iShares highlights three international markets it believes will deliver outsized returns, while Lombard Odier emphasises the divergent fortunes within emerging markets. At the forefront of these trends are blossoming technology sectors in both India and Brazil, with fintech being a key sector in both markets.

- iShares reports on three trends driving Mexican equities this year.

- Brazil drops interest rates by 50 bps two months in a row, as inflation eases.

- India’s Paytm recently reported revenue was up 39% year-over-year; its share price is up 78.5% year-to-date.

In its October report ‘Three International Opportunities Worth Considering’, iShares picked out Japan, India and Mexico as potential high-growth markets.

According to the report, Japan is witnessing a comeback, with $5.7bn inflows into Japan ETFs through August this year and the Nikkei 225 trading at its highest level in over 30 years. Equity market reforms, leadership in high-tech supply chains, and a high-profile visit by Berkshire Hathaway [BRK-B] CEO Warren Buffet have driven the country’s resurgence year-to-date.

India thematic ETFs have seen $2bn inflows in the year through August, according to iShares. Over the same period, the MSCI India Small Cap Index gained 25.9%, putting it “amongst the best-performing single country indices in the world in 2023”.

The Indian economy overtook the UK’s to become the world’s fifth-largest last year, with economists expecting it to be third (behind the US and China) by the end of the decade, according to S&P Global and Morgan Stanley. Global supply chain challenges are also playing into India’s hands, with government incentives for overseas manufacturers driving $6.5bn in investments during 2022, reported Reuters last April.

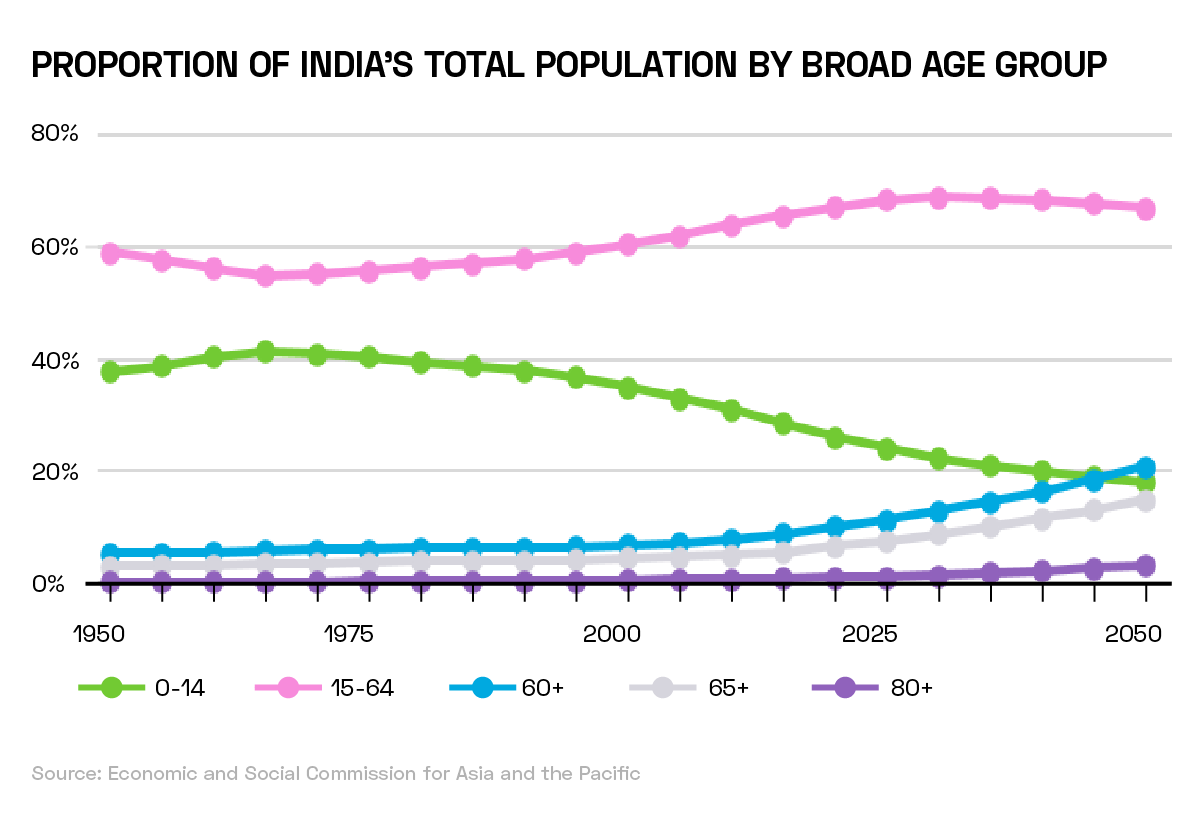

“We believe that investors should pay close attention to India's favourable demographic trends,” wrote Jeff Spiegel, Head of US iShares Megatrend and International ETFs, and Mark Orans, Senior Thematic Strategist, in the October report. Out of India’s population of 1.4 billion people — the world’s largest — over 970 million “fall within the prime working ages of 15–64, indicating a robust potential workforce”.

Additionally, iShares highlights India’s 432-million-strong middle-class cohort, “a formidable group of consumers”, of which Apple [AAPL] is taking note by opening its first physical stores in the country.

The MSCI Mexico IMI 25/50 Index gained 27.4% in the year through August, with the region’s equities having “had the strongest year of all”, according to iShares. This has largely been driven by “geopolitical fragmentation”. The report identifies three qualities that cement Mexico’s appeal to investors: its geographic proximity to the US; its participation in the USMCA free trade agreement, which reduces tariffs on trade between the US and its two neighbours; and the strength of its manufacturing base and labour force.

Brazilian Resilience

Swiss private bank Lombard Odier published a report in early October outlining the ways in which the opposition of Brazil and China exemplifies the divergent fortunes of emerging markets in the current climate.

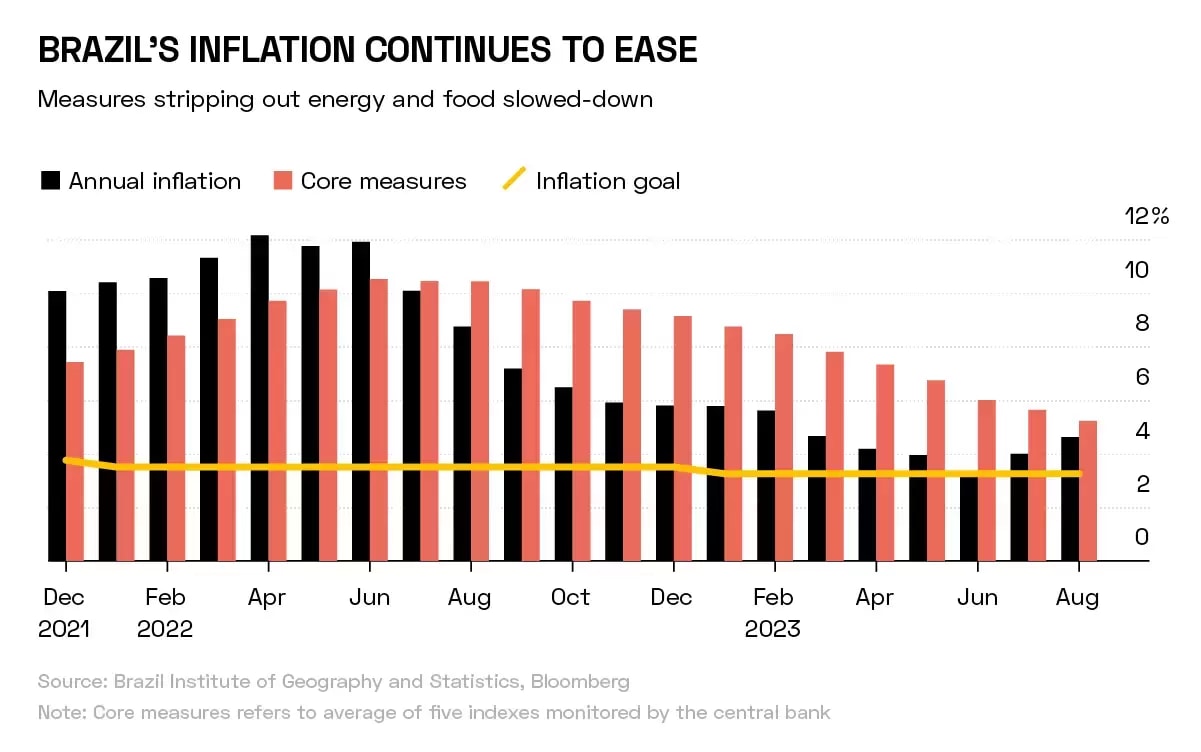

“China’s growth may slow to 5% this year and 4.3% in 2024, remaining between 2% and 4% in the decade ahead,” said the report, while “Brazil has positively surprised investors with a bumper harvest, improving economic growth, domestic reforms, falling inflation and interest rate cuts”.

Having begun hiking rates 12 months ahead of the US Federal Reserve, Brazil’s central bank surprised economists with an aggressive 50 basis-point cut in August. It repeated the cut in September, with board members announcing they expected the policy to continue in upcoming meetings.

“Consumer price inflation has fallen into the Banco de Brazil's inflation target range and it should gradually decline through 2024,” wrote Homin Lee, Senior Macro Strategist at Lombard Odier.

Paytm Cashes In

Among the tailwinds for Indian equities has been a governmental policy of digitisation, said Angus Shillington, Emerging Markets Deputy Portfolio Manager at VanEck, on an episode of the Opto Sessions podcast last month.

“Digitalisation means better connectivity with bank customers, better flow of credit to the bottom of the social pyramid,” said Shillington.

One of the frontrunners in India’s digital payments industry is Paytm [PAYTM.NS]. Paytm reported that revenue increased 39% year-over-year in its most recent earnings, alongside its third successive quarter of profits, despite rising labour costs and a lack of government incentives.

However, Paytm has attracted the ire of Indian regulators, with the country’s central bank issuing a fine of ₹53.9m for non-compliance with provisions including ‘Know Your Customer’ requirements, according to Reuters.

Elsewhere, Indian online food delivery service Zomato [ZOMATO.NS] launched a logistics service on 13 October that will offer retailers an intra-city delivery service for small parcels.

Bringing Fintech to LatAm

Brazil’s economic stability is another tailwind for its own fintech industry. Across Latin America, fintech grew from less than $50m in 2016 to $2.1bn in 2022, according to The Fintech Times. The number of fintech companies in Latin America and the Caribbean more than doubled between 2018 and 2021, according to the Inter-American Development Bank.

Microsoft’s [MSFT] March report ‘“We Have to Solve the Problem”: How Three Fintechs are Boosting Financial Inclusion in Latin America’ highlighted Brazilian fraud protection company ClearSale [CLSA3.SA] as one of the frontrunners in broadening access to financial services in the region.

“Fraud protection, avoiding the — often — nightmare of legacy systems, and improving payment- and micro-instalment options would all be very helpful in improving the LatAm financial sector,” said fintech expert Benjamin T. Beasley, according to the report.

Investing in India Tech

According to Tech Wire Asia, India’s favourable demographics are a positive for Apple, which is continuing to increase its market share there. In April, the iPhone maker announced record $6bn revenue from the country, an increase of almost 50% year-over-year. Apple could account for 7% of all smartphone sales in the country in the second half of the year, according to data from market researcher Counterpoint, reported Reuters.

Apple shares are up 35.9% year-to-date.

Indian tech stocks have so far this year outpaced some of the US’ biggest tech companies. Zomato has gained 90.9% year-to-date, while Paytm is up 78.5%. Only three (Nvidia [NVDA], Meta [META] and Tesla [TSLA]) of the so-called “magnificent seven” tech stocks have seen greater gains.

ClearSale’s shares fell 27.2% year-to-date.

iShares offers targeted ETFs for each of its three target markets; the iShares MSCI Japan ETF [EWJ], the iShares MSCI India ETF [INDA] and the iShares MSCI Mexico ETF [EWW].

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy