Blockchain is showing signs of resurgence, most notably in the form of bitcoin’s recent rally. Two upcoming events — a potential Bitcoin spot ETF and the Bitcoin halving in April 2024 — could shape the industry’s future: the ETF could boost mainstream accessibility, and the halving has historically impacted bitcoin’s price.

- Blockchain experienced extreme volatility in recent years, but robust companies are emerging.

- The potential launch of Bitcoin spot ETFs is a major development in the cryptocurrency world, with the Securities and Exchange Commission considering eight to 10 pending filings.

- Bitcoin halving is a fundamental part of its design, reducing mining rewards every four years to control inflation.

Blockchain has been on a rollercoaster ride in recent years, from the dizzying heights of early 2021 to the lows of December 2022. In what could be described as a market blow-off top, followed by an unprecedentedly swift phase of quantitative tightening, the industry underwent a rigorous stress test that left many of its players behind.

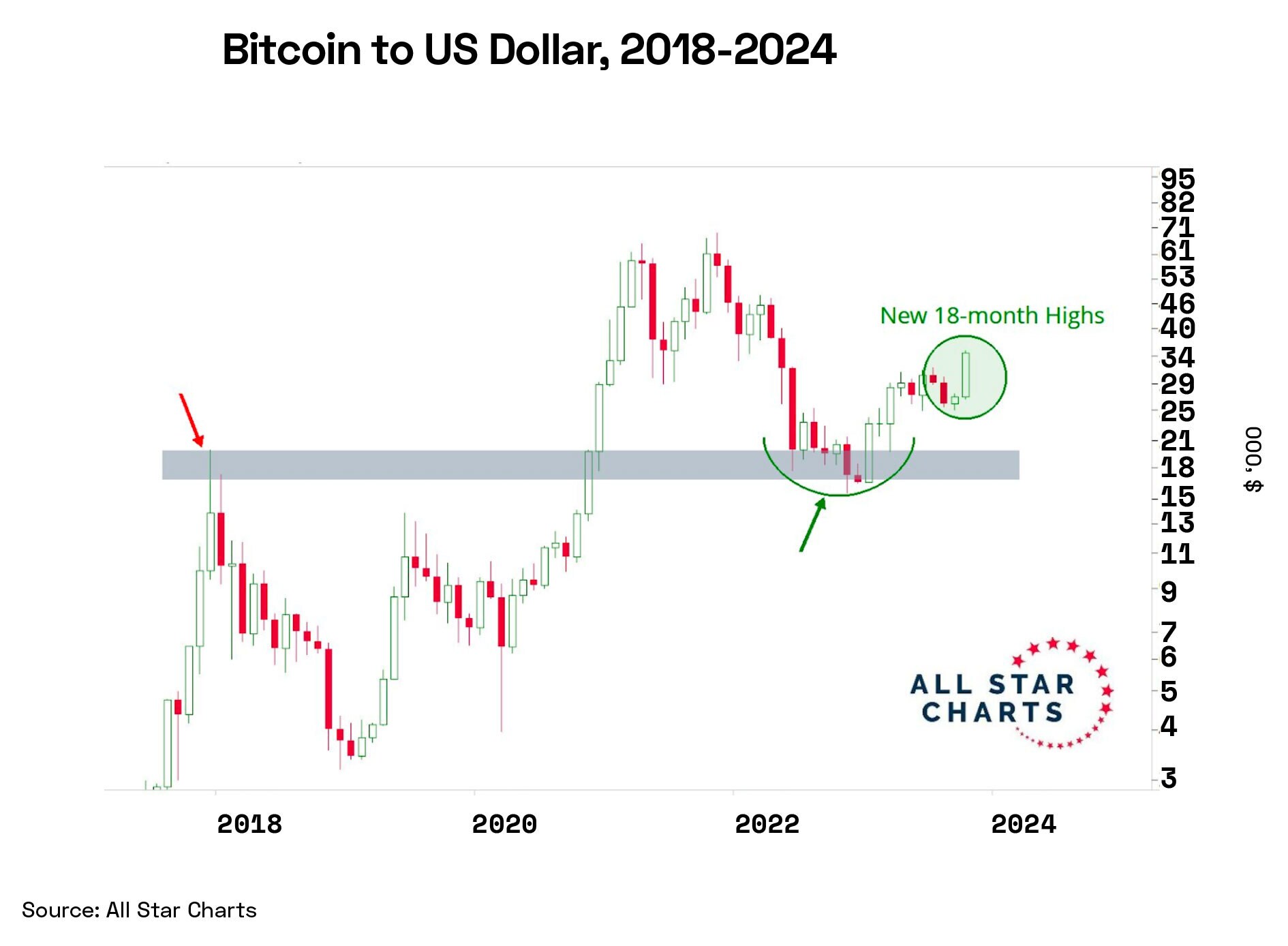

Now, as the dust settles, it seems that only the most robust companies stood firm. Because signs of resurgence are visible, with the blockchain theme showing notable strength over the past three months, and bitcoin rallying to an 18-month high.

In our latest analysis, we explore the trajectory of blockchain's evolution, as we stand at a potentially critical juncture for the industry.

A Game-Changing Moment

The blockchain sector’s recent price surge and potential for continued outperformance can be attributed to two upcoming, pivotal events.

First, the highly anticipated Bitcoin spot ETF is on the horizon in the US. Although there is no confirmed launch date or official approval from the Securities and Exchange Commission (SEC) as of the time of writing, the market is optimistic that it may see at least one Bitcoin spot ETF go live in the upcoming quarter. The product is expected to create opportunities for mainstream investors, offering a new level of accessibility to Bitcoin without the complexities of direct ownership.

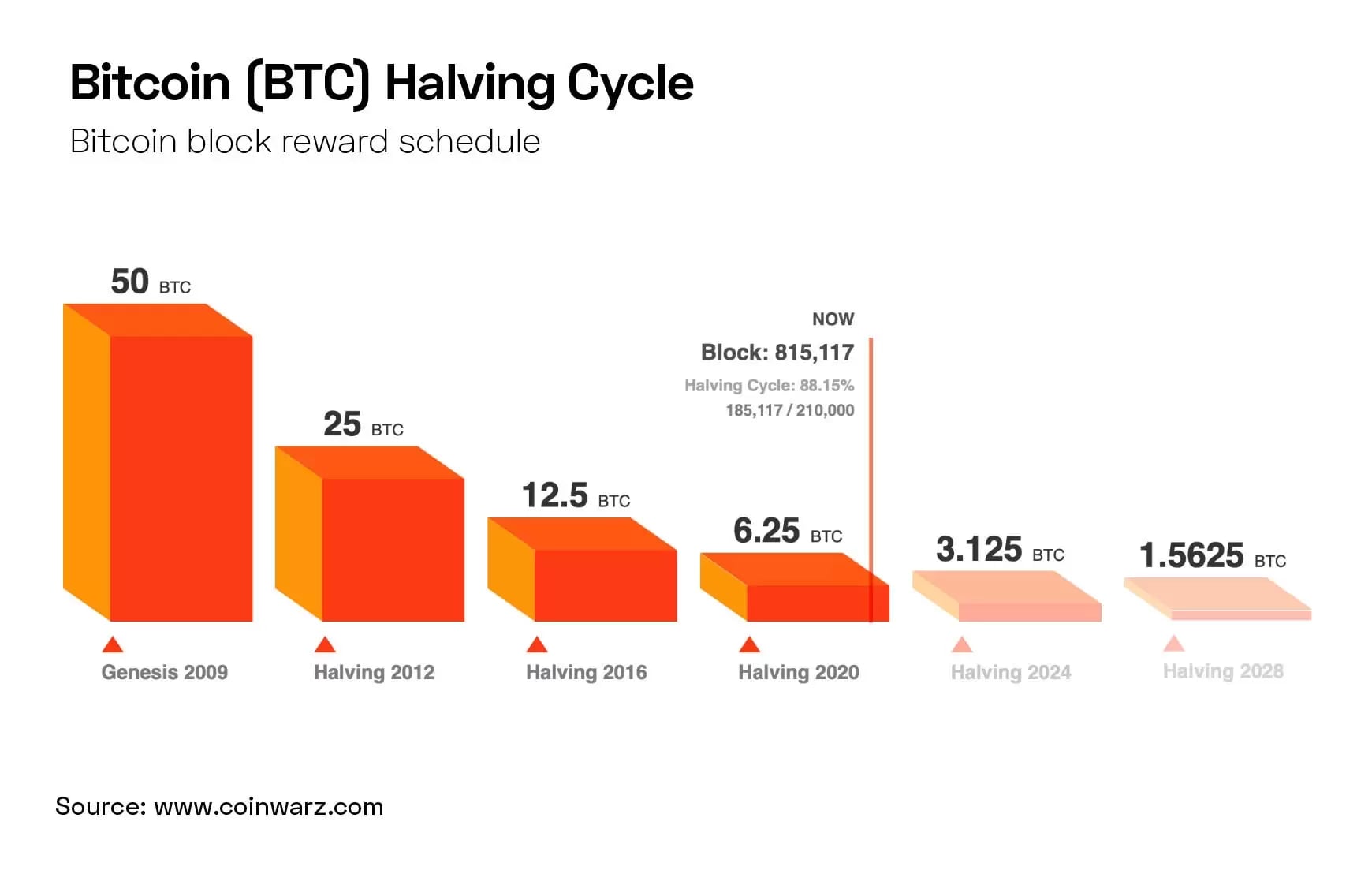

Second, the next Bitcoin halving is expected to take place on 24 April 2024. This quadrennial event, which has been consistent since Bitcoin's inception, slashes the block rewards for miners by 50%. Historically, the halving has acted as a catalyst for price increases, as the ensuing reduction in new Bitcoin supply tends to amplify scarcity, bolstering demand.

As these events draw near, they bring with them not just anticipation but the potential to shape the trajectory of bitcoin’s value, not to mention the blockchain industry at large.

Bitcoin Spot ETF: Accessibility and Legitimacy

SEC Chair Gary Gensler has said that his agency is considering eight to 10 pending filings for Bitcoin spot ETFs. The SEC is afforded a 240-day period for commentary on these filings, meaning it has to start making decisions by 10 January 2024. Among the contenders, Cathie Wood's ARK Invest is first in the queue.

The significance of the potential ETF launch cannot be overstated.

A key factor is that it promises to bestow a newfound legitimacy on cryptocurrency as an asset class: asset management giants like BlackRock are anticipated to be among the first to receive approval.

Moreover, the establishment of a Bitcoin spot ETF would provide institutional investors with an opportunity to engage with the asset class. By fitting within the existing framework of their investment policies, it simplifies entry into the cryptocurrency market, bypassing the complexities associated with other investment avenues like futures contracts or custody solutions.

Understanding Bitcoin Halving

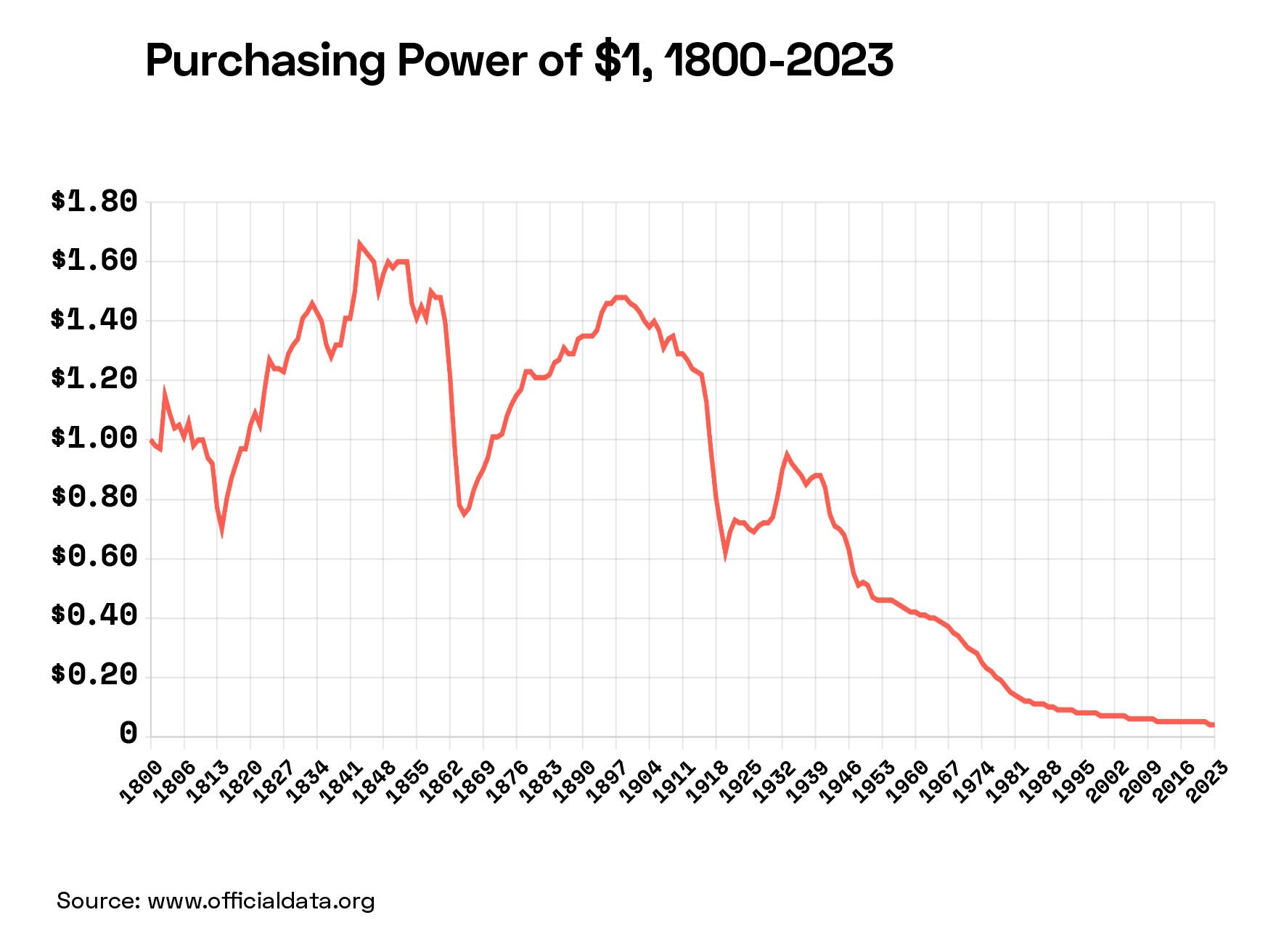

Turning to the Bitcoin halving, this mechanism is at the core of Bitcoin’s design as a deflationary currency, setting it apart from inflationary fiat currencies.

Established in the wake of the 2008 financial crisis, Bitcoin emerged as a decentralised financial system. As a testament to its deflationary blueprint, there will only ever be 21 million bitcoins in existence. To date, 92% of this total has been mined, leaving 8% remaining. These await their release into circulation, a process meticulously controlled by the halving mechanism.

Mining is the backbone of the Bitcoin ecosystem. Miners solve complex cryptographic puzzles that allow them to add new blocks of transactions to the Bitcoin blockchain — the ledger that constitutes the foundational transaction record of the cryptocurrency. In return for their computational work, miners are rewarded with newly minted bitcoins.

Miners were initially rewarded with 50 bitcoins per block. However, in accordance with Bitcoin’s halving schedule, this reward has decreased by 50% every four years. Currently, the reward stands at 6.25 bitcoins per block, with the next reduction to 3.125 bitcoins slated for April of next year.

The rationale behind the halving is to control inflation by regulating the rate at which new bitcoins enter circulation. If the demand for Bitcoin remains constant or grows, the decreased flow of new bitcoins post-halving is theorised to exert upwards pressure on its price.

Historical Price Impact of Halvings

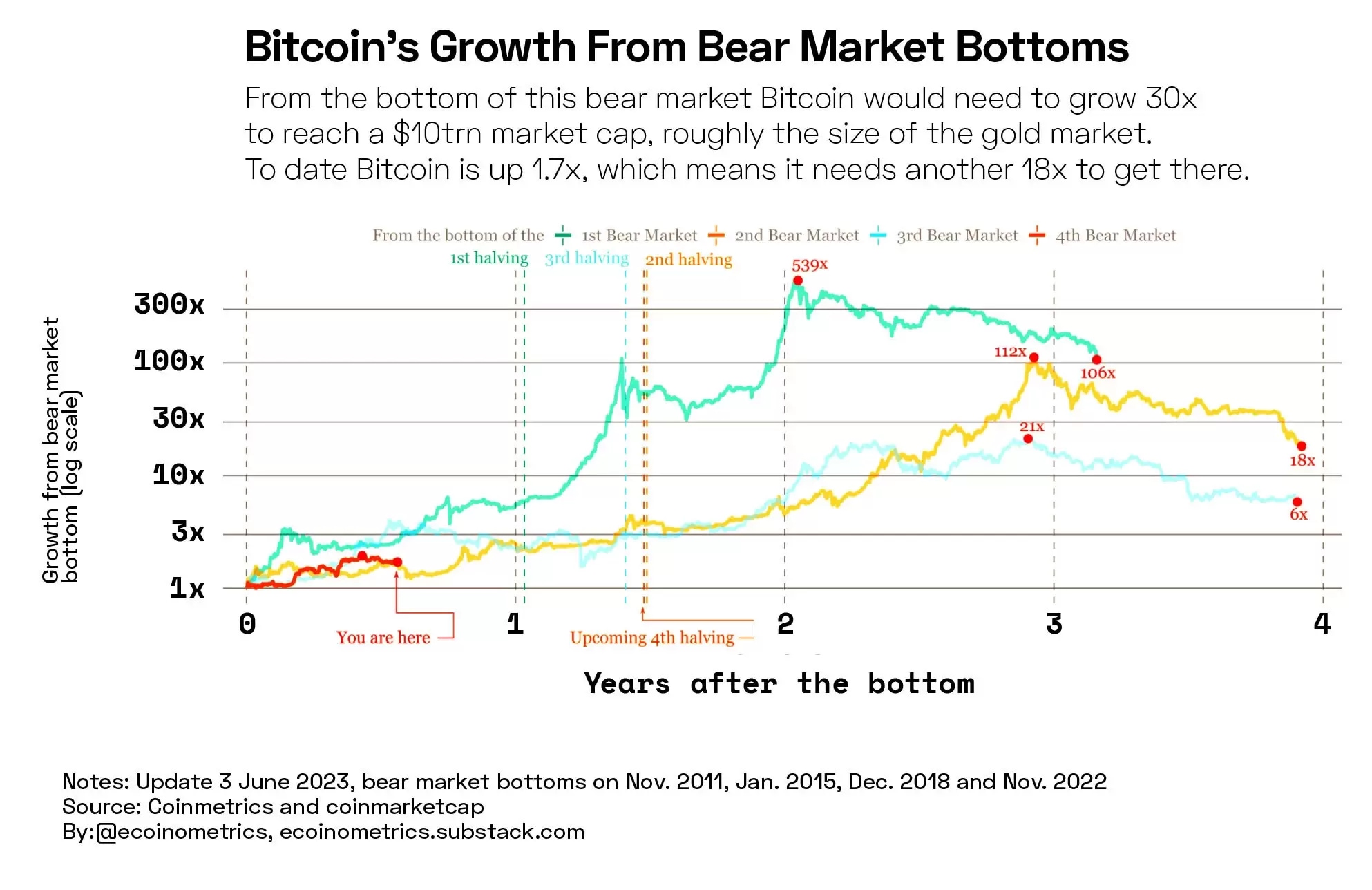

Halvings typically do not yield immediate price surges. The market often experiences a settling period as it adjusts to the new mining economics.

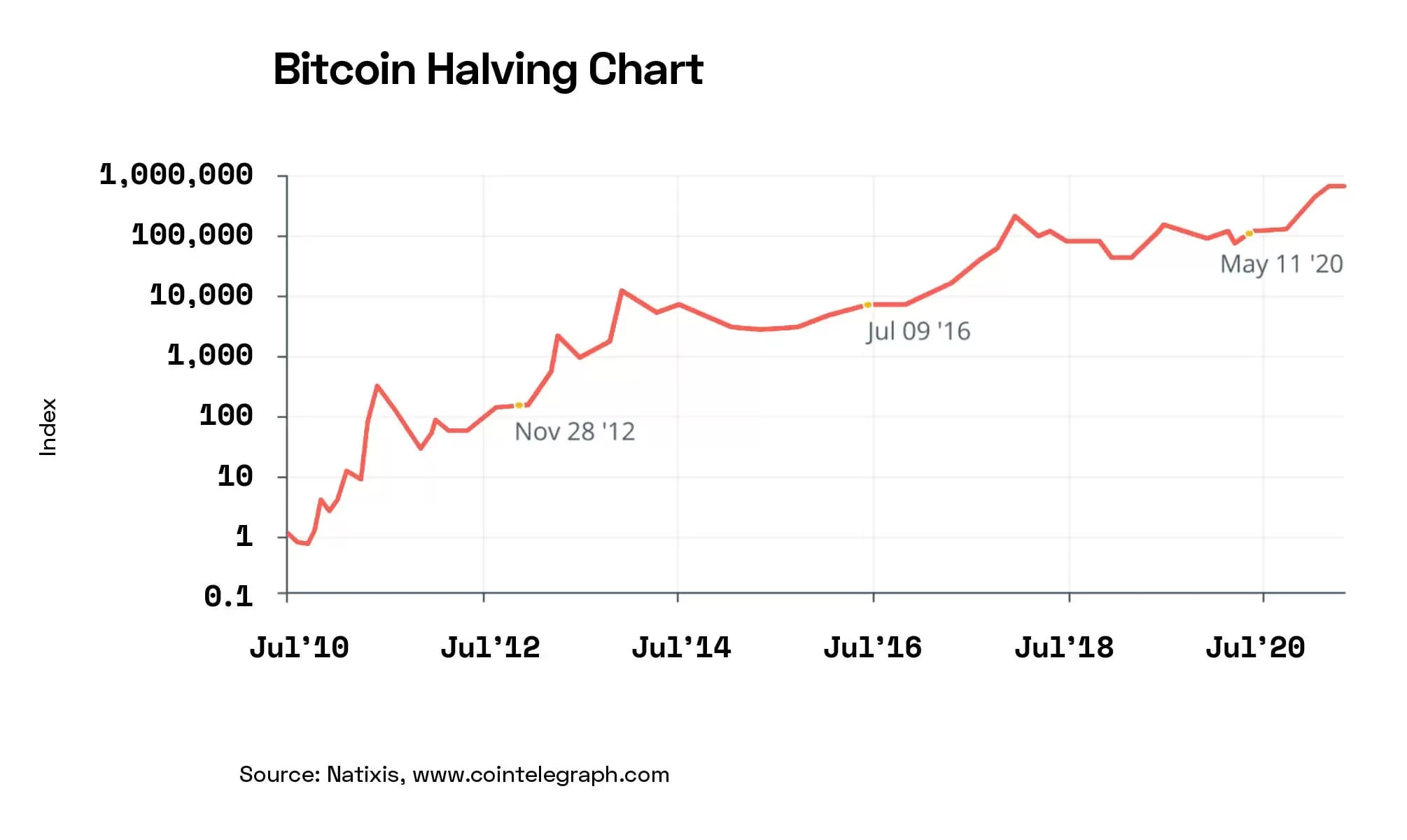

Nevertheless, historical patterns observed after the previous three halvings indicate that, within the subsequent 12-18 months, bitcoin’s price reached multiple all-time highs and found a new local maximum. Although past performance is not indicative of future results, these trends provide valuable insights.

The chart below illustrates the potential long-term influence of halvings on Bitcoin's price trajectory.

It is worth considering that the halving event itself often sparks increased public relations efforts and publicity, which in turn can lead to heightened Bitcoin awareness and potentially boost its value in the run-up to the halving.

As we approach the next halving, the industry watches, speculating on its potential impact and the broader implications for Bitcoin’s future.

How to Invest in Blockchain Stocks

Compare the top-performing Blockchain ETFs in the OPTO App.

ETFs, or exchange-traded funds, offer an economical and diversified way to invest in a variety of stocks within a particular theme.

Bitwise Crypto Industry Innovators ETF [BITQ] offers exposure to the crypto economy by enabling investment in companies that are building out core infrastructure, including bitcoin miners and brokerages. The ETF was up 21.7% over six months and 119.8% year-to-date (YTD) on 2 November.

Global X Blockchain ETF [BKCH] invests in companies that are positioned to benefit from the increased adoption of blockchain technology. The ETF was up 19% over six months and 104% YTD on 2 November.

Amplify Transformational Data Sharing ETF [BLOK] invests at least 80% of its net assets in the equity securities of companies actively involved in the development and utilisation of blockchain technologies. It was up 13.7% over six months and 44% YTD as of 2 November.

| ETF | 6 Month | YTD | |

|---|---|---|---|

| Bitwise Crypto Industry Innovators ETF [BITQ] | +21.7% | +119.8% | Add to watchlist > |

| Global X Blockchain ETF [BKCH] | +19% | +104% | Add to watchlist > |

| Amplify Transformational Data Sharing ETF [BLOK] | +13.7% | +44% | Add to watchlist > |

| iShares Blockchain and Tech ETF [IBC] | +3.02% | +77.2% | Add to watch list > |

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy