Marc Stapley, CEO of Veracyte, joins OPTO Sessions to discuss why he believes the biotech industry has underperformed since Covid-19. He also explains why Veracyte is different from many of its peers, and the developments that are setting it up for future growth.

Welcome to the Neighborhood

In some ways, biotechnology has been a microcosm of the broader tech sector in recent years.

“There used to be a period where, from an investment standpoint, high growth at whatever cost was very much rewarded,” Marc Stapley, CEO of specialist molecular diagnostics companyVeracyte [VCYT], tells OPTO Sessions.

This was the environment in which many of today’s biotech companies matured. “Then Covid-19 hit.”

At the same time as investors were pouring money into tech companies offering food delivery or video conferencing services, biotech became a highly attractive industry. It reached what Stapley calls a “local maximum” in early 2021 at the height of the pandemic response.

When the macro environment turned in 2022, Stapley says, “high growth at any cost was no longer rewarded”. Investors demanded cash flows — leaving many biotechs struggling to raise cash, service their debt and become profitable.

The effects can still be felt.

The company currently provides its diagnostic tests through a centralized laboratory based in the United States. However, as part of its strategic expansion, it plans to make these tests available internationally by offering them as in vitro diagnostics (IVDs). Notably, the company’s breast cancer test, Prosigna, is already available as an IVD, setting the stage for broader global availability of its diagnostic solutions.

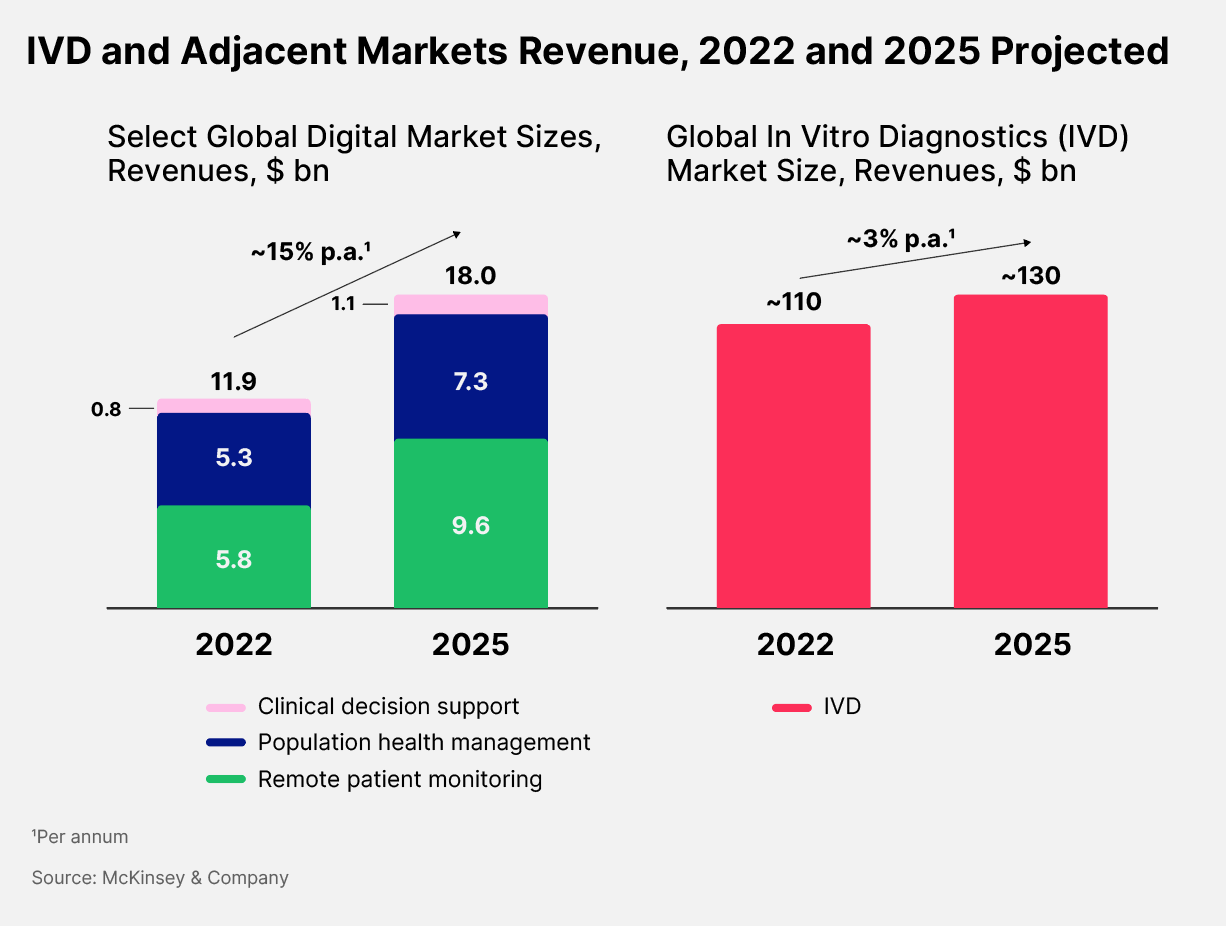

According to McKinsey, industries adjacent to IVD are expected to grow faster between 2022 and 2025 than the core market. Clinical decision support, population health management and remote patient monitoring, combined, are expected to grow at approximately 15% per year, compared to approximately 3% for IVD.

This has made what Stapley calls the molecular diagnostics neighborhood seem unattractive to investors. “There are houses with boarded-up windows, houses on fire, houses that have completely collapsed and fallen down.

“There’s a couple of nice houses in that neighborhood, but the problem is, you don’t even drive down to take a look at them. We’re one of those nice houses in a tough neighborhood,” he says.

On the Up

That said, Stapley believes that the industry as a whole has started to turn things around over recent months.

Veracyte announced a successful Q2 in early August. Revenue increased 27% year-over-year to $114.4m, while earnings swung from a $0.12 loss to $0.07 of profit on a per-share basis. Analysts had predicted a loss of $0.02 per share on revenue of $100.28m.

The firm also raised full-year revenue guidance from $402m–410m to $432m–438m.

Stapley explains how this successful quarter sits within a longer-term context. “Veracyte changed three years ago to become a very different company with the acquisition of two other companies,” he explains — namely Decipher Biosciences and HalioDx.

“We became a multinational company with a broad portfolio of products and employees in multiple time zones. We went from around 250 employees to around 850 employees.”

This prompted a strong focus on underlying financial performance that Stapley believes differentiated Veracyte from other companies in its neighborhood at the time.

“For the last 12 or 13 quarters we’ve consistently beaten and raised our own expectations. Q2 2024 was really the most recent culmination of that.”

The core testing business — particularly the Decipher Prostate and Afirma tests — drove the company’s performance, growing 32% and 17% respectively.

Stapley underscores that the company is now delivering profits as well as revenue growth, which again sets it apart from its neighbors.

“Our margin in the quarter was 21%. That grew from 15% on a consistent basis in the prior quarter,” he says.

New Neighbors

Geographically speaking, Veracyte is on the move. Stapley explains that it is expanding its testing products into non-US markets, particularly Europe. While this brings challenges with it, these in turn present opportunities.

“The US model of having a centralized laboratory and being able to run your tests in one location for the entire nation… You can’t do that. You can’t set up one of those labs in every important country.”

The solution that Veracyte has hit upon is to launch its tests as kits.

“We can enable other labs that already exist and already do a lot of testing in their own countries, and understand how to do that, and have the relationships with the physicians and the hospitals… to be able to run Decipher Prostate or our Prosigna breast cancer test, or ultimately, our nasal swab test for lung cancer.”

These lung cancer tests are another example of how Veracyte’s potential market is expanding. Relying on breakthrough technology that identifies the genetic markers that indicate lung cancer — as well as sophisticated artificial intelligence and machine learning technology that can detect these in tissue from throughout the respiratory tract — Veracyte has produced a non-invasive test that enables far more precise risk assessment for potential lung cancer patients.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy