This month on The Big Picture, Jens Nordvig, Co-Founder and CEO of MarketReader, discusses the complexities of the ways interest rates impact the stock market; the uncertainty in the current market environment; and the different phases of a rate peak. He also delves into how the evolving tech sector and biotech revolution are reshaping investment opportunities.

The Federal Reserve’s (Fed) influence on equities markets is indirect but significant. Particularly for growth stocks, higher interest rates reduce their long-term discounted cash flow and make it harder to obtain low-cost debt financing.

High inflation is also correlated with high bond yields. For that reason, falling bond yields would be one indicator to the Fed that inflation is coming under control, meaning it can potentially consider cutting rates. That would be good news for equities.

“When we have [bond] yields moderating because of good news on inflation, the equity market certainly likes it,” says Nordvig.

However, bond yields are currently highly volatile. “I open up my MarketReader ETF monitor every morning, and almost every day, the most volatile instrument is the iShares 20+ Year Treasury Bond ETF [TLT].”

This volatility, he believes, is a clear indication that the market is not yet confident that rates have peaked.

“When we have [bond] yields moderating because of good news on inflation, the equity market certainly likes it.”

The Phases of a Rates Peak

Nordvig outlines two scenarios that could indicate a rates peak, or the point at which the Fed no longer increases interest rates and starts to maintain or cut their levels.

The more “bullish” of these two scenarios — wherein calming inflation data indicates to the Fed that it can safely stop hiking, or start cutting, interest rates — is described above. The other involves bearish factors, like recessionary fears and a lack of economic growth, entering the equation.

“If I was going to outline a path that I think is pretty likely, it would be one where the inflation numbers start to get better. The Fed responds, saying, ‘Okay, we're also getting more comfortable, and we’re going to be thinking soon about how to cut.’ The equity markets are going to like that.

“But I wouldn't be surprised if we then, over some period of time, still have economic weakness entering the picture.”

For this reason, Nordvig anticipates that the peak of the current interest rates cycle could consist of two phases: the first being a positive peak, which is triggered by positive results on inflation (i.e., it is falling); and a second phase being prompted by negative macroeconomic data.

This latter phase would be more challenging for the equity market, because of its association with weaker economic growth.

The Biotech Revolution

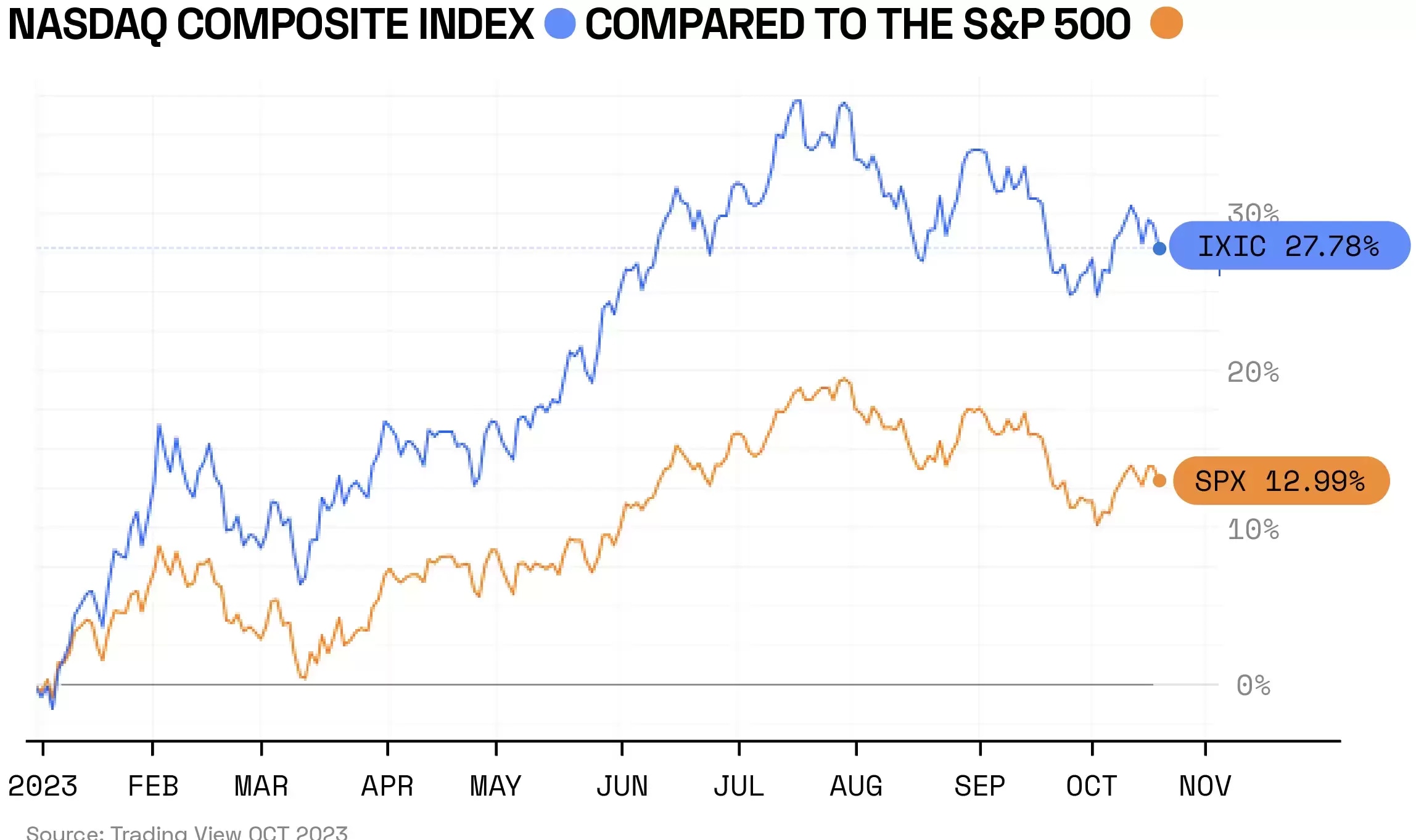

Nordvig observes that there has been a divergence between the broader performance of equities and that of the technology market. The Nasdaq Composite is up 27.2% year-to-date as of 19 October, while the S&P 500 has rung up a more modest 12.4%.

Artificial intelligence (AI) and certain biotech stocks are driving this disparity, according to Nordvig.

AI in particular has significant momentum because large investments have been made — such as Microsoft’s [MSFT] $10bn investment into OpenAI in January — by large, established technology players who, besides significant reserves of capital, also have access to abundant data on which to train new AI models.

“It’s very hard to fade that momentum,” says Nordvig.

Biotech stocks are, however, starting to make the kinds of moves that large tech stocks associated with AI made earlier this year. Nordvig picks out the Danish pharmaceutical company Novo Nordisk [NOVO-B.CO]. Nordvig calls Novo “one of the best-performing stocks this year”; its share price is up 55.1% year-to-date.

“People are starting to believe that these new drugs that are coming to the market will mean that all these other medical services providers and equipment providers are not going to be needed anymore.”

Nordvig says that he has observed a knock-on effect of the increased pipeline of revolutionary treatments from biotech companies like Novo onto medical devices companies. According to Nordvig, these equipment makers are collapsing because “people are starting to believe that these new drugs that are coming to the market will mean that all these other medical services providers and equipment providers are not going to be needed anymore.

“We used to think about, what’s going to be the next trillion-dollar company? Is it going to be Tesla [TSLA], is it going to be Amazon [AMZN], and so forth. But we actually have some biotech companies knocking on the door that I think will make people think differently about tech going forward.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy