Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

GlobalFoundries IPO

How to trade on GlobalFoundries’ IPO

New York-based semiconductor company GlobalFoundries has filed for an IPO to debut its shares on the Nasdaq later this year. Find out how we can alert you of GlobalFoundries’ impending listing and how you can trade CFDs and spread bet on the company’s IPO with us.

28 October 2021

GlobalFoundries going public

$25bn+

GlobalFoundries’ valuation

13% YoY

GlobalFoundries revenue increase

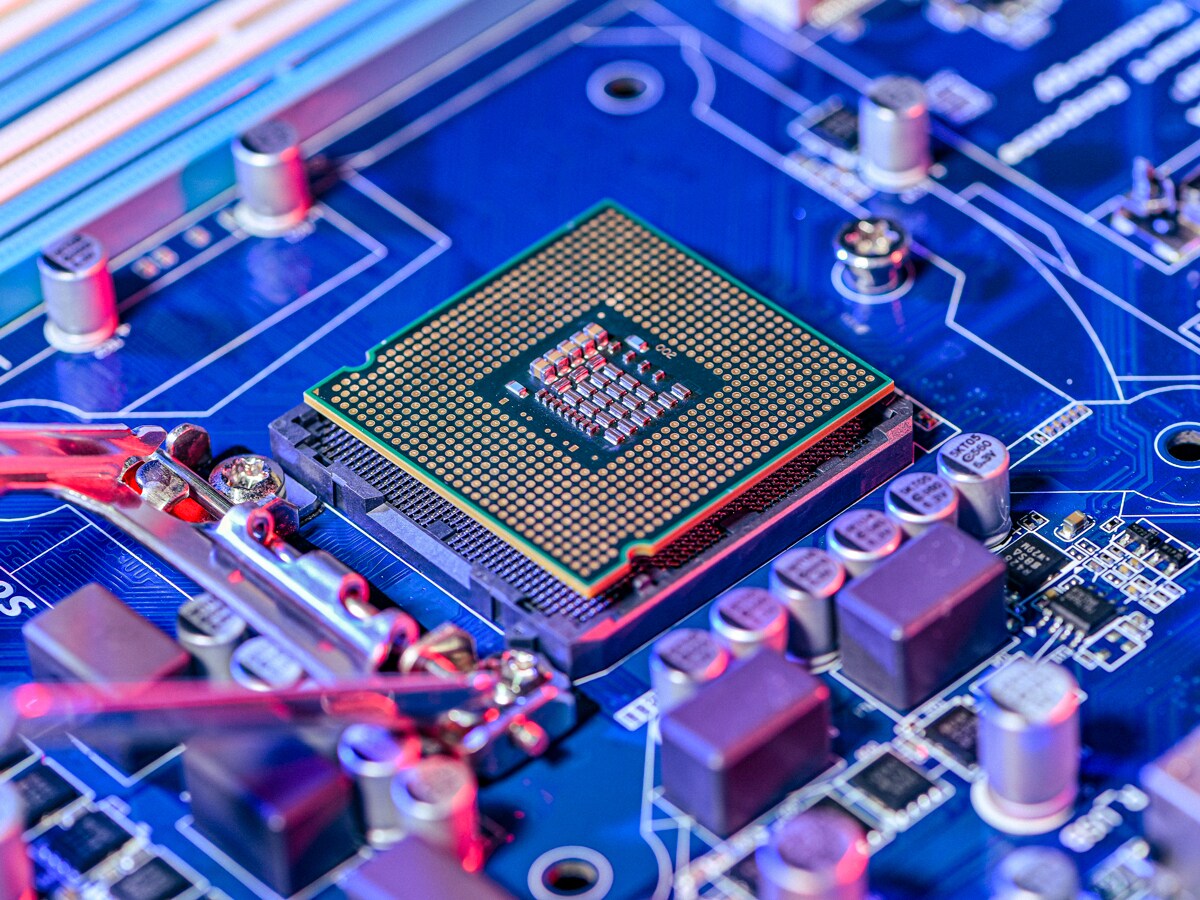

What does GlobalFoundries do?

GlobalFoundries is a chipmaker within the semiconductor industry and a spin-off from the manufacturing arm of Advanced Micro Devices (AMD). The company designs and manufactures chips for the automotive, mobility, industrial, computing and software markets. GlobalFoundries is one of the largest semiconductor foundries in the world in terms of production, owned by Abu Dhabi-based sovereign wealth fund Mubadala Investment Company since 2009. It has over 200 global customers and operates in 14 locations, with manufacturing facilities in the US, Singapore, and Germany.

When is GlobalFoundries’ IPO date?

GlobalFoundries is expected to go public on 28 October 2021. It joins a particularly crowded year-end IPO schedule, with the likes of Stripe, Rivian, and Polestar also eyeing up their stock market debut. It also comes at a time when microchips are in great demand, given the semiconductor shortage that has gripped the industry in 2021.

GlobalFoundries will be listing on the Nasdaq exchange in New York with the stock symbol ‘GFS’.

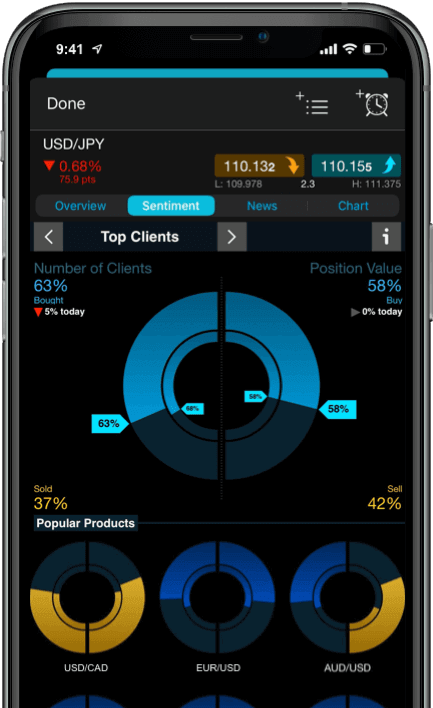

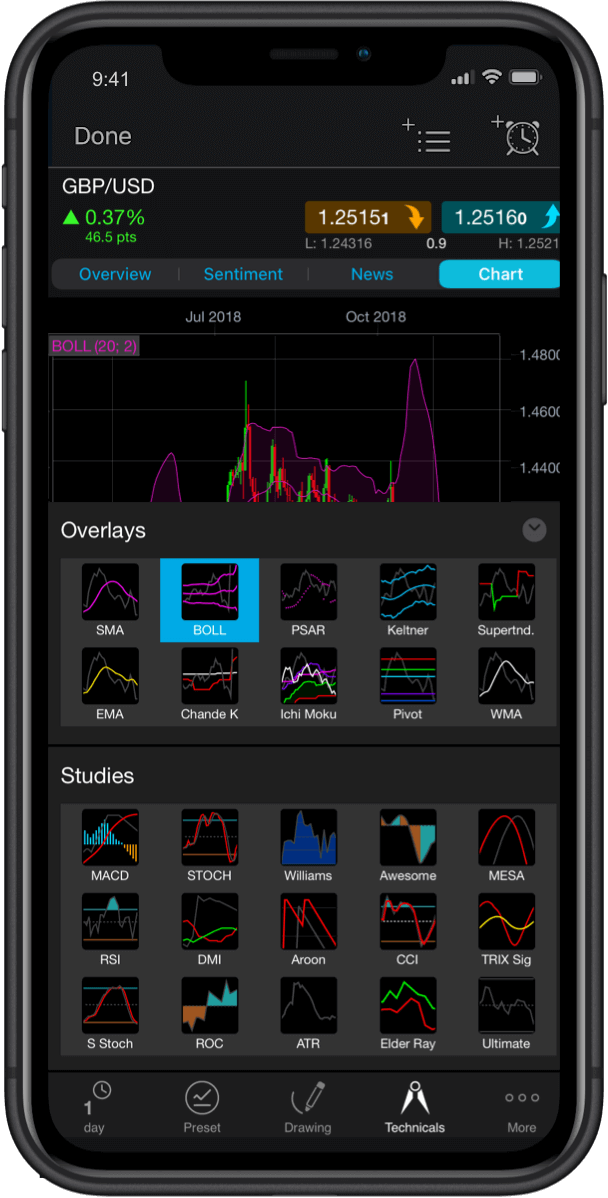

Keep up to date with upcoming IPOs and new stocks that are listing on our platform. If you’re interested in trading on GlobalFoundries, register your interest below and we will send you an email notification when the IPO is live, and you can start spread betting or trading CFDs on our derivative price.

GlobalFoundries’ share price and valuation

GlobalFoundries will price its shares between $42 and $47 apiece.

According to Reuters, the company is seeking a valuation of $25bn, a high figure that may be justified due to an increased investor appetite this year for growth technology companies. It aims to raise approximately $1bn in funds, although this may change when terms of the share sale are set.

How to trade on GlobalFoundries stock

1. Register your interest

By entering your email into the sign-up box above, we will notify you when GlobalFoundries has listed on the Nasdaq.

2. Practise trading

Trade on GlobalFoundries’ competitors while you wait using £10,000 of virtual funds.

3. Pick a strategy

Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

4. Control your risk

The IPO market can be volatile, so explore our range of stop-loss orders, including traditional, trailing and guaranteed GSLOs.

How has GlobalFoundries been performing financially?

GlobalFoundries is one of the largest semiconductor manufacturers in the world with a current market share of more than 7%, based on data from TrendForce.

In June 2021, the company reported a half-year revenue of $3.0bn, up nearly 13% from the previous year. Net loss in the same period fell to $301m from almost double the figure of $534m in 2020. Overall revenue for 2020 was $4.85bn with a net loss of $1.35bn, which is quite a substantial figure of over one quarter.

In its S-1 filing, the company admitted that although the supply-demand imbalance is expected to improve over the medium-term, the semiconductor industry will require a significant increase in investment to keep up with demand.

Please remember that past performance is not a reliable indicator of future results.

Why may investors be interested in GlobalFoundries?

Why may some investors avoid the GlobalFoundries IPO?

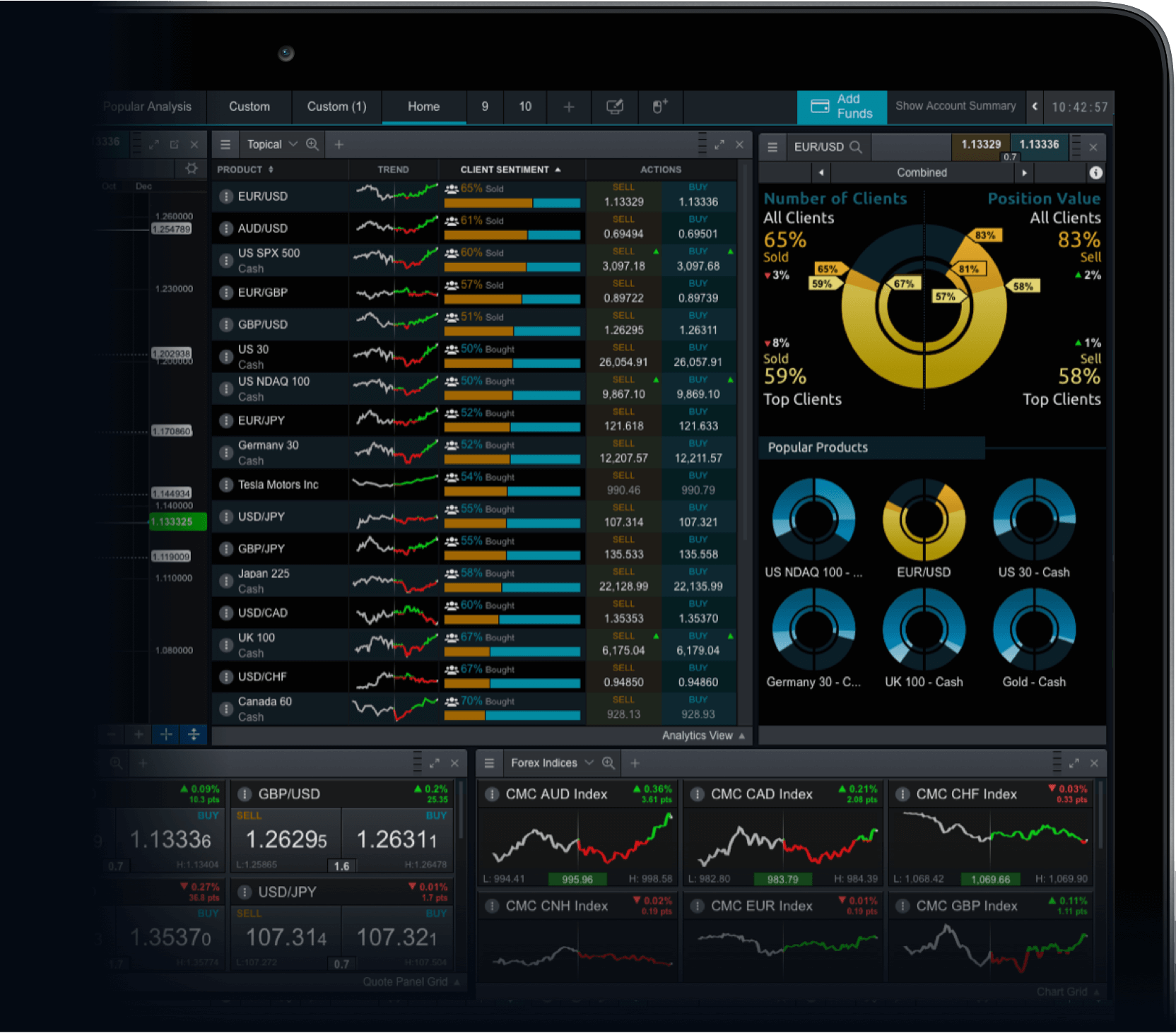

Trade on similar instruments to GlobalFoundries

Analog Devices

- All clients

100% of CMC client accounts with open positions on Analog Devices expect the price to rise.

Intel

- All clients

98% of CMC client accounts with open positions on Intel expect the price to rise.

Microchip

- All clients

100% of CMC client accounts with open positions on Microchip expect the price to rise.

Taiwan Semiconductor Manufacturing Co

- All clients

98% of CMC client accounts with open positions on TSMC expect the price to rise.

Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice – it must not form the basis of your trading or investment decisions.

FAQS

Who are the underwriters for GlobalFoundries’ IPO?

Major financial companies Morgan Stanley, Bank of America, JP Morgan Chase, Citigroup and Credit Suisse are acting as the underwriters for GlobalFoundries’ IPO.

What other semiconductor stocks are there?

You can spread bet or trade CFDs on a wide range of semiconductor stocks on our platform, including TSMC [TSM], Micron Technology [MU], NVIDIA [NVDA], Intel [INTC], AMD [AMD] and Qualcomm [QCOM].