Edwin Dorsey, Founder and Author of the short-selling newsletter The Bear Cave, has developed a knack for spotting bad businesses. Here, he shares with OPTO Sessions how he uses approaches like Freedom of Information Act (FOIA) requests as part of a process that identifies companies that ought to be shorted.

If you’re going to look for short-selling opportunities, it pays to keep an eye on the details. That, at least, is the mantra of Edwin Dorsey, Author of The Bear Cave, a Substack newsletter in which Dorsey highlights businesses that he believes are highly overvalued by the stock market.

If you know what you’re looking for, there are plenty of potential early warning signs, such as cluster selling. Just as several staff members buying their own shares can be a positive sign, a cluster of sales sends a warning signal.

“I would rather see five different executives each buy $10,000 of stock than one executive buy $100,000 in stock, even though the number’s greater,” Dorsey tells OPTO Sessions. However, “if you see five different people each sell half their holdings, then that piques my interest a lot”.

As well as share purchases and sales, Dorsey also keeps a keen eye on personnel comings and goings. “I spend a lot of time, maybe more than anyone else, just tracking resignations.

“Every week, I’ll manually go through the list of all the executives and board members who resigned that week — it’s about 300 a week — just trying to find the most suspicious. If somebody leaves after less than three years, that’s a problem.”

In addition to early executive departures, resignations of particular concern are those effective immediately, as well as consecutive resignations in key roles.

“If the chief financial officer is resigning, and a board member or chief accounting officer resigned even a year ago, effective immediately, it kind of promotes this thread that, hey, maybe there’s a problem going on that the market might be missing.”

The FOIA

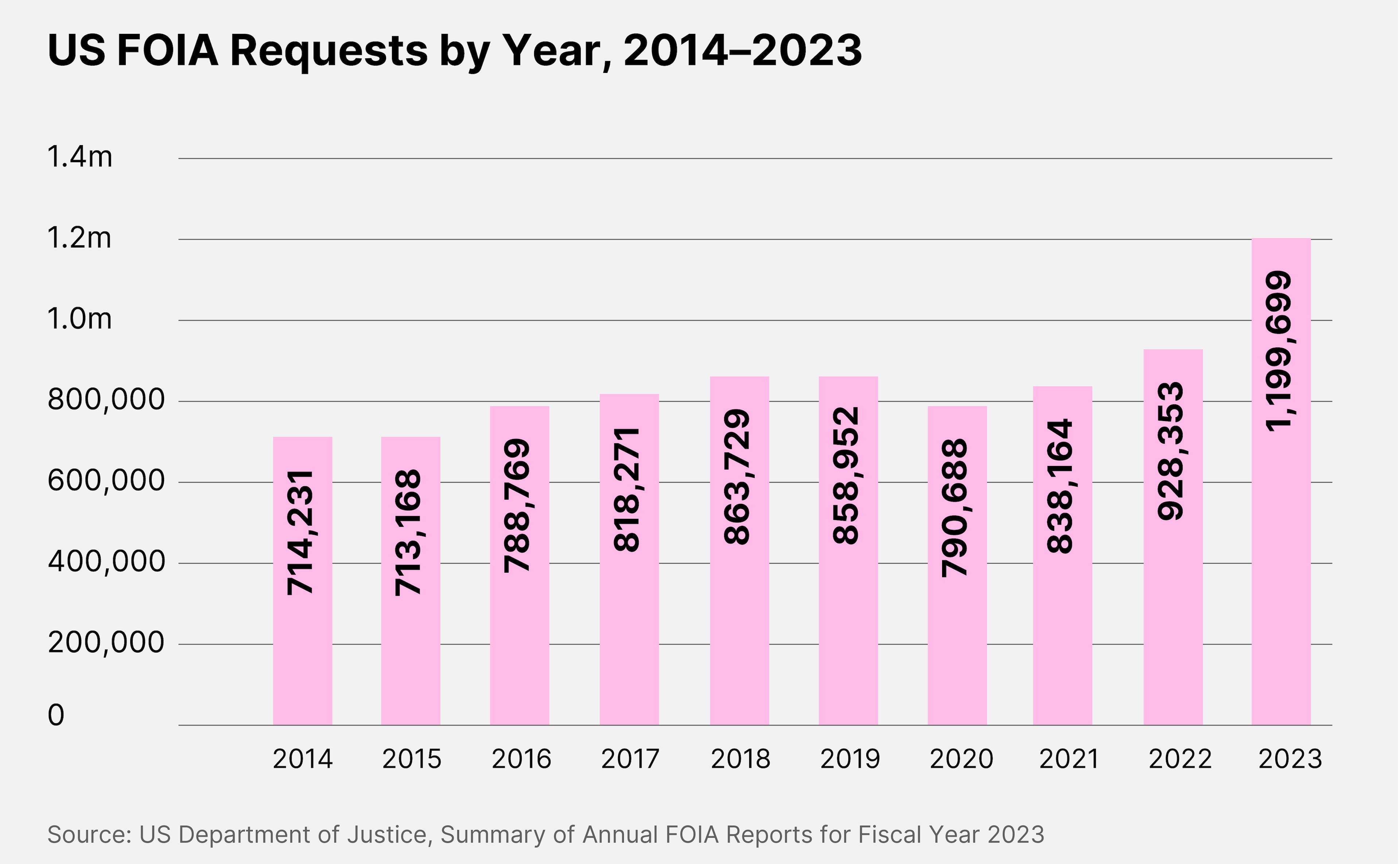

Once his suspicions are aroused, Dorsey uses the Freedom of Information Act (FOIA) to request that hard evidence be delivered.

“My bread and butter is filing FOIA requests with state-level regulators for consumer complaints against the company,” he says.

He gives the example from early in The Bear Cave’s history of The Joint [JYNT], a chiropractic clinic.

As Dorsey wrote in October 2021: “The company’s franchise base has grown from 309 clinics in 2016 to 555 today. Over that time, shares are up ~3,500% and currently trade at ~80x profit and ~40x franchise royalty and fee revenue. Investors believe the franchise network is healthy and has room to grow. The Bear Cave doesn’t.”

By doing some digging into the company’s reviews, Dorsey identified that there were persistent complaints about billing.

“So I start filing FOIA requests with state-level regulators,” he says. “I might send a FOIA request to the Illinois State Attorney General and say, ‘Hey, can I have all consumer complaints filed against The Joint in the last three years?’”

The results: hundreds of pages of complaints from the states where The Joint had major operations demonstrated a litany of cases whereby customers had been auto-enrolled into monthly unlimited contracts and often had their signatures forged.

“Enrolling people onto monthly chiropractic treatments when they only intended to get one session is a great way to boost the short-term profitability. It’s not a good way to build a multibillion-dollar business.”

In the year after Dorsey’s Substack article on The Joint on 7 October 2021, the company’s stock fell 83.9%. Though it is up 42% year-to-date as of 26 June, it remains 95.8% below its level prior to Dorsey’s exposé.

Unfit For Purpose

Planet Fitness [PLNT], a gym brand, faced widespread complaints of overbilling in early 2023. Gym memberships, Dorsey observes, are “notoriously tough to cancel”. A preliminary review of the company’s terms revealed that customers couldn’t cancel over the phone or online but had to go in person to the site where they first signed up for their membership.

Dorsey was shocked by the revelation: “This is 2024. You can’t cancel over the phone?”

He then filed a FOIA request in every state for consumer complaints against the business.

“I get thousands of pages of complaints. What was happening, these complaints allege, is that even when people would go into Planet Fitness franchises to cancel, they’d be told, ‘You can't cancel today, this is a payment processing day, come back another day.’ Or they’d go in and fill out the forms to cancel but still continue being billed.”

Dorsey’s Substack article on Planet Fitness went out to his subscribers on 19 January 2023. The stock hit a 52-week low on 26 September, 46.8% down from its prior level. Though the stock is up 1.7% year-to-date in 2024, it remains 10.1% below its level before Dorsey’s investigation into the company.

Authentic Intelligence

While determining exactly how many complaints constitute a red flag is often a subjective call, Dorsey says that, in some instances, public data can help.

“The National Association of Insurance Commissioners publishes a database where you can see every insurance company, the number of closed and confirmed complaints against that insurance company, and the ratio of complaints that they have relative to their size.”

However, it is more often down to Dorsey’s own judgement. This is why, despite the arduous research his method relies on, he prefers to conduct it manually rather than use artificial intelligence (AI).

“I want to be as close as humanly possible to the actual complaint and understand what’s going on. When you use AI to summarise, there are so many ways things can get twisted in statistics and summaries.”

Dorsey’s method isn’t foolproof. He explains how his first-ever article on The Bear Cave back in October 2020, on Celsius Holdings [CELH], “missed that the [company’s] core product was extremely popular and getting more popular”.

Besides that, however, he says there have been no major errors and “a lot of real successes”.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy