Cathie Wood, Founder, CEO and Chief Investment Officer of ARK Invest, discusses how the firm is set up to capture the most disruptive technological trends, as well as to provide investors with targeted, diversified exposure to these, as a hedge against volatility elsewhere in their portfolios.

When Wood explained to a friend outside the investment industry why she needed to start ARK Invest, their response was, “So you mean the future of investing is investing in the future?”

Wood believes that this is a very apt description of ARK’s approach and philosophy.

“We’re the closest you’ll find to a venture fund in the public markets,” says Wood. “We're talking about the way the world is going to work, not the way the world has worked.”

ARK’s approach is centred on disruptive innovation.

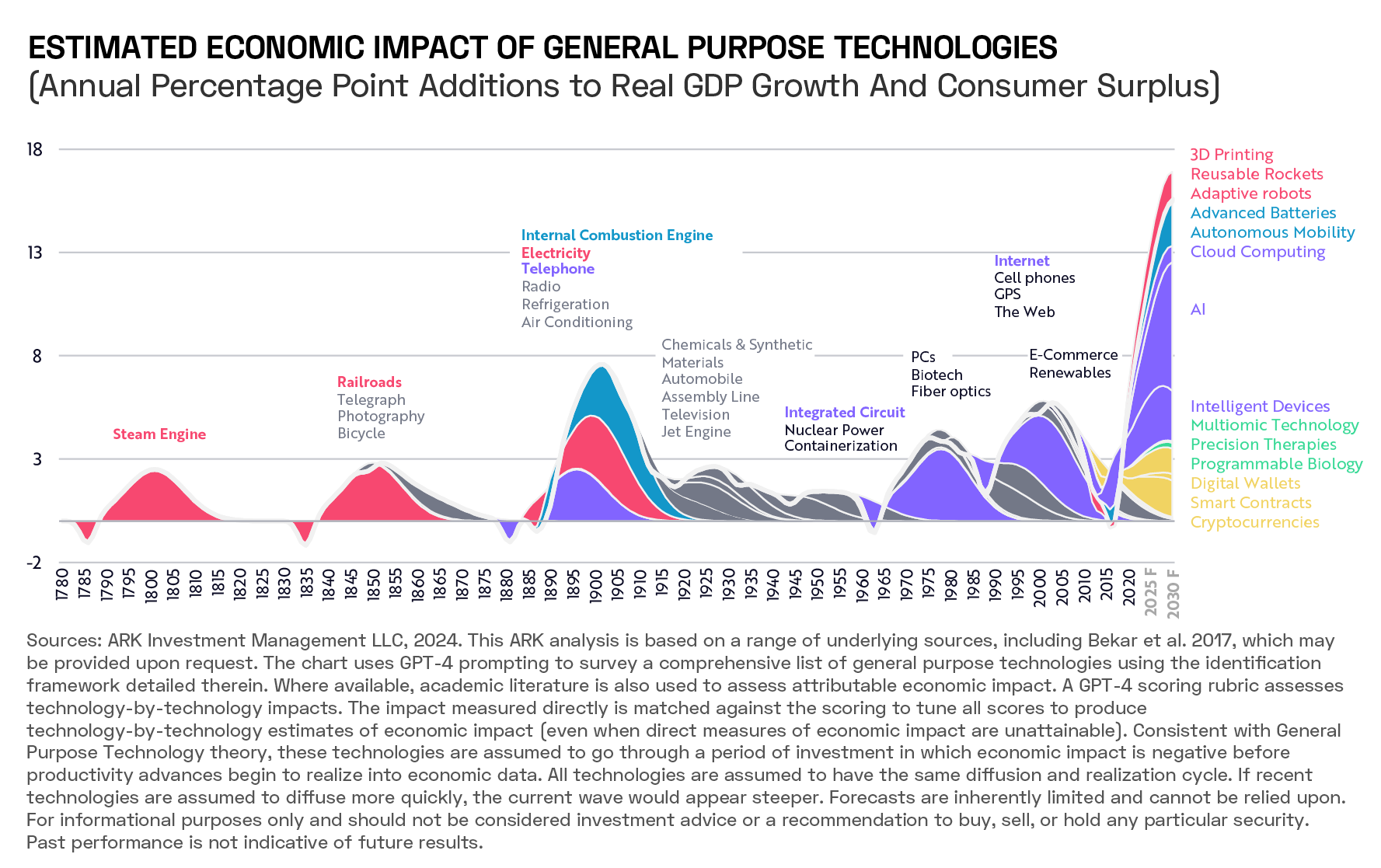

Its ‘Big Ideas 2024’ report, released in January, outlines how five major technology platforms — artificial intelligence (AI), public blockchains, multiomic sequencing, energy storage and robotics — are evolving in tandem and converging with one another.

In the process, they are completely changing the world.

You need to familiarise yourself with technological disruption, says Wood, “not just because of your investments, but because of your life.

“The world is going to transform so completely, we think, during the next five to 10 years, because of these five platforms evolving at the same time that you’re not going to recognise it.”

Tech Specialists

Given the central role that technological innovation plays in ARK’s strategy and the importance of understanding these nascent, complex technologies, ARK’s team is constructed in such a way that specialised experts are front and centre.

“We’ve set up our research department so that our analysts’ responsibilities are organised by technologies. They’re tech specialists, sector generalists,” says Wood.

Putting technological specialists in charge of targeted portfolios means that ARK can provide focused exposure to the most disruptive forms of innovation.

“Our portfolios don’t look anything like the broad-based indices. The overlap is 5%, maybe 8% tops,” says Wood.

This means ARK offers over 90% diversified exposure to what Wood calls “truly disruptive innovation”, as opposed to indices, which typically have a backward- rather than forward-looking setup.

“The big broad-based benchmarks are made up of companies that have been very successful historically but may be disrupted” going forward, she says.

For this reason, ARK’s products can be used by investors as an effective hedge against volatility elsewhere in their portfolios.

ARK’s Products

ARK’s flagship fund is the ARK Innovation ETF [ARKK]. Top holdings as of 22 February include Coinbase [COIN], Tesla [TSLA] and Roku [ROKU]. In the 12 months to 22 February, ARKK has gained 16.5%.

Advances in biotech are captured by the ARK Genomic Revolution ETF [ARKG], though Wood hints that the fund might be due a name change in the near future to reflect the fact that it now focuses on far more than gene (i.e., DNA) editing; ARK’s ‘Big Ideas 2024’ report mentions “DNA, RNA, proteins and more” as areas addressed by the theme of ‘precision therapies’. The fund’s top holdings include CRISPR Therapeutics [CRSP], Exact Sciences [EXAS] and Recursion Pharmaceuticals [RXRX]. ARKG has slid 3.6% over the past 12 months.

The ARK Autonomous Technology and Robotics ETF [ARKQ], which Wood says is focused on autonomous taxi platforms, robotics and 3D printing, holds stocks such as Tesla, Kratos [KTOS] and UiPath [PATH]. ARKQ has gained 10.2% over the past 12 months.

Wood points out that crypto and blockchain currently comprise an “important subset” which “may absolutely take over in the long term” when it comes to the ARK Fintech Innovation ETF [ARKF], which focuses on innovations in financial technology. Top holdings include Coinbase, Shopify [SHOP], and Block [SQ], and the fund gained 47.2% over the past year.

The Next Generation Internet ETF [ARKW] holds stocks that benefit from disruption to internet infrastructure, in fields such as cloud, mobile, social media and the internet of things. In Wood’s words, this fund “is focused on AI and blockchain heavily”. Top holdings include Coinbase, Block and Roku. ARKW has gained 42.1% in the past year.

Finally, the Space Exploration ETF [ARKX] — which Wood says is “even more out there, in outer space” — focuses on space exploration stocks such as Trimble [TRMB], Kratos and AeroVironment [AVAV], and has gained 4.8% in the last year.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy