China’s economy may be stalling, but the country’s tech industry has been an outlier in recent weeks. While near-term economic recovery could depend on further stimulus packages, tech stocks may well be lifted by the AI opportunity.

- A strong ‘618’ festival has boosted Chinese ecommerce giants.

- Despite stimulus concerns, China tech is benefitting from the AI opportunity, says Jens Nordvig, founder and CEO of Exante Data.

- How to invest in China tech: the KraneShares CSI China Internet ETF offers pure-play exposure to companies focused on the internet and internet-related technology.

Just one day after US Secretary of State Antony Blinken’s visit to Beijing last week, President Biden called his Chinese counterpart a “dictator” when referencing February’s spy balloon incident. The remark was described by a Chinese foreign ministry spokesperson as a “political provocation”.

As tensions continue to simmer between the two countries, leaving some investors nervous, Chinese equities are falling, with the market waiting for a stimulus to revitalise the ailing economic recovery. The policies implemented so far have been below expectations and have failed to inspire confidence.

According to Jian Shi Cortesi, investment director at Swiss asset manager GAM, the government has a balancing act on its hands: “support the economy in the short term, while not creating problems for the long term”.

As Jens Nordvig, founder and CEO of Exante Data and MarketReader, told Opto: “While the Chinese economy has reopened, it is not benefitting from the same type of support that western economies did when they reopened.” On top of this, the economy is yet to get to grips with “an acute housing crisis”.

Amid the gloom, however, Chinese tech stocks are proving to be a bright spot. In the past month, the Hang Seng Index has gained 1.3% while the KraneShares Hang Seng TECH Index ETF [KTEC] has gained 2.8%. The rise would have been higher if not for last week’s selloff in top holding Alibaba [BABA], which was triggered by an unexpected leadership shake-up.

There’s scope for investors to be cautiously optimistic when it comes to China tech. Earnings seem to be improving, and the current quarter’s sales could be boosted by the 618 shopping festival.

Ecommerce players see festive cheer

According to third-party data provider Syntun, the 618 festival’s gross merchandise value was RMB798.7bn, up from RMB379.3 last year. Market leaders JD.com [JD], Pinduoduo [PDD] and Alibaba’s Tmall generated a combined RMB614.3bn.

Following the conclusion of the festival, ecommerce giant JD.com announced in a press release that “the event surpassed all growth expectations, delivering remarkable results for brand merchants and cementing JD.com’s position as an industry leader”.

Alibaba’s Taobao and Tmall Business Group reported a record number of merchants participating in the weeks-long festival. The number of influencers and Taobao merchants releasing short-form videos surged 200% and 55% respectively, while the daily average number of people watching short videos on the Taobao marketplace was up 113% from 2022, reported Alibaba’s own news site Alizila.

Strategic shift to drive growth at Alibaba

The leadership shake-up at Alibaba will see Eddie Wu, chairman of the Taobao and Tmall Group, replace Daniel Zhang as CEO. The appointment is a potential indicator that the tech giant is going to double down on its ecommerce division.

Last week Morningstar cited a media report by LatePost saying that Alibaba might dedicate more resources to Taobao, which caters to smaller merchants and value-for-money products, as opposed to Tmall, which is home to larger merchants.

Such a strategic move “places near-term earnings pressure on Alibaba, but it should boost Alibaba’s long-term competitiveness” argued Chelsey Tam, senior equity analyst at Morningstar.

Data compiled by Bloomberg shows that the earnings forecasts for Alibaba — as well as that for Tencent [0700.HK] — have recently been revised to their highest level since 2021.

China tech capitalises on AI demand

Ecommerce earnings could take a hit if a new stimulus isn’t announced. Nevertheless, some Chinese tech equities will benefit from “the global focus on artificial intelligence (AI) opportunities”, Nordvig told Opto.

A number of the country's leading internet companies are already jumping on the AI trend, including Alibaba and Baidu [BIDU].

In April, Alibaba launched Tongyi Qianwen, a large language model (LLM), which it hopes will rival OpenAI’s Microsoft [MSFT]-backed ChatGPT. Meanwhile, Baidu has unveiled Ernie Bot, which the company’s founder and CEO Robin Li Yanhong has previously claimed is “two months behind” OpenAI’s LLM, but would evolve faster through human feedback.

A chatbot test carried out earlier in June by Xinhua Institute, a think tank linked to the Xinhua state news agency, found that Ernie Bot is ahead of Tongyi Qianwen when it comes to accuracy and reliability, as reported by the South China Morning Post.

The success of Chinese internet companies’ chatbots is likely to largely depend on whether the regulatory environment will support AI innovation. Draft measures to regulate generative AI are expected to be published later this year.

A softening regulatory environment

Overall, though, the regulatory environment in China seems to be softening — the tech industry has been facing less scrutiny this year, while the gaming industry has seen dozens of licences awarded for new titles.

This should give investors cause to be bullish on China tech stocks going forward. They could also get a second wind from the Japanese and Korean tech industries, which are currently bottoming, according to Cortesi.

“We have seen that many of these stocks have derated to close to historically low valuations over the last two years. These sectors have started to rebound and investor sentiment has begun to warm given the potential benefit from demand [for] AI computing on these companies,” argued Cortesi.

How to invest in China tech

ETFs, or exchange-traded funds, offer an economical and diversified way to invest in a variety of stocks within a particular theme.

Funds in focus: KraneShares CSI China Internet ETF

Several key ETFs offer exposure to the China tech theme, which has recently been added to the Opto app.

The KraneShares CSI China Internet ETF [KWEB] tracks the CSI Overseas China Internet Index and offers pure-play exposure to companies focused on the internet and internet-related technology. The fund is down 14.9% in the past six months.

The iShares MSCI China Tech UCITS ETF [CTEC.AS] is weighted in favour of communication (35.82%), followed by information technology (29.41%) and consumer discretionary (27.31%) as of 23 June. The fund is down 9.1% in the past six months.

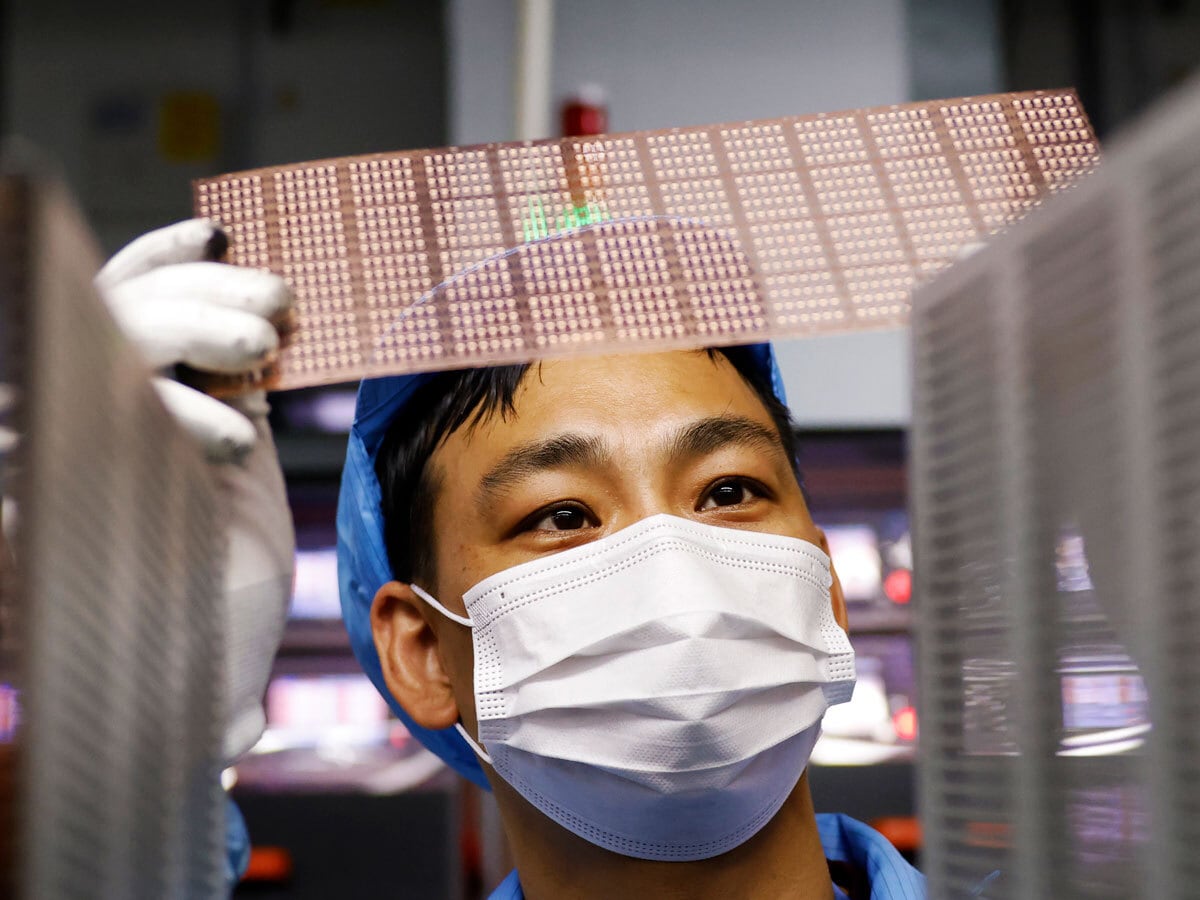

The Global X MSCI China Information Technology ETF [CHIK] offers broad exposure to the country’s tech industry. The top three sectors by weighting are: semiconductors (17.4%), electronic components (17.3%) and telecommunications equipment (16.4%) as of 31 May. The fund is down 2.8% in the past six months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy