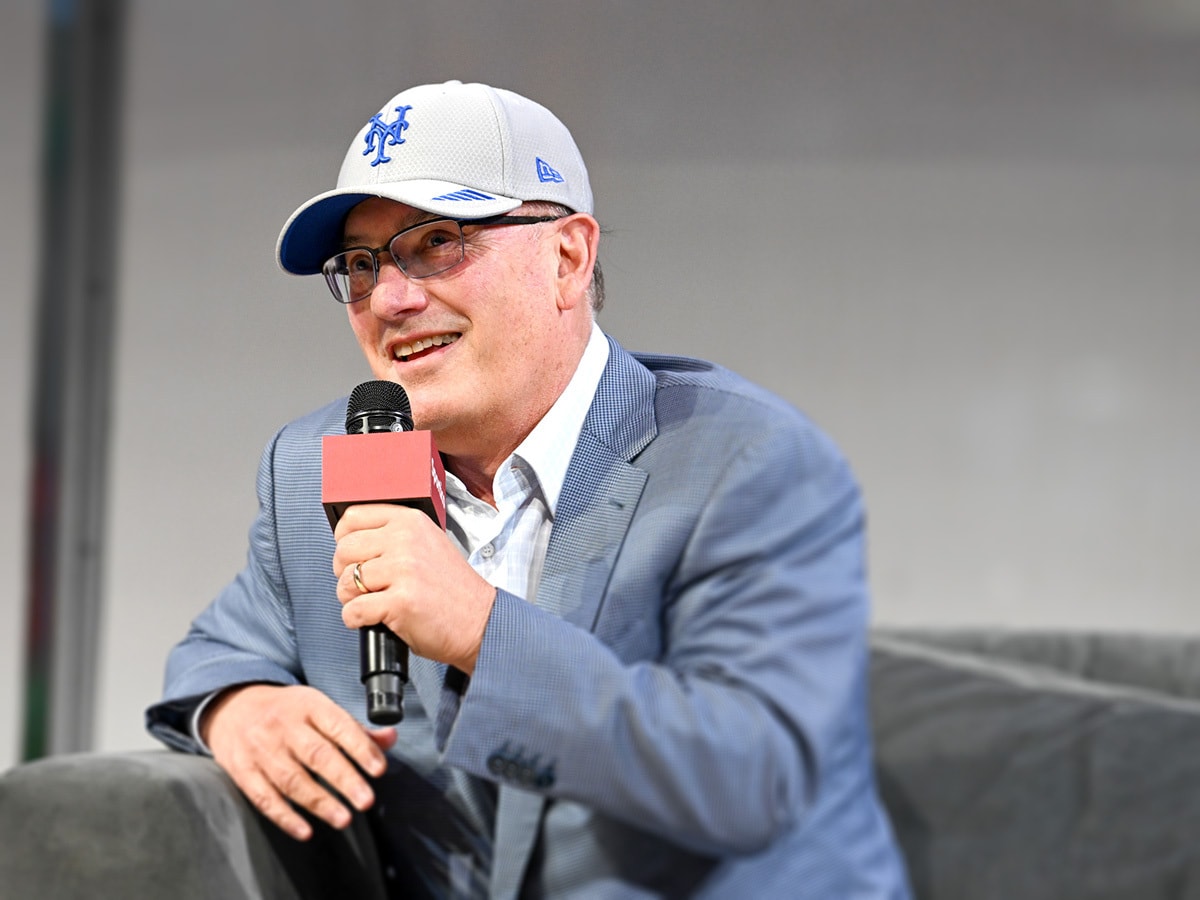

Why Steve Cohen is Still Bullish on AI

“Our view is that what happened with DeepSeek is actually bullish because it advances the move to artificial super intelligence,” said the billionaire manager of the Point72 hedge fund at a conference in Miami, as quoted in the Financial Times; Point72 recently launched a new artificial intelligence-focused (AI) strategy. Meanwhile, global tech stocks have largely bounced back, spurred by ASML’s [ASML] upbeat earnings call.

AI Apps: A $2bn Market

OpenAI’s ChatGPT has grossed $529m since it was launched as a mobile app in May 2023, according to a new report by Appfigures quoted by Bloomberg. This puts it at the forefront of what has become a $2bn market. Within this market, assistant apps like ChatGPT and DeepSeek are by far the most popular category, while 12 segments saw average growth of 862% in 2024.

Is Alibaba’s Better than Meta’s?

Alibaba [BABA] has claimed its upgraded Qwen 2.5 Max AI model outperforms Meta’s [META] Llama and DeepSeek’s V3 in key benchmarks. In a post on WeChat, Alibaba Cloud also suggested its model surpasses those of OpenAI and Anthropic in some tests. Alibaba is ramping up efforts to attract China’s AI developers, competing with Tencent [TCEHY] and Baidu [BIDU].

Earnings Preview: Can Palantir Maintain Momentum in 2025?

The top-performing stock on the S&P 500 in 2024, Palantir’s [PLTR] share price went from strength to strength last year. Valuable defense contracts and a focus on AI have helped it continue to run, though some analysts consider the stock overvalued. The firm is set to announce Q4 earnings on Monday, February 3, after US markets close; will the results continue to bolster PLTR, or are there clouds ahead for the stock?

The Apple Link-up No One Saw Coming

Apple [AAPL] has quietly partnered with SpaceX and T-Mobile [TMUS] to integrate Starlink support into iPhones, Bloomberg detailed, expanding satellite connectivity beyond its existing Globalstar [GSAT] service. A software update released on Monday enables the feature, with T-Mobile rolling out a beta test for select users. Elon Musk confirmed that Starlink will initially support images, music and podcasts.

ASML Reports Huge Spike in Orders

The chipmaker’s share price surged 11% after reporting Q4 net bookings of €7.1bn, far exceeding analysts’ €4bn forecast. Orders for its advanced extreme ultraviolet lithography machines reached €3bn, also beating expectations. Revenue rose 24% to €9.3bn, with net income at €2.7bn. CEO Christophe Fouquet noted AI chip demand is driving growth despite broader semiconductor weakness.

Are Nuclear Stocks Overvalued?

Uranium prices dropped by some 5% after DeepSeek’s breakthrough raised doubts about future electricity demand. Uranium stocks, which had been climbing on bets as to the eventual power needs of AI, wobbled but rebounded quickly, Seeking Alpha detailed. One analyst nonetheless warned that valuations had run ahead of fundamentals.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy