AstraZeneca’s [AZN.L] share price has soared in 2022. Steller earnings in the first quarter and a diverse portfolio of products have helped boost investor confidence in the stock. And with economic uncertainty unsettling equity markets, investors could do worse than consider AstraZeneca as a defensive play.

Upcoming half-year results should provide clues on how the pharmaceutical giant is performing and whether it’s worth investing in.

What’s happening with AstraZeneca’s share price?

AstraZeneca’s share price has outperformed its biotech stock peers in 2022 so far. Over the six-month timeframe, its London-listed stock is up 23%, beating Moderna’s [MRNA] 10.3% gain and Pfizer’s [PFE] 3.8% decline. It has also outperformed the wider FTSE 100’s 3.8% in that time.

Those gains slowed in July, with the share price up 3.7% over the past month to close Friday 22 July at 10,766p. Conversely, Moderna’s stock has shot up 17.9% over the same period.

Genomics, biotech and healthcare innovation is among the six top performing investment themes at the moment, according to Opto’s theme performance screener. Over the past month, the theme has gained 2.8% after shaking off a slump in performance during the first half of the year.

What to look out for in AstraZeneca's earnings

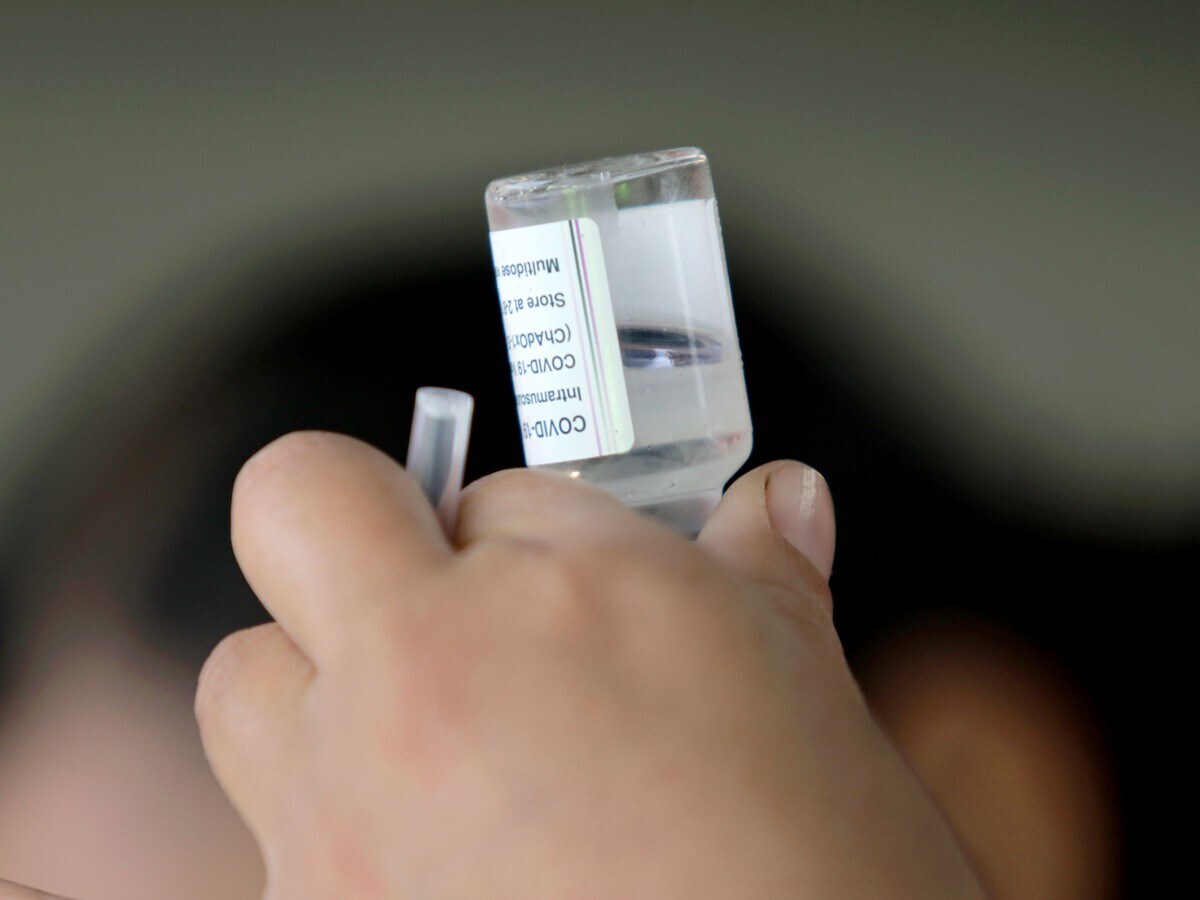

Any news relating to AstraZeneca’s Covid-19 vaccines will be closely watched, but investors should also keep an eye on wider business performance. Unlike Moderna, which is a vaccine pure play, AstraZeneca has a diversified portfolio of treatments that should reduce the impact of any slowdown in Covid-19 vaccine sales.

In the first quarter of 2022, AstraZeneca’s total revenue increased 60% year-over-year to $11.3bn, with core earnings per share up 20% to $1.89. AstraZeneca pointed to growth across the company for the stellar haul, singling out revenue from subsidiary Alexion and contracts for coronavirus treatment Vaxzevria.

Oncology treatments proved to be another highlight, with product sales up 18% year-over-year despite Covid-19 continuing to disrupt cancer diagnosis and treatment.

AstraZeneca is guiding for total revenue growth to be in the high teens for the full year, with core EPS increasing in the mid to high 20s.

During first quarter results, AstraZeneca said that it expects total revenue from Covid-19 medicines to decline by the low to mid 20s percentage this year, with a drop in Vaxzevria sales being offset by growth in sales of its Covid prevention drug Evusheld. Operating expenses are also expected to increase due to integration of rare diseases specialist Alexion.

Any change in this guidance during second quarter earnings could move AstraZenca’s share price.

AstraZeneca’s vaccine effective after six months

AstraZeneca recently announced that its Covid-19 treatment provides equally effective protection against hospitalisation and death as the available mRNA vaccines. The findings come following an expert review of 79 real world studies that compared AstraZeneca’s Vaxzevria with mRNA treatments.

This was backed up by research from the University of Bristol, which showed protection against severe coronavirus infections remained high after two doses of AstraZeneca’s treatment. The research looked at NHS health records for 7 million adults and found that hospital admissions were significantly lower up to six months after a second dose had been administered. The Pfizer-BioNTech treatment was found to produce equally effective results.

While this might not materially change the sales outlook for AstraZeneca’s treatments after the height of the pandemic, it’s nevertheless a vouch of confidence that could translate to improved sentiment around its stock.

Can AstraZeneca beat expectations?

Analysts are expecting AstraZeneca to post earnings of $0.77 per share for the second quarter, up from $0.43 from the same period last year, according to Yahoo Finance. Revenue is pegged at $10.53bn, up 28.2% year-over-year.

In the last two quarters, AstraZeneca has managed to beat Wall Street expectations. In the first quarter of 2022, AstraZenaca posted earnings of $0.95 a share, surpassing the forecasted $0.83 a share.

Should AstraZeneca beat expectations once again with a solid set of earnings, then the share price could continue to climb higher — something that shouldn’t be sniffed at when equities are taking a hammering. For income seekers, the stock also carries a 1.95% forward dividend yield.

Of the 28 analysts offering price targets on the Financial Times, the median target on AstraZeneca’s stock is 11,790.3p, suggesting a 9.5% upside on Friday’s close. Among the 31 analysts offering ratings on the stock, the majority have an ‘outperform’ rating.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy