Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

Worldcoin token eyed by US regulators

The Worldcoin Foundation, OpenAI founder Sam Altman’s cryptocurrency project, is rolling out globally despite a US regulatory crackdown. The Worldcoin token will require users to prove their identity (and humanity) with an eye scan that founders say is essential where distinguishing between humans and robots becomes harder. US regulators will not, however, allow Worldcoin tokens to be traded in the US, fearing cryptocurrencies are a vehicle for fraud.

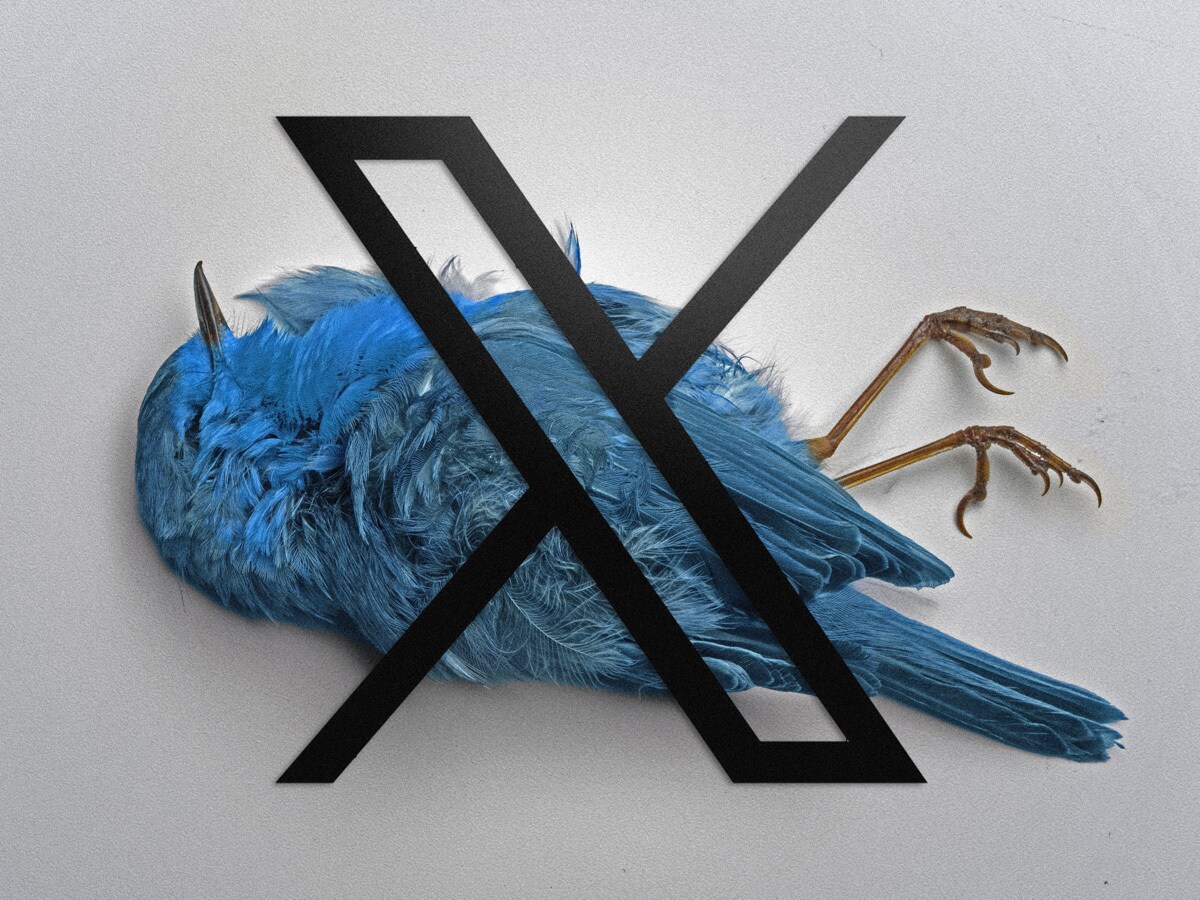

X marks its spot

Elon Musk has announced the rebranding of microblogging platform Twitter as X, with competition in the space building and intensifying. Linda Yaccarino, Twitter’s CEO, tweeted on Sunday that X would be “centred in audio, video, messaging, payments/banking — creating a global marketplace for ideas, goods, services, and opportunities”, as reported by the Financial Times. This alludes to Musk’s plans for the rebranded “X Corp” to become an “everything app”.

ETF assets up 18% in 2023

ETFGI, a research and consultancy firm covering the ETF industry, reports a global net inflow of $6.62bn into thematic ETFs in June, with inflows for the year totalling $19.11bn — already making this the fourth-highest year of net inflows on record. Thematic ETFs’ global assets have increased 18.3% so far in 2023, rising from $221bn at the end of 2022 to $261bn.

Alnylam and Roche in high-pressure partnership

Alnylam Pharmaceuticals will receive up to $2.8bn from Roche Holding, including $310m cash up front as part of a deal to collaborate on developing a treatment for high blood pressure, reported Bloomberg. If the drug is brought to market, the two companies will sell jointly in the US, while Roche will have exclusive rest of world rights.

Indian government scuppers BYD

Chinese electric vehicle (EV) maker BYD’s proposal for a $1bn car factory in India has been rejected by the Indian government, according to reports from the country. While Tesla [TSLA] is reportedly in talks to establish a supply chain in India, the nation’s government is reported to be committed to keeping Chinese companies out of its major sectors thanks to concerns over security.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy