On November 3rd, the U.S. presidency wasn’t the only change drawing voters to polls, as on the same day, three states, Maryland, Louisiana, and South Dakota, all voted yes on a ballot to legalize sports betting, bringing the number of states that allow sports betting to 25. Meanwhile, three other states, Hawaii, Massachusetts, and Ohio, are all exploring their own measures.

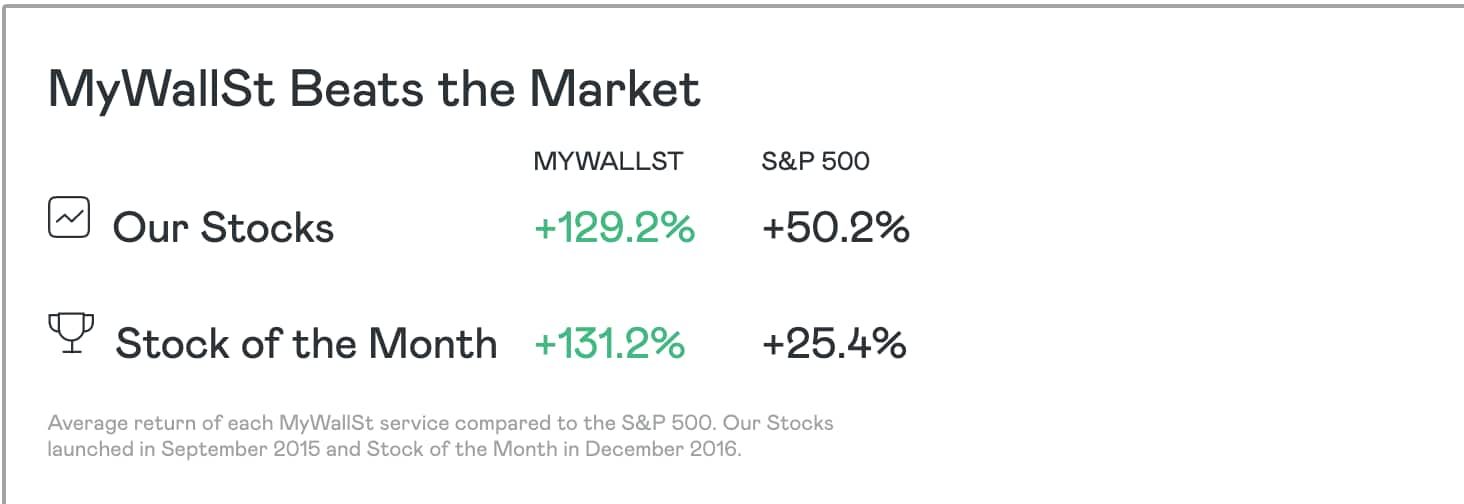

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

This comes after a 2018 ruling by the Supreme Court ended a federal ban on the practice, and has led to the rise of companies like DraftKings and Gan Ltd, which spiked following the news.

However, this is a very new industry in the U.S., and with that comes lots of volatility. How then can investors be expected to put their faith in stocks that thrive off of an activity that has largely been illegal for most of their lives?

Online betting’s big 2021

Whether you agree with it or not, people love to gamble. Why do you think Vegas is one of the most iconic cities on the planet? And although 2020 pretty much killed foot traffic in traditional casinos, the concept is still alive and well, and growing at a staggering rate:

- In 2019, the first full year of legal sports betting in the U.S., the American Gaming Association (AGA) found that $13 billion was wagered.

- This was double 2018’s $6.5 billion.

- Over 15% of Americans (38 million adults) planned to bet on the 2019 NFL season alone.

- Another 24% stated that they would bet on NFL games “if it was legal and convenient to do so in their state.”

That was before a pandemic shut down traditional sports brokers Yes, COVID’s obliteration of sports in the early days of this pandemic did hurt online betting too — how do you make money if there’s nothing to bet on? — but despite this, the likes of Draftkings recovered well. Since it went public via a reverse merger (SPAC) on April 23, its stock has jumped 185%, largely thanks to the rising number of states legalizing the practice of online gambling and a return of professional and collegiate sports.

And it’s not like governments will be in a hurry to discourage this practice. When the coronavirus caused nationwide lockdowns in March, state governments absorbed a tough financial blow, watching countless tax streams evaporate. Lawmakers’ hunger for sources of new income has opened the door for up-and-coming vice industries, like online sports gambling, to fill the void the virus has created in states’ budgets.

The bottom line is that legalization of online sports betting now seems to be a question of when, not if, and if it follows the same success as in Europe, where it has been legal for years, then this $40 billion global industry is going to be taking us on a wild ride.

I mean, there’s even an ETF for it now, ‘The Roundhill Sports Betting & Gaming ETF’, with a very cool ticker symbol:

BETZ.

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy