The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

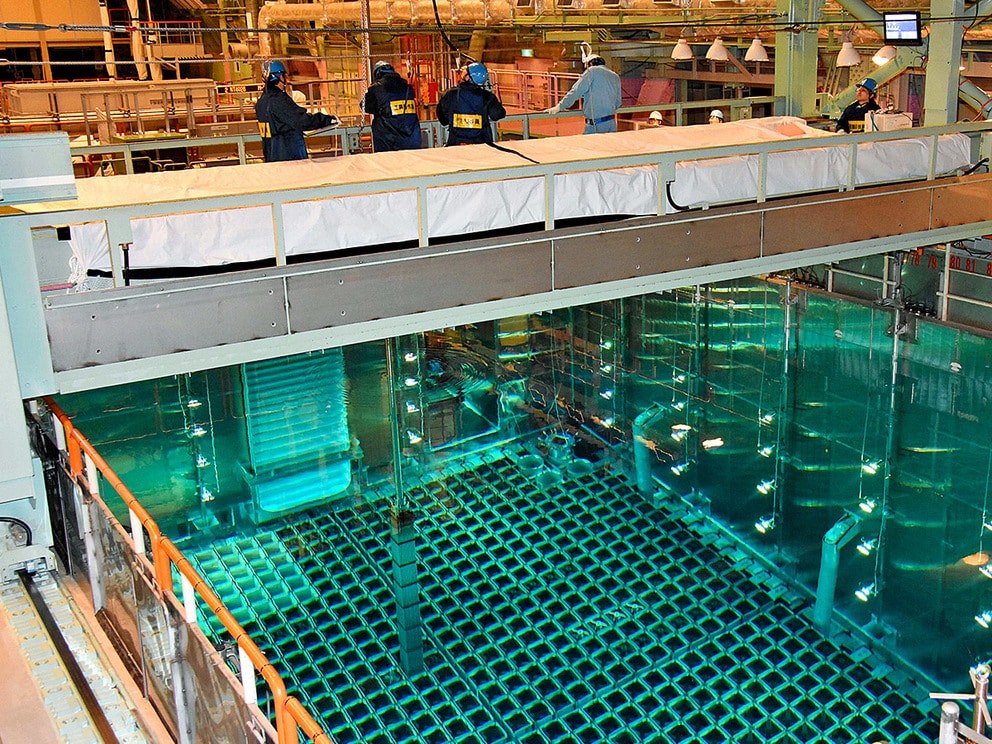

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data by Business Insider. However, it dropped 6.2% year-to-date to below $30 as of 24 February.

$158.78m

Total net assets of the North Shore Global Uranium Mining ETF

According to Yahoo Finance, the North Shore Global Uranium Mining ETF’s year-to-date total daily return was 26.7% on 8 March. The fund had net assets of $158.78m.

In comparison, the VanEck Vectors Uranium+Nuclear Energy ETF [NLR] and Global X Uranium [URA] had year-to-date total daily returns of -1.8% and 16.4%, respectively.

Nuclear demand powers rush to uranium

The North Shore Global Uranium Mining ETF, launched on 3 December 2019, consists of companies involved in the mining, exploration, development and production of uranium. It also tracks companies that hold physical uranium.

The fund had 27 holdings as of 8 March. National Atomic Company Kazatomprom [KAP.IL], the world’s largest uranium producer has a 16.1% weighting, uranium and nuclear fuels products producer Cameco [CCJ] 13.4%, and uranium investment group Uranium Participation Corporation [U.TO] 9.13%.

Kazatomprom’s shares climbed 38.5% in 2020, data from TradingView shows. Although production volume fell 26% year-over-year during the three months ended 31 December, sales volume for the year-end were similar to 2019, helped by strong demand from China.

Cameco’s shares also soared in 2020, climbing 51.4%. While the company only produce 5 million pounds of uranium in 2020, it added 12.5 million pounds to its portfolio in long-term contracts — its largest pipeline of uranium contracts since 2011.

“Growing demand for nuclear power means growing demand for uranium,” wrote Tim Gitzel, Cameco’s CEO, alongside the results. “However, on the supply side there are some big question marks about where uranium will come from … due to years of persistently low prices.”

“Growing demand for nuclear power means growing demand for uranium. However, on the supply side there are some big question marks about where uranium will come from … due to years of persistently low prices” - Tim Gitzel, Cameco’s CEO

Fuelling the future

Many countries, such as Belgium, have been phasing out nuclear power due to its high operating costs compared to clean energy rivals like wind and solar. Meanwhile, countries like the UK have identified it as a way to achieve cleaner energy.

In the US, the recent power outages in Texas and president Joe Biden’s commitment to decarbonisation has also been a boon for nuclear. Last December, the Senate Committee on Environment and Public Works approved the American Nuclear Infrastructure Act, including establishing a US national strategic reserve of uranium.

“The legislation will provide a strong platform to revitalise the US Uranium Industry,” Amir Adnani, CEO and president of Uranium Energy [UEC], said in a statement.

“The legislation will provide a strong platform to revitalise the US Uranium Industry” - Amir Adnani, CEO and president of Uranium Energy

However, the most significant surge in demand for uranium is expected to come from developing world markets looking to nuclear power as a cleaner energy alternative to fossil fuels.

According to the World Nuclear Industry Status Report, 52 new nuclear reactors were being constructed worldwide in mid-2020. China is building 15, India making seven and South Korea building four.

For Tim Rotolo, CEO and founder of North Shore Indices, the uranium market is still in the early stages of a bull market. The global nuclear power market is expected to grow at a compound annual growth rate of 2% between 2020 and 2026, according to Mordor Intelligence.

“Supply and demand dynamics appear favourable for uranium as miners have slashed production just as the construction of new nuclear energy reactors is accelerating,” Rotolo added.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy