The industrial part of the global economy has seen plenty of volatility this year. While the sector has been subject to various ups and downs over the last few years, there have been a few growth trends that have held steady.

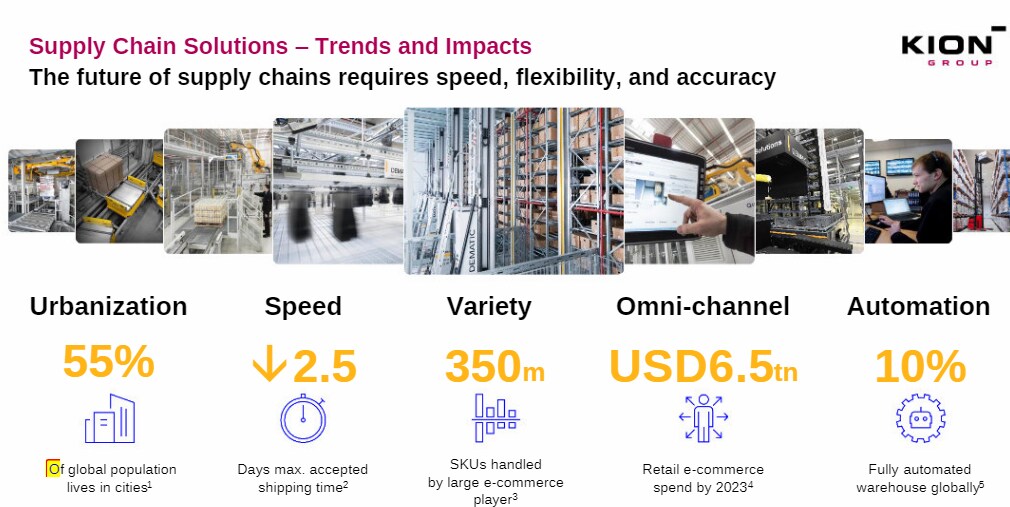

A key emerging trend in the industrial sector is the acceleration of warehouse automation and smart factories. This trend was featured in a recent ‘Logistics Report’ put together by The Wall Street Journal, which highlighted how the coronavirus pandemic has resulted in companies making deeper investments into logistics technology and distribution centres.

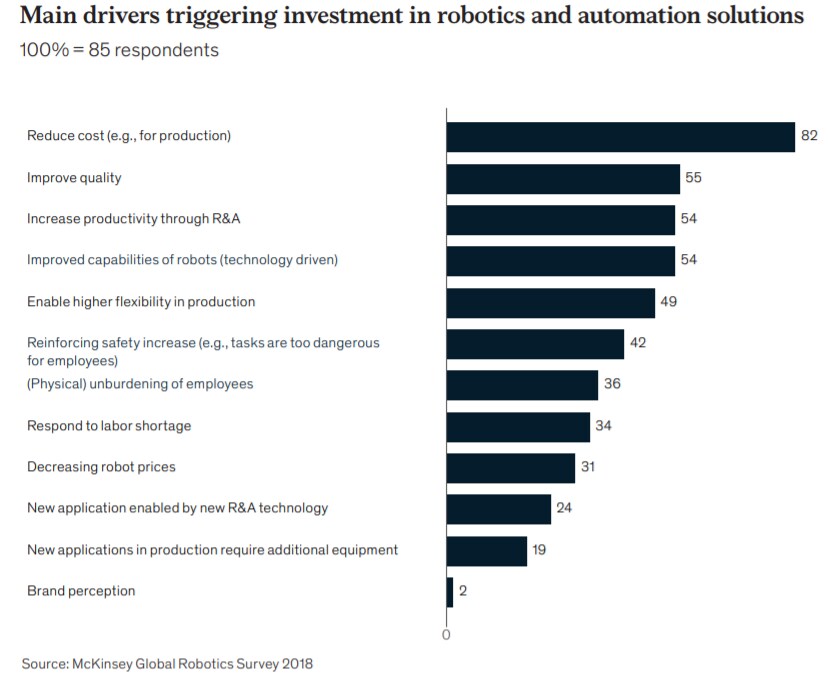

The trend is being driven by both an increase in online shopping and social distancing restrictions within warehouse operations, which is furthering a need for more technological solutions. Indeed, automation leader Honeywell’s [HON] ‘Intelligrated Automation Investment’ study revealed that companies working in the e-commerce, food and beverage and logistics sectors are most willing to increase investments in automation.

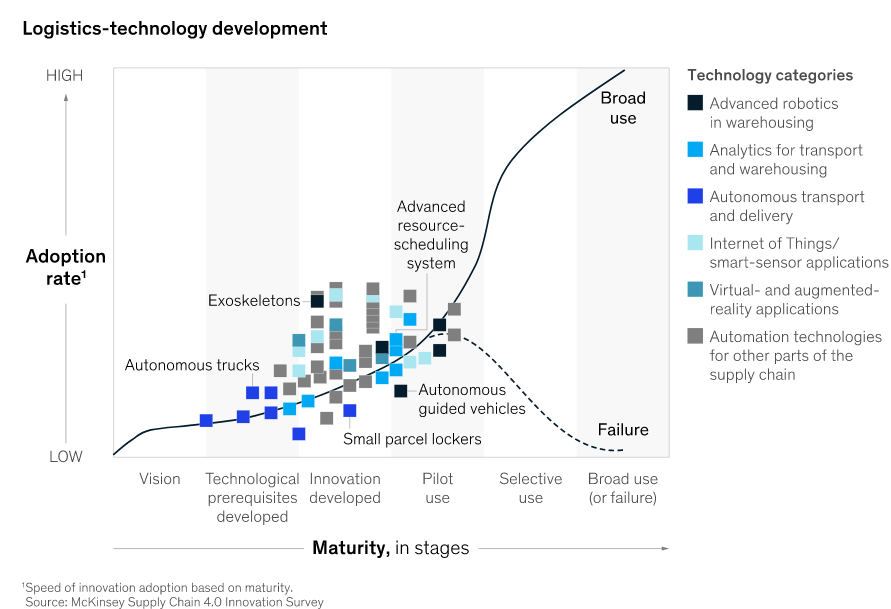

I expect this to be a multi-year trend with several beneficiaries, including a number of currently private makers of robotic components. Technology advancements in robotics are moving quickly and improvements in sensing technology, machine learning and connectivity are likely to drive further investments from companies seeking to both increase supply chain efficiency and reduce costs.

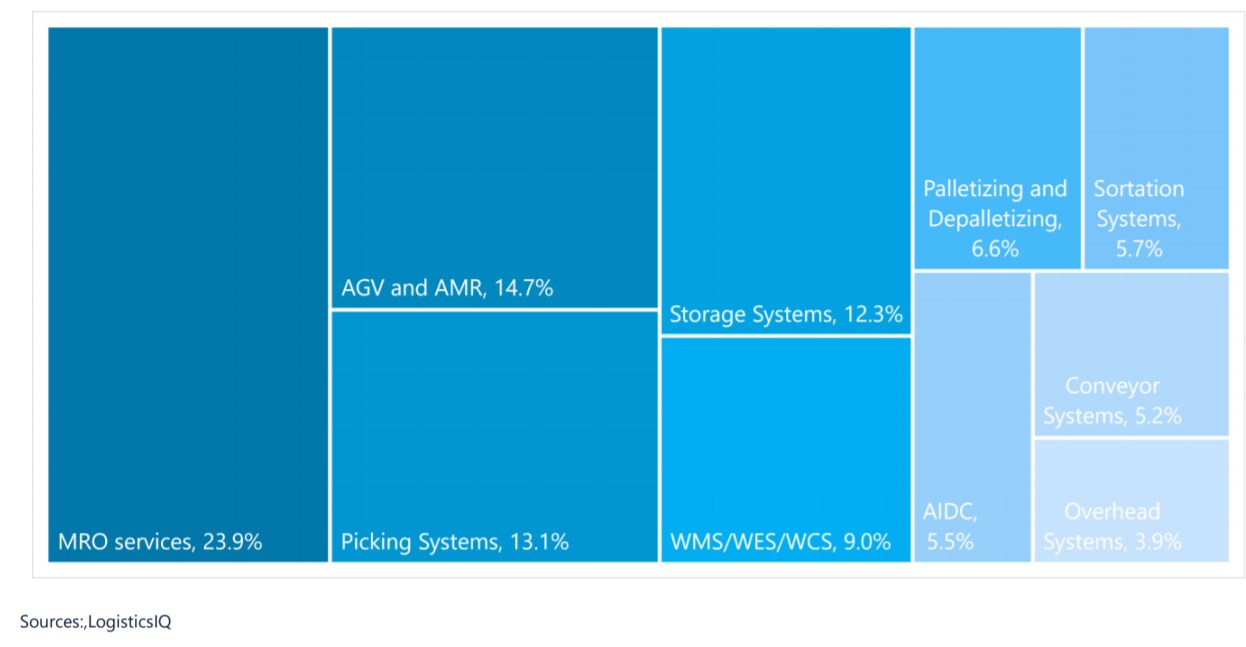

Some examples of warehouse automation solutions include automated storage and retrieval storage (AS/RS), conveyor systems, pick-to-light systems, voice picking/tasking, sortation systems, collaborative mobile robots (AMRs), automated guided vehicles (AGV) and drones.

Automation within logistics benefits both businesses and customers through cost efficiencies and faster distribution. Other advantages include fewer errors and increased warehouse safety. Many companies refer to this overall movement as ‘Industry 4.0’, which includes usage of cloud computing and blockchain technology for big data and analytics insights — essentially, it marks the digital transformation of the industrial sector.

A budding market primed for growth

The global market for warehouse and logistics automation was valued at about $46bn in 2018 and forecasts expect it to reach $80bn by 2023, with e-commerce expected to be the main driver fuelling the increase, according to ResearchandMarkets.com.

Mordor Intelligence, meanwhile, estimates the logistics automation market to be worth about $55.15bn in 2019, but expects it to reach $107bn by 2025, a 12% CAGR. Further adoption is also being driven by high warehouse rent prices, a shortage of skilled workers and micro-fulfilment centres. Furthermore, an environment with record low-interest rates and elevated capacity utilisation as well as aging equipment sets the stage for a strong investment cycle in automation to replace an ageing fleet.

The major players in the automation market

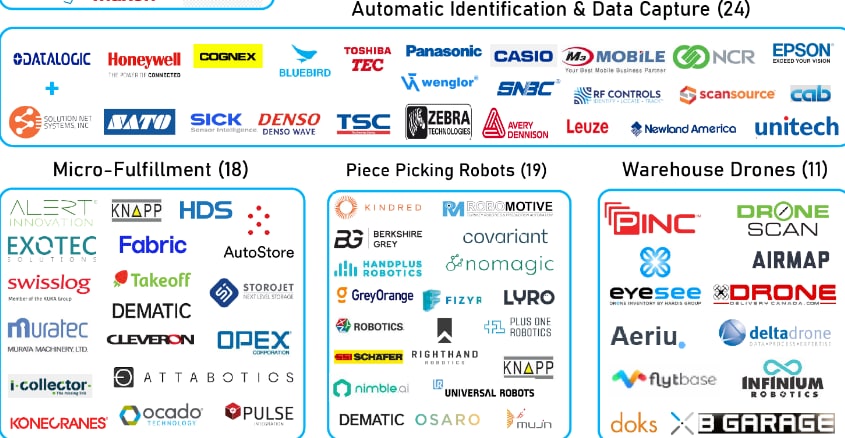

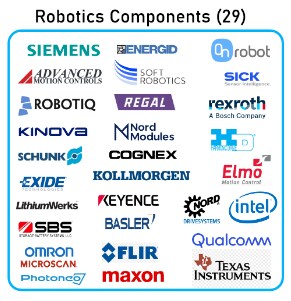

There are a number of interesting companies in the automation market ecosystem, of which I’ve looked to provide a snapshot at the end of this article by highlighting 400 key players broken down into specific technology groups. Robotics companies are a hot area that has seen some recent deals, including Shopify [SHOP] buying 6 River Systems for $450m and Teradyne [TER] buying AutoGuide for $165m — both companies work with collaborative mobile robots and automated guided vehicles.

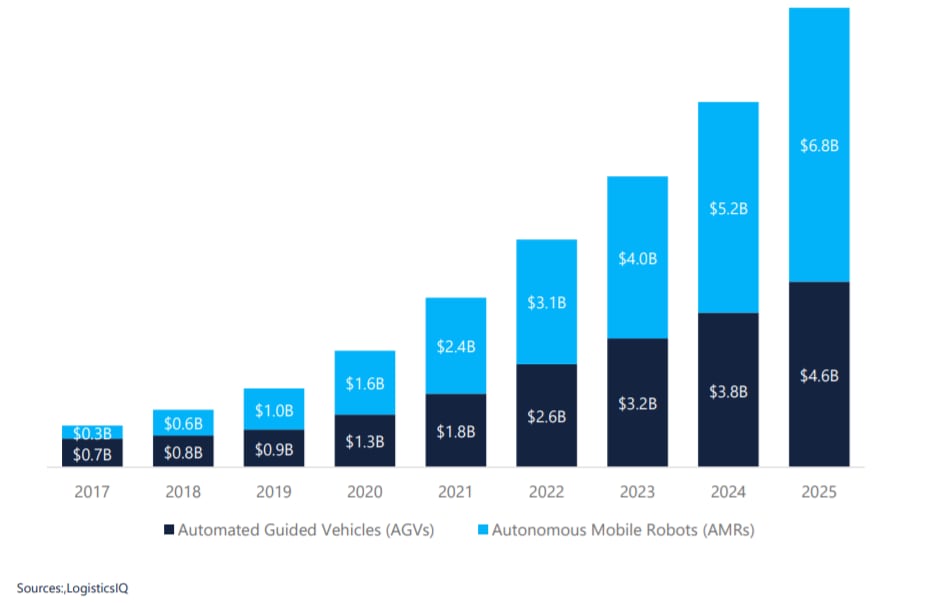

Demand for mobile robots surged 60% in 2018 and is set to surpass a $3bn market by 2022, according to Interact Analysis. Annual shipments of industrial robots are also increasing rapidly and creating a much larger installed base. A few other key US private companies to keep an eye on are Locus Robotics, Fetch Robotics, Rethink Robotics and IAM Robotics.

A few international large players include European-based Schneider Electric [SU], Siemens [SIE] and Kion Group [KGX] — the German multinational manufacturer is considered a top pure-play stock in the space — as well as Japanese-based Omron [6645].

In the US, the main large-cap plays in the industrials space include Honeywell [HON], Emerson [EMR], Eaton [ETN] and Rockwell Automation [ROK]. However, these large companies also have a lot of other businesses, which may mean they won’t see as much of an overall profit/revenue impact so I prefer to look at mid-cap pure plays.

Top pure-play mid-cap picks

One of the most interesting names is Zebra Technologies [ZBRA], which has a leading 40% market share in barcode printing as well as enterprise mobile computing and data capture solutions. Zebra Technologies is positioned well to capitalise on megatrends such as the internet of things (IoT), enterprise mobility, cloud computing and e-commerce.

The Illinois-based company recently acquired Reflexis Systems, a leading provider of intelligent workforce management solutions, for $575m. Zebra Technologies recently noted an acceleration in interest in digitisation and automation across its key four vertical markets, specifically citing the grocer market as a large customer. The company also announced that it is planning to collaborate with Fetch Robotics later this year for warehouse picking.

PTC [PTC], another one of my top mid-cap pure-play picks, is a leading maker of cloud software for industrial companies that has been investing in IoT and sees a long-term opportunity in computer-aided design, product lifecycle management and augmented reality markets.

The company has strategic alliances with Rockwell Automation [ROK], ANSYS [ANSS] and Microsoft [MSFT]. Market research company International Data Corporation predicts that by 2022, 70% of manufacturers will use cloud-based innovation platforms and marketplaces for cross-industry and customer co-development.

GreyOrange, an exciting private warehouse automation and robotics provider, relies on PTC’s Windchill cloud technology for their product lifecycle management needs. PTC acquired this technology through its Onshape acquisition.

AMETEK [AME] is a favourite industrial tech play of mine, although it only has around a 10% exposure to the automation theme. It called out strength in the automation business, specifically in China, on its latest earnings call.

Cognex [CGNX], meanwhile, is a leader in machine-vision products with exposure to factory automation as well as logistics and other end markets. Cognex’s products are also used to automate distribution processes in the logistics industry, including for applications in retail distribution and e-commerce to scan, track and sort goods through distribution centres.

Avery Dennison [AVY] is a player in labels and packaging that has a strong radio-frequency identification business and sees broader adoption in the apparel business as more companies are buying into their use for better inventory management, especially as omnichannel growth surges.

XPO Logistics [XPO] is also a top logistics play that’s implementing a lot of these technologies. In 2018, it launched a proprietary warehouse management platform called WMx that integrates robotics and other advanced automation into operations with a high degree of control, even when complex third-party software is involved. Its warehouse platform is a key competitive advantage, particularly in multi-channel environments.

The small-cap automation players to watch

After these mid-cap names, there are also a few interesting smaller industrial stocks such as Gates Industrial [GTES], which is a small maker of power transmission and fluid power solutions that are used in warehouses, such as conveyor belts.

Matthews International Corporation [MATW] has an industrial technologies segment that delivers marking and coding equipment, consumables, industrial automation products as well as order fulfilment systems for identifying, tracking, picking and conveying consumer and industrial products for the warehousing and industrial industries.

Teledyne Tech [TDY] is a long-time favourite of mine. The company is a leading lidar (light detection and ranging) name that designs and manufactures sensors and modules for industrial robots. Its technology improves vision guidance for robots as well as logistics and automated guided vehicles.

Hyster-Yale [HY] is another small maker of lift trucks and components for various markets that has been positioning more in the fully automated and hybrid automated solution markets.

Moog [MOG-A] is an industrial company I have long favoured and is seen as undervalued. The company is a maker of precision components and controls. It noted in its latest annual report that “an aging population and lack of skilled labor in many industries is increasing the need for more advanced robotics”.

“In addition, advances in sensors, artificial intelligence and autonomous systems are making it possible to introduce new types of automation into old industries such as construction and agriculture. Moog is ideally positioned to take advantage of these macro trends. Our deep expertise in motion components and high-reliability systems, combined with our continuing investments in innovation, give us the tools to meet this emerging demand,” the company said in a statement.

Belden [BDC] is a maker of connectivity solutions and cables that are used in many of these industrial automation tools and robots. It noted the rising cost of labour and surprising decline in the cost of robotics at its December investor day. It said: “As labor costs have risen, the costs of robots, which is a good proxy for automation costs in general, have declined substantially. So labor is getting much more expensive with machines getting much less expensive. This, coupled with a historically low cost of capital with interest rates near all-time lows, creates a very compelling case for investments in automation.”

Another important note it mentions is that “beyond these favourable cost dynamics, the current historically long economic expansion cycle has resulted in elevated capacity utilization rates and aging equipment”. “Specifically, utilisation rates in the United States are approaching 80% and equipment age approaching 8 years or peak levels for this up cycle. These are typically good leading indicators of demand in addition to the favorable dynamics around industrial IoT that we benefit from. Aging and heavily utilized equipment should drive demand for replacement and upgrade. We expect this to support further investment in new automation,” it added.

Materion [MTRN] is a maker of advanced engineer materials that cites industrial automation as a key driver, while Barnes [B] is a small maker of precision components. The company’s automation business designs and develops robotic grippers, advanced end-of-arm tooling systems, sensors and other automation components for intelligent robotic handling solutions and industrial automation applications.

A few more small-cap stocks in the space include FLIR Systems [FLIR], which is a maker of industrial vision products, often thermal imaging, and its camera business is instrumental to the machine vision industry.

Altra Industrial Motion [AIMC] is a maker of motion-control products with industrial automation and robotics cited as key growth end-markets. Allied Motion [AMOT] is a very intriguing $440m maker of motion-control components with applications for industrialised and specialised robots.

Applied Industrial [AIT] is a distribution play and is a leading distributor of a long list of products including bearings, power transmission products, engineered fluid power components, specialty flow control solutions, machinery, robotics automation products, industrial rubber products, linear motion components, tools, safety products as well as other industrial and maintenance supplies.

An offshoot of this theme is the continued benefit to semiconductor companies and a few notable ones with exposure to the automation theme include Teradyne [TER], Entegris [ENTG], Brooks [BRKS], Cadence [CDNS], Synopsys [SNPS], Silicon Labs [SLAB], ON Semi [ON], CEVA [CEVA], Novanta [NOV], Ambarella [AMBA] and Nvidia [NVDA].

In closing, there are a number of angles to position for the ‘Industrial 4.0 revolution’ that is in the early stages of an accelerated transformation due to the technological improvements in robotics, automation software, AI and machine learning.

400 Key Players in Warehouse Automation Market Ecosystem

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy