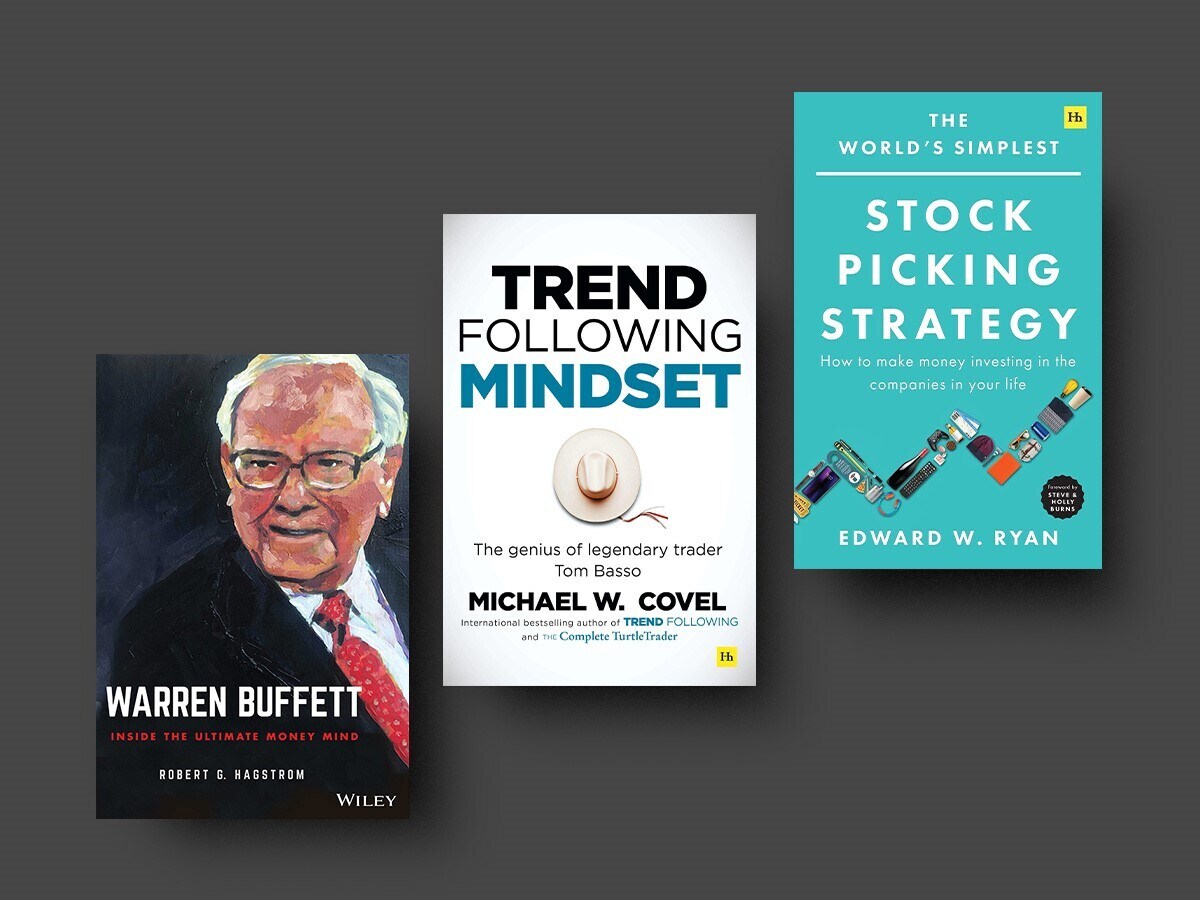

Warren Buffett: Inside the Ultimate Money Mind

By Robert G. Hagstrom

This book gives an insight into the investment mindset of the Sage of Omaha from the age of 11 when he picked up a book by F.C. Minaker called One Thousand Ways to Make $1000.

After devouring many other investment tomes, Buffett used this newly minted knowledge —alongside the rationalism and pragmatism inherited from his father — to develop his so-called ‘money mind’.

Hagstrom aims to show how others might incorporate those building blocks into their own mental framework. “We will show how such a person can best manage their portfolio in this new, fast-paced, media-frenzied world. Those investors who work towards achieving a money mind will stand a much better chance of being successful,” he writes.

The book explains the philosophies of self-reliance, rationalism, pragmatism and facing down irrelevant noise. It also outlines the evolution of value investing, discusses how to develop a business-driven investing mindset and describes the defining traits of successful active management.

Trend Following Mindset: The Genius of Legendary Trader Tom Basso

By Michael Covel

This book is based on the many conversations between Basso and Covel on the latter’s ‘Trend Following’ podcast. In them, Basso describes his philosophies around trading, business, life and the hows and whys of his trend-following mindset.

We get Basso’s perspectives on how to get started in trading, what trend following is, how and why it works so well, constructing your own trading system, position-sizing and account management. It also looks at the work-life balance of a trader, the transition from independent trader to professional money manager, and includes Basso’s trend-following research papers.

The book contains fascinating insights into Basso’s career and his early years, including the story of when a mutual fund salesman turned up at his father’s house when he was 12 years old. “I listened in to their conversation, got interested in what I heard and then started buying mutual funds,” Basso recalled. “By the time I got to college I had got back to break-even because of the fund manager’s fees. It was then that I realised that the markets went up and down.”

The World’s Simplest Stock Picking Strategy: How to Make Money Investing in the Companies in Your Life

By Edward W. Ryan

Wall Street equity adviser Ryan believes following a “simple and fun process” of investing in companies you interact with and admire can be profitable.

“The process is centred around your competitive advantage as an investor, which is your intimate knowledge of the products and services that are part of your life. The best performing stocks are almost always those that we encounter as a customer early in a company’s lifecycle,” he writes. “No matter your age, education or background you are just as capable of executing this investment strategy as anyone else.”

The book has built-in steps to help investors construct a balanced portfolio, invest during market pullbacks when other investors are fearful, avoid overtrading and deal with the sticky problem of when to sell an investment.

Two for 22

Here are two more investment-oriented books penned for release next year to look out for:

The Bond King: How One Man Made a Market, Built an Empire, and Lost it All

By Mary Childs

Childs tells the story of Bill Gross, the co-founder of investment management firm Pimco, who “turned the sleepy bond market into a destabilised game of high risk, high reward”.

The Cryptopians: Idealism, Greed, Lies and the Making of the First Big Cryptocurrency Craze

By Laura Shin

One for any crypto fans in your family. Shin takes a look at the creation of Ethereum, which enables the user to launch their own new crypto coins and has “created a new crypto fever”. She argues that cryptocurrency was growing increasingly marginal until this “brilliant new idea” changed its fortunes once again.

Characters featured in the book include Ethereum co-founder Vitalik Buterin and initial CEO Charles Hoskinson, who left the project after five months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy