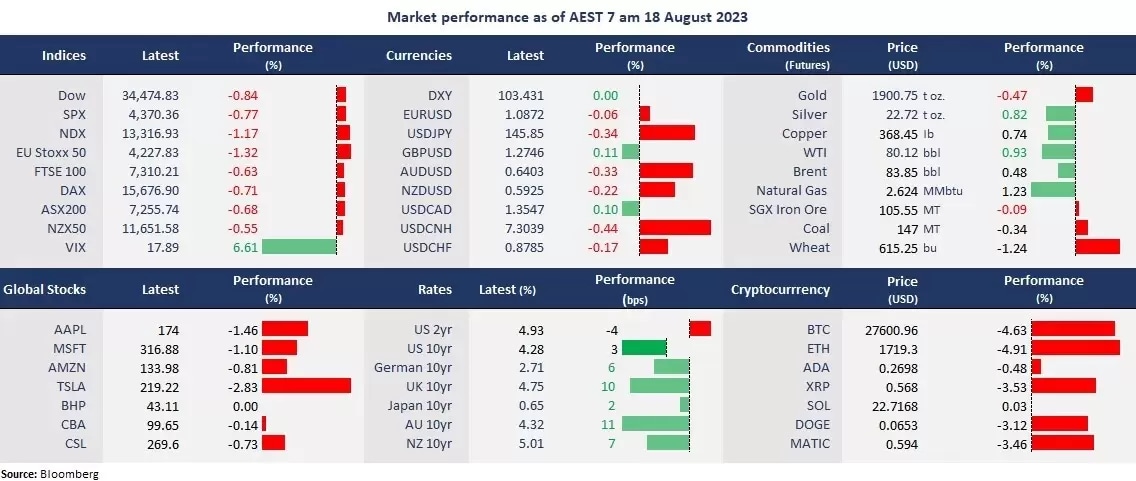

Wall Street fell for the third straight trading day as rising bond yields continued to rattle the equity markets, with three benchmark indices under the 50-day moving average. Dow was also dragged by Walmart’s slump despite strong earnings results. The grocery store’s shares fell more than 2% on Thursday, dragging on the broad consumer stocks.

The US 10-year bond yield hit 4.3% at a 16-year high before pulling back to 4.28%. And the CBOE Volatility Index rose 6.6% to 17.89, the highest since 31 May. On the return of inflation worries, markets seem to repeat the trends in 2022 at this moment. While technology stocks lost steam, the energy sector again took the lead, warning of choppy movements ahead. The Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium next week will be critical for the broad sentiment.

The US dollar eased rising after China’s intervention in the currency market as Yuan fell to the lowest level since 2007 on the selloff in Chinese equities. The Japanese Yen also rebounded after USD/JPY rose to a concerned level that may trigger the BOJ’s intervention in the exchange rate. Gold extended losses further on the bond yields jitter, while crude oil rebounded on the inflation trades. The news about China’s plan to restructure the debt of the private funds also helped sentiment.

Futures point to a lower open across Asia. The Nikkei 225 futures were down 0.90%, the ASX 200 futures slid 0 29%, and the Hang Seng Index futures fell 1.07%.

Price movers:

- 10 out of 11 sectors finished lower in the S&P 500, with Consumer Discretionary and Consumer Staples, leading losses, down 1.58% and 1.01%, respectively. Energy is the only sector that finished in the green, up 1.11%, thanks to a rebound in oil prices.

- Walmart’s shares fell 2.2% despite strong quarterly results. In the second quarter, the retailer’s earnings per share came to US$1.84, topping an estimated US$1.70. The net revenue was US$161.6 billion, beating an expected US$159.7 billion. The company also upgraded its full-year guidance of earnings per share for 2024 to between US$6.36 and US$6.46 from US$6.10 and US$6.20.

- Bitcoin brieftly slumped to just above 25,000 for the first time since mid-June amid risk-off sentiment and a strengthened USD. The digital coin fell sharply for the second straight day after Fed’s comments on upside inflation, approaching key support of 24,600.

- Both Chinese offshore Yuan and Japanese Yen rebounded against the USD from their lowest levels since November 2022 after China’s intervention on the exchange rate. USD/CNH and USD/JPY may head off their imminent supports of 7.27 and 145, respectively.

ASX and NZX announcements/news:

- Spark New Zealand (NZX: SPK)’s FY23 revenue rose 20.7% to NZ$4,491 million. Its net profit jumped 176.8% to NZ$1,135 million. The imputed amount per quoted equity is NZ$0.135. Its FY24 guidance for EBITDAI is NZ$1,215-$1,260 million, with the total dividend per share at NZ27.5 cents per share, 100% imputed.

Today’s agenda:

- Japan’s National Core CPI for July

- UK’s Retail Sales for July

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.