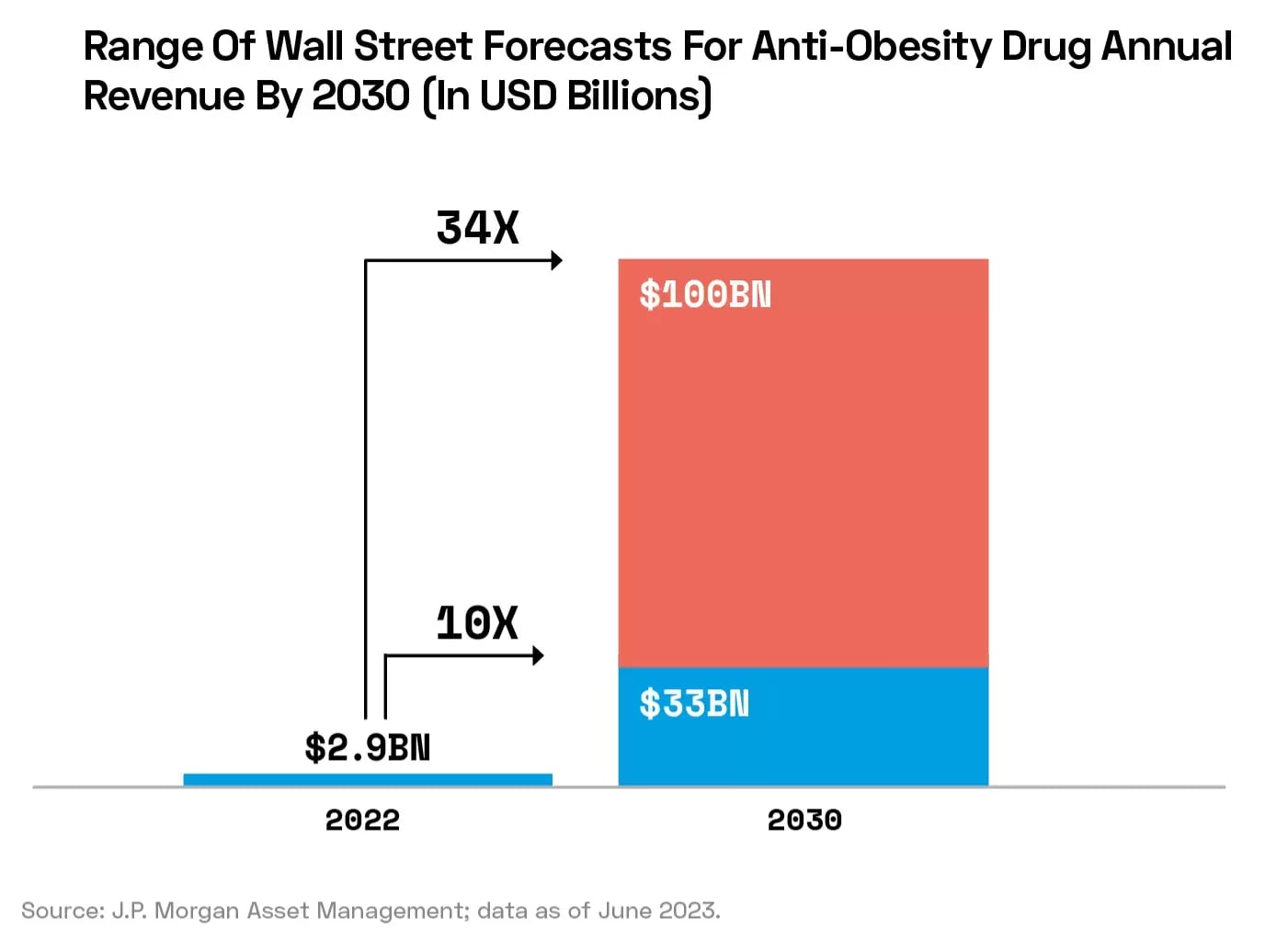

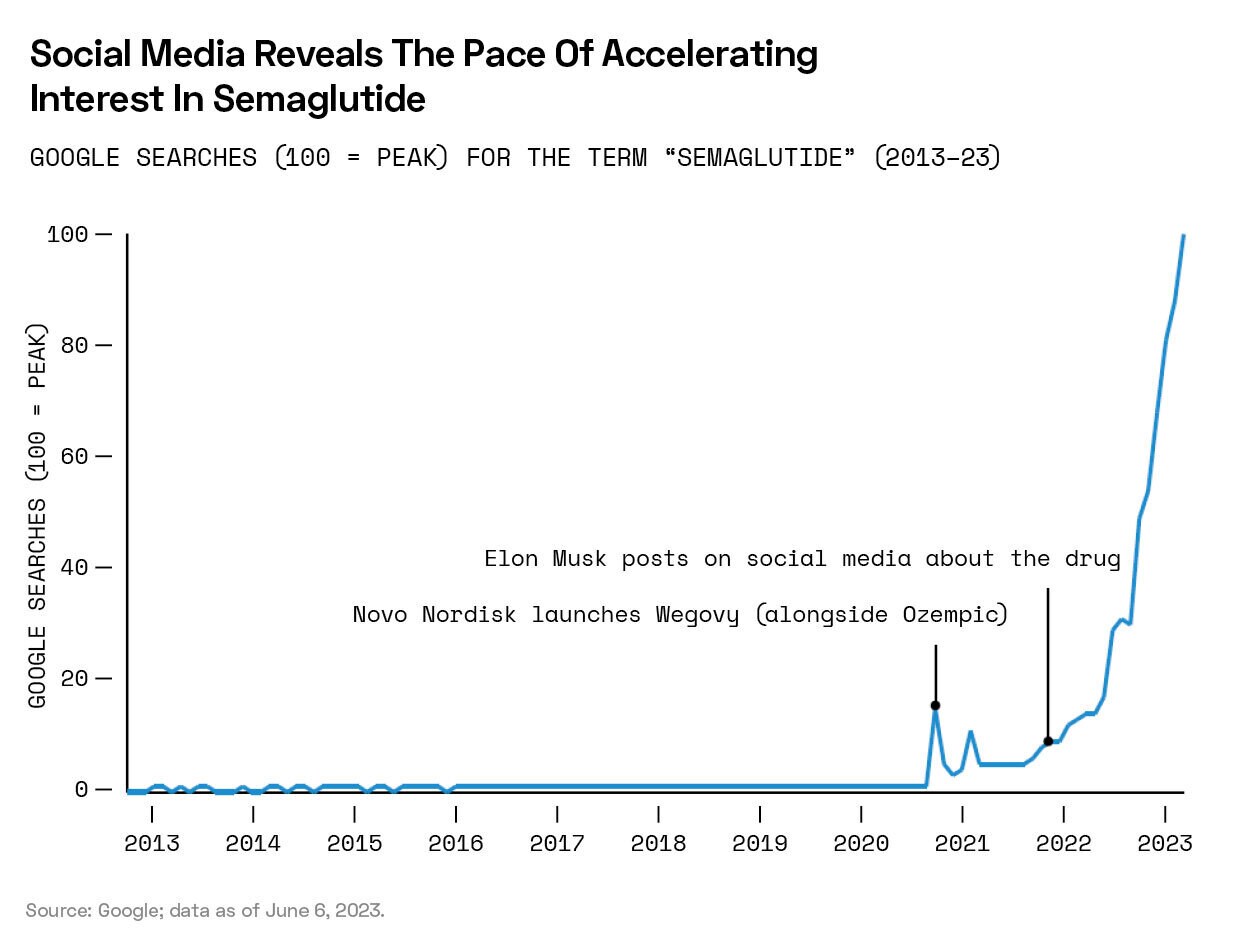

Since Elon Musk tweeted about his use of Wegovy to lose weight in October 2022, the use of GLP-1s for weightloss purposes has ballooned. Goldman Sachs and J.P. Morgan both estimate the market could reach $100bn by the end of the decade.

- Goldman Sachs suggests the anti-obesity drug market could reach $100bn by 2030.

- Novo Nordisk shows Wegovy reduces risk of heart disease-related conditions.

- Year-to-date, Novo Nordisk and Eli Lilly are up 46.2% and 62.5%, respectively.

In its report, ‘Why the Anti-obesity Drug Market Could Grow to $100bn by 2030’, Goldman Sachs argues that the market could be 16 times bigger than its current size of $6bn by the end of the decade. Moreover, during this time, 15 million US adults could be treated with anti-obesity medications (AOMs), which would represent approximately 13% of the eligible US obese/overweight adult population.

Driving the growth of this market are drugs that mimic the action of glucagon-like peptide 1 (GLP-1), and are often referred to by that hormone’s name. Originally developed as a treatment for type-2 diabetes, they have recently been found to achieve weight loss of up to 21%, although the report hints that the next generation of AOMs may yield even better results.

Obesity has been recognised as a chronic disease by the American Medical Association since 2013, and GLP-1s represent the most effective form of treatment so far discovered.

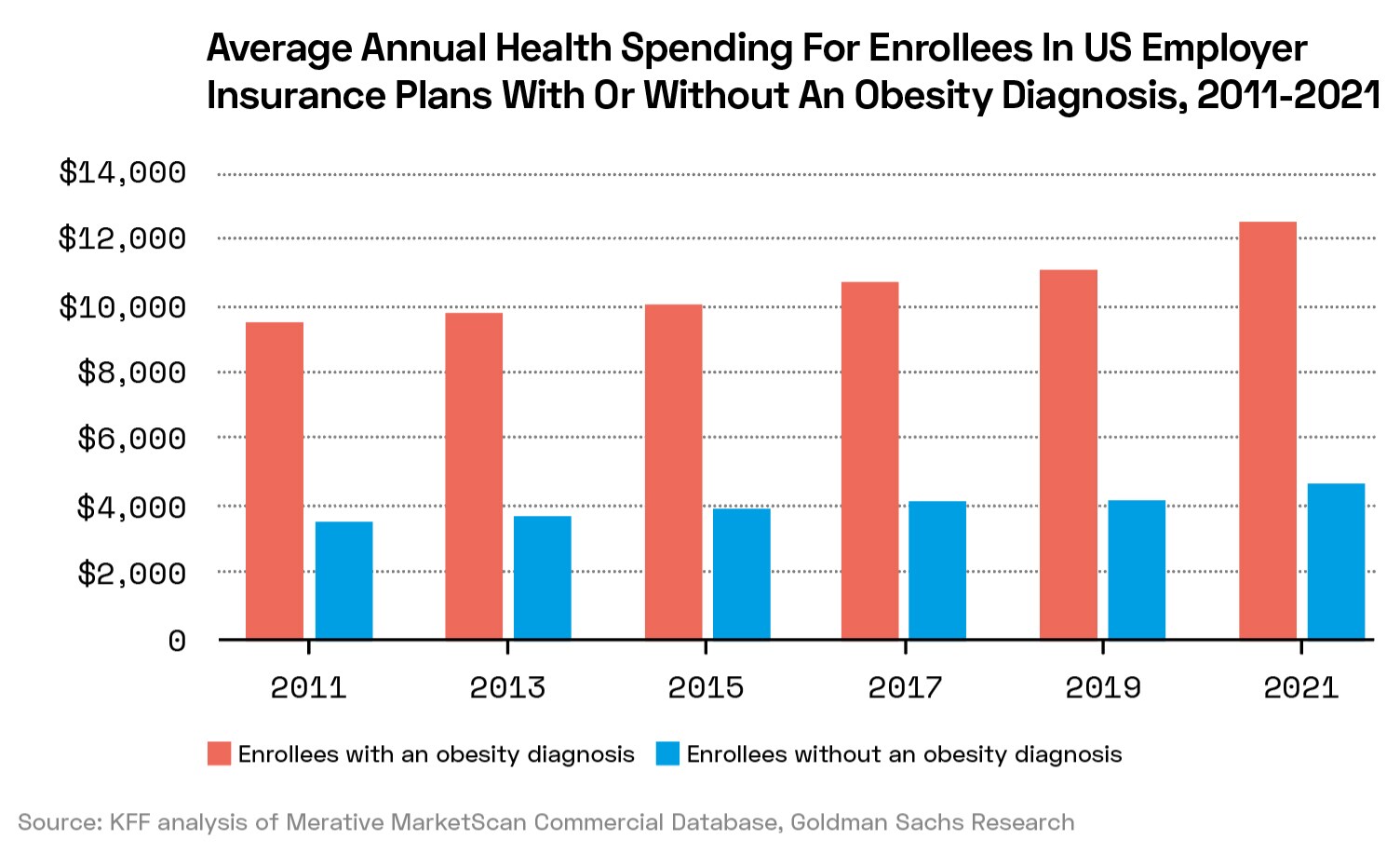

The Goldman Sachs report cites the Centres for Disease Control and Prevention’s estimate that the medical costs related to obesity ran to approximately $173bn in the US in 2019. The implications of effective AOMs are huge, therefore, both in terms of economic savings and healthcare outcomes.

Goldman Sachs notes in the report, however, that the $100bn figure is “relatively sensitive to minor tweaks to underlying drivers”.

Similarly, J.P. Morgan Asset Management says that analysts tally the potential market size at nearly $100bn by 2030. In a July report by Olivia Schwern, Life Sciences Private Capital Associate, even a pessimistic model sees the market expanding rapidly to approximately $33bn in the same time period — a more than tenfold increase from $2.9bn in 2022.

Costs and Benefits

As Deloitte points out in its report, ‘Growth of GLP-1s has Implications for Multiple Stakeholders’, “Total annual medical costs for obese adults are an average of $1,861 higher than medical costs for people with healthy weight.”

At present, it isn’t clear that consumers or healthcare providers are convinced that the costs of GLP-1s — which, according to Deloitte, range between $900–$1,300 per month — will be outweighed by the savings incurred by their users.

According to a poll by health policy research organisation KFF cited by Deloitte, only 16% of adults would be interested in trying a weightloss drug if it wasn’t covered by a health plan. Meanwhile, some insurance providers are “pulling back on their coverage of some GLP-1s”, wrote George Van Antwerp, Managing Director of Deloitte, and Jay Bhatt, Managing Director of the Deloitte Health Equity Institute and the Deloitte Centre for Health Solutions, authors of the report.

Deloitte anticipates that increasing demand for the drugs could spur an uptick in M&A activity, as large incumbents look to smaller biotech firms that already have a developed product.

Antwerp and Bhatt cited the example of Eli Lilly [LLY] acquiring private biotech Versanis Bio in order to bolster its presence in the market.

Similarly, Novo Nordisk [NVO] is moving to acquire Canadian biotech Inversago Pharma for $1.1bn. Novo already produces Wegovy, one of the best-known products in the space (indeed, its endorsement by Elon Musk appears to have sparked the trend’s explosive growth).

Good For the Heart

On 11 November, Novo Nordisk presented clinical trial data to the American Heart Association’s annual scientific meeting, demonstrating that Wegovy can reduce the incidence of heart attack, stroke or death from heart disease by 20%.

The announcement of the full results built on a preliminary release from August, and showed a divergence in the risk profiles between the test and control groups almost immediately after treatment began, reported Reuters.

According to a report by CNBC, the results could help Novo to maintain its advantage over Eli Lilly, whose GLP-1 competitor, Zepbound, was approved for weightloss treatment by the US Food and Drug Administration (FDA) earlier in the same week.

Dr. Howard Weintraub, Clinical Director of the Centre for the Prevention of Cardiovascular Disease at NYU Langone Heart, who was involved in the Novo study, told the news outlet: “If you look at where the insurance companies are going to be obliged to go, they’re going to be obliged to go with the drug that reduces cardiovascular events.”

The Next Gene-ration

However, even Wegovy’s dominant market position could be under threat in the longer term. Metabolics therapeutics company Fractyl Health presented data in early October that showed single dose GLP-1-based pancreatic gene therapy Rejuva outperformed semaglutide (the compound that Novo markets as Wegovy for weightloss and as Ozempic for diabetes treatment) in a study on mice.

Mice given the single Rejuva dose lost 25% of their body fat, compared to 18% in those given daily semaglutide doses.

Timothy Kieffer, Chief Scientific Officer at Fractyl Health, said in a press release that the gene-based treatment has the potential to offer “more potency, better tolerability, and more durability”.

How to Invest in Weightloss Drugs

Novo Nordisk’s share price is up 46.2% year-to-date, and up 158.7% since 4 June 2021, when the FDA approved Wegovy for obesity treatment.

Eli Lilly’s share price is up 62.5% year-to-date, and got a 3.2% boost on 8 November, the day the FDA approved Zepbound for obesity treatments.

Eli Lilly and Novo Nordisk are the top two holdings in the VanEck Pharmaceutical ETF [PPH] as of 15 November, with respective weightings of 8.6% and 6.4%. The fund tracks the MVIS US Listed Pharmaceutical 25 Index, which is comprised of companies involved in pharmaceutical research and development, as well as the production, marketing and sales of pharmaceutical products.

PPH is flat year-to-date. Third-biggest holding Johnson & Johnson [JNJ], which is down 13.9% in the year so far, appears to have weighed on the fund’s performance.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy