In part two of this two-part series, Frédérique Carrier, head of investment strategy at RBC Wealth Management, compiles the technological solutions to invest in to help foster a sustainable future.

This report looks at the importance of sustainability from an investment perspective. It highlights some of the technologies and innovations that could help curb the greatest threats to the sustainability of the global economy. In our view, companies at the forefront of developing technology solutions to sustainability issues may offer compelling long-term investment opportunities.

Greentech

Environmentally friendly technologies that aim to reduce greenhouse gas (GHG) emissions.

Our climate change article looked at several emerging technologies used in buildings to dramatically cut fossil fuel consumption. We highlighted geoexchange technology, which takes advantage of constant subterranean temperatures to heat and cool structures.

Greentech also encompasses electric vehicles (EVs) and the ecosystem around them, including batteries, parts, and semiconductors. According to a Deloitte Insights report released in 2020, EVs accounted for 2.5% of new car sales globally in 2019.

"Greentech also encompasses electric vehicles (EVs) and the ecosystem around them"

It expects EV sales to grow by an average of 29% per year over the next decade, with EVs constituting just over 30% of new car sales globally by 2030 thanks to a broader model offering, a reduction in battery costs, and greater access to affordable public and home charging infrastructure.

Regional differences will emerge depending on governments’ commitments to investing in EV infrastructure and offering cash and tax incentives. Deloitte expects EV sales in 2030 to account for 48% of domestic new car sales in China, 42% in Europe, and a more modest 14% in the US.

Other Greentech industries include wind farms and solar power, and the development of batteries to store the power generated by these intermittent sources of energy — the wind doesn’t always blow and the sun doesn’t always shine — while comparatively the demand for electricity is more constant.

Wind energy accounted for some 8.8% of total electricity generation in the US in 2020, according to the US Energy Information Administration (EIA), while solar energy contributed a lesser 2.3%. Together they provided some 10% of all electricity generated in the US. The EIA predicts the share of all renewables (i.e. including hydro) in the US electricity generation mix will double from the current 21% to 42% by 2050, with wind and solar driving much of that growth.

Hydrogen, another key aspect of Greentech, could potentially help meet a non-negligible 14% of US energy demand by 2050, according to the Fuel Cell & Hydrogen Energy Association.

While much of the attention garnered by hydrogen has focused on transportation applications — cars, heavy trucks, locomotives, ships, even planes — a number of technological hurdles to realise that potential still need to be cleared. However, there are currently feasible applications in oil refining (as a substitute for natural gas) and steelmaking (as a substitute for coking coal) that are already attracting considerable investment by industry majors.

Cement manufacturing and steel production are the two largest industrial sources of GHG emissions. Engineered wood, another greentech product, is being used to replace both of these materials in the construction of larger buildings — one built in Norway rises 18 stories.

Some Greentech solutions, such as recycling robots, also tackle waste management. These have become increasingly popular after China banned the import of plastic waste in 2018 following three decades of importing close to half of the world’s recyclable plastic waste.

"Some Greentech solutions, such as recycling robots, also tackle waste management"

This ban has provided the impetus for innovations elsewhere in the world that can efficiently process this waste in place of China. For example, artificial intelligence robots are able to not only sort rubbish but also extract recyclable components from it and assess their purity — valuable data to have in order to recycle these materials efficiently.

Agritech and foodtech

Food development and delivery solutions spanning a range of activities from farm to table.

Agriculture has already benefitted from the growing adoption of soil-friendly techniques such as no-till farming and cover cropping. GPS technology has enabled more precise land management and reduced input usage (fertilisers, pesticides, and fuel). But the industry remains one of the largest sources of GHG emissions.

Technology solutions in this field can potentially address all four of the threats outlined above while tackling the challenge of feeding a growing world population. Since the 1950s, consumption of protein in China has grown by five times while the country’s population has doubled. Agritech and foodtech can be leveraged to produce protein foodstuffs in a sustainable manner.

Agricultural innovations, such as the development of vertical farming, a reengineered farming process using stacked production systems, may permit the same or greater production of some foodstuffs on drastically less land. Moreover, this type of farming can be employed in closer proximity to cities, reducing the need for transport. Technologies that enable cultivation with less water can also help to mitigate water scarcity, while hydroponics use little to no soil.

Foodtech has fostered the development of plant-based products, which directly reduce GHGs (cattle produce a significant amount of methane), as well as the creation of protein sources via processes that use much less water. The United States Geological Survey estimates that the production of a hamburger weighing a quarter pound (113 grams) requires 460 gallons of water (some 1,750 litres). Alternative sources of protein can require only half as much.

460 gallons

Amount of water required to produce a quarter pounder burger

Other aspects of foodtech such as food traceability for just-in-time delivery can lower inventories, thus reducing waste and GHG emissions. The World Wildlife Fund estimates that one-third of food ends up as waste, and as it rots, it produces methane.

Agritech can also foster social progress to the extent that more efficient farming practices can help raise farmers’ standards of living, particularly in developing countries, and in the process enable family planning and reduce the pressure to migrate.

Fintech

Development of applications that can empower economically “unbanked” populations.

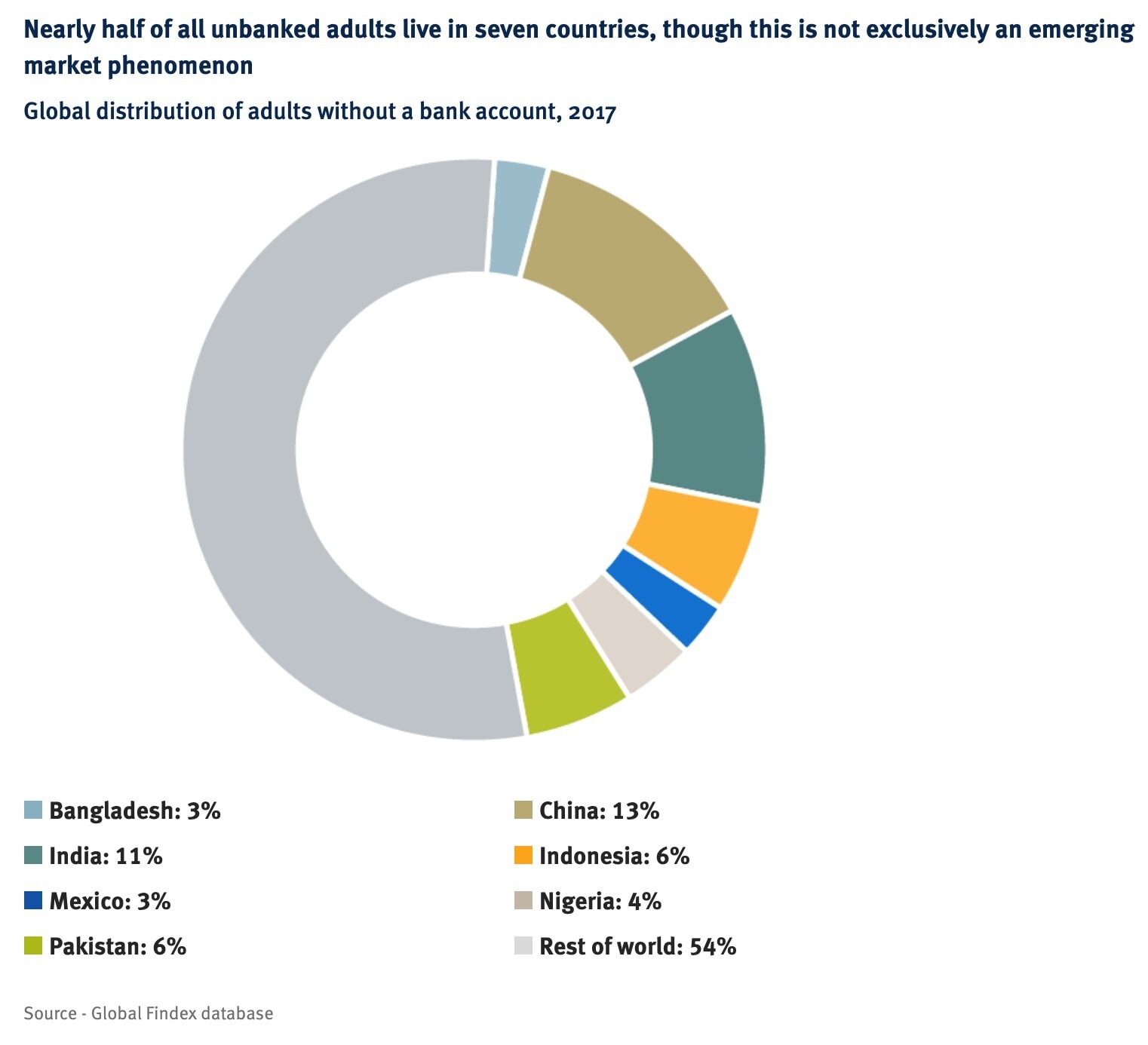

According to the World Bank, in 2017 just over 1.7 billion people in the world were unbanked, i.e. no access to financial services. While that number most likely has come down, the issue is particularly acute in low-income countries. But richer nations are not spared entirely. According to the Federal Deposit Insurance Corporation, as of 2019, 7.1 million households remained unbanked in the US, representing a non-negligible 5.4% of the country’s households.

Nearly half of all unbanked adults live in seven countries, though this is not exclusively an emerging market phenomenon.

FinTech solutions, including blockchain and emerging digital payment systems, are among the new technologies that can improve access to banking and credit. One example is the M-Pesa text message-based payment system initially launched in Kenya in 2007.

The service allows the user to send and withdraw funds via basic mobile phones. By its 10-year anniversary, the service was used by 30 million customers across 10 countries, with over 95% of households in Kenya having at least one M-Pesa account. According to the World Bank, M-Pesa has advanced the financial empowerment of women, helping them gain control over their income, and fostered start-up businesses.

Healthtech

Development of devices, medicines, and systems to improve the quality of life.

Ageing societies, rising health care costs, and unequal access to health care are widespread problems. Where access to proper care is inadequate, it is often due to the lack of reliable diagnosis, and substandard equipment, medication, and/or doctors. By reducing costs and improving efficiencies, telemedicine and digital diagnostics can make some of these services more widely available.

The ability to remotely collect, read, and interpret data, and provide an expert diagnosis to a patient in an underserved community or rural area can go a long way to improving the living conditions for many, in both emerging and developed regions. In the latter, telemedicine practitioners are able to not only diagnose but also prescribe medication to patients due to the increased popularity of smartphones and wearables.

Remote surgery can improve access further to those living in remote areas. This involves using an internet-connected robotic system to perform increasingly complex surgical procedures. This technology can circumvent lengthy and costly transport by ambulance or helicopter, and in doing so may also speed up treatment.

Smart cities

Tackle climate change, freshwater shortages, waste management, and even foster social progress.

Smart Cities can help reduce the detrimental impact of urbanisation on the environment and improve the quality of urban life. These are cities in which infrastructure, utilities, services, homes, and more are connected via the Internet of Things and 5G and use artificial intelligence technologies to optimise the flow of goods and people. This connectivity enables cities to optimise waste management and water consumption. It can also facilitate more efficient traffic flow to enhance public safety.

"Smart Cities can help reduce the detrimental impact of urbanisation on the environment and improve the quality of urban life"

For example, many cities today already employ sensors on trash receptacles to alert authorities when capacity is reached, allowing the refuse collection fleet to be deployed more efficiently. And while artificial intelligence is already being used to manage traffic, with greater connectivity more progress is possible on this front.

Sensors in sewage systems can monitor water levels and alert managers to a potential leak, enabling them to redirect wastewater, if necessary, to prevent floods. Such technologies can prevent economic losses and help protect livelihoods.

Parking management solutions is another area that can bring added productivity. Some cities offer the option for people to reserve a parking spot at the same time as when they make an appointment or reservation, so they don’t have to waste time — and gas — looking for a parking space. If they see that no spot is available, they can adjust their plans accordingly to make more efficient use of their time.

Asia is leading the global race to create smart cities, with a number of high-tech hubs in China including Shenzhen, Shanghai, and Guangzhou, but the technologies are being increasingly adopted in the West. Singapore also ranks very highly on this front, thanks to integrating the Internet of Things into mobility and transport, health care, and public safety, combined with a highly digitised public administration.

Closing words

Over the next several months, we will cover each of these sustainable technology (SusTech) themes in more detail. As technologies emerge that make the world more sustainable, companies at the forefront of developing technology solutions to sustainability issues could represent interesting investment opportunities, in our opinion.

The companies and industries that revolve around innovations and new technologies can make for volatile investments. Implementing these themes can carry higher-than-average risk and should thus be viewed within the context of a well-diversified portfolio.

We believe that for investors who can withstand such a higher level of risk, the secular opportunities that emerge out of these themes could contribute to portfolio performance in the long term.

This article was written by RBC Wealth Management and originally published on the firm’s research and insights page, here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy