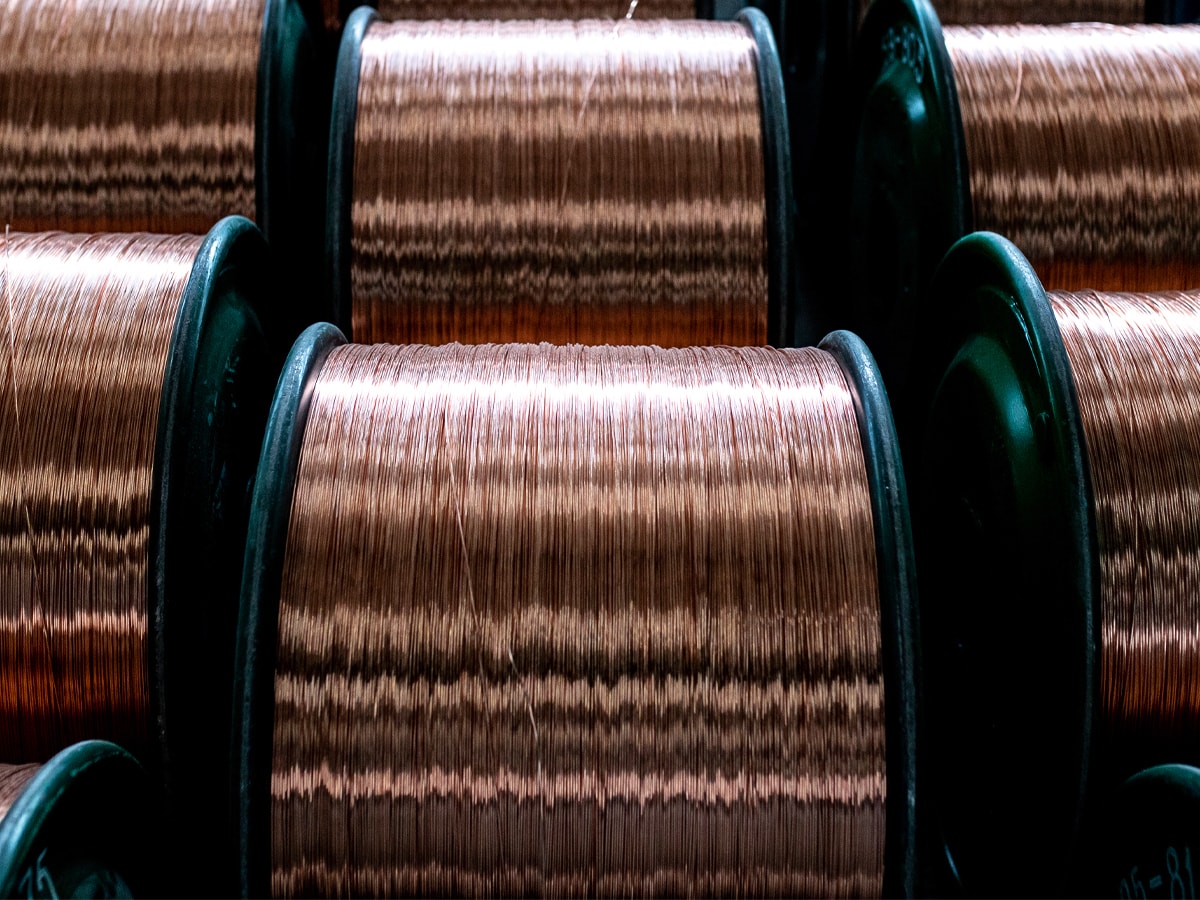

Rocketing demand for copper, fuelled by the clean energy revolution, has strengthened the Global X Copper Miners ETF [COPX].

The fund has risen 154% in the past year, from $15.76 at the close on 11 June 2020 to $40.04 at the close on 11 June 2021. The Global X Copper Miners ETF’s rise has been driven by increased demand for electric vehicles and wind turbines, where copper is a crucial component, as governments and companies strive to meet carbon emissions targets.

The price of copper breached the $10,000 per tonne mark at the start of May for the first time in 10 years and remains just above that level as of 11 June.

154%

Growth of the Global X Copper Miners ETF over the past year

Concerns that the price of copper was due for a correction had weighed down the Global X Copper Miners ETF earlier in the year, when it fell to an intraday low of $33.90 on 25 March. However, the fund has largely recovered since then to hit an intraday high of $46.96 on 10 May.

The Global X Copper Miners ETF’s year-to-date total daily return, according to Yahoo Finance, was 32.47% on 14 June and, as of 11 June, it had net assets of $1.27bn.

A critical metal

The Global X Copper Miners ETF, launched on 19 April 2010, provides investors access to a broad range of copper mining companies across materials, financials and industrials.

The fund had 33 holdings as of 14 June, with Vedanta [VEDL] having the biggest weighting at 5.73%, followed by Glencore [GLEN.L] with 5.21%, Zijin Mining [2899.HK] at 1.48%, Freeport-McMoRan [FCX] at 5.01% and Teck Resources [TECK] at 4.97%.

Shares in Freeport-McMoRan have grown 57.3% in the past year (through 11 June). In April, the group — which has operations across the Americas and Indonesia — reported first-quarter net income of $718m compared with a net loss of $491m this time last year.

“We are well-positioned for… accelerating demand from copper’s critical role in building infrastructure and the transition to clean energy,” Richard Adkerson, chairman and CEO of the company, said in a statement.

“We are well-positioned for… accelerating demand from copper’s critical role in building infrastructure and the transition to clean energy” - Richard Adkerson, chairman and Freeport-McMoRan CEO

Teck Resources’ share price has also surged 30.6% in the year so far, as of 11 June, off the back of positive earnings. The company posted a 247% first-quarter profit hike to $326m in April and a 76% profit rise from its copper mines in Canada and Chile.

However, copper mining companies have faced challenges, including COVID-19 mining disruptions in developing nations such as Chile. There is also a heavy reliance on demand from China, which accounts for over half of global copper consumption, according to Seeking Alpha.

Higher copper prices may also tempt buyers to switch to alternatives such as aluminium. Harrison Schwartz, a financial analyst, wrote in Seeking Alpha that he believes copper prices could decline in the short term. “Copper rose slightly too high in too short a timeframe largely due to a one-off supply issue which is now showing many signs of receding,” he wrote.

The copper megatrend

However, not all commodity analysts have such a bearish outlook. According to an article authored by Michael Gayed, founder of The Lead Lag Report, analysts at CNBC forecast that copper could hit $20,000 per tonne by 2025.

Indeed, copper demand is expected to continue to benefit from the growth in renewable products as well as from the opening of economies post-pandemic.

“It is a metal that has performed very well in inflationary environments for the past few decades” - Jay Jacobs, head of research for Global X

Jay Jacobs, head of research for Global X, recently told ETF Trends that copper can also protect investors against rising inflation. “It is a metal that has performed very well in inflationary environments for the past few decades”, he said.

Goldman Sachs is also a fan. It declared that “copper is the new oil” in a report in April, according to Investor’s Business Daily. It sees wind-related copper demand reaching 1.3 million tons a year by 2030, growing at a rate of 12.4% a year. As part of a supercycle for commodities, the firm forecasts that copper prices will likely reach $15,000 per ton by 2025.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy