Yuri Khodjamirian, Chief Investment Officer at Tema ETFs, discussed the politics of the global reshoring trend with OPTO Sessions, including why he feels that support for reshoring will continue regardless of the outcome of this year’s presidential election.

Yuri Khodjamirian, Chief Investment Officer at Tema ETFs, discussed the reshoring trend in depth with OPTO Sessions.

While this trend has profound implications for companies at the micro level, it is a fundamentally macro phenomenon. Khodjamirian shared his views on its various political ramifications.

One of reshoring’s major drivers is the geopolitical tension that has simmered, particularly between the US and China, for years.

While former President Donald Trump is often identified as the source of these tensions, Khodjamirian believes that the trend pre-dates his tenure.

“The US’ tilt away from globalization and towards a more protectionist trade policy started about 15 years ago,” he explained.

Other geopolitical tensions such as the conflict in the Middle East are further hampering globalized trade routes.

“The Red Sea carries 12% of global trade. It is currently in a serious situation because of the war going on around there and the rebels attacking ships. So you’re now having ships use trade routes that haven’t been used since the 18th century, sailing around Africa.”

With challenges in the Panama Canal due to water scarcity, and the impact of the war in Ukraine factoring in on top of that, managers of large multinational companies can be forgiven for planning their next phases of manufacturing capacity in their home markets, said Khodjamirian.

Electoral Implications

As reshoring is partly a matter of policy, the US election could in theory have a major influence.

However, Khodjamirian and his team consider the election’s ramifications for reshoring through the lens of the major bipartisan bills that have already been passed to support it.

He highlighted the cumulative amount of government funding that three bills in particular — the Infrastructure Investment and Jobs Act, the Creating Helpful Incentives to Produce Semiconductors and Science Act, and the Inflation Reduction Act — have unlocked. Deloitte puts their cumulative total at over $2trn.

These bills passed with bipartisan support because, Khodjamirian believes, “the US understands that it has two really major challenges”. The first of these is the need to rebuild its manufacturing base, and the other is the need to upgrade its infrastructure. “This is, quite clearly, easy for politicians to support. Rebuild roads, get jobs into the US, support manufacturing.

“This is also important because it’s often to swing states, to the ‘rust belt’ of the US, where a lot of this investment is going.”

However, Khodjamirian said the trend transcends the scope of the US government, and is largely driven by commercial imperatives.

“It’s not going to be a flash bang of these acts and then it’ll disappear. In many ways, these are companies making these decisions. This is why it’s so exciting in terms of a structural trend. We don’t really like to invest in government policy, because it can be fickle and can change.”

In the context of November’s election, Khodjamirian believes that both parties will strike a pro-reshoring pose: the Democrats will pitch themselves based on the legislation that President Biden has brought into effect, while Trump is known to be “a big supporter of reshoring, deglobalization and the rebuilding of the US’ manufacturing base”.

The Industries of the Future

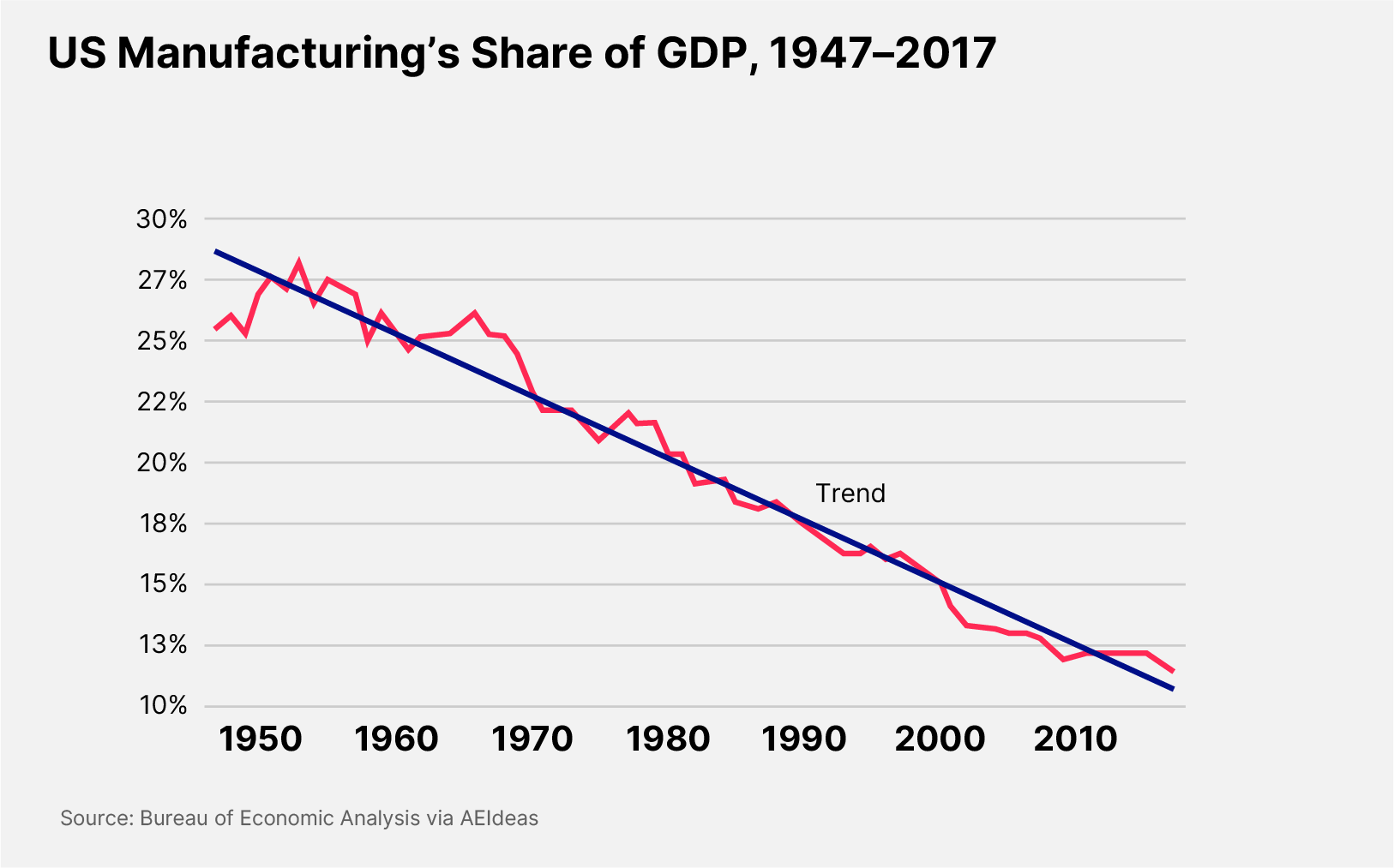

Having been close to 30% of the US economy by GDP in the 1960s, manufacturing accounted for just 10% in 2023.

However, Khodjamirian suggested that the percentage is starting to nudge upwards, and he predicted a “rebalancing” towards manufacturing over time.

“I think there will be a boost in terms of construction and new infrastructure, which, in theory, should also increase the productivity of the economy. If you’re starting to get more productive factories and investment, manufacturing should become more efficient as well, which is a way of helping the overall growth rate of the economy.”

Another positive, for Khodjamirian, is that reshoring is built with modern technology in mind, and is therefore highly future-proof. Some of the US’ most high-tech sectors are the most dependent on global supply chains.

Pharmaceuticals is a case in point: the US imports as much as 80% of the basic ingredients it uses to make medicines, primarily from China and India. Semiconductors, electric vehicles (EVs) and batteries are also characterized by heavy reliance on overseas imports.

Khodjamirian suggested that, over the long term, reshoring could leave the US economy in an even better position, with “a domestic pharmaceutical ingredients industry, a domestic semiconductor manufacturing industry, a domestic EV and battery industry. And these are probably the industries of the future”.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy