Darktrace’s IPO will be London’s first major listing since Deliveroo’s [ROO] disappointing public debut. The Cambridge-based cybersecurity company is looking to list on the London Stock Exchange in a move that could value it at £3bn, the Financial Times reports.

Unlike Deliveroo [ROO], Darktrace will list on the premium segment of the LSE, making it eligible for FTSE indexes. Deliveroo’s decision not to list in the premium segment was one of the reasons ETF buyers avoided buying the stock.

"Our intention to list on the London Stock Exchange marks a major milestone in Darktrace's history of rapid growth, and a historic day for the UK's thriving technology sector,” said Darktrace chief executive Poppy Gustafsson.

“Our intention to list on the London Stock Exchange marks a major milestone in Darktrace's history of rapid growth, and a historic day for the UK's thriving technology sector” - Darktrace chief executive Poppy Gustafsson

Why should investors care about Darktrace’s IPO?

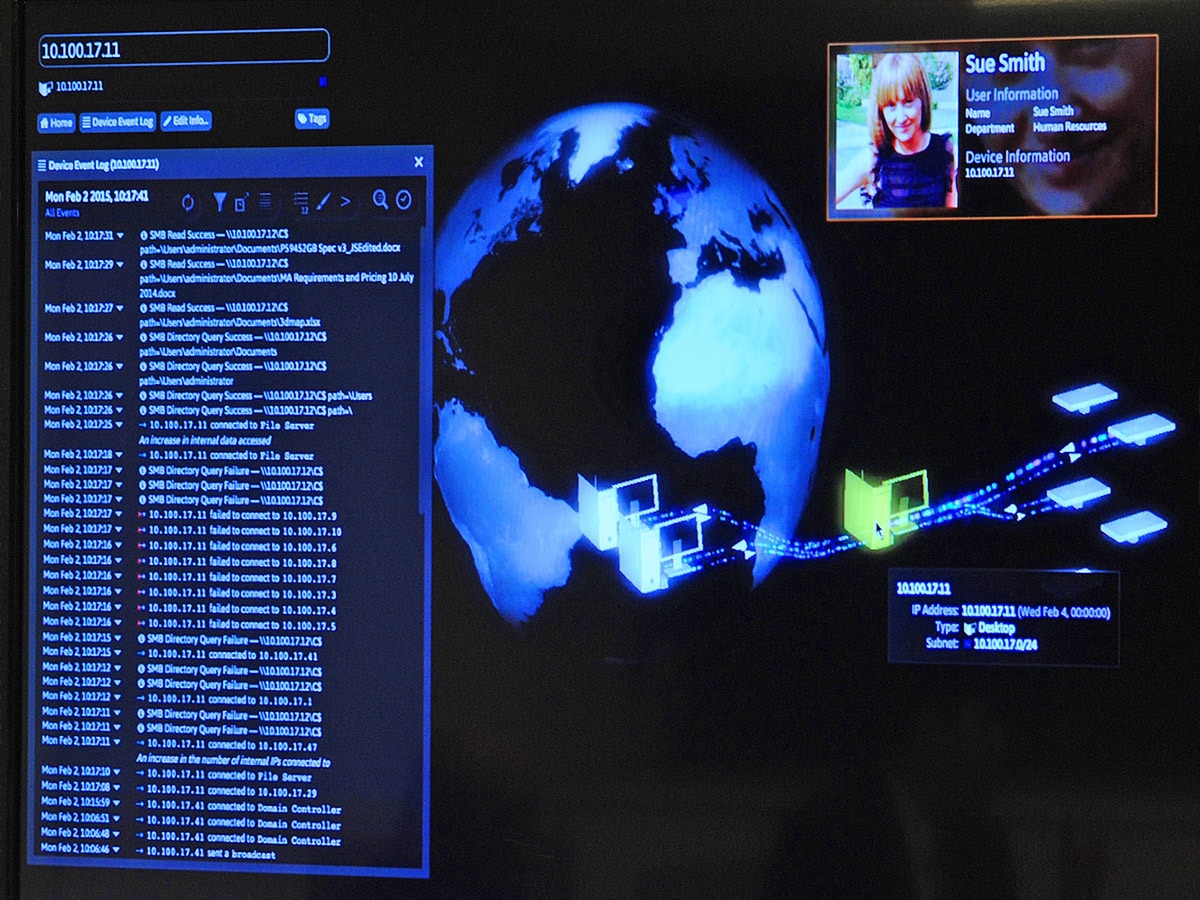

Darktrace, which uses AI to detect potential cyber threats, saw its revenue increase 45% year-on-year to circa £200m in its latest financial year. While impressive, that growth rate is lower than the 73% jump seen in the previous year. One explanation is that the pandemic has put a dampener on the B2B sales the company relies upon.

To keep Darktrace’s growth momentum going, money raised through a listing will go towards marketing and expanding its 5,000 strong client base, which includes the NHS and Coca-Cola [KO]. Alex Webb, writing in his Bloomberg opinion column, notes that Darktrace seems to be mimicking the tactics of big US SaaS outfits like Salesforce [CRM], where huge amounts are spent to market heavily to early adopters.

£200million

Darktrace's revenue in last financial year - a 45% YoY rise

According to Webb, Darktrace spent 82% of sales revenue on marketing, while only 6% is allocated to R&D — the company’s cybersecurity peers usually spend 25% on this area. This shows a company that is eager to grow, but investors will want to be reassured that it won’t get left behind in a cybersecurity arms race.

One dark cloud is speculation that Darktrace has chosen to list on the LSE due to its association with Autonomy co-founder Mike Lynch. Lynch is fighting extradition charges to the US over the $11bn sale of Autonomy to Hewlett Packard [HPE] in 2011 — he is accused of inflating the value of Autonomy’s price.

Lynch’s Invoke Capital was Darktrace’s first and biggest backer. In 2018, Lynch stepped down from the Darktrace board and last year the company used a $127m loan to reduce Invoke’s holding.

Darktrace’s IPO and the cybersecurity investment theme

Darktrace would naturally fit into the cybersecurity investment theme, which has seen a circa 53.25% gain over the past year and 6.50% in the past month, according to our thematic performance screener.

Cyberattacks have been on the rise. In 2020, the World Health Organisation reported a five-fold increase in cyberattacks since the pandemic started. A recent New Yorker story revealed North Korea’s cyber forces have made off with billions through schemes like cryptocurrency thefts.

In the corporate sector, 55% of CEOs plan to increase their cybersecurity budgets in 2021, according to a survey by PWC.

An August 2020 report from Interpol predicted that cyberattacks will only continue to increase in the near future, as vulnerabilities related to home working will see “cybercriminals continue to ramp up their activities and develop more advanced and sophisticated modi operandi.”

In an interview with TheGuardian, Gustafsson underlined that the future of cybersecurity wouldn’t be “Terminator-style robots out shooting each other” but small pieces of code exploiting everyday objects, such as the chipset in an electric car.

“I really don’t think it’s very long until this [AI] innovation gets into the hands of attackers, and we will see these very highly targeted and specific attacks that humans won’t necessarily be able to spot and defend themselves from,” Gustafsson told The Guardian.

“I really don’t think it’s very long until this [AI] innovation gets into the hands of attackers, and we will see these very highly targeted and specific attacks that humans won’t necessarily be able to spot and defend themselves from” - Poppy Gustafsson

As concerns over cybersecurity have grown, so have the share prices of major companies in the sector. Cisco’s [CSCO] share price has gained over 18% so far this year (as of 21 April’s close), while Accenture’s [ACN] share price is up 13.36% in the same timeframe.

Darktrace could be well-positioned to benefit from the growing need for advanced cybersecurity. On its advisory board sits former home secretary Amber Rudd, former MI5 director general Lord Evans of Weardale and ex-CIA senior officer Alan Wade, which bode well for a firm in this area. The big test will be the company’s first set of results as a publicly-traded company.

This will give investors a sense of how well its business strategy is performing and whether it is still experiencing the “rapid growth” Gustafsson mentions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy