Out of necessity, Peter Beck, Founder and CEO of Rocket Lab, built his company as a smaller, scrappier underdog. However, he believes that these humble beginnings now give the company an advantage compared to larger competitors, particularly Elon Musk’s SpaceX.

Stratospheric Valuations

Since the early days of Rocket Lab [RKLB], Founder and CEO Peter Beck was used to coming up against larger, better-funded competitors.

“We were tracking, at one point, 140 start-ups in small launch,” Beck tells OPTO Sessions. “We were not picked to be the favourite. I think Virgin Orbit had over $1.2bn poured into it; that’s $1.1bn more than we spent getting our first rocket into orbit.”

Virgin Orbit ceased operations in May 2023, following a major mission failure, and sold its assets for less than 1% of the $3.5bn valuation it reached in 2021, according to the Guardian. Rocket Lab, however, is still going strong.

The valuations of their competitors perplexed Beck and his team at the time but fostered an intense focus on delivery, which he feels has given Rocket Lab an edge.

“Sometimes having too many resources makes you lazy,” he says. “We can’t outspend our competitors. We have to outthink them or outwork them.”

The Muskito

Of all Rocket Lab’s competitors, none is larger than SpaceX, the company that Elon Musk founded with the ambitious long-term goal of colonising Mars.

Like Rocket Lab, SpaceX has earned its position. Musk self-funded its first four launches, after which SpaceX secured its first commercial contract with NASA. Beck himself, speaking to the Washington Post, credited SpaceX with Rocket Lab’s very existence and for proving the commercial viability of the space industry.

That doesn’t mean that Rocket Lab has no designs on SpaceX’s business. In his interview with the paper last Monday, Beck compared Rocket Lab to a mosquito, stating that his aim “is to outsmart them and outwork them… The crazy thing about a mosquito is that it’s kind of annoying, but there’s a nonzero chance that you might get bit, get malaria and die.”

Beck strikes a similar note on OPTO Sessions. He agrees with Musk, saying that scaling any product is “100 times harder than building the first one”.

“A number of people bring a rocket to orbit once, twice, or a few times. But that’s not actually very impressive.

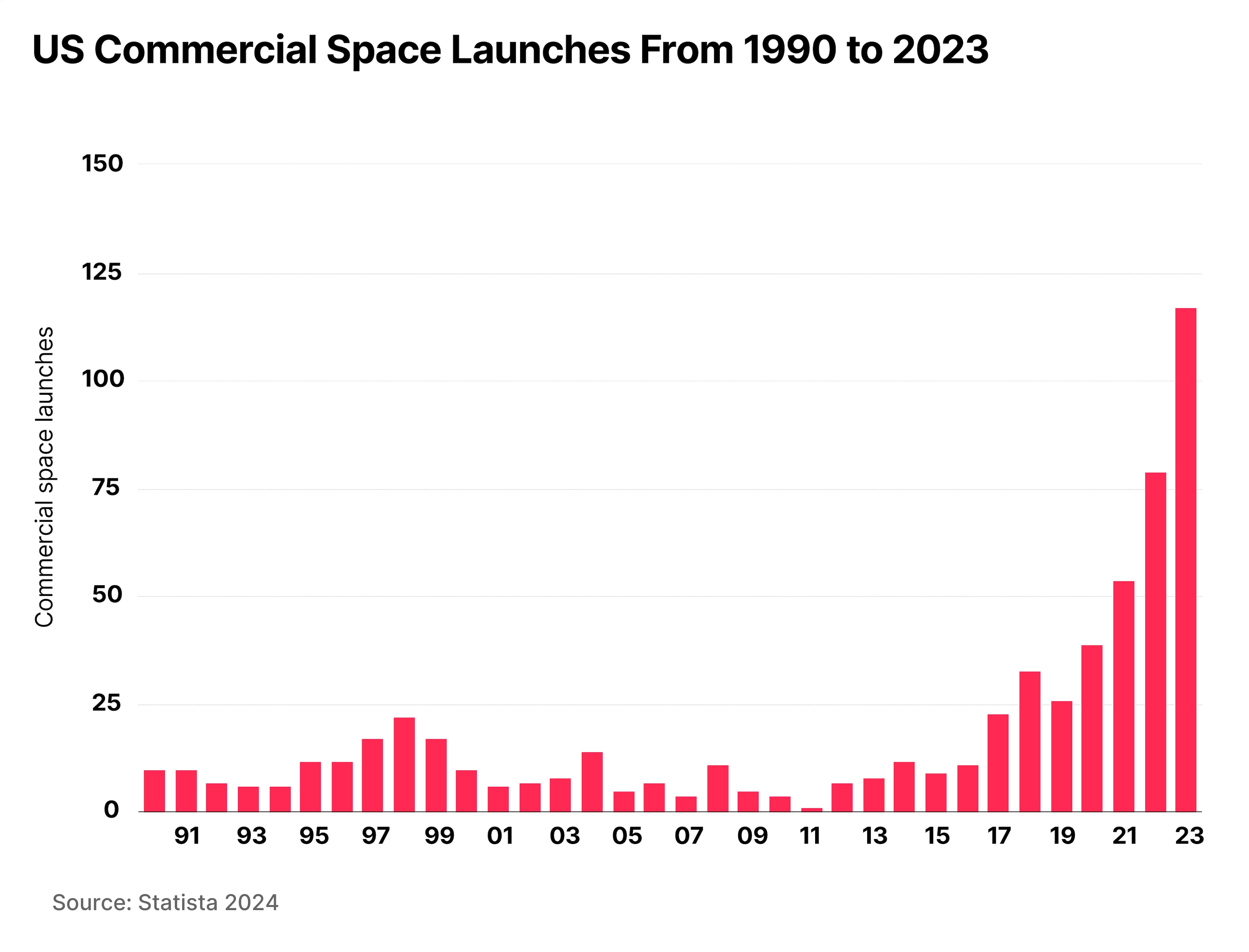

“Apart from SpaceX, nobody else is building and launching at that frequency. I reckon it takes about 50 rockets before you start to get into a groove.”

“I reckon it takes about 50 rockets before you start to get into a groove.”

The “groove” that Rocket Lab has got into is the small launch business. “There was no small category” before Rocket Lab’s Electron, says Beck: “We kind of created it.”

Electron is the world’s only reusable orbital-class small rocket, designed to deliver small satellites to precise and unique orbits.

Is Bigger Better?

SpaceX has moved to fend off its competition.

It has, for example, developed a ‘rideshare programme’ of small satellite batch launches that could be seen as targeting the customer base of smaller competitors like Rocket Lab.

Beck is confident that his company can compete. “There’s very few examples in history when monopolies persist,” he says.

“We have an advantage. We’ve learned everything we’d need to learn on a small rocket, including reusability.”

Beck explains that a small rocket is, counterintuitively, much harder to build than a large rocket.

“There are so many things on a small rocket that don't scale. Such as quality control organisation: they don’t care if you’re building a 12-inch valve, or a two-inch valve. The size of the valve doesn’t matter, it’s the same size organisation.”

Considerations like this soak up a large percentage of the budget for a craft the size of Electron.

In building Electron, Beck says, “We have been forced to innovate to fit all those functions into a sticker price of $8m”.

The upshot is that when it comes to a product like Neutron — Rocket Lab’s mega constellation, deep-space and human spaceflight launcher, with a height of 43 metres, compared to Electron’s 18m — there is suddenly a lot more room to manoeuvre.

“At a Neutron sticker price — call it $50–55m — it’s like luxury. I’ve never had so much margin to do stuff before.

“We have created an organisation that is just so lean and so efficient. When you apply that to a much larger scale, then it’s just awesome.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy