Tencent Inc [0700] has been the breakout star of China’s tech industry since its launch in 1998. Everything the web giant has done – from the development of its messaging app WeChat to buying stakes in Snapchat and Tesla – has gone from success to success, helping it quietly rise to rival the likes of Google and Netflix in power and value.

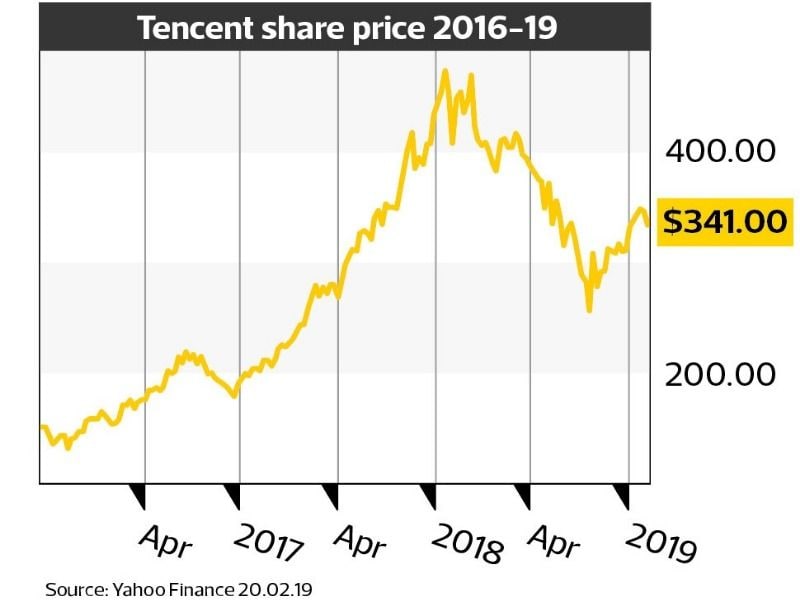

Since floating on the Hong Kong Stock Exchange in 2004 at just HK$0.83, the stock had seen nothing but gains, reaching a high of HK$474.60 in January 2018, an incredible growth of 57080%. But amid a slowing Chinese economy and the ongoing trade war, the stock slowed in 2018, closing the year down 22.6% – a year loss for only the second time in the company’s history (the first was in 2007).

In the past few months, however, the stock has started to rebound, gaining 38% since the beginning of November 2018. And in an apparent effort to ensure the gains and growth continue, the internet colossus has continued to invest in new ventures.

Tencent currently has investments in more than 600 subsidiaries and has started 2019 by expanding its portfolio further. A joint venture with South Korean gaming firm Netmarble Group to bid for Nexco Group’s parent corporation NXC Group could be worth as much as USD$9bn. It also teamed up with a consortium of investors – Google among them – to back Indonesia’s answer to Uber, Go-Jek. These signs would appear to suggest a business looking to diversify its asset base with a broad range of astute investments.

600

Number of subsidiaries Tencent has invested in

A strong brand

Tencent has brilliantly established a core customer base willing to part with its cash. The introduction of Tencent’s first key product, QQ, proved that. What began as a web-based messaging system has grown into one of China’s biggest instant messaging platforms.

It has successfully coupled this with a music streaming service reportedly boasting 700m subscribers, 120m of them paying customers. Combine these with QQ.com, one of the internet’s biggest portals where subscribers can pay for additional content, and it’s hardly surprising that Tencent’s brand has been labelled the fifth strongest in the world by BrandZ. The ratings firm has compiled rankings of the world’s most valuable brands since 2006 by combining financial and market data with surveys of more than 3.6m consumers in 51 countries.

The politics hurdle

China’s tense relationship with the US indicates that Tencent’s future might not be quite so rosy. Commentators have noted that, without a resolution to the bitter trade war between the two countries, Tencent will be negatively impacted. The intelligent investments it is already making could stymie any negative ramifications, though it will be fascinating to see how this plays out on the global stage.

Tencent’s core businesses

WeChat and Weibo have been key to Tencent’s success. The former passed a key milestone in 2018, registering over one billion monthly users for the first time. By comparison, Facebook-owned WhatsApp counts 1.5 billion monthly users. WeChat is undoubtedly a formidable competitor – and gaining strength.

Numerous outlets have struggled to pin down figures for individual revenue streams with Tencent consistently vague on them, preferring to list those figures as internal sectors.

Five of Tencent’s biggest brands

QQ was where it all started for Tencent. The red-scarf-wearing penguin mascot is ubiquitous across China and the portal is one of the most visited web portals in the world.

As China’s answer to WhatsApp, WeChat is catching up to its Western counterpart at a rate of knots with more than one billion monthly users.

Epic Games

A 40% stake in Epic Games means Tencent has a major say in the world’s most popular video game, Fortnite.

Riot Games

Tencent took a majority stake in Riot Games in 2011, giving it a major say in one of the biggest MMORPG’s League of Legends. The game has changed the face of esports worldwide placing Tencent firmly at the forefront of this market.

Ubisoft

After helping Ubisoft to stave off a bid from rival French firm Vivendi, Tencent’s stake in Ubisoft allowed it to bring the Call of Duty franchise to China for the first time in its history.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy