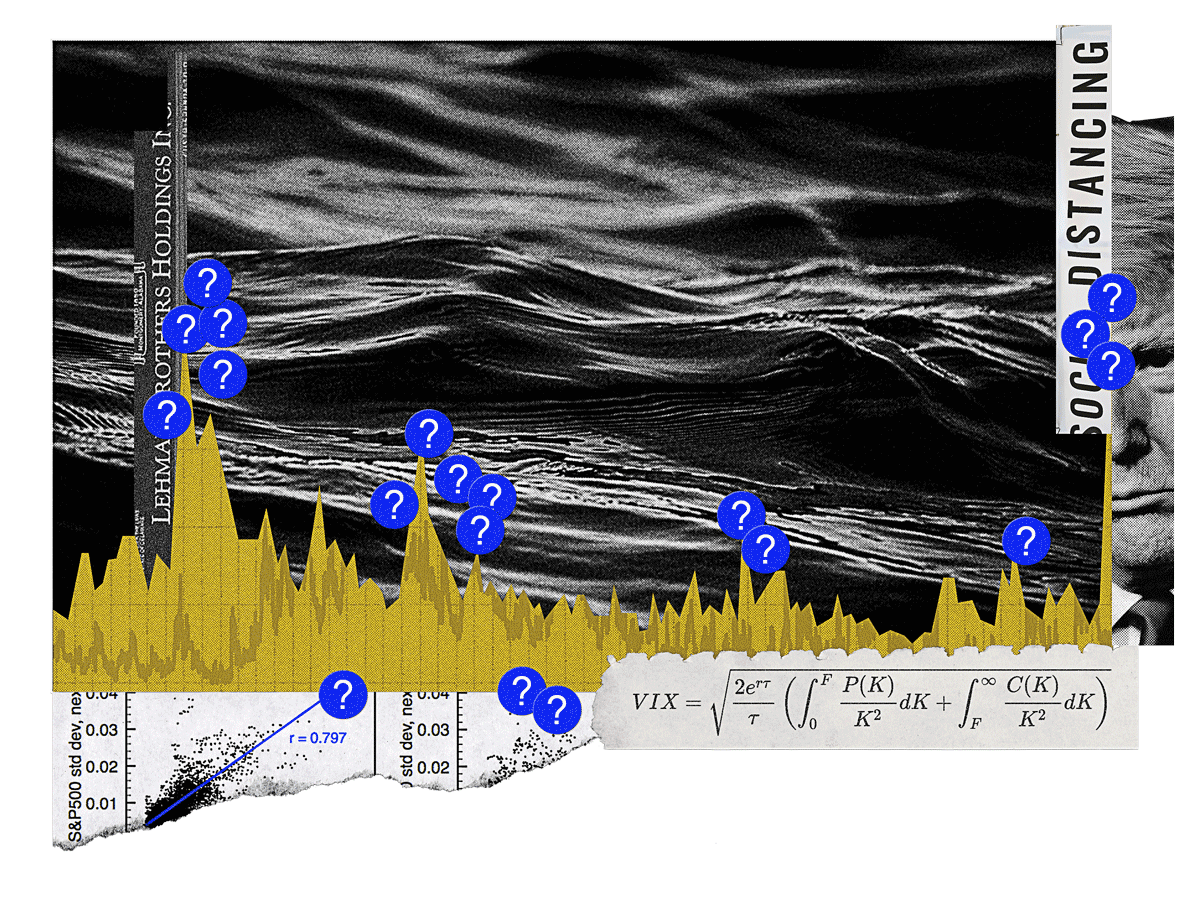

As markets plummeted in March, commentators could not stop pointing to the so-called fear gauge. The index has in the past be been described as a sort of misery barometer, but it is not entirely as it sounds.

The Chicago Board Options Exchange (CBOE) first unveiled the Volatility Index [VIX] — also commonly referred to as the VIX — in January 1993 as a way to measure the expected future volatility in the markets.

It was also to be used as an index that futures and options contracts on volatility could be written, as trading volatility had long been considered beneficial.

Known as the father of the fear gauge, Robert Whaley, a professor of management and head of the Financial Markets Research Center at Vanderbilt University in Nashville, was commissioned by the exchange in the fall of 1992 to develop a formula that could measure volatility based on option prices.

Given that the CBOE had a monopoly on index option trading through its S&P products at the time, Whaley was able to take the entire history of trades and invert the option pricing formula to determine the projected short-term volatility.

Because institutional investors — those that the index is basing its expected volatility on in the futures market — use S&P 500 options (mainly puts) as a way to hedge risk, when an unexpected macro event occurs like the coronavirus pandemic earlier this year they rush out to buy them.

“As a result, since the VIX depends on those index puts and its computation, if the price of S&P 500 index puts goes up, the VIX goes up. That's the reason it's called the fear gauge,” Whaley tells Opto.

“As a result, since the VIX depends on those index puts and its computation, if the price of S&P 500 index puts goes up, the VIX goes up. That's the reason it's called the fear gauge” - Robert Whaley

The index has since grown to become one of the most-watched on the markets, but it wasn’t long until speculative stock players started to utilise it to place bets on fear.

From a simple tracker to a giant trading ecosystem

When the VIX was first released, it was mainly used as a metric for driving buying and selling decisions.

However, the CBOE had intended it to be used as an asset. “They wanted volatility in play,” Whaley recalls.

It took the exchange’s product development committee 11 years to finally be able to launch the VIX on the futures market. Then in February 2006, VIX options were introduced. These securities were a more attractive proposition, as it allowed people to buy the VIX as another form of portfolio insurance. By buying put options investors could hedge their portfolio against a sudden downturn, while put options protected against a rapid reversal of short positions.

“[Investors sought] protection against black swan events, which are essentially like spikes upward in the level of VIX,” Whaley says. He explains that buying VIX options effectively meant investors were “getting a clean bet on volatility, as opposed to S&P put options which are really two bets”.

“[Investors sought] protection against black swan events, which are essentially like spikes upward in the level of VIX” - Robert Whaley

Consequently, the VIX futures market took off among corporate investors. Because of the index’s reliance on puts for computation, the VIX acts as a sort of “bias predictor”, according to Whaley. It represents the expected future volatility over the next 30 days. He likes to think of it as an insurance contract.

“When things broke loose was January 2009,” Whaley recalls, just after the financial crash. At this point, Barclays introduced the first VIX exchange-traded note, ultimately taking the index out of the derivatives market.

The unstoppable rise of volatility trading

The transition from the futures market to the retail market was fast, especially given the latter’s size and how easy it is to open a trading account. “There are something like 100 times more security trading accounts than futures trading accounts”, Whaley notes.

The retail market was quick to jump on the bandwagon. Jason Miller, an independent trader speaking to The Wall Street Journal, best summed up its growing popularity as a trading strategy when he stated that “one person’s fear is another person’s opportunity.”

The fear of future market shocks spurred many independent investors to include products like the VIX, that rise during a steep sell-off, in their portfolios

There were teething issues, of course, and the VIX presented a bit of a riddle for those who didn’t properly understand it. Many outside the options industry projected meaning onto it that simply wasn’t there, such as the idea that trading on expected market moves can itself move markets.

When Credit Suisse introduced its own VIX futures products — including the TVIX, which allowed investors to double their bets on VIX futures — considerably more risky bets were being placed. The firm was forced to remove the product this year after it rose by 206% in H1. The closure raised concerns that the bank would not be able to adequately hedge its clients’ positions, the Financial Times noted.

Despite that, and to this day, VIX products are among the 20 most actively-traded securities on the US stock exchange. That’s a worrying development Whaley suggests, as all an investor is doing is taking a directional bet on an index. “It's not as if you're buying anything that is socially constructive in any way. In essence, you're just reading from the person on the other side of the trade.”

“It's not as if you're buying anything that is socially constructive in any way. In essence, you're just reading from the person on the other side of the trade” - Robert Whaley

Volatility players pounce on market tailspin

The popularity of trading volatility was exacerbated earlier this year with the arrival of COVID-19 and the ensuing market panic. The sell-off in March — the most volatile month in the stock market’s history — ballooned uncertainty and attracted fresh interest.

Around the time the S&P 500 was tumbling to $2,398 on 18 March, the VIX index was fresh off a record high of 82.69, achieved on 16 March.

As a result, tail-risk volatility strategies outperformed. The CBOE Eurekahedge Long Volatility Hedge Fund Index and the CBOE Eurekahedge Tail Risk Hedge Fund Index returned 39.70% and 44.29%, respectively, in the first quarter of the year.

Since its inception, the VIX index has averaged around the 18 mark, however, Whaley doesn’t expect it go back to that level until well into next year. At the start of August, it sat at 24.28.

“There is ongoing uncertainty about the pace of an economic recovery and how quickly a vaccine might be found, but the dispersion around these projected rates, which the VIX measures, is getting lower,” Whaley explains.

“There is ongoing uncertainty about the pace of an economic recovery and how quickly a vaccine might be found, but the dispersion around these projected rates, which the VIX measures, is getting lower” - Robert Whaley

While the VIX’s recovery has not been linear, market confidence has grown since March and the index will continue to fall. However, this might not be a given.

“The wild card for me is the US election. This is where the rationality argument loses its wheels, and why it will probably take until 2021 to get below the 20 level,” Whaley says.

Trading complicated derivatives is not easy, but if volatility-related products are used as a mechanism for placing short-term directional bets, it can sometimes prove to be an effective hedging tool.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy