There is no denying it, renewable energy is the future with more companies springing up each year, pushing the sector into bigger and better growth. By April 2019, renewable energy growth outpaced coal energy for the first time ever in the U.S. with 23% of U.S. power generation produced by renewable energy sources. This was largely driven by reduced costs and increased energy capacity.

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

2020 did not prove to be the year we were all expecting, but the International Energy Agency stated that on a global level, 90% of all new energy generation was from renewable sources, with 10% being from fossil fuels. Indeed, as climate-conscious energy sources become much more commonplace, investors are also starting to take more notice. Many renewable energy companies have more than doubled their share price in 2020, while the likes of Enphase Energy have soared more than 400%, and Sun Power around 300% by the end of 2020. Let’s not forget Tesla’s impressive run as a testament to the hype surrounding clean energy companies.

With president-elect Joe Biden due to take office in January, the U.S. could be on the verge of pushing forward with renewable energy, as Biden’s proposed $2 trillion climate plan puts cutting down on carbon emissions as the clear focus for the future. So we look at 2 interesting and potential renewable energy stocks to potentially invest in for the New Year.

Solar Edge

I have written about SolarEdge (NASDAQ: SEDG) a good few times now, particularly as a competitor to Tesla in the solar panel and energy converter business. SolarEdge is a great company which has benefitted front the huge increase in solar installations the past year. Looking at 2021, solar power predicted to be the biggest type of renewable energy growth, this stock is one to take notice of.

Although traditionally a solar company, it also produces inverters that convert solar power from the panels on your roof into usable electricity for the home. Added to this SolarEdge produced the world’s first charging inverter which combines grid power and solar power energy sources into one, easy-to-use system for charging your electric vehicles.

Unfortunately, SolarEdge reported disappointing Q3 earnings as the difficult business cycle has taken its toll on the commercial side of its solar panel business. Large-scale solar installation simply did not gain enough traction in the last quarter and as a result, revenue was down 17% year-over-year (YoY) to $338 million. That being said, net income was up 3.6% YoY to $66 million, and earning per share remained constant at $1.21.

The disappointing results came in alongside some good news as its largest market, Europe, generated a record-setting solar revenue. 53% of overall revenue was generated by this market at $165 million. If 2021 means bringing the U.S. more in-line with similar green energy policies that Europe has already implemented, then revenue for the U.S. market should begin to catch up over the next few years.

Bloom Energy Corp.

Bloom Energy (NYSE: BE) is a hydrogen fuel cell company that produces component parts for energy generation. This company’s share price has soared 280% in 2020 from just under $8 to around $30 in 2020. With green energy and innovation in areas such as Hydrogen fuel-cell technology, this is a stock to watch in 2021.

Bloom Energy might seem like a small-cap stock to invest in, but this company has spent time and energy keeping its client base as broad and diversified as can be. With customers in health care, banking, media, and communication, plus many other industries, Bloom Energy should be well able to ride out any continued market uncertainty.

Bloom Energy also entered into a financial partnership with NextEra last July, whereby NextEra bought a six-megawatt fuel project from them. In addition, the company has collaborated with SK Engineering and helped to build two clean energy facilities in South Korea, both of which are powered by Hydrogen fuel-cells.

This is a fast-moving and innovative company that is emerging as a keen player in the hydrogen fuel-cell market. Although this could present a risky investment due to both the market and its size in this competitive industry, this company has plenty of space to grow. In addition, it has a diversified clientele and it is attracting bigger names in the energy sector with whom to partner with. This could be a great renewable energy stock to invest in for 2021.

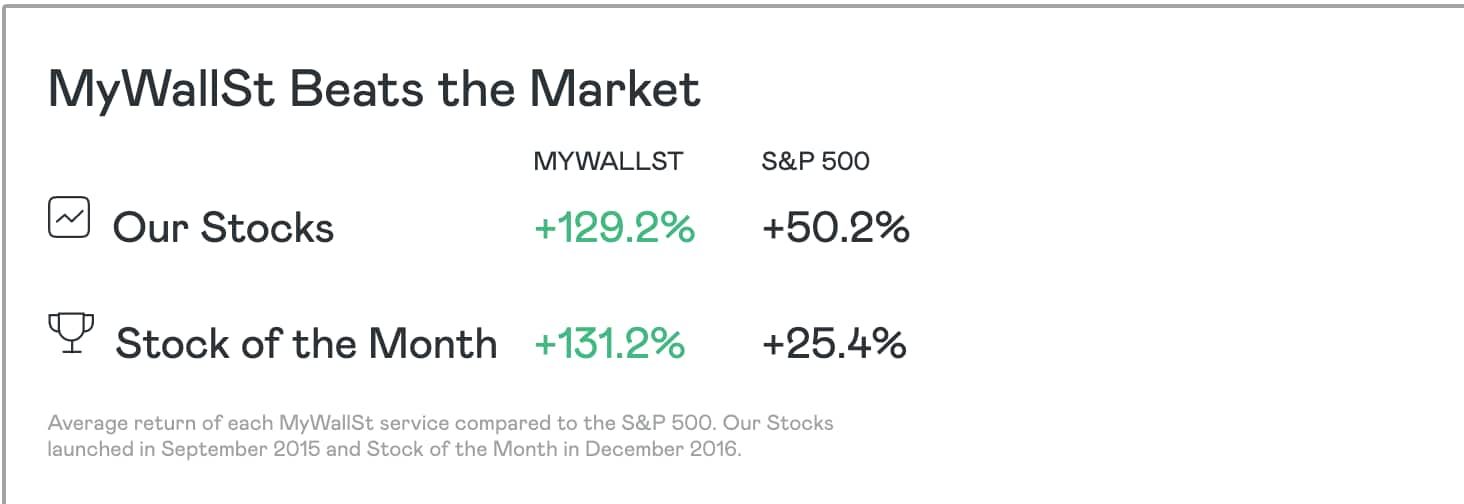

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy