Staying ahead of megatrends is a crucial part of being a good investor. One emerging theme in the massive healthcare sector to focus on is telehealth, also known as telemedicine.

Telehealth is defined as the distribution of health-related services and information via electronic information and telecommunication technologies. It allows for clinicians to contact, care, monitor and provide advice to patients from a remote location.

Technology is improving lives in many ways and there have been a number of innovations in medical technology as it applies to devices, but the service side is relatively untapped.

Examples of telehealth include utilising mobile devices for food logs or medication notes, online patient portals, appointments and more with the goal of more accessibility, cost efficiency and convenience.

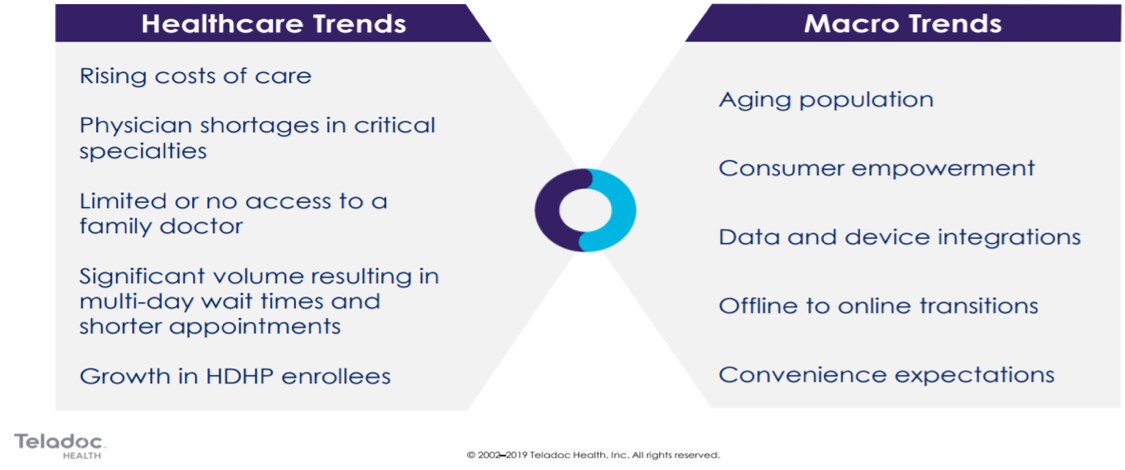

Forecasts show an increased shortage of doctors as well as increasingly long waiting times, two areas telehealth can help to address.

According to a 2013 Cisco global customer experience report, 74% of patients prefer easy access to healthcare services over in-person interactions with providers, indicating convenience is the key.

74%

of patients prefer easy access to healthcare over in-person interactions

Telehealth has the potential to improve engagement between patients and providers, improve healthcare maintenance, and, in some instances, avoid unnecessary and costly acute care settings, with estimated savings of more than $6bn annually to US companies, according to a Tower Watson report in 2014.

A burgeoning market

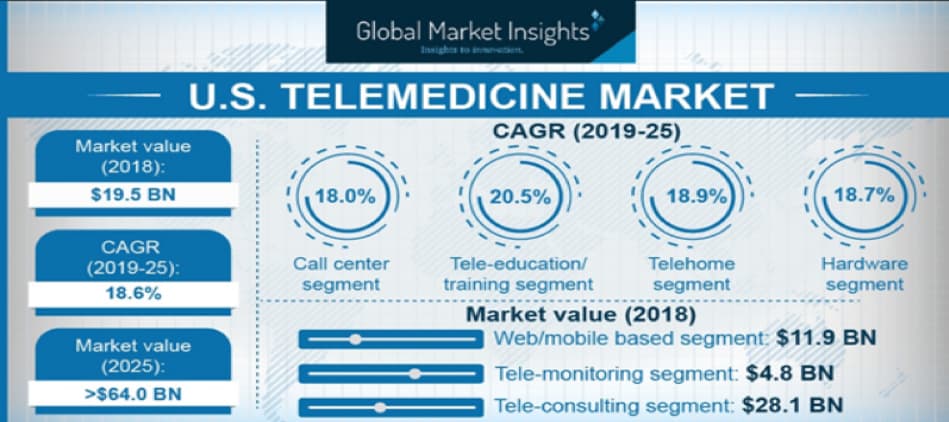

The telehealth market has started to surge in growth in the last two years and was valued at $49.8bn in 2018. It is expected to reach $266.8bn by 2026, according to Fortune Business Insights (other estimates predict to reach $130bn by 2025).

The industry is seeing a lot of growth in the number of new startups in the area, fueled by adoption in fields such as online consultation.

$266.8billion

Predicted valuation of telehealth market by 2026

The market is anticipated to grow by around 25% CAGR with 40% of that growth coming from the Americas and a key driver for the market is the increasing prevalence of chronic illnesses.

The combination of expanded penetration expanded services and an overall growing need for services makes it one of the most compelling areas to invest for the next five to 10 years.

A recent PwC survey found 51% of US physicians have adopted telemedicine technology just to stay competitive.

51%

of US physicians have adopted telemedicine technology to stay compeititive

Telehealth also had a demographic tailwind with more millennials turning to it as a more convenient and cost-effective means of care.

Telemedicine has faced reimbursement hurdles. However, US Medicare is starting to expand coverage and private insurers are being forced to follow suit.

There is also a major opportunity in behavioural health with the rising cases of mental illness, including anxiety and depression that could potentially be better addressed with virtual care.

According to a 2010 report by the Centers for Disease Control and Prevention, or the CDC, there are approximately 1.25 billion ambulatory care visits in the US per year, including those at primary care offices, hospital emergency rooms, outpatient clinics and other settings.

At an IBI Annual Forum in 2016, Virtual healthcare provider TelaDoc [TDOC] estimated that approximately 417 million, or 33%, of these visits, could be treated through telehealth.

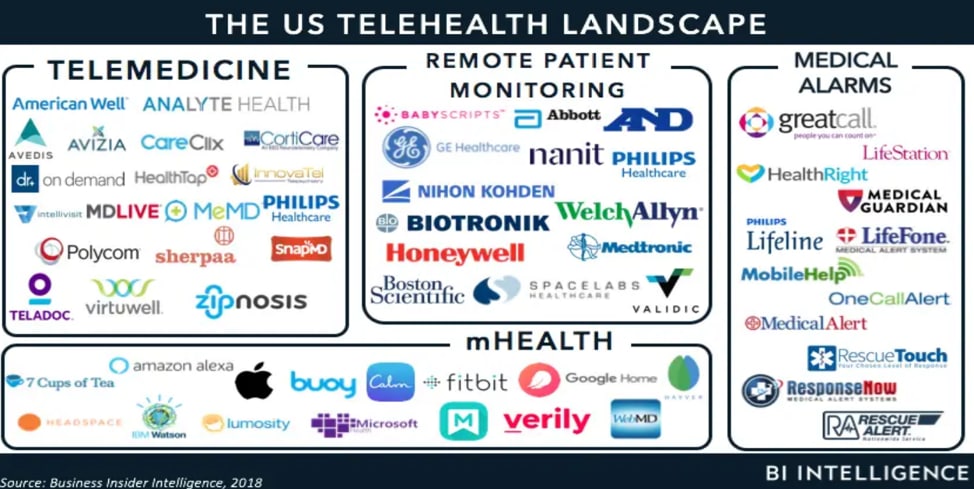

Below is a useful view of the telehealth landscape from Global Markets Insights that highlights the sectors involved across the industry and various segments. The trouble is most of the pure-play companies remain private at this point, although I expect to see plenty of IPO’s in the space over the next few years.

Telehealth startups set to float

There are a number of intriguing private companies to be aware of including American Well, GlobalMed, Dictum Health, InTouch Health, Doctor on Demand, MDLIVE, Encounter Telehealth, HelloMD, iCliniq and SnapMD.

Cigna [CI], a managed care insurance provider, invested $50m in MDLIVE back in 2018, with Anthem [ANTM], another provider of healthcare insurance, also investing $59m in a strategic partnership with American Well.

Seeing investments like this as well as CVS Health [CVS] teaming up with American Well, TelaDoc and Doctor on Demand validates the sustainability of this megatrend.

I expect there to be plenty of more companies in the telehealth space to go public in the next few years and anxiously await more investment opportunities. This period of time is something that could detract from the value scarcity that TelaDoc currently has, which sustains its premium valuation multiple as one of the few avenues to invest in an emerging megatrend.

“I expect there to be plenty of more companies in the telehealth space to go public in the next few years and anxiously await more investment opportunities”

The telehealth stocks to watch

TelaDoc is the most notable pure-play that is publicly traded, the $5.6bn – as of 22 November stock price – provider of virtual healthcare services has seen shares rise to $80 this year from just $10 in 2016.

The US-based telehealth company trades 10 times enterprise volume to sales with annual revenues growing 77.8%, 59.2%, 89.4% and 79.1% respectively in the last four years. As it stands, 2019/2020 estimates for growth sit at 31.2% and 25% respectively.

Profitability is a few years away, however, making Teladoc a name with plenty of doubters, as can be seen with the 37.8% of its float short – a figure that is hitting new highs along with its share price.

As a provider of high-quality video conferencing equipment that clinicians and patients can use with telehealth, Zoom Technologies [ZM] is an ancillary way to play this theme. Zoom is trading at an extremely high valuation of 31.5 times enterprise value to sales ratio with rapid revenue growth.

The enterprise networking service company is far from a pure-play and needs to come down to a cheaper valuation, but telehealth can be an important driver of growth in the coming years.

Catasys [CATS], a $250m provider of big data predictive analytics, also has a solid connection to telehealth.

The California-based company trades at just 7.3 times enterprise value to sales ratio, with revenues growing 96.7% in 2018 and estimated growth of 129.6% in 2019 and 146% in 2020. It is targeting behavioural health and estimates its total available market at $33.7bn.

Catasys uses machine intelligence to deliver analytics to managed care companies to identify and recommend care to candidates for medical or behavioural intervention.

In closing, although there are not a lot of ways to invest purely in the telehealth theme at this time of writing, it is an important megatrend seeing rapid growth and an expanding market.

There are likely to be more public companies in the space in the coming years to allow for better participation in the theme, but for now, TelaDoc is the single best way to participate.

“Although there are not a lot of ways to invest purely in the telehealth theme at this time of writing, it is an important megatrend seeing rapid growth and an expanding market”

By Joe Kunkle, who is the founder of Options Hawk, a service that provides news, analysis and option movement research. Alongside this, he runs his personal trading account and is head research analyst at investment firm Relativity Capital.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy