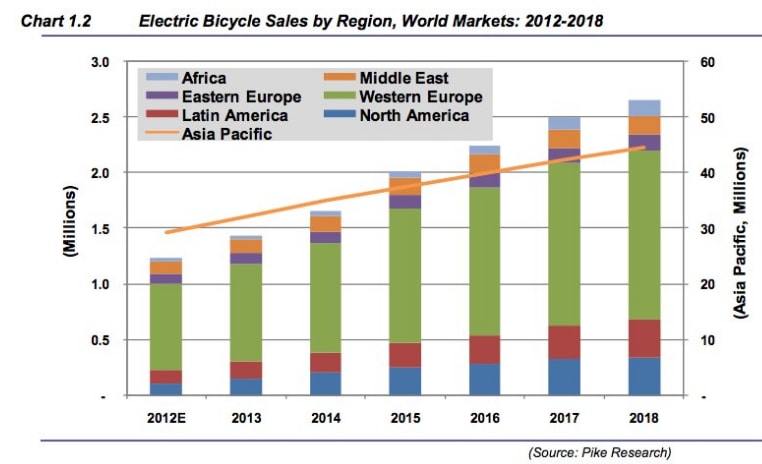

E-bikes have been around for a long time, but the last few years have seen exceptionally strong sales growth in Europe and Asia. Now, the US is following suit, partially due to the coronavirus pandemic accelerating a number of trends favourable to the space.

An e-bike, also known as electric bicycle, is a bicycle with an electric motor that can either assist the rider’s pedal-power or move the bike entirely on its own. Electric bicycles use rechargeable batteries to power the motor, do not emit CO2, and travel at speeds ranging from around 15 to 30 mph.

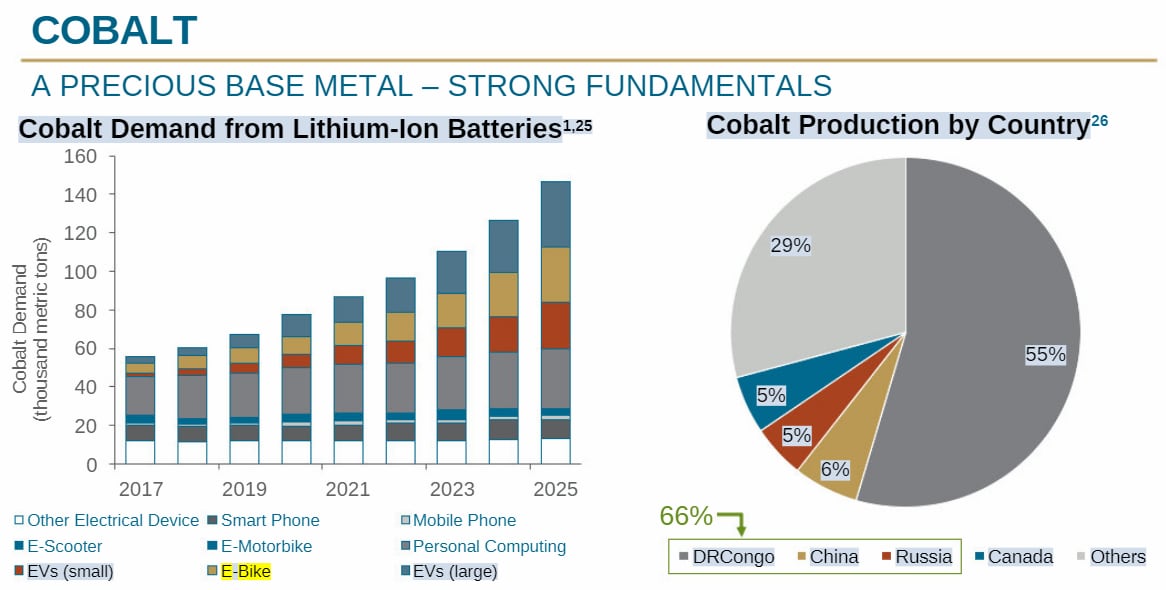

Electric bikes mainly use Li-ion chargeable batteries, and can travel up to 168 miles, depending on the bike, in one single charge — although the possibility of fuel-cell-powered e-bikes is on the horizon.

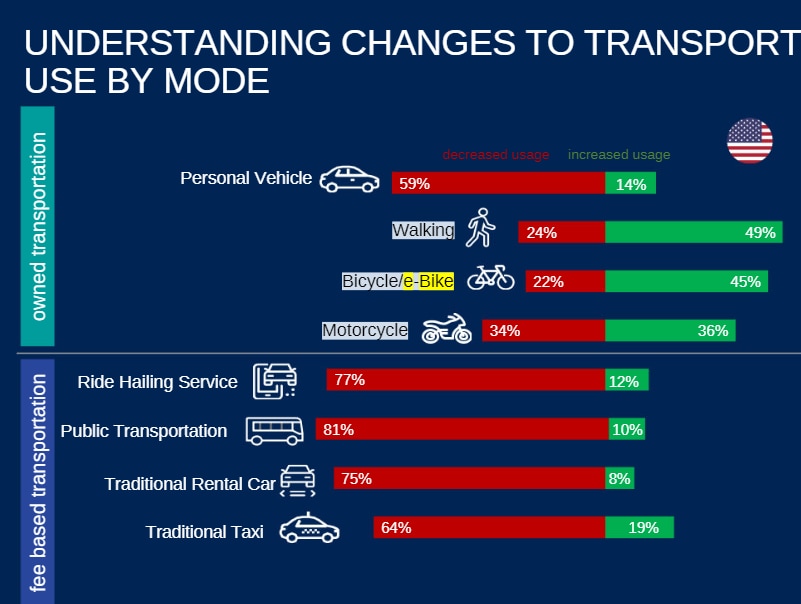

Throughout the coronavirus pandemic, people’s travel needs have been restricted closer to home and we can see that cycling has become increasingly popular.

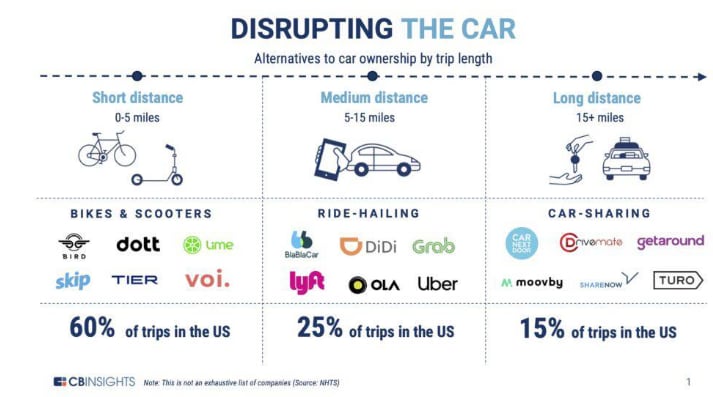

E-bikes are gaining traction across the board: for recreational use, as an alternative mode of commuting, and for couriers and delivery drivers. There are a number of advantages to rising e-bike usage: they are better for the environment, cheaper than other means of transportation, reduce traffic congestion, have low maintenance and are easy to store or transport.

With people avoiding other public transport methods due to health concerns during the pandemic, e-bike usage has seen a substantial uptick. State subsidies are also boosting business: concerns regarding rising global emissions have prompted government support in countries around the world, a trend unlikely to change in the near-term.

The global electric bicycle market is expected to reach $21bn by 2024, growing a 12.5% CAGR, according to an average of various market research reports. This growth is expected to be supported by a rising consumer preference towards recreational and adventure activities —something I’ve written about previously. The e-bike market in North America is projected to be the fastest-growing, at a CAGR of 19.77%.

Other factors, such as logistics and rental services, are also supporting growth. The versatility of these bikes means they have a lot of consumer appeal for both recreational and fitness activities. E-bikes are also handy when it comes to taking to short trips, whether that be commuting or shopping.

The market is also seeing strong growth in high-performance e-mountain bikes, and continuous innovation and improvement in technologies will make e-bikes even more appealing to consumers. There have already been breakthroughs in Lithium-Ion battery technology allowing for lighter, more efficient bikes with a greater travel range.

I also expect connectivity and integration of performance tracking to support the appeal of these new bikes. We are already seeing predictive analytics, 3D-printed parts, electrification and wireless connectivity advancements making the bikes safer, faster and more convenient.

E-bikes are also less intimidating thanks to the pedal-assist, resulting in less sweating and energy expenditure for those wanting to commute to work. With the majority of Americans commuting for around 26 minutes, this makes the bikes a viable option. In terms of safety, the bikes also have high-powered LED lights for night-riding, and can be locked, secured, and tracked via apps.

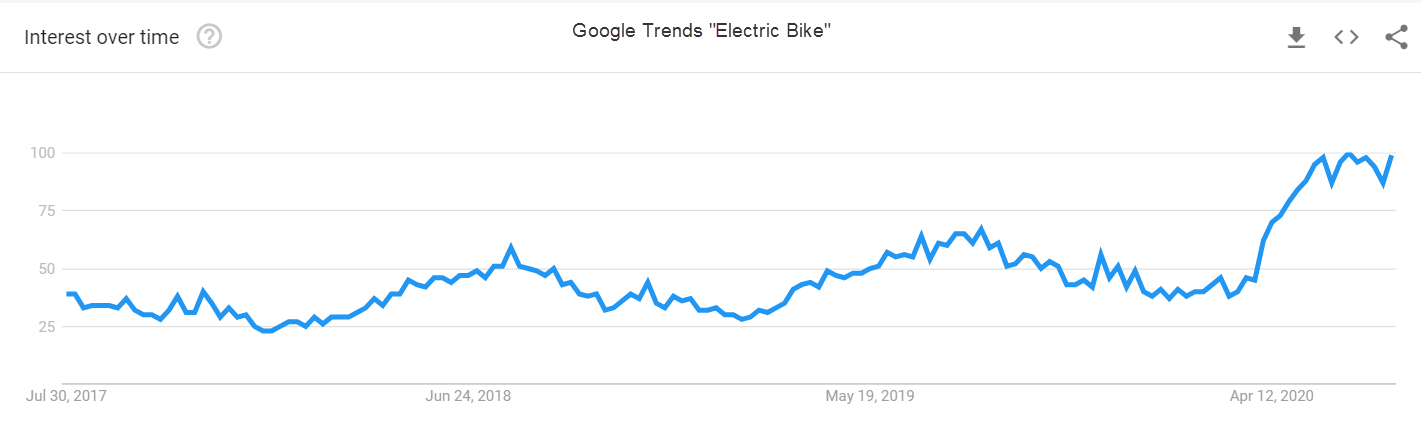

This chart from Google Trends demonstrates increased interest in electric bikes, peaking during the lockdown months.

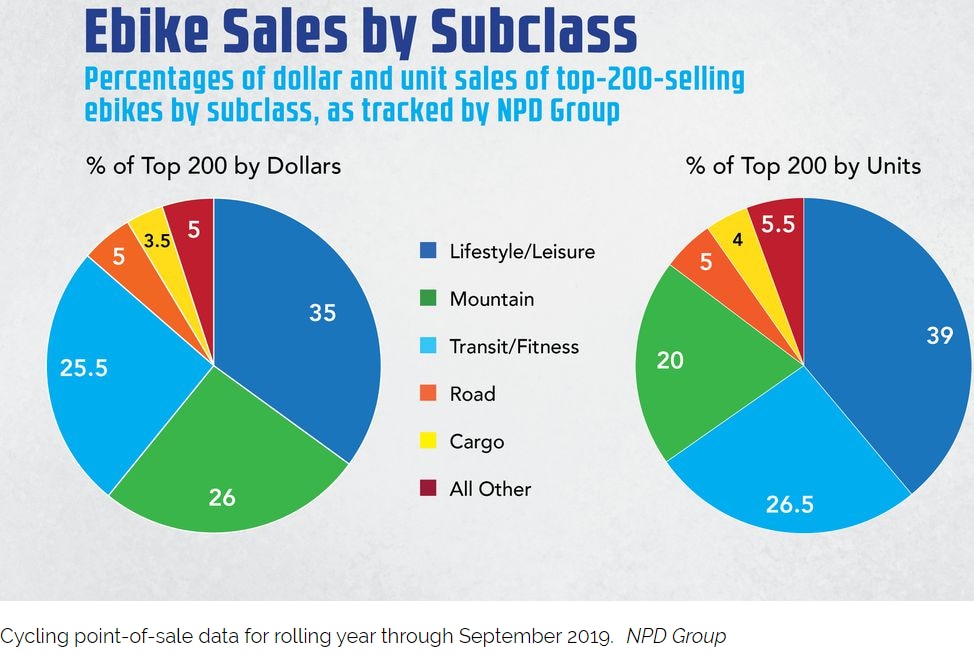

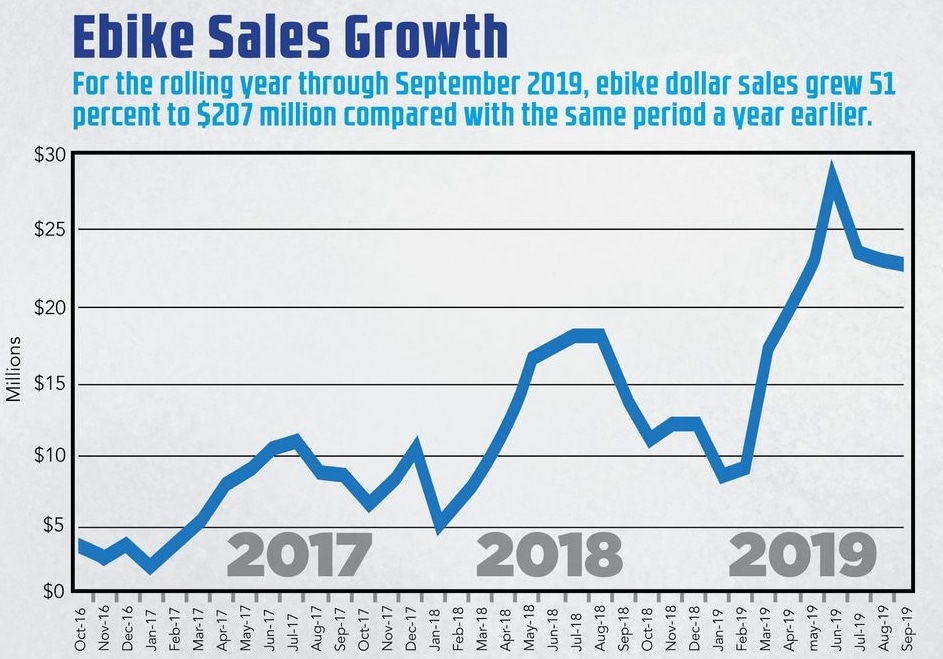

The European and Asian markets have already seen significant adoption, and now the North American sales surge suggests the trend has crossed the Atlantic. Market research group NPD recently noted that US retail sales of e-bikes rose 84% in March, 92% in April and 137% in May.

Bosch eBike Systems has also noted that customers in the US are setting sales records — and it expects the trend to continue, with the bikes providing an ideal solution for individual transportation well beyond the coronavirus pandemic. A few notable US e-bike companies have also reported solid numbers; Aventon Bikes saw a 600% increase in bike demand in June, while Rad Power Bikes says demand was up nearly 300% in mid-May.

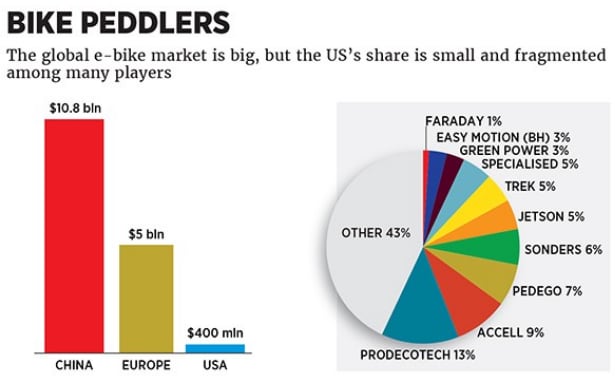

The e-bike market is highly fragmented, with the major players holding a relatively low share of the total market. Some of the major market players are Giant Bicycles, a Giant Manufacturing Co [9921.TW] brand, Merida [9914.TW], Trek Bikes, Riese & Müller, and M1 Sporttechnik.

Because of this, there are not a lot of pure-play ways for investors to participate in the growth trend. We may see consolidation and IPOs among some of the smaller private companies in the next few years, which would offer investors more options.

For now, there are still a few ways to get in on the e-bike trend, which also applies closely to the growing e-scooter market as well: looking at manufacturers, battery providers, and those creating sharing networks.

Who are the bike makers?

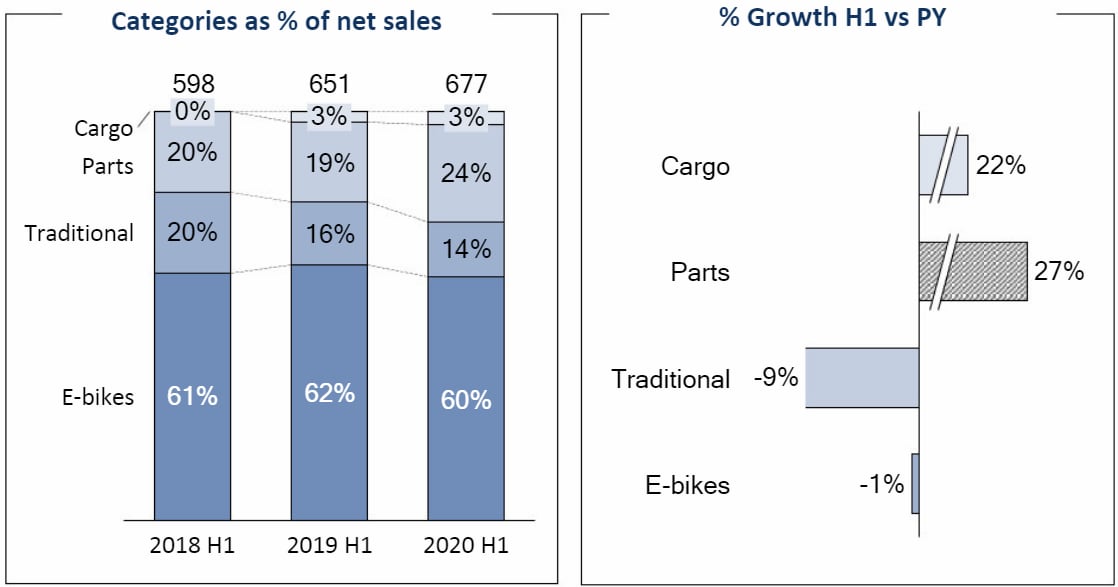

Accell Group [ACCEL]is a Netherlands-based bicycle company that recorded revenues of $1.2bn in 2019. Its bicycle brands include Atala, Babboe, Ghost, Haibike, Nishiki, Raleigh and Sparta, among others. In June, it launched its next-generation e-cargo bike: Carqon.

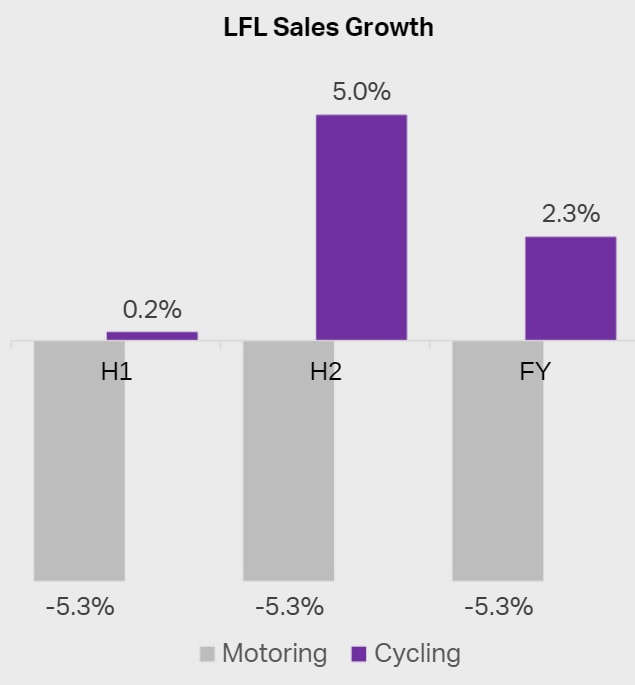

Halfords Group [HFD]is a British retailer of car parts and tools, camping equipment and bicycles. In fiscal year 2020, it reported revenues of $1.15bn, and its latest update showed growth in the cycling segment.

Giant Manufacturing [9921:TW] is a Taiwanese bike producer, and is considered the world's largest bicycle manufacturer. It expects $2.33bn in revenues in 2020, up 13.5% year-on-year.

Merida Industry [9914:TW] is another Taiwan-based maker of bicycles, with revenues expected to come in at $1.06bn in 2021, up 14.2% year-on-year.

BYD Co [1211:HK] is a Chinese maker of automobiles, battery-powered bicycles and other means of transportation. BYD expects $19.95bn in revenues in 2020, up 13.2% year-on-year.

Uber [UBER] and Lyft [LYFT] are both worth a quick mention here, owing to their respective e-bike sharing initiatives.

Who makes the components?

Shimano [7309:JP] is a Japan-based maker of bicycle components, which expects $3.2bn in revenues in 2020, up 3.6% year-on-year.

Fox Factory [FOXF] is a small-cap name that makes various components for outdoor recreation. Forty percent of its sales are tied to bike components.

Vista Outdoor [VSTO] makes a variety of outdoor products and, while the brand is more closely tied to the hunting space, it does produce bike helmets.

Allegion [ALLE] is a maker of a variety of doors and locking components, and owns the Kryptonite lock brand.

G4S [GFS:LN] is a security company that’s seeing growth in its tracking systems for e-bikes.

MIPS AB [MIPS], a global helmet manufacturer, has seen a recent surge in demand for bike helmets in the US and Europe.

Thule Group [THULE], a Swedish maker of cargo accessories, has noted that e-bikes require higher quality bike racks because they are heavier than regular bikes. It's seeing strong demand for these solutions.

Invacare [IVC] was an intriguing discovery for me. The company is better known for its exposure to the Healthcare industry as a distributor of wheelchairs and mobility scooters, but it also makes e-bike drive systems.

Rheinmetall AG [RHM] is a defence contractor that makes support systems for e-bikes to improve propulsion.

Continental AG [CON] is a worldwide leader in tyres, and the firm has noted strong demand for e-bicycle tyres.

Looking to the suppliers

Another way to play the overall electrification and battery trend is via the suppliers. AlbeMarle [ALB] is the leading supplier of lithium, while its competitor, Sociedad Minera [SQM], is also worth keeping an eye on. Lithium Americas [LAC] is a small lithium exploration company.

On the battery side, Livent [LTHM] is a smaller producer of lithium-based batteries. There is also the The Global X Lithium & Battery Tech ETF [LIT], that covers the sector more broadly. Precious metals streaming company Wheaton Metals [WPM] has exposure to Cobalt and is seeing strong demand for Lithium-Ion batteries.

O2 Micro [OIIM] is a small and speculative company with a market cap of $81.55m and a patented lithium-ion cell balancing methodology. It reckons its technology could find a use case with major OEMs in everything from e-bikes and e-vehicles to vacuum cleaners, power tools and energy storage systems. It recently noted: “While we believe each of these market areas will continue to expand long term, we are seeing the e-bike market now show significant expansion in countries recovering from COVID-19 as people turn more to bikes for travel and recreation.”

Johnson Matthey [JMAT] makes battery materials, and is seeing continued momentum in Fuel Cells and Battery Systems for e-bikes.

The e-bike of the future may well utilise hydrogen fuel-cells, which can provide longer ranges and faster refuelling. A few names to watch in this fuel-cell industry include Plug Power [PLUG], Ballard Power [BLDP] and Bloom Energy [BE].

Future tech: chips and sensors

There are a number of chip companies that are likely to have some exposure to e-bikes in the future but a few that stood out based on recent commentary include ST Micro [STM] as a maker of battery design systems, Power Integrated [POWI] as a power supply chip-maker, and Diodes [DIOD] and Methode Electronics [MEI] for sensors and connectors.

In my view, the e-bikes segment is just starting a longer-term cycle of growth, and there will be plenty of beneficiaries. I am certain the list above is not complete, and I'll keep researching and paying attention to commentary in this exciting market.

By Joe Kunkle, who is the founder of Options Hawk, a service that provides news, analysis and option movement research. Alongside this, he runs his personal trading account and is head research analyst at investment firm Relativity Capital.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy