Last week’s operational update covering September failed to halt Argo Blockchain’s share price slide, with the stock down over 80% in 2021. The AIM-listed crypto miner’s update revealed that Argo mined fewer bitcoins month-on-month. However, the UK-headquartered firm is set to boost hashrate capacity at its Texas facility, while it works to cut costs and source financing opportunities.

Argo Blockchain’s [ARB.L] stock has continued to fall following last week’s operational update, which covered its bitcoin mining activity in September. The AIM-listed crypto miner’s update revealed that Argo mined fewer bitcoins compared with the previous month, helping to send the Argo Blockchain share price to fresh lows.

However, the UK-headquartered crypto miner is set to boost hashrate capacity (a measure of computational power required to process crypto transactions) at its Texas facility, thanks to a significant hardware upgrade, while the firm works on cutting costs and sourcing financing opportunities, including a new equity issue with a “strategic investor”. Despite the tough trading conditions, at least one broker reckons the company is well-positioned to capitalise once the economic environment improves.

Argo Blockchain share price plunges after operational update

A poorly received operational update from the UK-headquartered crypto miner last week only added to the stock’s woes, sending the Argo Blockchain share price plummeting to a fresh 52-week low on Thursday 13 October – the stock fell to 13.00p intraday, before closing marginally higher at 14.00p.

The company’s update covering September revealed that Argo mined 215 bitcoins or bitcoin equivalents during the month, which came in lower than August’s 235. The company said this was “primarily due to a 12% increase in average network difficulty … and the curtailing of operations at its Helios facility in Texas during periods of high electricity prices”. This decline saw mining revenue slide significantly from £4.39m in August, to £3.78m in September. On the plus side, Argo did boost its mining margin from 20% to 25%.

Argo Blockchain’s share price is now down 84.82% year to date, its lowest level since December 2020, and the shares have plunged 90.42% from the 52-week high at 155.00p, recorded on 17 November 2021. In February last year, the shares peaked at over 300p, so it’s been a seismic decline over the last 18 months.

The steep fall in cryptocurrency prices over the last 12 months – with bitcoin down over 70% from its 52-week high north of $67,000 in November last year, to levels under $20,000 – has certainly weighed on crypto-related stocks, including miners. And with no end in sight to the Russia-Ukraine conflict, which continues to act as a major drag on the markets, high energy prices are likely to continue for the foreseeable future. In this context, we could see further cutbacks in mining activity over the short- to medium-term.

What’s the medium-term outlook for Argo Blockchain stock?

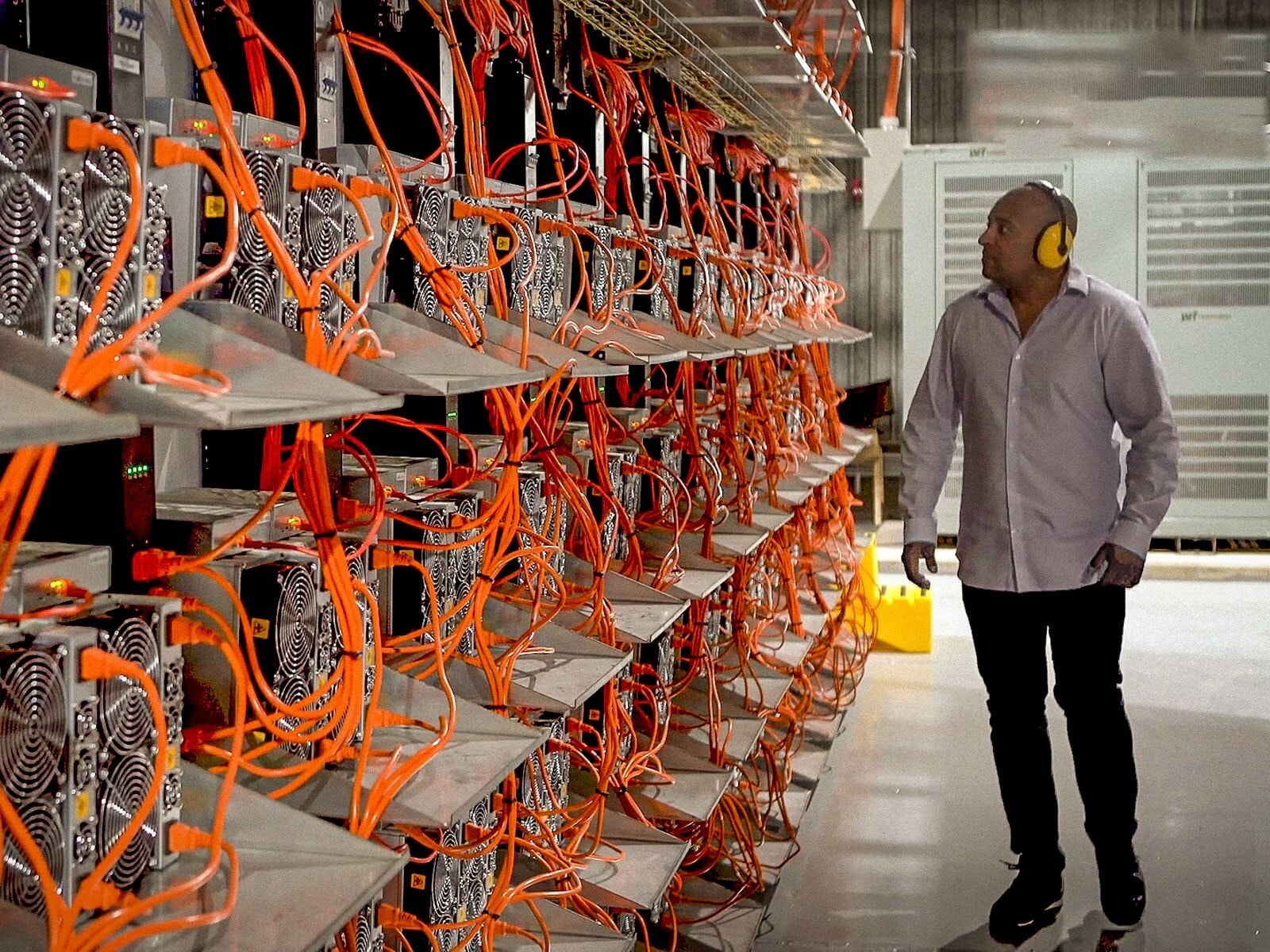

The crypto miner is poised to boost operations at its key Helios facility in Texas, through a major hardware upgrade. In last week’s operational update, CEO Peter Wall said the company “continues to execute on its plans to grow operations at Helios. We are nearing completion of the installation of our new Bitmain S19J Pro machines, which will increase our total hashrate capacity to 2.9 EH/s by the end of the month”. This upgrade represents an impressive 81% increase in total hashrate capacity compared with Q1 2022, according to Wall.

The update followed Argo Blockchain’s 7 October press release, where the firm admitted it was working on reducing costs – for example, through a new power agreement with an electricity generator in Texas, which should help the company maintain full operations there. The board also announced it would “pursue a combination of financing opportunities to strengthen [its] balance sheet”. These include plans to sell 3,400 mining machines for £6m, and raise £24m through a proposed subscription with a strategic investor. These moves are likely to raise investor concerns, but Argo Blockchain is taking action to ensure it survives the current headwinds.

Encouragingly, analysts at FinnCap said in a note following Argo Blockchain’s 25 August interim results, that the company is “excellently positioned to capitalise when conditions change”. FinnCap highlighted Argo Blockchain’s ability to scale the Helios crypto mining facility during tough market conditions. The broker placed a 220p price target on Argo Blockchain stock – a 1,381% leap from current levels.

What are analysts’ views on Argo Blockchain?

Barclays analyst Ramsey El-Assal downgraded the US-listed Argo Blockchain [ABRK] to ‘equal weight’ from ‘overweight’ following the 7 October strategic announcement, which, says El-Assal, raises concerns over the business’s long-term capital structure.

Analysts offering 12-month price targets for Argo Blockchain’s London listing have a median target of 109.85p, according to the Financial Times, which represents a huge potential upside of 639.73% from last week’s 14.85p close. One analyst holds a ‘buy’ recommendation, along with one ‘hold’. Similarly, eight analysts polled by the Wall Street Journal covering ABRK have five ‘buy’ and three ‘hold’ ratings, for a consensus ‘overweight’.

It’s clear that Argo Blockchain is in the midst of a particularly tough period, with the company resorting to various funding initiatives to reinforce near-term liquidity, but analysts’ longer-term outlook suggests this crypto miner may be poised to bounce back, once conditions turn more favourable.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy