1. Introduction

Smart cities, also known as ubiquitous cities (or u-cities), are urban developments that harness and integrate technology and communication systems within their infrastructure. In doing so, urban planners can improve a city’s operational efficiency and provide better services, governance, and welfare to citizens by increasing two-way communication and feedback flows through data touchpoints.

The global smart cities market was a $1.2trn industry in 2022, and is set to grow to $7.2trn at a compound annual growth rate (CAGR) of 25.8% between 2023 and 2030, according to Grand View Research. The concept is in its early days but gaining traction globally.

$7.2trn

Smart cities growth between 2023 and 2030

Smart cities rely on a broad range of applications including water and waste management, traffic control, healthcare, governance, education, agriculture, disaster management, buildings and infrastructure, payments and commerce and tourism. The most prominent sub-themes are smart transportation, smart infrastructure, smart grid, smart building and smart city platform segments.

Internet of Things (IoT) forms the backbone of a smart city's connectivity, including low-power wide-area networks (LPWAN) and cellular networks such as 4G/LTE and 5G. Further advances in 5G technology create massive opportunities for the development of smart cities.

Given the wider trends in growing urban development, companies involved in bringing the smart city vision to life make attractive medium- to long-term investment targets.

2. Key players

The following companies are leading innovation in the smart cities space, as identified by GlobalData.

Accenture [ACN]

- Accenture, which has a market cap in excess of $186bn, began working on smart cities in 2009, when it worked with Dutch officials to make Amsterdam the EU’s first intelligent city.

- It is developing Area X.O, a smart city and testbed for networked autonomous vehicles in Ottawa, Canada.

- The tech firm is involved in a broad number of future-forward applications, ranging from developing AI platforms for businesses to sustainability enablement technology.

IBM [IBM]

- The $131.6bn multinational specialises in technology hardware and software, data analytics and consulting services.

- IBM launched the pivotal "Smarter Planet and Smarter Cities” initiative in 2009 and remains a key innovator in the space.

- Since 2019, IBM Canada has collaborating with telecom group Bell Canada and the City of Markham to test and monitor city infrastructure under the Smart City Accelerator Research Program.

Cisco Systems [CSCO]

- Cisco is among the world’s 50 highest valued companies, with a market cap of $201.3bn. It calls itself “the worldwide leader in IT, networking and cybersecurity solutions”.

- Cisco is a pioneer of smart cities platforms, having developed Cisco Kinetic for Cities, a set of tools and guidelines for building a smart city framework.

- It offers smart solutions for waste management, lighting, environment, parking, security and network architecture in cities, as well as innovations in smart utilities.

3. Background

The concept of a ubiquitous city was born in the South Korean district of Songdo, the world’s first smart city.

There are broadly two ways for a city to become ‘smart’. The first is to create a brand-new purpose-built city. An example of this is NEOM, Saudi Arabia’s ambitious $500bn futuristic development that integrates advanced robotics, port and logistics facilities, cleantech innovations and smart governance technologies.

The other method is to implement smart city systems in existing cities, such as the Amsterdam Smart City platform that works with social organisations, companies and government officials to identify and implement smart solutions. Another example is the UAE government’s paperless transformation under the Smart Dubai Plan 2021.

Shanghai, Seoul, Barcelona, Beijing and New York ranked as the top five smart cities in 2022, according to Juniper Research. Shanghai took first place thanks to Citizen Cloud, its integrated platform that serves as a one-stop point for over 1,000 different services for residents. Asian cities tend to dominate the charts due to their quick adoption of data management platforms, digitised utility management and efficient public services, effectively seeking to balance the adoption of digital technologies with consumer data privacy.

4. The investment case for smart cities

It is estimated 68% of the world population could live in cities by 2050, almost double the amount that did in 2018, according to the UN Department of Economics and Social Affairs. With growing urbanisation comes a need for the effective management of cities. Technological advancements in high-speed internet coupled with sensors, IoT and machine-to-machine communication have the potential to usher in a paradigm shift in the way cities are designed.

Smart cities are also more sustainable cities. The built environment has a large role to play in reducing emissions, with many smart developments prioritising green energy.

Smart initiatives are expected to generate $70bn in annual spending by 2026, up from $35bn in 2021. A large portion of this will centre on smart grid projects, which by 2026 will save over 1,000 TWh of electricity, the equivalent of more than five years' of Greater London's energy usage at current levels, says Juniper Research. Smart city technologies will also generate high levels of savings, with the value of energy savings alone estimated at $96bn by 2026, making their implementation in most cases highly cost-effective.

Such technologies are still at an early-stage, signifying a promising investment opportunity.

5. Growth drivers

The main drivers pushing market growth for smart city technologies and services are spreading urbanisation, the need for effective resource management, concerns about public safety and the growing need for effective energy management. Government initiatives are further widening adoption globally in a race to develop their countries. Smart cities have also benefitted from the emergence of a new variety of public-private partnerships, which have provided new funding routes for infrastructure development. The sector’s growth largely bounces off the rising trends in wider technology markets, and improvements in these have increased the effectiveness of smart city solutions, in turn increasing government trust in implementing these solutions.

Below are the theme’s key sectors and biggest growth drivers.

Communications and smart governance —

Within this segment, city surveillance, e-governance, smart lighting and smart infrastructure take the lion’s share in revenue growth trends between 2017 and 2030, according to Grand View Research. Of this, smart infrastructure accounted for 28% of market share in 2022. This is heavily fuelled by governments attempting to digitise their economic operations.

Smart utilities —

Energy management dominated the smart utilities segment in 2022, accounting for 55% of revenue, with growing energy demands spurring the adoption of virtual power plants that rely on AI, machine learning and IoT for security. Waste management is expected to grow at a CAGR of 27% between 2023 and 2030, according to Grand View Research.

Smart transportation —

Smart transportation took the highest revenue share as of 2022 at 46%, as it blankets key elements including smart mobility, parking management and smart ticketing. The segment was valued at $26.75bn in 2021, with a forecasted CAGR of 7.7% between 2022 to 2030. Parking management is expected to have a 26.1% CAGR between 2023 and 2030 due to higher demand for efficiency and security in parking lots, according to Grand View Research.

6. ETFs that provide exposure to smart cities

Several ETFs specialise in smart cities, offering exposure to the broad mix of industries and players involved in the development of tomorrow’s cities, from public infrastructure to telecommunications to healthcare.

AMUNDI INDEX SMART CITY UCITS ETF (C) [SCITY]

This fund offers exposure to a broad range of companies touching on several of the diverse themes that smart cities encompass. Sectors with the heaviest weighting are consumer discretionary, followed by healthcare and information technology.

Click here to see the fund’s top 10 holdings.

LYXOR MSCI SMART CITIES ESG FILTERED DR UCITS ETF [IQCT.L]

This ETF represents the theme’s highest revenue drivers including smart connectivity (IoT), smart buildings, smart homes, smart safety and security, smart mobility, smart waste and water management, and smart energy and grids. Industrials and information technology are the primary focus.

Click here to see the fund’s top 10 holdings.

iShares Smart City Infrastructure UCITS ETF [CITY.MI]

The fund comprises developed and emerging market companies involved in sustainable smart city infrastructure solutions, with exposure broken down into two main sectors: industrials and information technology.

Click here to see the fund’s top 10 holdings.

7. Innovation and development

In recent years, organisations have attempted to integrate technologies such as IoT to overcome the challenges introduced by Covid-19. The pandemic has highlighted the reliance of the global economy on urban areas as well as the significance of public healthcare in smart city projects, which means the healthtech sector is expected to grow. The digital health market was over $195bn in 2021, and is set to expand at a CAGR of more than 16% between 2022 and 2030, according to Global Market Insights.

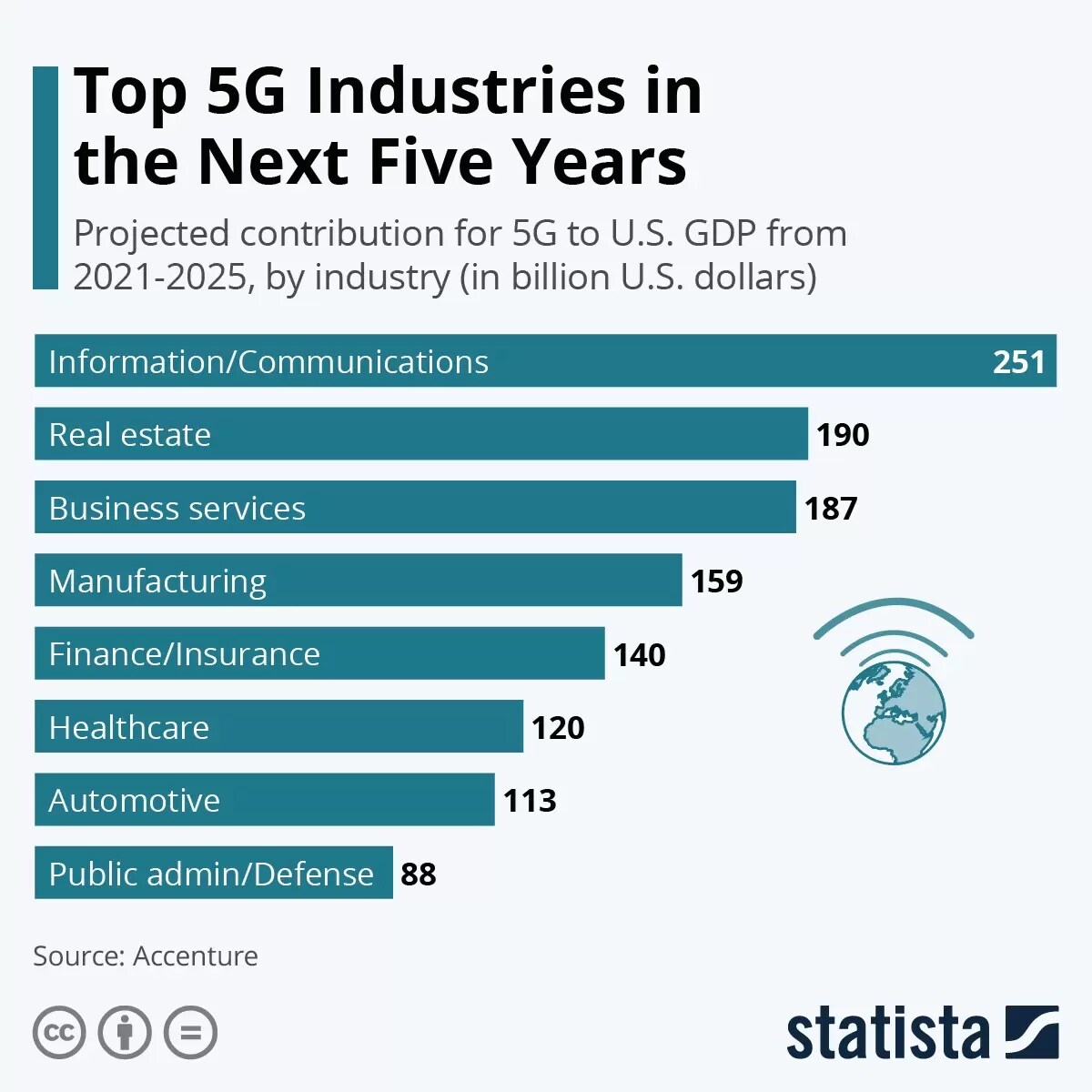

The potential for further development is vast and ever-growing. Smart cities are as progressive as our mobile networks allow, and their future depends on advancements in 5G technology — something that Ericsson [ERIC] is focusing its efforts on. Further innovations in emerging technology such as blockchain and cybersecurity could also usher a new realm of possibilities for smart city applications. As visualised in the Statista infographic below, information and communications technology and real estate are expected to benefit the most from 5G growth between 2021 and 2025, based on data from Accenture.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy